There are several potentially market moving events on the immediate horizon. In theory, investors should be showing some concern ahead of tomorrow’s monthly employment report, Monday’s 10:1 ex-split in Nvidia (NVDA) and Apple’s (AAPL) Worldwide Developers Conference, and Wednesday’s double-whammy of a CPI report coming hours before an FOMC meeting. Any or all of these have the potential to induce volatility not only to the affected stocks, but to the market as a whole. But options markets aren’t reflecting that possibility.

We can look at the level of the Cboe Volatility Index (VIX) as a proxy for the demand for volatility protection from institutions. Although its current 12.75 level is above its recent lows, it is not above them by much. Furthermore, while VIX is a 30-day lookahead, its counterpart, VIX9D is looking towards the more immediate future – the next 9 days. It too is reflecting little concern about volatility over that period:

3-Months, VIX9D (red/green daily candles), VIX (blue line)

Source: Interactive Brokers

When we look at the options on ETFs linked to the S&P 500 (SPX) and Nasdaq 100 (NDX), SPY and QQQ respectively, the IBKR Probability Lab shows that for both, traders are placing higher probabilities for upside moves after tomorrow’s figures rather than downside:

IBKR Probability Lab for SPY Options Expiring June 7th

Source: Interactive Brokers

IBKR Probability Lab for QQQ Options Expiring June 7th

Source: Interactive Brokers

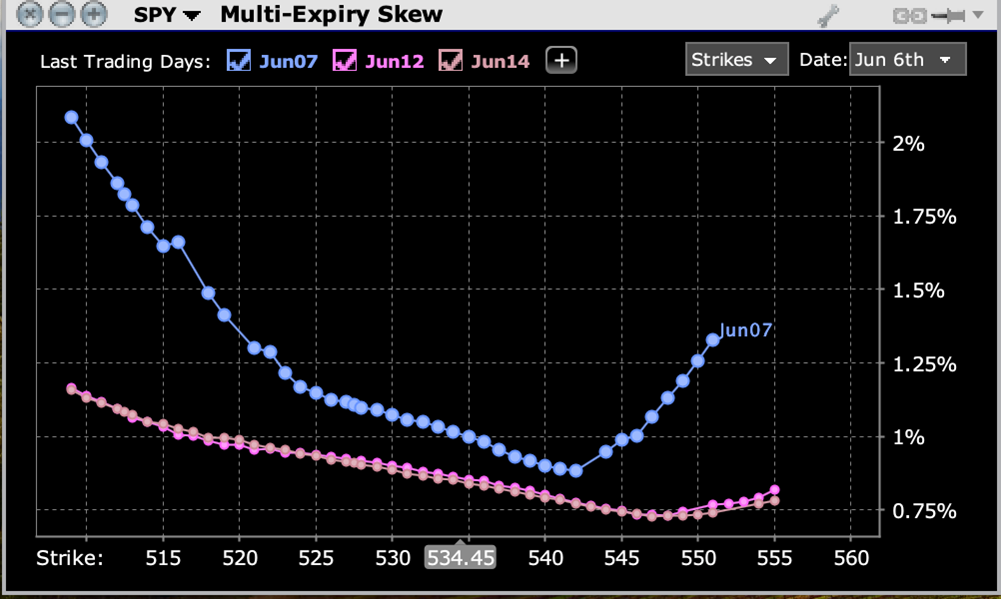

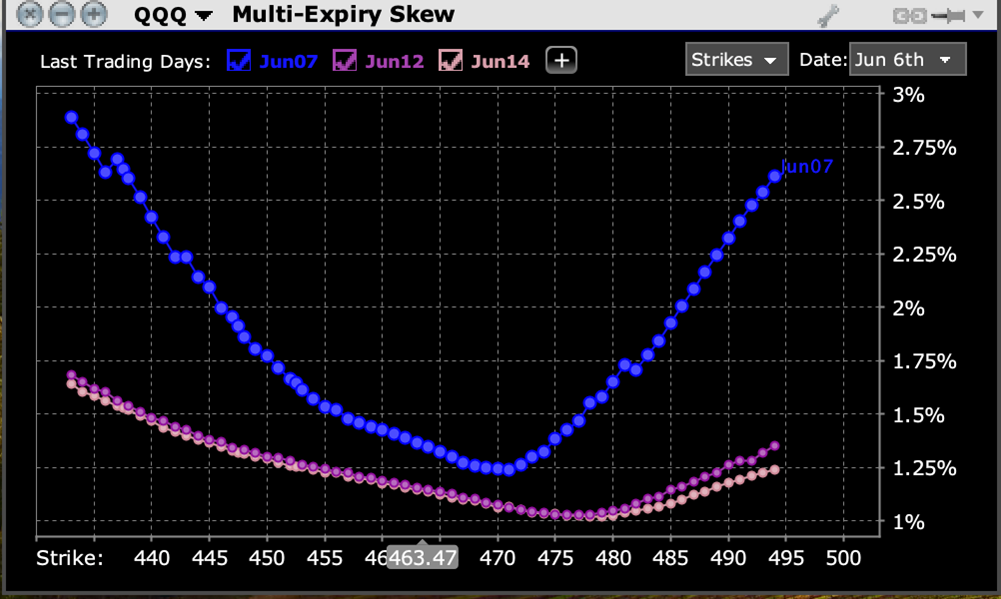

The probabilities imply that tomorrow’s numbers will be benign, at least for equities. That means that the consensus of a 185,000 increase in Nonfarm Payrolls, an Unemployment Rate of 3.9%, and monthly Average Hourly Earnings growth of 0.3% will be met, or if missed, that the miss will be market friendly. That said, skews for those options expiring tomorrow do show a steep downside skew:

Multi-Expiry Skew for SPY Options Expiring June 7th (blue), June 12th (magenta), June 14th (pink)

Source: Interactive Brokers

Multi-Expiry Skew for QQQ Options Expiring June 7th (blue), June 12th (magenta), June 14th (pink)

Source: Interactive Brokers

I find it notable that the skews for options expiring next week also display some bias to the downside even if the probability distributions do not:

IBKR Probability Lab for SPY Options Expiring June 12th

Source: Interactive Brokers

IBKR Probability Lab for QQQ Options Expiring June 12th

Source: Interactive Brokers

The current market environment seems to share its motto with New York State: Excelsior, or “higher.”

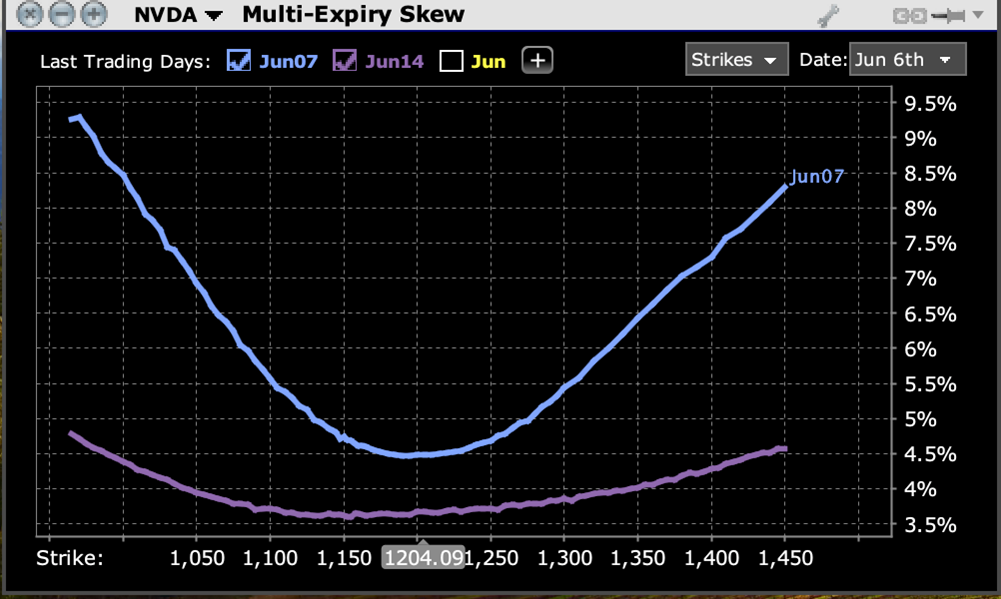

Considering that NVDA is up over 10% this week so far and that AAPL has been higher for each of the past nine sessions, one might think that some concern about Monday’s events could be considered “sell the news” events. Not really. Starting with NVDA, we do see that the probability distribution has a slight downward bias, but that could easily be attributed to the fact that the stock ran through those strikes yesterday with no resistance:

IBKR Probability Lab for NVDA Options Expiring June 14th

Source: Interactive Brokers

Note also that the skew for options expiring next Friday is generally flattish and upward sloping, indicating that FOMO remains in play:

Multi-Expiry Skew for NVDA Options Expiring June 7th (blue), June 14th (purple)

Source: Interactive Brokers

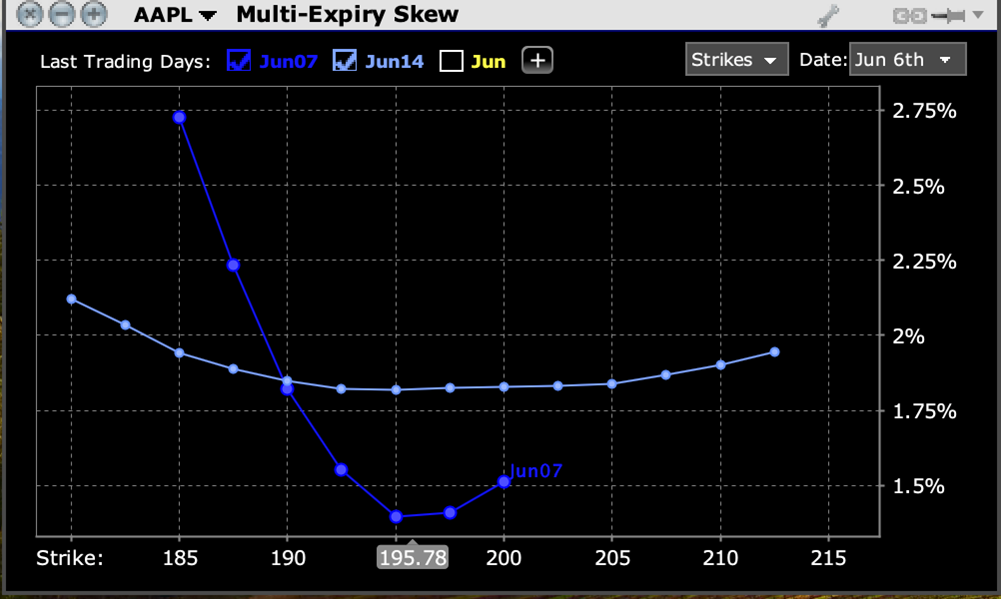

The probability distribution for AAPL is more centered, but its options skew for next week is even flatter than NVDA’s

IBKR Probability Lab for AAPL Options Expiring June 14th

Source: Interactive Brokers

Multi-Expiry Skew for AAPL Options Expiring June 7th (dark blue), June 14th (light blue)

Source: Interactive Brokers

Could it be that the only thing we have to fear is a lack of fear itself? I wouldn’t blame you if you arrived that that conclusion.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link https: ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!