What is Gamma?

Gamma is one of the least understood of the Greeks affecting an option’s price. Many investors are familiar with the Greek variable delta: the change in the underlying option’s price with respect to the change of the underlying stock price. Gamma is the rate of change in delta per $1 dollar move in the underlying asset’s price. Because it measures the rate of change of delta, gamma is the first derivative of delta, or the second derivative of the underlying stock price. Since delta is not a constant measure, as a stock price changes, the change in delta is measured by gamma. An option’s sensitivity to gamma is also not constant and is more pronounced as the option approaches expiration, especially for options where the strike price is close to the current price of the stock, ETF or index.

Accelerator and Decelerator

If delta is the “speed” of an option, gamma tells investors about its “acceleration” – i.e. the rate of change in the speed or delta of an option. Gamma tends to be at its highest when the option is near or at-the-money, while deep in or out-of-the-money options will have a low gamma. For investors trading options set to expire in less than 3 weeks, the accelerator and decelerator effects have the largest impact on the value of an option. Near-the-money options that are close to expiration are extremely sensitive to small movements in the underlying stock. If we look at the chart below, we see that short-dated options (1 month) will have a higher gamma when they are near the current price of the stock (peak) compared to a 6-month option. Additionally, gamma is most sensitive and highest for options that are close to the current price (centre of chart) versus options that are either far “in-the-money” or far “out-of-the-money” (left side and right side).

Chart 1: Gamma Sensitivity vs. Time & Moneyness

Source: Options Industry Council

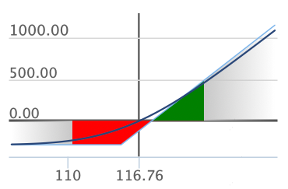

Gamma with Calls

For a call option, as the stock price rises, delta increases due to gamma, creating the option’s unlimited profit potential. As the stock continues to rise, delta will increase up to 1, creating an upside risk profile that resembles being long the stock. Gamma is effectively increasing the sensitivity of the option to the stock price as it rises, accelerating the gains. In contrast, as the stock price decreases, gamma will reduce delta towards 0. This creates the “limited risk” factor of a call option, since as the stock declines, the option becomes less sensitive to further declines, decelerating the losses. Consider the following example: $BMO’s June 2021 $116 call option has a delta of 0.50 and a gamma of 0.02. If $BMO increases by $1, the delta will increase by the gamma value to 0.52. If $BMO decreases by $1, the delta will decrease by the gamma value to 0.48.

Chart 2: BMO Call Option

Source: OptionsPlay

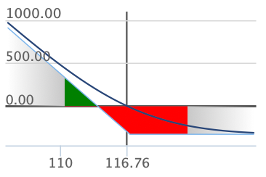

Gamma with Puts

For a put option, as a stock price declines, delta increases due to gamma, creating the substantial profit potential associated with a put option. As the stock continues to decline, delta will increase up to 1, creating an upside risk profile that resembles being short the stock. Gamma is effectively increasing the option’s sensitivity to the stock price as it declines, accelerating the gains. In contrast, as the stock rallies, gamma will reduce delta towards 0. This creates the “limited risk” factor of a put option, since as the stock rallies, the option becomes less sensitive to further rallies, decelerating the losses. Consider the following example: $BMO’s June 2021 $117 put option with a delta of -0.50 and a gamma of 0.02 will see delta move to -0.52 if $BMO decreases by $1 and to -0.48 if the price increases by $1.

Chart 3: BMO Put Option

Source: OptionsPlay

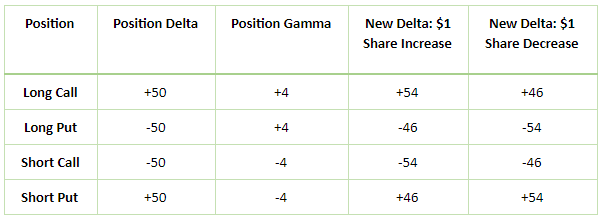

Long vs. Short Gamma

Option strategies can be divided into long gamma and short gamma strategies. Long calls and puts are considered long gamma strategies, while short calls and puts are short gamma strategies. Long gamma works in the investor’s favour when the stock moves in the expected direction by accelerating the gains. Moreover, if the stock moves in the opposite direction, it can decelerate the losses. Short gamma strategies work against the investor when the stock moves in the opposite direction than what is expected by accelerating losses, while decelerating gains as the stock moves in the expected direction.

Table: Gamma vs. Delta

Source: OptionsPlay

While gamma can be a somewhat tricky concept to grasp at first, it is important for investors to understand the difference between long gamma and short gamma strategies and how this can impact changes in option pricing. The most important concept to remember is that gamma acts as an accelerator and decelerator on the gains and losses of an option as the stock moves higher and lower. While the four types of strategies can be confusing at first, long calls and puts are long gamma and short calls and puts are short gamma. As an option approaches expiration it will have a higher gamma, especially options with a strike price that is near the current price of the stock. This will result in an accelerator or decelerator that is very sensitive to the value of the option as the stock moves in favour of or against the investor’s desired direction.

Take advantage of free access to OptionsPlay Canada: www.optionsplay.com/tmx

—

Originally Posted on June 1, 2021 – Gamma, Your Option’s Silent Accelerator and Decelerator Pedal

Dollars expressed are in CAD

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Copyright © 2021 Bourse de Montreal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montreal Inc.’s prior written consent. This information is provided for information purposes only. The views, opinions and advice provided in this article reflect those of the individual author. This article is not endorsed by TMX Group or its affiliated companies. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange,TSX Venture Exchange and/or Montreal Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, The Future is Yours to See., and Voir le futur. Réaliser l’avenir. are the trademarks of TSX Inc. and are used under license. Montreal Exchange, MX are the trademarks of Bourse de Montréal Inc. All other trademarks used herein are the property of their respective owners.

Disclosure: Montréal Exchange - Option Matters

This material is from Bourse de Montréal Inc. and is being posted with its permission. Opinions expressed in this document do not necessarily represent the views of Bourse de Montréal Inc.

This document is made available for general information purposes only. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

Although care has been taken in the preparation of this document, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information contained in this document and reserve the right to amend or review, at any time and without prior notice, the content of this document.

Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions in this document or of the use of or reliance upon any information appearing in this document.

Disclosure: Canadian Options Trading

Canadian Listed Options involve risk and are not suitable for all investors. Trading of certain standardized Canadian Listed Options may not be permitted for U.S. Residents. For more information read the Characteristics and Risks of Listed Canadian Standardized Options, also known as the options disclosure document (ODD). To receive a copy of the ODD call 877-745-4222 or copy and paste this link into your browser: https://www.cdcc.ca/f_en/Options_Disclosure.pdf

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Montréal Exchange - Option Matters and is being posted with its permission. The views expressed in this material are solely those of the author and/or Montréal Exchange - Option Matters and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Margin Trading

Trading on margin is only for experienced investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!