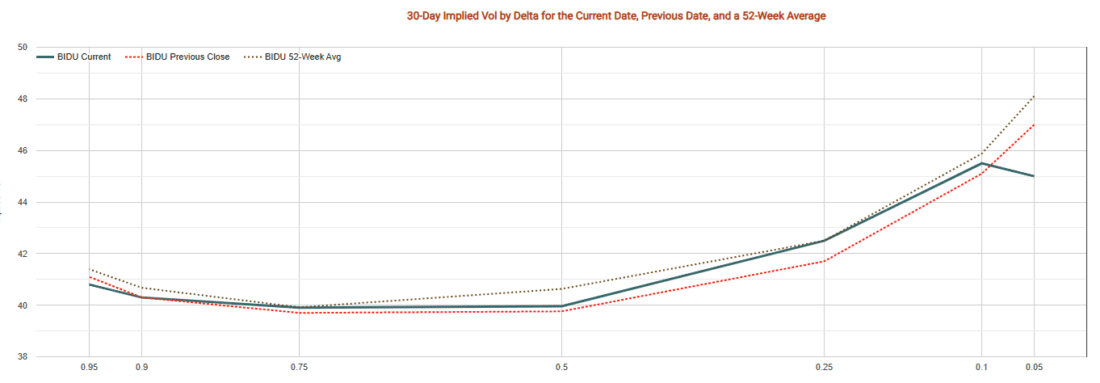

Implied Volatility Skew in BIDU Points to Bullish Trader Sentiment

source: market chameleon Bidu IV Skew

Baidu Inc. (BIDU) is showing signs of a potential bullish shift in both its stock performance and options market sentiment. Recent data suggests that traders are positioning for upside in the stock, with options skew and open interest levels signaling growing confidence in a rally.

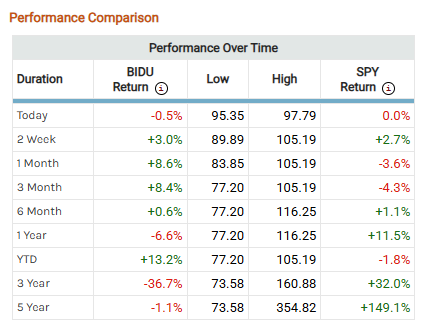

Strong Relative Performance

source: Market Chameleon

Over the past three months, BIDU has outperformed the broader market, returning +8.4%, compared to the S&P 500’s -4.3%. The trend has continued over the past two weeks, with BIDU up +3% versus SPY’s +2.7%. This relative strength hints at a shift in investor sentiment, especially as BIDU has been in a longer-term downtrend.

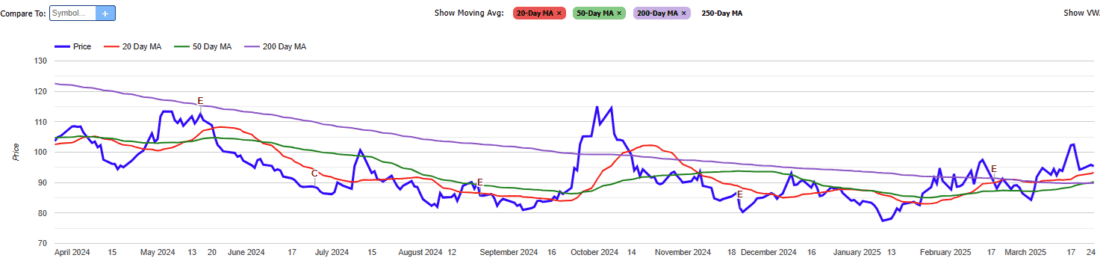

Bullish Technical Crossover

source: Market Chameleon

Technically, BIDU is flashing a potential reversal signal. The 20-day moving average recently crossed above the intermediate-term price trend—a bullish crossover that often marks the early stages of a trend change. After months of pressure, this could be the inflection point bulls have been waiting for.

Option Skew Tilts Bullish

Option traders appear to be leaning heavily toward the upside. The implied volatility (IV) skew shows that 25-delta call options are trading at an 8.8% premium to equivalent puts. This upward-sloping skew suggests that the market is pricing in a greater probability of an explosive upside move than a dramatic drop.

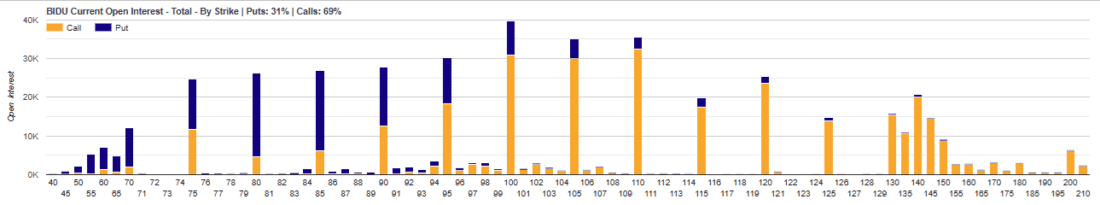

Open Interest Supports Bullish Sentiment

source: Market Chameleon

Looking at open interest, the divergence between calls and puts is notable. Call open interest ranks in the 88th percentile, while put open interest is in the 48th percentile—a strong indicator of elevated bullish positioning relative to historical norms.

Much of this call interest is concentrated in out-of-the-money strikes ranging from $100 to $200, which implies that traders are targeting significant upside potential in the stock.

Macro Backdrop & Valuation

Amid rising tensions with the U.S. imposing new tariffs and concerns about a domestic slowdown, China’s tech sector—particularly its AI push—has been accelerating. Baidu’s role in AI development, especially following the buzz around DeepSeek’s R1 model, could position the company for growth just as investor interest is reigniting.

Despite the recent rally, BIDU is still down -6.1% over the past year, while the S&P 500 is up +11.6%. That disconnect may present a value opportunity, especially if momentum continues building.

—

Originally Posted on March 25, 2025 – BIDU Option Skew Points to Bullish Call Buildup — Is a Trend Reversal Underway?

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!