Stock and bond markets had a banner week last week; originally because of hopes that the FOMC and Chair Powell would offer dovish commentary, then later because the rhetoric could be interpreted as “heads I win, tails I win.” Buy the rumor, buy the news, as it were.

It’s important to keep this in mind: when Powell says “maybe”, investors hear “yes”.[i]

Ask yourself this question: Why exactly do we need rate cuts if all manner of risk assets are rallying, including foreign stocks and cryptocurrencies, and while credit spreads and credit default swaps show no signs of overt stress (at least not in the aggregate) – especially if the FOMC’s Summary of Economic Projections now anticipates 2.1% real GDP growth for 2024?

Two (of many) potential answers come to mind:

First, it is simply possible that having committed itself to a well-received interest rate policy in an election year, the Federal Reserve wants to minimize the perception that they might make changes that could be seen as advantaging or disadvantaging one party or another.

I’d hate to think that political considerations are outweighing the data, but that is not outside the realm of possibility.

Second, is the FOMC seeing signs of economic and/or credit stress that are not readily apparent to most investors?

In response to a reporter’s question about the likelihood of slowing the current pace of balance sheet reduction (aka quantitative tightening, or QT), Powell offered this response:

And in terms of the timing [of QT], I said “fairly soon.” I wouldn’t want to try to be more specific than that. But you get the idea. The idea is—and this is in our—in our longer-run plans, that we may actually be able to get to a lower level, because we would avoid the kind of frictions that can happen. Liquidity is not evenly distributed in the system. And there can be times when in the aggregate reserves are ample or even abundant, but not in every part. And those parts where they’re not ample there can be stress. And that can cause you to prematurely stop the process to avoid the stress. And then it would be very hard to restart, we think. So something like that happened in [20]19, perhaps. [emphasis mine]

So that’s what we’re doing. We’re looking at what would be a good time and what will be a good structure. And, you know, “fairly soon” is words that we use to mean fairly soon.

Why did the Chair bring up the events of 2019 without obvious prompting? For those who don’t remember, there was severe stress in the repo markets that banks use to finance their positions. Stock markets barely noticed, but the stresses behind the scenes were building dangerously. That prompted the Fed to reverse course on the QT policies that were then in place. The resulting stimulus was then indeed noticed quickly by stock markets, and they launched higher on a furious momentum rally that was only brought to an end by the Covid outbreak. The credit stress – or more specifically, the monetary policy response – turned out to be a good thing for most investors for several months. Could that be at play again? I know we shouldn’t be rooting for credit market stress and the dangers that it can engender, but equity investors like any outcome that brings accommodative policies.

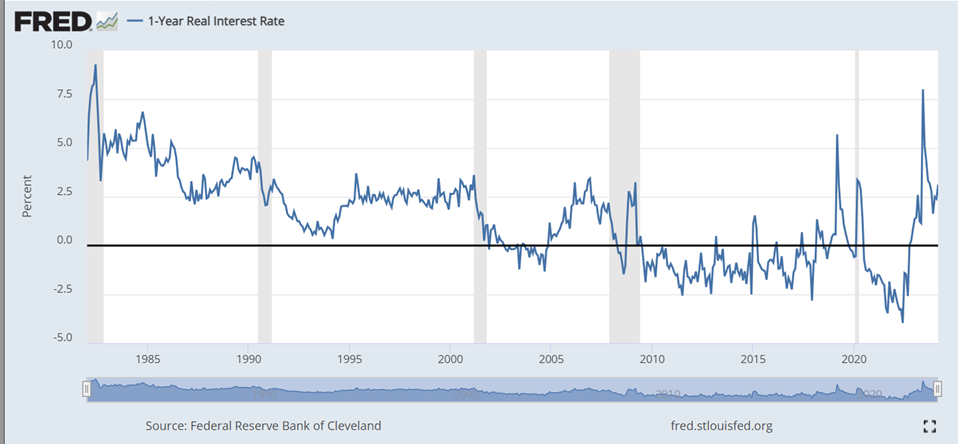

One other thing to keep in mind is this. The Fed has been quite cagey about telling us where exactly the “neutral rate” lies. Powell has asserted that rates are currently restrictive, meaning above that neutral rate, despite the obvious evidence that markets act as though the contrary is true. It seems as though the Fed is not properly accounting for the amounts of fiscal stimulus that have been occurring in recent years. This is something I discussed in a recent video as an underappreciated factor in the current rally, and something that former Treasury Secretary Summers acknowledged last week. Bear in mind, while over the past decade we’ve become accustomed to real interest rates at or near zero (when fiscal stimulus was far less a factor), we are currently much closer to historically normal levels of real rates.

—

[i] I discussed this topic, and much more, on a radio interview earlier today.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

The third reason why we “need” rate cuts is simply because a whole generation of investors have been raised with the notion that the Fed is always accommodative. Remember the ‘Greenspan put’ and ‘Helicopter Ben’? The Fed itself can’t wean itself off of an accommodative stance. I bet that the economy could take another 150-200 bps of rate increases before anything meaningfully slows down. I think that a good gauge of when to stop would be when the housing market enters a true bear market … 20% off for everyone.

It is obvious to the casual observer the Fed is acting politically. And it’s not “to minimize the perception that they might make changes that could be seen as advantaging or disadvantaging one party or another.” They are clearly choosing sides.

I’m on the same page as Steve. I’m knee deep in the CRE space, so my industry is getting hammered by higher rates. That said, the overall economy is cruising along on a good glide path. I see no reason to lower rates in 2024 unless we see unemployment spike higher.

Meanwhile back at the ranch, has anyone else noticed all these companies languishing at the 50 day exponential average? On more or less average volume? No bouncy bouncy, just a weird levitation? Not an especially inspiring picture I think.