TLDR: Reasonable people disagree about important issues all the time. Eventually, one side is proved right and the other one is, well, sad about being wrong. When it comes to the Fed interest rate path, the stakes are high and either the Fed or investors will be very disappointed (hedge fund managers can get very sad when they lose, sometimes publicly.) So why do markets disagree with the Fed?

There is no disagreement about the near term. The odds of one more quarter-point increase in the federal-funds target at the Fed’s policy meeting on May 2-3 have become a near lock.

But … but … but

Markets keep pricing in rate reductions in the second half of this year even though Fed’s determination to quash inflation seems almost scary. Their decision to keep hiking came against Fed staff’s forecast of a mild recession later this year.

Inflation, for its part, hasn’t been cowed by the scary Fed talk. While off from its four-decade peak hit last year, it has stopped improving (or improving fast, at least).

Consumers also see inflation rising, not falling, in the coming 12 months, no doubt because of the recent leap in energy costs. So they, too, are doubting the Fed’s ability to get it under control.

And if you’re the Fed, you worry about inflation expectations because they’re at the very heart of any inflation targeting framework. Expectations of high inflation can be self-fulfilling in an economy with constantly adjusting prices.

Meanwhile … in another land …

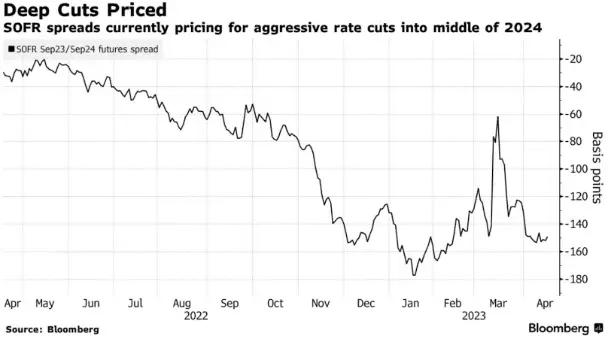

Short-term interest rate futures are priced for the Fed to cut interest rates by about 150 basis points from September 2023 to September 2024. The swaps market linked to Fed policy dates currently prices in a rate peak of about 5.14% in June, about 55 basis points of cuts by year-end and a combined 190 basis points of cuts by September 2024.

Why??

Well, it’s complicated.

Although the March CPI report was in line with our expectations overall, a key component – so-called “shelter inflation” – which mainly measures rental costs was shown falling from 8.3% to 5.3%.

Chair Powell’s contention a while back was that inflation was only held high by this somewhat made up measure. And that it would drop like a stone once shelter inflation turned.

He seems no longer so sure but the market definitely is.

Furthermore, credit is somewhat tight in the aftermath of the banking turmoil that started with the SVB failure. A fritz in lending can majorly restrain economic activity. Bloomberg consensus now puts the probability of a recession in 2023 at 65%.

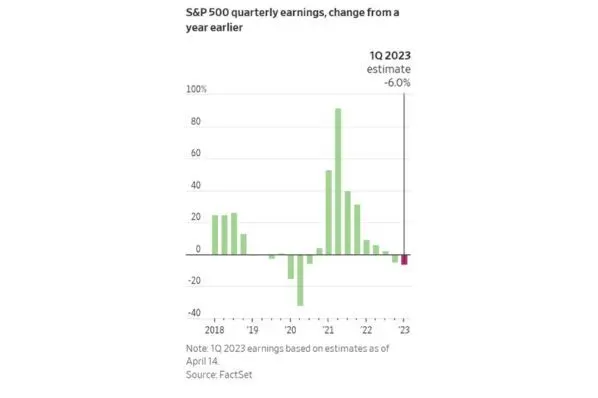

If interest rate markets are wrong (and the Fed is right), the biggest loser is likely to be the equity market: it has chugged along nicely buttressed by the comforting thought of Fed cuts by year end. That kept them from darker thoughts about faltering earnings growth, high valuations and the like.

S&P 500 companies are expected to report profits declining at the start of the year by the biggest amount since the second quarter of 2020. Stocks also look expensive relative to history. The S&P 500 trades at about 18 times its next 12 months of expected earnings. That ranks in the 81st percentile for valuations going back the past 40 years, according to the wise men at Goldman.

The conclusion? If the cuts currently priced in don’t come, stocks might well tank. And equity investors will definitely be sad.

What stocks are doing well today?

This section is powered by Open AI connected to TOGGLE AI

???? Thanks for all your feedback! This section is still paused but an enhanced version is on the way (we promise)! ????

Aggregated Leading Indicator Update!

Subscribe to Pro here to receive our pre-market Leading Indicator newsletter and access all Leading Indicators online! Currently, the Peak and Trough leading indicators are showing statistically significant readings.

- TLI

- Rangefinder Index

- Peak Probability Indicator

- Trough Probability Indicator

- Candle Breadth

- Market Phase Shift Indicator

- active leading indicator

- inactive leading indicator

Learn more about the Leading Indicators in the Learn Center!

Upcoming Earnings: Jet, set, United?

Click here to test what to expect when UAL releases earnings today.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

Asset Spotlight: Adani Ports Forward RoE at a low

TOGGLE analyzed 5 similar occasions in the past where valuation indicators for Adani Ports reached a recent low and historically this led to a median increase in the stock price over the following 6M. Read full insight!!

General Interest: Cast iron shenanigans

Today we go with something light-hearted.

It would be fair to say that during lockdown numerous people have improved their cooking skills. And as we became better cooks, we started to long for better tools.

Chef knives are probably the most visible growth space in kitchen utensils. Knife prices have exploded in the last five years and connoisseurs consider it normal to fork $1,000 for a handmade Japanese gyuto – which will chip if you look at it the wrong way. Even an ol’ reliable German blade will set you back $140 (we’re talking of course of the Wusthof 20cm).

Cast iron pans, much like their sharper counterparts, have developed some sort of cult following. And similarly to carbon iron knives they require some hardcore maintenance.

For one, the cult of cast iron forbids soap – thou shalt not soapen thine panne. So be ready to roll up your sleeves and scrub after using your skillet.

Secondly, after you clean a cast iron pan and before you set it aside you need to “season“ it – that means you need to grease it, if you were wondering.

Yes. You just cleaned your pan and then you have to … rub vegetable oil on it again. And then you set it to cook. And then when it cools off you can finally store your greased pan. We’re not joking ¯_(ツ)_/¯.

Cast iron pans are a lot of work, but who are we to judge. The New Yorker conversely feels they are good enough to judge, and did so in this hilarious article.

—

Originally Posted April 18, 2023 – Why are markets challenging the Fed?

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!