Russ discusses how calmer bond markets have benefited equities.

Equities continue to grinder higher driven by stellar earnings. And while multiples have been mostly flat year-to-date, valuations remain supported by low and stable rates. Put differently, the steady rally in equities is linked to a quieter bond market.

Back in May I last discussed the significance of bond market volatility for equity markets. At the time there was considerable uncertainty surrounding both inflation and the Fed’s new reaction function. As a result, after years of trading with a negative correlation to stocks, bonds and equities started co-moving to a degree not seen in two decades. In addition, bond market volatility was quickly leaking into stock markets.

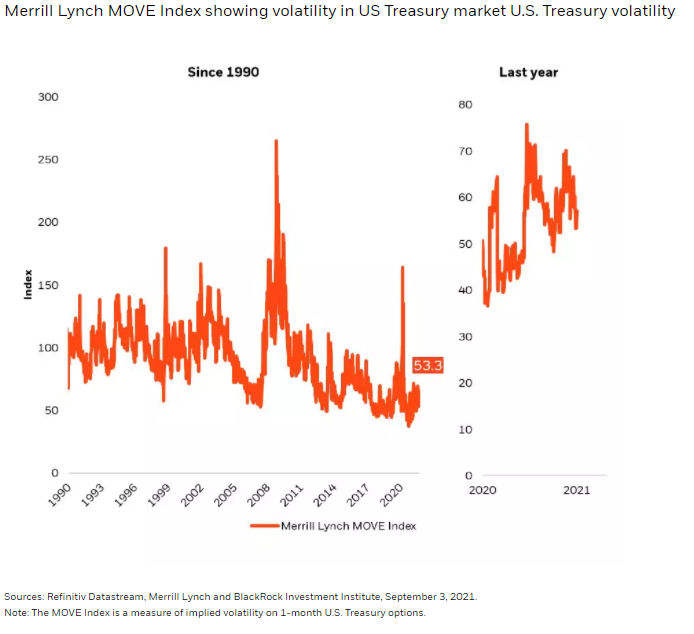

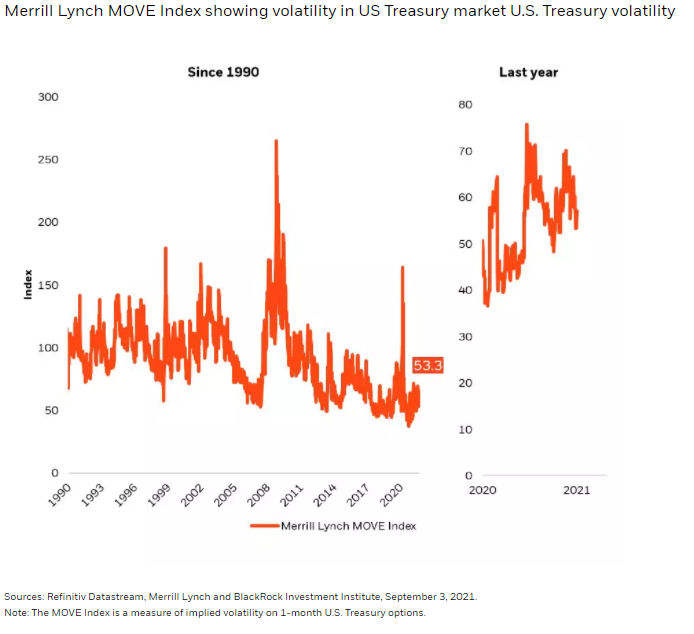

More recently bond market volatility has ebbed, in the process benefiting equity markets. Volatility in the U.S. Treasury market, as measured by the MOVE Index, recently traded close to the June lows. Rate volatility is now down roughly 20% from the July peak and 25% from the February top (see Chart 1).

Bond Volatility – ML MOVE Index

Not coincidently, equity market volatility has also moderated. Implied equity volatility, measured by the VIX Index, has been lingering in the mid-to-high teens, below the long-term average. The “volatility-of-volatility” has also plunged, down roughly 30% from the summer peak.

The recent moderation is consistent with the post-pandemic normalization. Based on weekly data, last year implied volatility averaged slightly under 30. While the 2020 average is obviously skewed by last spring’s panic, even during the back half of 2020 the VIX averaged around 25. Year-to-date the VIX has averaged slightly under 20, in-line with the long-term norm.

The drop in implied volatility, which reflects investor willingness to pay for index options, has followed a similar decline in realized volatility, i.e. the annualized standard deviation of stock returns. One-year realized vol on the S&P 500 is 15%; while three-month volatility is around 10%.</p.

With realized volatility confirming the drop in implied vol, one big question is whether bond markets will play along? This matters as the direction of bond market volatility continues to be a key driver of equity market volatility, a dynamic confirmed by the data.

Year-to-date the beta of equity volatility to bond volatility has been roughly 0.95; the MOVE Index has also explained approximately 30% of the variation in the VIX. This suggests that both the sensitivity and significance of equity markets to bond market volatility remains elevated. In other words, to a greater extent than normal stocks are taking cues from bonds.

Implications for portfolios

More muted bond volatility has several implications for equity positioning: Most importantly, low and steady rates provide a supportive backdrop for stocks. The current regime also suggests favoring non-financial cyclical expressions over banks. As I’ve discussed, the bank trade is somewhat hostage to bond markets. If rates stay quiet there are arguably better cyclicals expressions in consumer discretionary, materials and industrials. Finally, lower volatility, i.e. cheaper options makes it economical to own more equity exposure in option form.

—

Originally Posted on September 30, 2021 – Why A Steadier Bond Market Supports Stocks

Investing involves risk, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of September 2021 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

The BlackRock Model Portfolios are provided for illustrative and educational purposes only, do not constitute research, investment advice or a fiduciary investment recommendation from BlackRock to any client of a third party financial advisor (each, a “Financial Advisor”), and are intended for use only by such Financial Advisor as a resource to help build a portfolio or as an input in the development of investment advice from such Financial Advisor to its own clients and shall not be the sole or primary basis for such Financial Advisor’s recommendation and/or decision. Such Financial Advisors are responsible for making their own independent fiduciary judgment as to how to use the BlackRock Model Portfolios and/or whether to implement any trades for their clients. BlackRock does not have investment discretion over, or place trade orders for, any portfolios or accounts derived from the BlackRock Model Portfolios. BlackRock is not responsible for determining the appropriateness or suitability of the BlackRock Model Portfolios or any of the securities included therein for any client of a Financial Advisor. Information and other marketing materials provided by BlackRock concerning the BlackRock Model Portfolios –including holdings, performance, and other characteristics –may vary materially from any portfolios or accounts derived from the BlackRock Model Portfolios. Any performance shown for the BlackRock Model Portfolios does not include brokerage fees, commissions, or any overlay fee for portfolio management, which would further reduce returns. There is no guarantee that any investment strategy will be successful or achieve any particular level of results. The BlackRock Model Portfolios themselves are not funds. The BlackRock Model Portfolios, allocations, and data are subject to change.

For financial professionals: BlackRock’s role is limited to providing you or your firm (collectively, the “Advisor”) with non-discretionary investment advice in the form of model portfolios in connection with its management of its clients’ accounts. The implementation of, or reliance on, a Managed Portfolio Strategy is left to the discretion of the Advisor. BlackRock is not responsible for determining the securities to be purchased, held and sold for a client’s account(s), nor is BlackRock responsible for determining the suitability or appropriateness of a Managed Portfolio Strategy or any securities included therein for any of the Advisor’s clients. BlackRock does not place trade orders for any of the Advisor’s clients’ account(s). Information and other marketing materials provided to you by BlackRock concerning a Managed Portfolio Strategy—including holdings, performance and other characteristics–may not be indicative of a client’s actual experience from an account managed in accordance with the strategy.

For investors: BlackRock’s role is limited to providing your Advisor with non-discretionary investment advice in the form of model portfolios in connection with its management of its clients’ accounts. The implementation of, or reliance on, a Managed Portfolio Strategy is left to the discretion of your Advisor. BlackRock is not responsible for determining the securities to be purchased, held and sold for your account(s), nor is BlackRock responsible for determining the suitability or appropriateness of a Managed Portfolio Strategy or any securities included therein. BlackRock does not place trade orders for any Managed Portfolio Strategy account. Information and other marketing materials provided to you by BlackRock concerning a Managed Portfolio Strategy—including holdings, performance and other characteristics—may not be indicative of a client’s actual experience from an account managed in accordance with the strategy. This material is subject to change.

Prepared by BlackRock Investments, LLC, member FINRA.

©2021 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

USRRMH0921U/S-1847929

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!