In the fourth installment of our US elections series, we consider the consequences of changes in policy on economies and markets outside the United States. Given that a victory for any Democratic presidential candidate would typically mean a status quo in terms of policy settings, our analysis focuses largely on the implications of a second Trump presidency. Some countries will fare better than others in the latter scenario, and we tease out where the effects are most likely to be felt with a Trump White House.

How US Policy Changes Transmit Abroad

We have identified four main policy transmissions that we consider most relevant. First, and foremost, the US shapes global financial markets via the dominance of its reserve currency status as well as being home to the world’s largest and deepest capital markets. In particular, US influence transmits rapidly via changes in financial conditions expressed in the relative value of the US dollar as well as US interest rates. These conditions are heavily subject to the overall macro policy mix, with fiscal and monetary policy each playing central roles in shaping the outcome.

President Biden’s decision to exit the US Presidential race means the 2024 elections are less likely to result in a Republican sweep (2024 US Election – Big or Small Macro Policy Shift Coming?) and sizable fiscal expansion. Rather, Democrats could control the House, resulting in a more modest fiscal impulse. Markets’ perception of US monetary policy under a Trump administration would also be a key factor. We believe that Trump would attempt to influence monetary policy, even without a congressional mandate, and force markets to contemplate more inflation uncertainty in the long term. These potential scenarios have already been enough to move markets, with longer-term yields rising alongside Trump’s improved polling numbers.

In addition, the US president has executive discretion over policy areas independent of Congress. Three areas are likely to be most in focus: energy, trade and security. With regard to energy, Trump would undoubtedly amplify US efforts to grow US energy exports. Improved relations with major energy producers should also help ensure global energy supply remains abundant and prices contained. Energy supply and prices are part of a global market and thus the benefits/costs of US action directly affect the world’s economy.

On trade, there would almost certainly be tariff increases, with a disproportionate share being levied on Chinese imports. However, selective tariffs can also be expected on a range of imports from Europe and certain emerging market countries. We would not expect Mexico to face any meaningful trade disruption, with the Trump-authored USMCA only up for renewal in 2026 and likely to be extended under similar conditions. Given its discriminatory application by design, trade policy is the lever most likely to drive divergence between foreign economies and markets.

Finally, foreign and security policy are the exclusive domain of the president. Trump is likely to continue to extract higher security commitments from US allies, notably in Europe. The explicit pivot of US military attention to Asia would also impose a higher premium on China via geopolitical risk perceptions and the stifling of domestic reforms.

So Who Wins, Who Loses?

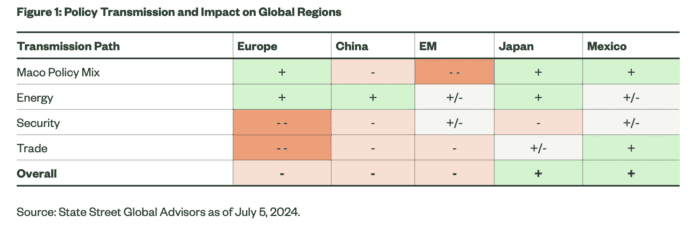

Figure 1 summarizes our overall views, with China and many emerging markets being most exposed due to their negative correlation with a stronger US dollar and higher US long-term rates. China would inevitably be the central target of US trade sanctions, but the impact on China would be partially mitigated by its ability to devalue the renminbi. The capacity of China’s corporate sectors to diversify production in third-party countries provides an additional offset. Moreover, as a large energy importer, China would be an indirect beneficiary of cheaper energy. Other large EM energy importers such as India would also benefit, although the emerging markets (EM) complex contains many energy producers for whom softer energy prices would pose a constraint on their own economic prospects.

In contrast to China, Europe cannot offset trade tensions via its exchange rate and thus would also suffer from RMB depreciation and loss of competitiveness vis-à-vis China. Trade disputes in large European capital goods also prevent any re-importation via third parties, thus leaving important industries in Europe heavily exposed. A larger trade war may well be prevented, but the price of that for the European Union may be concessions that weaken its export sectors. Another concession would be even higher security expenditures in exchange for US security commitments. This fiscal burden would also exacerbate long-term worries over European security and push structural risk premia higher on European assets.

Net winners from a new Trump regime are likely to be the same ones as during Trump 1.0. The Mexican peso was the best performing currency from 2017-2020 as anti-Mexican policies failed to materialize – we would expect the same in the domain of economics and markets for 2025-2028. Similarly, Japan is much less exposed to trade ruptures and could even displace some Chinese market share in the coming years; Japan would also benefit from cheaper energy costs.

More to Watch For

For investors, US elections are classically played via US equity sectors due to each party’s regulatory stance, as we outlined in a previous article. In conjunction with the rejection of the legality of the Chevron deference by the US Supreme Court, the US is about to enter an era where regulation is likely to be distinctly more ‘light touch’. Could this trigger similar moves towards deregulation beyond the borders of the US?

There is also a strong likelihood that a Trump administration would parallel this domestic deregulatory development by withdrawing the US from several global policy organizations and agreements across areas such as climate, finance, technology, and digital regulation. For Europe, this represents another structural challenge as the gap grows in favor of US outperformance in innovation and business environment. This is hard to specify but is a non-negligible tailwind to US exceptionalism more broadly. However, at the same time, domestic political cohesion may pose a threat to US leadership, something we will examine in our final article in the autumn.

—

Originally Posted July 22, 2024 – US Elections: Global Spillover Effects

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

This analysis clearly shows how a second Trump presidency might affect economies around the world, especially through trade and energy policies. It points out that different countries will be impacted in various ways and stresses the importance of adapting strategies. Thanks for sharing.