I’ve been frequently asked whether federal government policies are likely to have on markets. Considering that tariffs might be implemented as early as tomorrow, this is a critical consideration. Yes, policies will be critical, but not necessarily in the way that we might be currently expecting. Frankly, while many investors are understandably excited about the potential benefits of lighter regulation, they are not focused upon the potential negative effects to the economy of slower spending.

I know that some of you will inevitably interpret this piece through a political lens. I assure you this is not written with a political viewpoint in mind – my attempt is to stick to the potential economic effects of government policy on markets. Please be mindful of that while you read.

I believe that the role of fiscal stimulus as a force powering both markets and the economy (they’re not necessarily one and the same) has been underappreciated. Sure, we’ve all discussed the role that the various stimulus packages played in stoking inflation, but I believe that we’re still seeing beneficial economic results from them as well.

It is important to remember the direct role that government spending plays in the calculation of Gross Domestic Product, or GDP:

GDP = Consumption + Investment + Government Spending + Net Exports

Or

GDP = C + I + G + (X – M); where X= exports and M= imports

Although yesterday morning’s preliminary 4Q real GDP was reported at 2.3%, less than the 2.6% expectation, it is still pretty solid. It got a boost from a 4.2% jump in personal consumption, which would not have occurred if people didn’t feel that their own economic prospects are healthy.

Bear in mind that a good portion of the spending in the most recent package, the Inflation Reduction Act was in fact investment related because funds were allocated to infrastructure development. We reward companies for capital expenditures that have the promise of boosting future prosperity; we should do so for the government too.

Elections bring changes, and the key policy changes that the new administration promises include different approaches to government spending and net exports. The new administration asserts that spending is too high and needs to be curtailed. Without debating the politics of that statement, it should be clear that curtailing government spending would flip fiscal policy from expansionary to neutral or even contractionary, reducing “G” in the equation above.

Now, we also know that the new administration prioritizes increasing net exports, with tariffs as a key tool towards that goal. The effect upon GDP will ride upon whether the shrinkage in the “G” can be sufficiently offset by increasing “X” and/or reducing “M”. If yes, then the economic effects might be minimal or beneficial; if not, the US economy could suffer.

Some might be thinking that a weaker economy is OK if it brings rate cuts. But the equity market ultimately prefers a solid economy to one that is weak enough to require aggressive rate cuts. Remember, at this time last year expectations were for 7-8 rate cuts in 2024. We got only 4, and the first two didn’t come until September, yet the markets didn’t really care. Why? Because the economy was strong enough that aggressive cuts weren’t immediately required.

And we rallied in late 2022 and early 2023 despite rate hikes. Why? Again, because the economy was strong enough to overcome that drag.

And it’s not even clear that the bond market, which should relish slower spending, is fully on board with it either. If they were hopeful that spending cuts would reduce deficits and/or economic activity, then Treasury yields should have fallen. While yields are off their highs, 10-year notes are currently yielding over 10bp more than they were prior to the election. Bond traders have other concerns besides GDP though, and the higher yields also might reflect concerns about the budgetary effects of potential tax or tariff policies as well.

In short, there is a wide range of economic uncertainties that could affect markets in the coming months, and while the policies might be difficult to predict, the interaction between those potential policy changes is even more uncertain. Thus, economic policy initiatives will be critical for the economy and the markets, and their effects might be unpredictable. And of course, Chair Powell refrained from offering his opinions about them during Wednesday’s press conference. The Fed never likes to comment upon potential fiscal policies, particularly when they have yet to be fully decided.

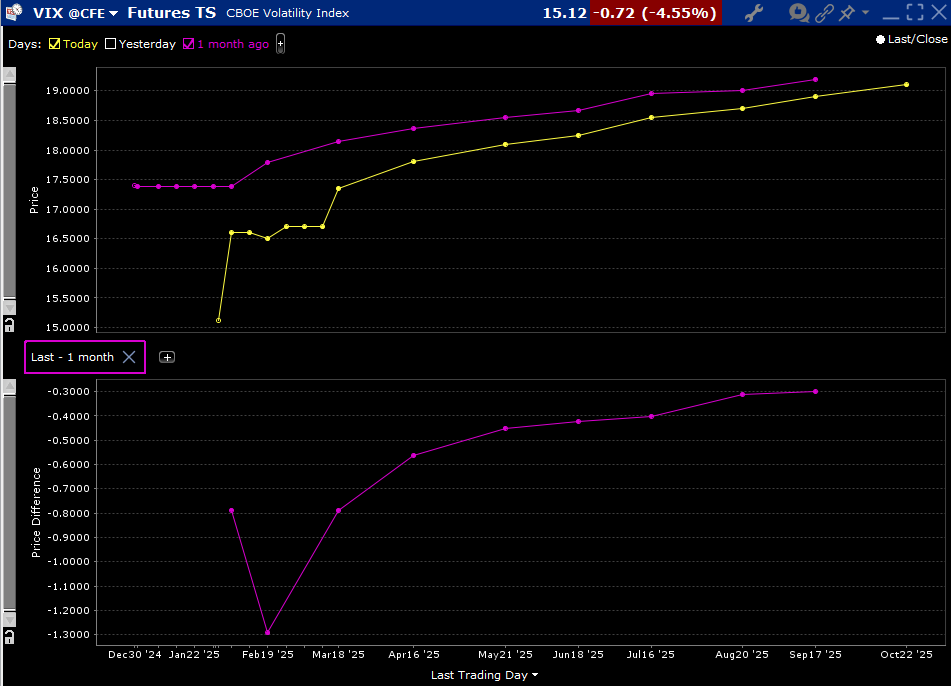

Yet the VIX futures curve seems rather unperturbed, both in the present and future….

VIX Futures Term Structure, Today (yellow, top), 1-Month ago (purple, top); Differences (bottom)

Source: Interactive Brokers

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

There are two types of tariffs: revenue and protective. Revenue tariffs (small percentages like 5-9%) historically are great for everyone in the world. Protective tariffs (like the ones Pres Trump is proposing) have never worked in the history of the world. They are always inflationary. Take clothes for example. Virtually no article of clothing is manufactured in the USA. So, Walmart imports a pair of underwear for a $1.00 ($1.05 with Walmart paying the revenue tariff). The protective tariff is 25%. Walmart has to pay this amount to the Federal Government. So, now the cost of that pair of underwear is $1.25. Now Walmart adds its profit to the cost. Say $3.00. Now that pair of underwear costs $4.25 instead of $4.00. If that pair of underwear were made in the USA, it would probably cost double or triple because of the increased costs of manufacturing (materials, labor, etc.) We are so dependent on the world to make things cheaply for us. The real problem, and the reason for this monetary battle, is because our government doesn’t trust China. It’s a damn shame.

No, you are not being at all political.

According to Wikipedia, all the Democrats in the Senate and House voted for the bill and all the Republicans voted against the Inflation Reduction Act of 2022. Per Google, over ten years the expected cost is 800 to 1200 billion. The bill has 705 billion for energy and climate change. The budget deficit beginning 2021 was 2772 billion, 2022 was 1376 billion, 2023 was 1684 billion, and 2024 was 1832 billion. If the 2025 budget is reduced by 1000 billion (14.9% of 2024 budget) then the public debt could still be growing but at a slower pace.

What was not mentioned was the long term detriment effects to the economy of bloated deficits.

Let’s all remember that inflation devalues monetary assets. We are in a Keynesian multiplier economy. The federal fiscal policy markers are favoring infrastructure spending to stimulate tax payments from companies and their employees working to vomwtw those projects. The economists working on those projections are actually do a better job than I formerly gave them credit for doing. We must pay the interest on the debt to devalue the bonds 30 years in the future. Inflation does the trick and we as citizens benefit greatly. I went fishing on the East Cape out of Cabo San Lucas it was 60 miles north of Cabo and the road washed. We carefully worked our way around the debris while a crew with shovels and wheelbarrows labored to remove rocks and mud from the highway. That was my “a-ha” moment. No federal spend. No heavy equipment. No payments for road development and the equipment associated with it. Federal spending is vital to float the debt and devalue it. The US has borrowed a lot of money that will be chump chsnge in 30 years to the buy and hold non- traders. As for President Trump – I am short a bit of /ES on the weekends. You never know what a weekend brings – Iranian General in the firstvterm. Columbian sanctions, Saturday sanctions this week? Markets dislike one thing only – uncertainty. I can game that.

Thanks Steve. Nice summary of GDP. The idea that the USA does not manufacture clothing is a myth. Checkout how many textile mills and clothing manufacturers there are in the US. Are the goods “cheap”, price wise? No, but the quality is evident.

Government spending is all financed with debt, which continues to put us in an increasingly precarious financial situation with the cost to service it. This is not sustainable; the answer is not “keep printing money and issuing debt.” Having said that, a reduction in government spending needs to be offset by an increase in consumer spending and & corporate spending/investment, particularly in the manufacturing sector which has gotten crushed in the last 4 years.