President Trump’s U-turns on Beijing and Fed Chair Powell are sparking a terrific risk-on rally in markets. News that the Commander in Chief is optimistic about a trade deal with China has fixed-income watchers dialing down inflation expectations and reaching for the long-end of the curve. Moreover, the bull flattening across the Treasury complex is also being influenced by the US head of state shifting toward a collaborative stance on the central bank, which is neutralizing action in the shorter maturities in light of less political pressure to cut. Corporate earnings and the economic calendar aren’t standing in the way of the bulls, as mixed PMI data coincided with a big beat on new home sales. Investors are responding by scrooping up stocks in all sectors and forecast contracts while they trim their defensive positions, which include volatility call options, equity index put derivatives and gold futures.

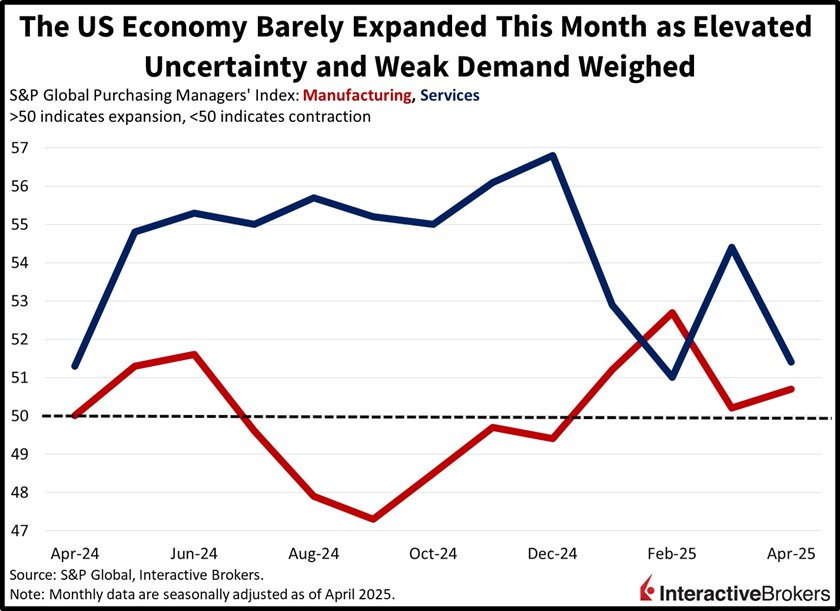

Purchasing Managers’ Index Depicts Weak April

The US economy barely expanded in April as a weak demand environment, elevated uncertainty and intensifying price pressures weighed on both the services and goods producing sectors. S&P Global’s April Purchasing Managers’ Index (PMI) came in at 51.4 and 50.7 across services and manufacturing, compared to the consensus estimates of 52.5 and 49.1 and March’s 54.4 and 50.2. Despite slower overall growth as illustrated by the weighted composite figure declining from 53.5 to 51.2, a 16-month low, activity remained above the critical expansion-contraction threshold of 50. Soft orders in services were hampered by exports, which include tourism and cross-border transactions. Similarly, trade policy and tariffs reduced goods exports at factories. Prices rose, meanwhile, a result of rising input costs, higher import charges and heavy wage bills. Employment grew slightly in aggregate, increasing in services but decreasing in manufacturing. Sentiment fell for the third consecutive month to the lightest level of optimism since July 2022, but the manufacturing sector was less pessimistic on hopes that protectionist measures will drive increased profitability.

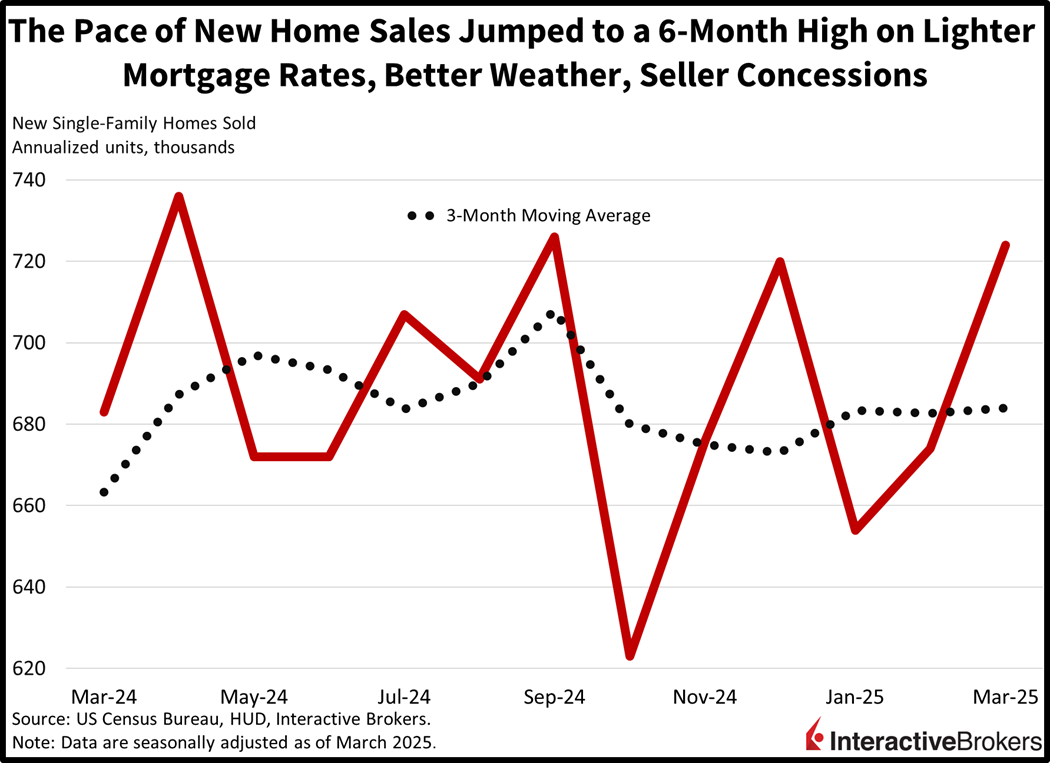

Home Sales Pick Up

The volume of new home sales last month rose at the fastest pace since September, as better weather, lower mortgage rates and seller concessions drove transaction volumes. The 724,000 seasonally adjusted annualized units blew past expectations of 680,000 and posted a sizeable gain relative to February’s 674,000. The 7.4% month-over-month (m/m) pick up was propelled by a 13.6% m/m increase in the South, which is the largest region in terms of new construction. Meanwhile, the Midwest gained 3% while the Northeast and West weighed on results, dropping 22.2% and 1.4% during the period.

Nasdaq Gains Nearly 4% as Investors Embrace Risk

Offensive positioning is dominating markets today as all major domestic benchmarks are climbing much higher. The Nasdaq 100, Russell 2000, S&P 500 and Dow Jones Industrial gauges are up 3.6%, 3%, 2.7% and 2.2%, with all sectors participating in the upside. But the components gaining the most are technology, consumer discretionary and industrials, which are advancing 3.9%, 3.5% and 2.2%. The Treasury complex is shifting south in bull flattening fashion, with 2 and 10-year maturities changing hands at 3.82% and 4.33%, unchanged on the former but 7 basis points (bps) lighter on the latter. Cheaper borrowing costs in aggregate are weighing on the dollar index, which is down 17 bps as the greenback depreciates relative to the euro, yuan and Aussie counterpart. Conversely, the US currency is appreciating against the pound sterling, franc, yen and loonie. Commodities are tilted bearishly as a lack of safe haven demand sends gold lower while oil prices decline on Kazakhstan’s defiance of OPEC+ production quotas in light of prioritizing national interests. Still, silver and lumber are up 3.1% and 0.4% while gold, crude oil and copper are down 3%, 2.7% and 0.2%.

Investors Focus on US-China Relations

Today’s incremental illumination of the dark global trade tunnel is offering investors a rising degree of assurance regarding the Trump put. The Commander in Chief appeared ready to stomach a heavy amount of market volatility and economic turbulence in pursuit of the challenging goals of fairer global trade and fiscal deficit reductions. But the President is now threading the needle of appeasing shareholders and the constituency by striking abrupt changes in direction when conditions become increasingly bleak. While a big deal featuring Beijing and Washington can be cemented, the Trump plan essentially requires its Far East rival to control a reduced share of international manufacturing activity, which is a frustration to Chinese head of state Xi Jinping. In conclusion, agreements between the two powerhouses are probable in the next few months, but the clashes of the world’s two largest economies are likely to persist for years to come.

International Roundup

Singapore Prices Eased Last Month

The Singapore Consumer Price Index (CPI) declined 0.1% m/m in March after increasing 0.8% in the preceding month. For the y/y metric, the index climbed 0.9%, matching February’s result and falling below the 1.1% forecasted by economists. Also in March, core prices advanced 0.50% y/y, slightly lower than the 0.60% increase in April. For m/m price gains, the information and communication category led with a 1.8% spike followed by the 0.4% northward movement of the household durables and services group.

March Prices Were Stable in Hong Kong

Hong Kong’s CPI was flat m/m in March after falling 0.10% in the second month of the year. Relative to March of 2024, prices climbed 1.4%, matching the rate of increase in February but coming in below the 1.5% median estimate.

Japan Manufacturing Contraction Continues

Japan’s manufacturing sector continued to decline this month, but the pace of the contraction moderated marginally from March, while the country’s services sector moved solidly into expansion territory. The Jibun Bank Manufacturing PMI climbed from 48.4 to 48.5 but stayed below the contraction/expansion threshold of 50. It was the tenth consecutive negative reading and worse than the forecast of 48.7. Business confidence hit its lowest level since June 2020 in response to the escalating trade war and factories reported weakening foreign demand. At the same time, an increase in customer orders helped drive the services PMI up from 50 to 52.2. While the trade war weighed on sentiment, service providers reported stronger sales.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!