Equities are rallying this morning and have begun the month of June on firm, solid footing. A strong expectation that the debt ceiling deal will become law this afternoon upon President Biden’s signature is generating optimism among investors. While job and wage growth remained persistent in May, investors are focusing on the increasing unemployment rate reflected in this morning’s Employment Situation Report, which has boosted sentiment. The tick up is fueling wagers for a Fed pause at its June 14 meeting, with odds of 72% favoring that outcome.

As expected by many Beltway observers, legislation to suspend the $31.4 trillion debt ceiling for two years and trim government spending passed the Senate yesterday and is waiting for President Joe Biden’s signature. The Senate rejected 11 proposed amendments to the legislation, largely because of the limited time available prior to the June 5 X date, or the date when a failure to suspend the ceiling would result in the U.S. defaulting on debt and failing to honor other obligations such as Social Security payments. Biden’s expected signature today will finalize the current-debt ceiling matter, which featured concessions made by both parties.

This morning’s Jobs Report offered details for both bulls and bears; however, it was much easier for the bulls to take the upper hand with recent tailwinds from artificial intelligence and the debt ceiling providing momentum. Meanwhile, the bears are tired from taking on the relentless bulls and failing to gain ground all year against the backdrop of equity volatility levels that are at their lowest levels in years.

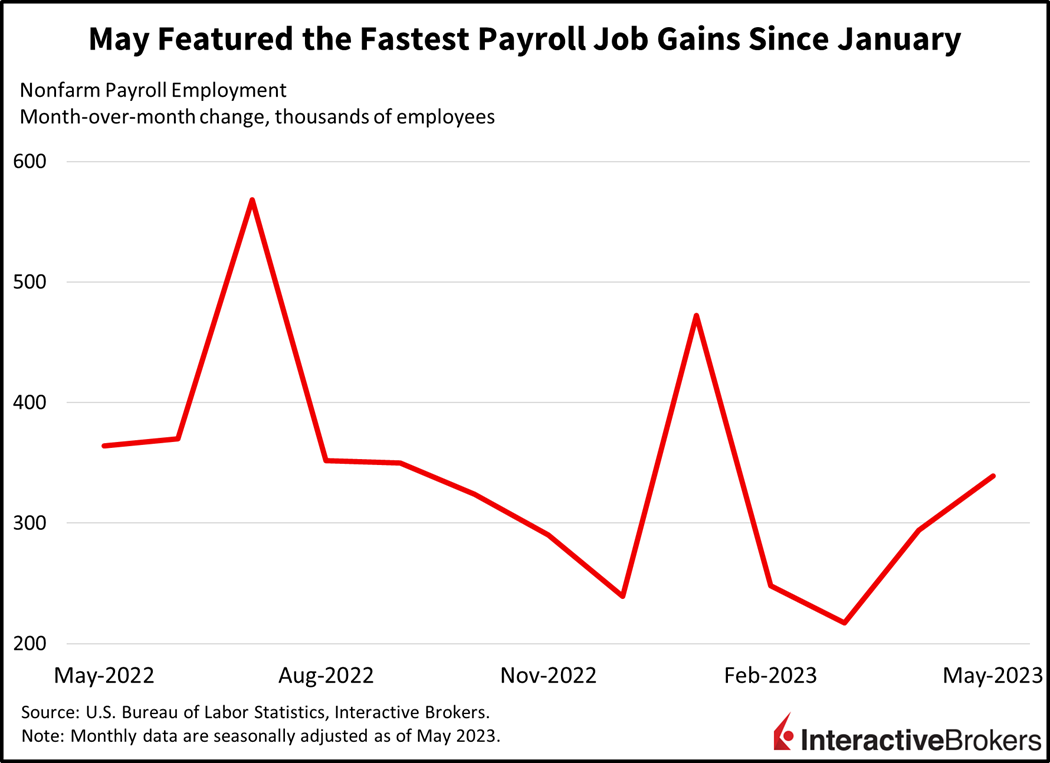

May job gains totaled a stellar 339,000, crushing expectations calling for 190,000 and reaching the highest monthly increase since January. May’s headline also reflected an acceleration in job additions from April, in which 294,000 jobs were added. Gains were broad-based among sectors with a couple of spoilers weighing on the headline. Leading the pack were the following sectors:

- Health care and social assistance, which added 74,000 jobs

- Professional and business services, which added 64,000 jobs

- Government, which added 56,000 jobs

- Leisure and hospitality, which added 48,000 jobs.

The construction, transportation and warehousing, retail, finance, mining and logging, and wholesale trade all added as well, albeit at more tempered levels. Manufacturing and information lost jobs during the month totaling 9,000 and 1,000.

Average hourly earnings remained relatively hot as well, but progress was nonetheless achieved due to a month-over-month (m/m) deceleration. Average hourly earnings grew 0.3% m/m, in-line with expectations and decelerating from the 0.4% pace of the prior month. Taken together, both payrolls and wage gains remain too hot and inconsistent with the Fed’s 2% inflation goal.

The often overlooked household survey told a different story in May, however, with self-employed workers weighing on the headline significantly. According to the household survey, 310,000 jobs were lost during the month, with self-employed workers driving the decline. Self-employed workers, which aren’t reflected in the establishment survey since they aren’t on company payrolls, were down 412,000. The dramatic loss in jobs led to a 30-basis point (bp) increase in the unemployment rate, from 3.4% in April to 3.7% in May, with both full-time and part-time employment suffering. The labor force grew after dipping in April, as more workers came into the labor market looking for work. Another labor headwind in the report was apparent in the average hourly workweek, dipping from 34.4 to 34.3, the lowest level since April 2020 during the depths of the pandemic recession. At odds with payroll jobs additions and wage increases, the aforementioned data points offer some weaknesses under the surface.

Stocks are leaping higher as the risk-on rally continues and are now up over 10% this year as ferocious optimism thrives. All major indices are up at least 1% today and cyclically tilted indices are up closer to 2%. The S&P 500 Index is up 1.4% to 4280 while the Russel 2000 and Dow Jones Industrial Average are up 2.5% and 1.8%. Bond yields are more cautious, however, with the 2- and 10-year Treasury maturities up 13 bps and 6 bps to 4.47% and 3.67%, driven by expectations of a tighter Fed and long-term inflation expectations. A higher-for-longer Fed is being reflected in currency markets as well, with the Dollar Index up 29 bps to 103.86. WTI crude oil has joined the party as well ahead of Sunday’s OPEC + meeting. It’s up 2.1% to $71.58 per barrel.

Recent earnings reports illustrate how spending on home goods such as computers continues to languish while upscale retailers have been able to maintain sales growth. Consider the following examples.

- Dell, which makes personal and business computers, reported first-quarter earnings of $578 million, down 42% from the $1.07 billion in earnings for the year-ago quarter. The company produced diluted earnings per share (EPS) of $0.79 and non-GAAP diluted EPS of $1.31. While the non-GAAP number declined from $1.84 for the year-ago quarter, it soared past the analyst consensus expectation of $0.87. For the most recent quarter, Dell’s revenue of $20.9 billion, which declined approximately 20% year-over-year (y/y), also beat the consensus expectation, which was $20.15 billion. Dell Co-Chief Operating Officer Chuck Whitten says the company maintained pricing discipline and benefited from reducing its operating expenses. In February, Dell announced it would lay off 6,650 employees in response to weakening PC sales after a surge in sales during Covid-19 pandemic when many Americans worked from home to help slow the spread of the disease. Whitten also maintains Dell’s supply chain improved prior to supply chains for the company’s competitors normalizing. Trading of Dell shares was halted yesterday with a notice of news pending. During a conference call after the earnings release, the company said it believes PC sales will continue to weaken this quarter, which sent shares of the company down approximately 3% in premarket trading today.

- Lululemon, which is an upscale athleisure retailer, generated $290.4 million in earnings, up from $189.9 million in the year-ago quarter, with results supported by strong sales outside of North America. The company’s adjusted EPS of $2.28 exceeded the consensus estimate of $1.97 and was up from $1.48 for the year-ago quarter. Lululemon’s $2 billion in revenue climbed 24% y/y and exceeded the consensus estimate of $1.93 billion. The company’s sales outside of North America climbed 60% y/y with sales in China growing 79% despite a weaker-than-expect economic recovery following the rollback of measures to contain Covid-19. Lower air freight also supported Lululemon earnings. Lululemon shares climbed approximately 15% after the company said it expects sales to continue growing and upgraded its guidance. It now expects to produce a full-year EPS of $11.74 to $11.94 per share, an increase from its previous guidance of $11.50 to $11.72 and significantly above the analyst consensus expectation of $11.61.

While strong payroll job gains and wage increases support inflation hawks, job losses for the self-employed, additions to the labor force, an increasing unemployment rate and a shorter workweek provide a different perspective for inflation doves. On balance, however, the totality of the data from the last few weeks points to another 25-bp hike from the Federal Reserve at the June 14 meeting.

While strong payroll job gains and wage increases support inflation hawks, job losses for the self-employed, additions to the labor force, an increasing unemployment rate and a shorter workweek provide a different perspective for inflation doves. On balance, however, the totality of the data from the last few weeks points to another 25-bp hike from the Federal Reserve at the June 14 meeting. If that case does manifest, it will likely lead to a repricing in equities and fixed-income, with markets currently expecting the Fed to pause in June and hike in July. I think a pause followed by a hike would be misleading and may lead to an unwarranted loosening of financial conditions, which threatens a fresh burst of inflationary pressures.

Visit Traders’ Academy to Learn More about Payroll Employment and Other Economic Indicators.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Blessed

How do we make balance between the fall in European inflation, recent Opec+ results, and debt ceiling decision to come up with a conclusion on Fed rate hike?

Good question, Massoud! Thank you for engaging with our article.