A concise weekly overview of the U.S. equities and derivatives markets

Last week (October 11 – October 15), Big Banks kicked off earnings season on a positive note. The S&P 500 Index is now higher on the year by 19%. Core Consumer Price Index (CPI) data, which excludes food and energy, rose 4% year-over-year in September. Additionally, the Producer Price Index (PPI) for last month was slightly below the consensus estimate, possibly indicating that supply chain bottlenecks are starting to subside.

The Federal Open Market Committee (FOMC) meeting minutes pointed to plans to slow monthly asset purchases, most likely later this year. The committee also highlighted the potential to keep short term interest rates very low for the next few years. However, despite the FOMC’s outlook, the market (Fed Fund futures) is pricing in a probable hike late next year.

Commodities continued to climb with Crude Oil chalking up eight straight weekly gains. Copper also had its largest weekly jump in nearly five years. In terms of S&P 500 Index sector performance, the Materials and Consumer Discretionary sectors led and Technology and Industrials were up more than 2%. Health Care and Consumer Staples were the laggards, gaining approximately 0.85% each.

Finally, weekly jobless claims fell to the lowest levels since the pandemic disrupted the global economy. The COVID-19 Delta variant spread has slowed and the White House announced plans to ease travel restrictions, which bolstered travel-sensitive companies. On the flip side of the ledger, the University of Michigan Consumer Sentiment Index reading fell near multi-year lows, but expectations called for a modest move higher.

Quick Bites

Indices

- U.S. Equity Indices climbed higher last week.

- S&P 500 Index (SPX®): Increased 1.8% week-over-week.

- Nasdaq 100 Index (NDX): Increased 2.2% week-over-week.

- Russell 2000 Index (RUT℠): Increased 1.48% last week.

- Cboe Volatility Index™ (VIX™ Index): Measured between 20.81 and 15.72 last week and closed at 16.30, lower by 2.5 vols week-over-week.

Options

- SPX options average daily volume (ADV) was about 1.5 million contracts per day, slightly below last week’s average of 1.62 million contracts per day. The one-week at-the-money (ATM) SPX options straddle (4470 strike with a 10/22 expiration) implies a +/- range of about 1.1%. The weekly ATM straddle settled on a 10.1% implied volatility.

- VIX options ADV was about 460,000 contracts last week, which was above the previous week’s ADV of 420,000 contracts. The VIX options call-put ratio was 1.2:1.

- RUT options ADV was 59,500 contracts, compared to an ADV of 57,400 contracts the previous week.

Across the Pond

- The Euro STOXX 50 Index increased 3.1% on the week.

- The MSCI EAFE Index (MXEA℠) increased 2.4% week-over-week and the MSCI Emerging Markets Index (MXEF℠) increased 2.2% week-over-week.

Charting It Out

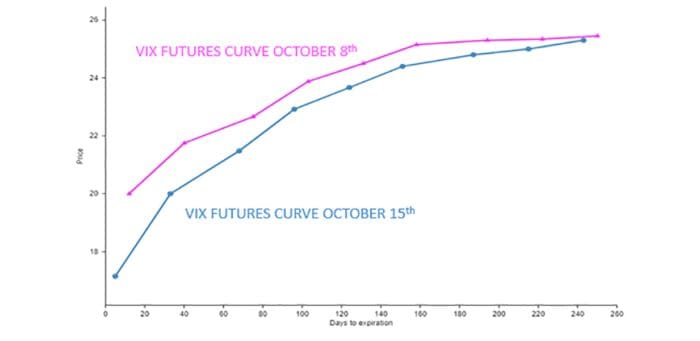

Observations on VIX futures term structure

- The VIX Index closed lower by 2.5 vols week-over-week. Over the past two weeks the VIX Index has declined nearly 5 vols.

- The front end of the VIX futures term structure continues to steepen. The spread between October and November VIX futures settled at 2.80 wide. A week prior that spread was 1.85 wide. October VIX futures fell 2.60 and the November VIX futures contract declined 1.65.

- The standard October VIX futures and options will expire on Wednesday, October 20.

VIX Futures Term Structure

Source: LiveVol Pro

Macro Movers

- The U.S. 10-year Treasury Yield declined from approximately 1.61% early in the week to lows of 1.51% intraday Thursday, before ultimately ending the week around 1.58%, lower by 2 basis points.

- The S&P GSCI continued its ascent, gaining another 2.6%. Crude Oil (WTI), which is now priced above $82 per barrel, added 3.6% last week. However, Copper and Lumber led the charge, gaining 10.6% and 7.0% respectively.

- Natural Gas (Henry Hub) declined from highs and closed the week down 2.4%. Soybeans, Cotton, Cocoa and Orange Juice also fell.

- The U.S. Dollar Index consolidated as interest rates chop between 1.5% and 1.6%. The recently released Federal Open Market Committee (FOMC) meeting minutes indicate a likely willingness to begin the tapering of monthly asset purchases in November.

- The FOMC will meet on November 2 and 3 but will not hold a press conference or provide an updated Summary of Economic Projections until the December 14-15 meeting.

- In a repeat of the previous week, Big Tech leaders were higher across the board, with the exception of Facebook.

- Facebook is set to report its quarterly earnings on October 25. There are questions about the company’s ability to maintain and grow advertising revenues.

- Tesla gained 7.3% last week. Amazon added 3.7% and Microsoft added 3.2%. Apple climbed by 1.4% and Alphabet shares were up 1.1%.

Major Cryptos

Bitcoin

- Bitcoin (BTC) prices were approximately $54,500 on Friday, October 8. BTC trended higher throughout the week and traded up to $61,300 on Friday, October 15. That’s the highest price since mid-April. All-time highs are near $65,000.

- BTC’s market cap is now $1.2 trillion, constituting 38% of the overall crypto market. BTC has meaningfully outperformed other cryptos in October.

- Last week, BTC prices exceeded $60,000 for the first time in six months. BTC continues to outperform, and the market seems optimistic about the prospect of a BTC-based ETF gaining SEC approval.

Ethereum

- On Friday, October 15, Ethereum (ETH) was trading around $3,850.

- ETH traded as low as $3,350 on Sunday but climbed to $3,800 by the end of the work week, up 6.3% on the week. ETH is now about 11% below all-time highs.

- ETH market cap is $456 billion, making up about 15% of the overall crypto market.

Crypto Industry

- MSCI estimates that there is roughly $7.1 trillion in market cap tethered to stocks of companies holding cryptocurrencies.

- The leading cryptocurrencies have been on a tear in October, led by BTC. The top crypto has gained approximately 40% month-to-date. ETH and Ripple have performed well but lagged. Bitcoin’s market leadership is in part driven by comments from SEC Chair Gensler and the potential for an approved BTC-based ETF in the U.S. The market seemingly anticipates a futures-based ETF, which has led to dislocation (significant premium) between the spot market for BTC and the near-term futures.

Growth in Cryptocurrencies

Source: The Daily Shot

Coronavirus

- The 7-day average COVID-19 infection rates in the U.S. decreased to approximately 86,200 on October 15, compared to approximately 99,700 a week prior. New COVID-19 cases have fallen by nearly 45% since early September.

- 58% of the U.S. population is fully vaccinated against COVID-19 and 66% have received at least one dose of a COVID-19 vaccine. For just those 12 years and older the numbers are 67% and 77% respectively. On October 14, the FDA recommended Moderna boosters for those 65 years or older and high-risk adults.

- The World Health Organization (WHO) is creating a team to investigate the origins of COVID-19.

COVID-19 Cases in the U.S.

Source: The New York Times

Tidbits from the News

Inflationary pressures have spread globally since Spring 2020. According to the chart below, 5-year expectations for inflation have shifted higher since late September. In the U.S., the Consumer Price Index (CPI) jumped 4% year-over-year. Higher prices for food and rent accounted for half of the gains. Rent is approximately 30% of the CPI calculation, so it will be closely watched going forward.

5-Year Global Inflation Expectations

Source: LPL Research and Bloomberg

- A record number of Americans quit their jobs in August, led by the Leisure industry, which is typically a reflection of a strong U.S. economy. Historically, people are willing to stay in their jobs during difficult economic times. There’s also currently a record 10 million job openings in the U.S. The Retail and Leisure/Hospitality industries continue to struggle with labor shortages.

Number of Americans Leaving Their Jobs

Source: St. Louis Federal Reserve and Chartr

The Week Ahead

- Data to be released this week: Industrial Production and Home Builders Index on Monday; Housing Starts on Tuesday; Beige Book on Wednesday; Weekly Jobless Claims, Philly Fed and Leading Economic Indicators on Thursday; Manufacturing and Services Purchasing Managers Index (PMI) on Friday.

—

Originally Posted on October 18, 2021 – The Week that Was: October 11 to October 15

General

- The information provided is for general education and information purposes only. No statement provided should be construed as a recommendation to buy or sell a security, future, financial instrument, investment fund, or other investment product (collectively, a “financial product”), or to provide investment advice.

- In particular, the inclusion of a security or other instrument within an index is not a recommendation to buy, sell, or hold that security or any other instrument, nor should it be considered investment advice.

Options

- Options involve risk and are not suitable for all market participants. Prior to buying or selling an option, a person should review the Characteristics and Risks of Standardized Options (ODD), which is required to be provided to all such persons. Copies of the ODD are available from your broker or from The Options Clearing Corporation, 125 S. Franklin Street, Suite 1200, Chicago, IL 60606.

- Trading FLEX options may not be suitable for all options-qualified market participants. FLEX options strategies only should be considered by those with extensive prior options trading experience.

- Uncovered option writing is suitable only for the knowledgeable market participant who understands the risks, has the financial capacity and willingness to incur potentially substantial losses, and has sufficient liquid assets to meet applicable margin requirements. In this regard, if the value of the underlying instrument moves against an uncovered writer’s options position, the writer may incur large losses in that options position and the participant’s broker may require significant additional margin payments. If a market participant does not make those margin payments, the broker may liquidate positions in the market participant’s account with little or no prior notice in accordance with the market participant’s margin agreement.

Futures

- Futures trading is not suitable for all market participants and involves the risk of loss, which can be substantial and can exceed the amount of money deposited for a futures position. You should, therefore, carefully consider whether futures trading is suitable for you in light of your circumstances and financial resources. You should put at risk only funds that you can afford to lose without affecting your lifestyle.

- For additional information regarding the risks associated with trading futures and security futures, see respectively the Risk Disclosure Statement set forth in Appendix A to CFTC Regulation 1.55(c) and the Risk Disclosure Statement for Security Futures Contracts.

VIX® Index and VIX® Index Products

- The Cboe Volatility Index® (known as the VIX Index) is calculated and administered by Cboe Global Indices, LLC. The VIX Index is a financial benchmark designed to be a market estimate of expected volatility of the S&P 500® Index, and is calculated using the midpoint of quotes of certain S&P 500 Index options as further described in the methodology, rules and other information here.

- VIX futures and Mini VIX futures, traded on Cboe Futures Exchange, LLC, and VIX options, traded on Cboe Options Exchange, Inc. (collectively, “VIX® Index Products”), are based on the VIX Index. VIX Index Products are complicated financial products only suitable for sophisticated market participants.

- Transacting in VIX Index Products involves the risk of loss, which can be substantial and can exceed the amount of money deposited for a VIX Index Product position (except when buying options on VIX Index Products, in which case the potential loss is limited to the purchase price of the options).

- Market participants should put at risk only funds that they can afford to lose without affecting their lifestyles.

- Before transacting in VIX Index Products, market participants should fully inform themselves about the VIX Index and the characteristics and risks of VIX Index Products, including those described here. Market participants also should make sure they understand the product specifications for VIX Index Products (VIX futures, Mini VIX futures and VIX options) and the methodologies for calculating the underlying VIX Index and the settlement values for VIX Index Products. Answers to questions frequently asked about VIX Index products and how they are settled is available here.

- Not Buy and Hold Investment: VIX Index Products are not suitable to buy and hold because:

- On their settlement date, VIX Index Products convert into a right to receive or an obligation to pay cash.

- The VIX Index generally tends to revert to or near its long-term average, rather than increase or decrease over the long term.

- Volatility: The VIX Index is subject to greater percentage swings in a short period of time than is typical for stocks or stock indices, including the S&P 500 Index.

- Expected Relationships: Expected relationships with other financial indicators or financial products may not hold. In particular:

- Although the VIX Index generally tends to be negatively correlated with the S&P 500 Index – such that one tends to move upward when the other moves downward and vice versa – that relationship is not always maintained.

- The prices for the nearest expiration of a VIX Index Product generally tend to move in relationship with movements in the VIX Index. However, this relationship may be undercut, depending on, for example, the amount of time to expiration for the VIX Index Product and on supply and demand in the market for that product.

- Mini VIX futures contracts trade separately from regular-sized VIX futures, so the prices and quotations for Mini VIX futures and regular-sized VIX futures may differ because of, for example, possible differences in the liquidity of those markets.

- Final settlement Value: The method for calculating the final settlement value of a VIX Index Product is different from the method for calculating the VIX Index at times other than settlement, so there can be a divergence between the final settlement value of a VIX Index Product and the VIX Index value immediately before or after settlement. (See the SOQ Auction Information section here for additional information.)

Exchange Traded Products (“ETPs”)

- Cboe does not endorse or sell any ETP or other financial product, including those investment products that are or may be based on a Cboe index or methodology or on a non-Cboe index that is based on investment products trading on a Cboe Company exchange (e.g., VIX futures); and Cboe makes no representations regarding the advisability of investing in such products. An investor should consider the investment objectives, risks, charges, and expenses of these products carefully before investing. Investors also should carefully review the information provided in the prospectuses for these products.

- Investments in ETPs involve risk, including the possible loss of principal, and are not appropriate for all investors. Non-traditional ETPs, including leveraged and inverse ETPs, pose additional risks and can result in magnified gains or losses in an investment. Specific risks relating to investment in an ETP are outlined in the fund prospectus and may include concentration risk, correlation risk, counterparty risk, credit risk, market risk, interest rate risk, volatility risk, tracking error risk, among others. Investors should consult with their tax advisors to determine how the profit and loss on any particular investment strategy will be taxed.

Cboe Strategy Benchmark Indices

- Cboe Strategy Benchmark Indices are calculated and administered by Cboe Global Indices, LLC as described in the methodologies, rules and other information available here using information believed to be reliable, including market data from exchanges owned and operated by other Cboe Companies.

- Strategy Benchmark Indices are designed to measure the performance of hypothetical portfolios comprised of one or more derivative instruments and other assets used as collateral. Past performance is not indicative of future results. Strategy Benchmark Indices are not financial products that can be invested in directly, but can be used as the basis for financial products or managing portfolios.

- The actual performance of financial products such as mutual funds or managed accounts can differ significantly from the performance of the underlying index due to execution timing, market disruptions, lack of liquidity, brokerage expenses, transaction costs, tax consequences and other considerations that may not be applicable to the subject index.

Index and Benchmark Values Prior to Launch Date

- Index and benchmark values for the period prior to an index’s launch date are calculated by a theoretical approach involving back-testing historical data in accordance with the methodology in place on the launch date (unless otherwise stated). A limitation of back-testing is that it reflects the theoretical application of the index or benchmark methodology and selection of the index’s constituents in hindsight. Back-testing may not result in performance commensurate with prospective application of a methodology, especially during periods of high economic stress in which adjustments might be made. No back-tested approach can completely account for the impact of decisions that might have been made if calculations were made at the same time as the underlying market conditions occurred. There are numerous factors related to markets that cannot be, and have not been, accounted for in the preparation of back-tested index and benchmark information.

Taxes

- No Cboe Company is an investment adviser or tax advisor, and no representation is made regarding the advisability or tax consequences of investing in, holding or selling any financial product. A decision to invest in, hold or sell any financial product should not be made in reliance on any of the statements or information provided. Market participants are advised to make an investment in, hold or sell any financial product only after carefully considering the associated risks and tax consequences, including information detailed in any offering memorandum or similar document prepared by or on behalf of the issuer of the financial product, with the advice of a qualified professional investment adviser and tax advisor.

- Under section 1256 of the Tax Code, profit and loss on transactions in certain exchange-traded options and futures are entitled to be taxed at a rate equal to 60% long-term and 40% short-term capital gain or loss, provided that the market participants involved and the strategy employed satisfy the criteria of the Tax Code. Market participants should consult with their tax advisors to determine how the profit and loss on any particular option or futures strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations.

General

- Past performance of an index or financial product is not indicative of future results.

- Brokerage firms may require customers to post higher margins than any minimum margins specified.

- No data, values or other content contained in this document (including without limitation, index values or information, ratings, credit-related analyses and data, research, valuations, strategies, methodologies and models) or any part thereof may be modified, reverse-engineered, reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of Cboe.

- Cboe does not guarantee the accuracy, completeness, or timeliness of the information provided. THE CONTENT IS PROVIDED “AS IS” WITHOUT WARRANTY OF ANY KIND, EITHER EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY WITH RESPECT MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE.

- Hypothetical scenarios are provided for illustrative purposes only. The actual performance of financial products can differ significantly from the performance of a hypothetical scenario due to execution timing, market disruptions, lack of liquidity, brokerage expenses, transaction costs, tax consequences and other considerations that may not be applicable to the hypothetical scenario.

- Supporting documentation for statements, comparisons, statistics or other technical data provided is available by contacting Cboe Global Markets at www.cboe.com/Contact.

- The views of any third-party speakers or third-party materials are their own and do not necessarily represent the views of any Cboe Company. That content should not be construed as an endorsement or an indication by Cboe of the value of any non-Cboe financial product or service described.

Trademarks and Intellectual Property

- Cboe®, Cboe Global Markets®, Bats®, BIDS Trading®, BYX®, BZX®, Cboe Options Institute®, Cboe Vest®, Cboe Volatility Index®, CFE®, EDGA®, EDGX®, Hybrid®, LiveVol®, Silexx® and VIX® are registered trademarks, and Cboe Futures ExchangeSM, C2SM, f(t)optionsSM, HanweckSM, and Trade AlertSM are service marks of Cboe Global Markets, Inc. and its subsidiaries. Standard & Poor’s®, S&P®, S&P 100®, S&P 500® and SPX® are registered trademarks of Standard & Poor’s Financial Services LLC and have been licensed for use by Cboe Exchange, Inc. Dow Jones®, Dow Jones Industrial Average®, DJIA® and Dow Jones Global Indexes® are registered trademarks or service marks of Dow Jones Trademark Holdings, LLC, used under license. Russell, Russell 1000®, Russell 2000®, Russell 3000® and Russell MidCap® names are registered trademarks of Frank Russell Company, used under license. FTSE® and the FTSE indices are trademarks and service marks of FTSE International Limited, used under license. MSCI and the MSCI index names are service marks of MSCI Inc. (“MSCI”) or its affiliates and have been licensed for use by Cboe. All other trademarks and service marks are the property of their respective owners.

Copyright

- © 2021 Cboe Exchange, Inc. All Rights Reserved.

Disclosure: Cboe Global Markets

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, or at www.theocc.com. The information in this program is provided solely for general education and information purposes. No statement within the program should be construed as a recommendation to buy or sell a security or to provide investment advice. The opinions expressed in this program are solely the opinions of the participants, and do not necessarily reflect the opinions of Cboe or any of its subsidiaries or affiliates. You agree that under no circumstances will Cboe or its affiliates, or their respective directors, officers, trading permit holders, employees, and agents, be liable for any loss or damage caused by your reliance on information obtained from the program.

Copyright © 2023 Chicago Board Options Exchange, Incorporated. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Cboe Global Markets and is being posted with its permission. The views expressed in this material are solely those of the author and/or Cboe Global Markets and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Complex or Leveraged Exchange-Traded Products

Complex or Leveraged Exchange-Traded Products are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy, and risks associated with the products. Learn more about the risks here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4155

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!