Key News

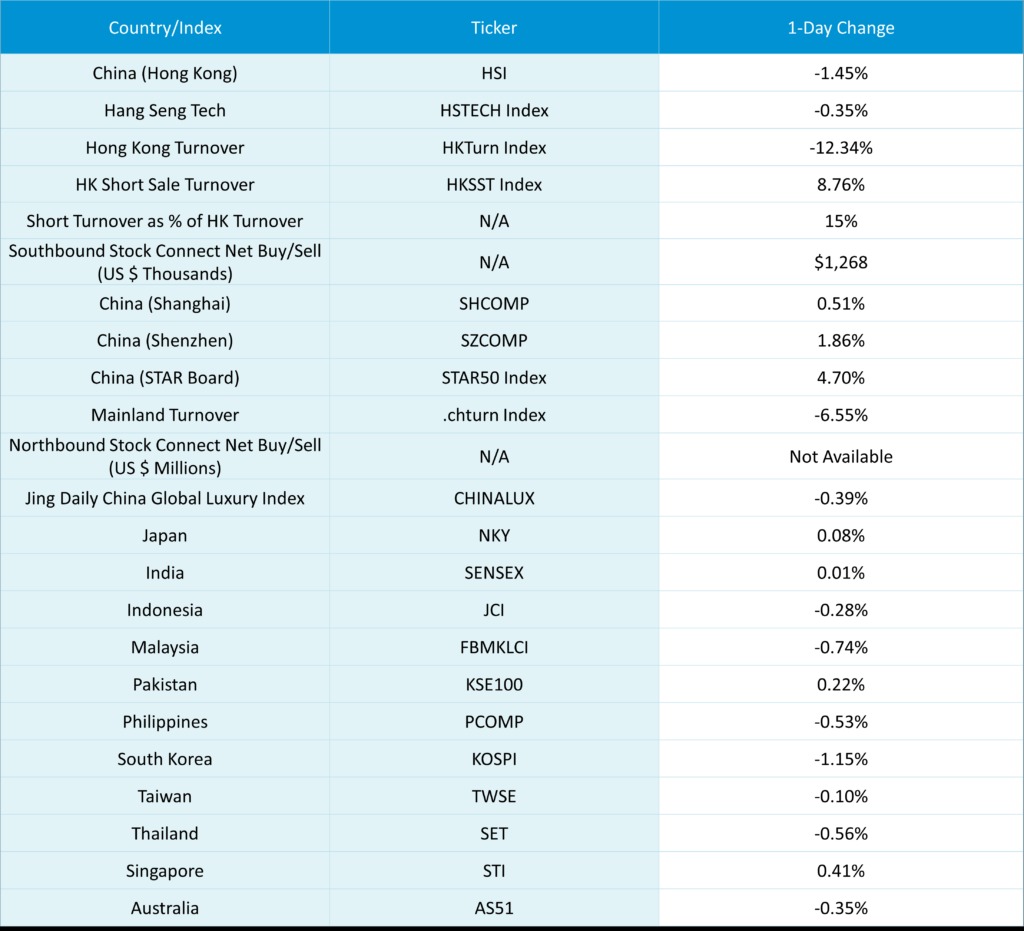

Asian equities were overall lower on a stronger US dollar overnight, as Mainland China outperformed while Hong Kong and South Korea underperformed.

The last few days demonstrate why we say there are two Chinese equity markets and why you should hold both: onshore China/Shanghai- Shenzhen – STAR Board stocks/95% owned by domestic investors versus the offshore China/Hong Kong stocks – US ADRs/majority owned by foreign investors. While foreign investors and Western media pan Friday’s NPC release for the lack of domestic consumption stimulus, Mainland investors cheered the news with a foreign bank’s Shanghai fixed income trading desk calling the announcement “ significant fiscal policy adjustments.” The Mainland market rose today following Friday’s after the close press conference. This doesn’t appear to be the National Team, as their favorite ETFs all had below-average volumes. Domestic investors recognize that local governments tend to employ more people in less affluent provinces; thus, cleaning up their balance sheets affects the real economy.

Mainland investors focused on statements in the press conference’s Q&A, including “We are actively planning for the next fiscal policy and increasing countercyclical adjustments” and “We will increase efforts to support large-scale equipment updates and expand the variety and scale of consumer goods for trade-in.” We don’t have the dates for the December China Economic Work Conference, which is an opportunity to articulate fiscal policy support.

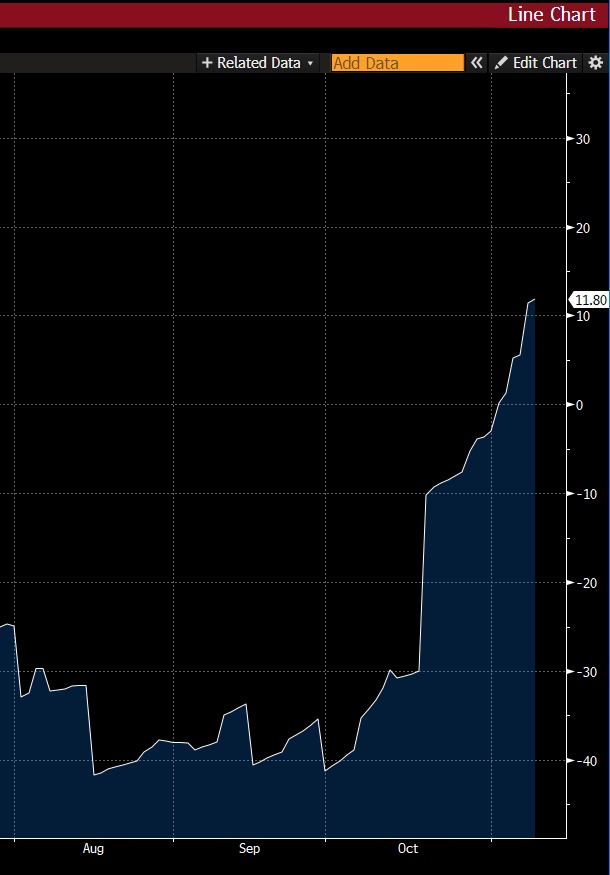

Signs that the economy is slowly improving, such as the recent PMIs, but today’s aggregating financing and new loans have both increased month over month. Yes, they missed economist expectations but improved as the Citi China Economic Surprise index continues to rise.

After such a powerful move post-stimulus, we are coming off overbought levels with offshore China /growth stocks only 5% overbought versus their October 4th high of 194% and onshore China 8% overbought versus their October 4th high of 257% (the level is based on the 10-year weekly distribution history).

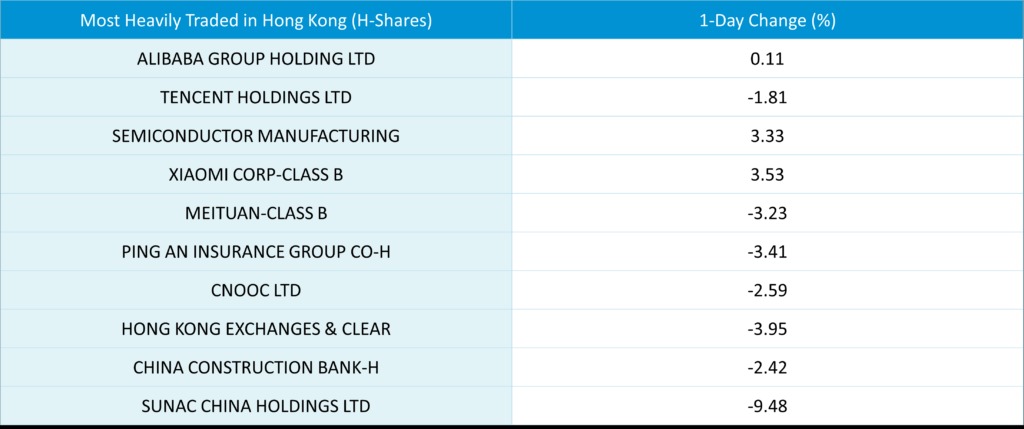

Hong Kong didn’t fall nearly as badly, with Alibaba +0.11% versus its ADR on Friday -5.94% on Singles Day today. With Singles Day running until midnight tonight, we don’t have a final number. However, the company has reported that within the following categories, each company sold more than RMB 100 Gross Merchandise Value (GMV):

- 79 beauty brands

- 139 home appliance and furniture brands

- Apple, Huawei, and 32 tech companies

- 66 fashion brands

I suspect Alibaba will put out a press release around noon NYC time with some preliminary data.

Hong Kong was off but not nearly as much as US ADRs on Friday, less semis/hard tech, with similar price action in the Mainland, outperforming on reports that the US government told TSMC not to sell 7 nanometer and smaller chips to Chinese companies. Surprisingly, TSMC was only off -0.46% overnight, though its technological monopoly will hold in the short term. Tencent, which reports Wednesday, was off -1.81% versus its ADR -5.17% on Friday, JD.com -2.32% versus its ADR -6.99%, NetEase +0.84% versus its ADR -5.42%, etc.

It’s unsurprising why we hold the Hong Kong shares versus the US ADRs. By holding the Hong Kong shares, we also benefit from large market dip buying from Mainland China via Southbound Stock Connect, such as today’s $1.268B of net buying. A non-factor in trading overnight was October CPI of 0.3% versus September’s 0.4% and economist expectations of 0.4%, while PPI was -2.9% versus September’s -2.8% and economist expectations of -2.5%—big week for earnings with Alibaba Friday, JD.com Thursday along with Bilibili, NetEase and Vipshop.

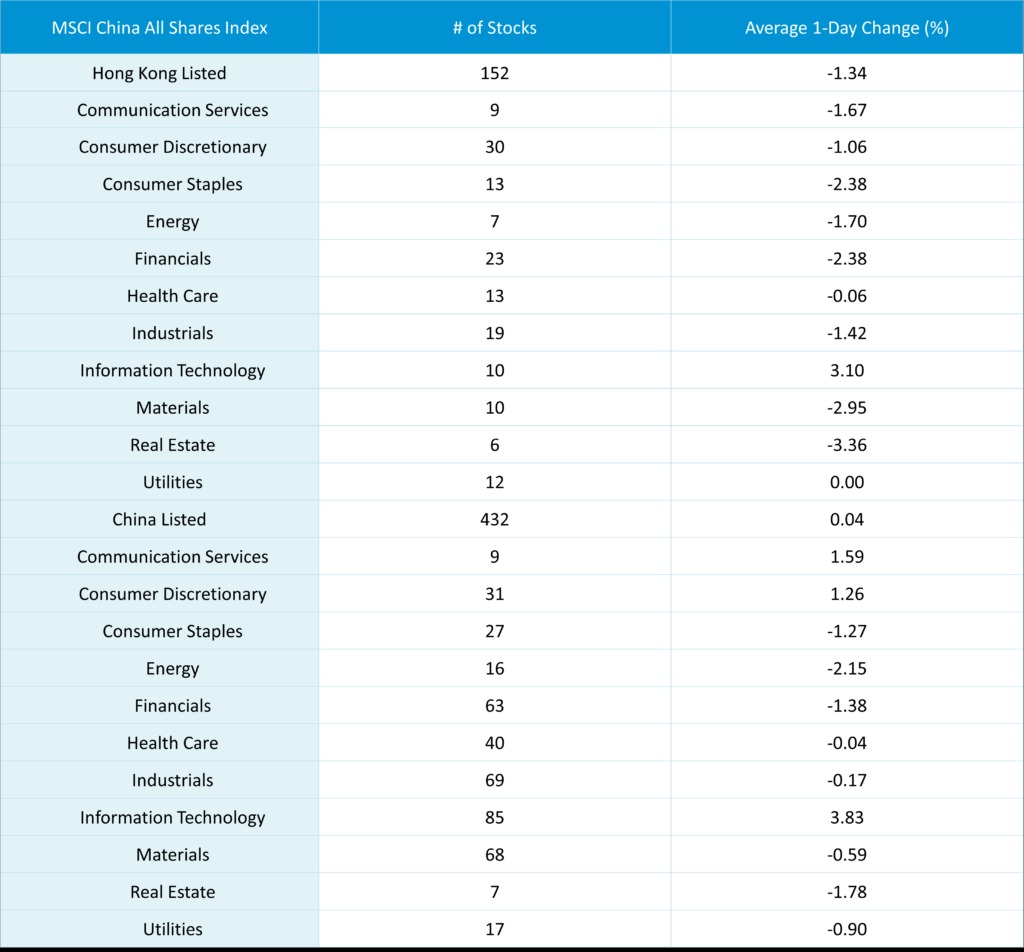

The Hang Seng and Hang Seng Tech fell -1.45% and -0.35% on volume -12.34% from Friday, which is 163% of the 1-year average. 128 stocks advanced, while 363 declined. Main Board short turnover increased by +8.76% from Friday, which is 154% of the 1-year average, as 15% of turnover was short turnover (Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). Value and small caps fell less than growth and large caps. Tech gained +3.1%, and utilities were flat, while real estate -3.37%, materials -2.95%, and financials -2.38%. The top sub-sectors were technical hardware, semis, and consumer durables, while insurance, diversified financials, and food/beverages were the worst. Southbound Stock Connect volumes were 2X pre-stimulus average as Mainland investors bought $1.268B of Hong Kong stocks and ETFs, with the Hong Kong Tracker ETF a very large net buy, Xiaomi and Alibaba large net buys, while Tencent and Sunac was a small net sell.

Shanghai, Shenzhen, and STAR Board gained +0.51%, +1.86%, and +4.07% on volume -6.55% from Friday, which is 271% of the 1-year average. 3,806 stocks advanced, while 1,206 declined. Growth and small caps outpaced value and Large caps. Top sectors were tech +3.8%, communication +1.55%, and discretionary +1.23%, while energy -2.18%, real estate -1.81%, and financials -1.41%. Top sub-sectors were internet, computer hardware, and semis, while power generation equipment, precious metals, and aviation were the worst. Northbound Stock Connect volumes were very high/2X pre-stimulus levels. CNY and the Asia dollar index fell versus the US dollar. Steel and copper fell.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.19 versus 7.16 Friday

- CNY per EUR 7.67 versus 7.72 Friday

- Yield on 10-Year Government Bond 2.09% versus 2.11% yesterday

- Yield on 10-Year China Development Bank Bond 2.16% versus 2.18% yesterday

- Copper Price -0.93%

- Steel Price -2.02%

—

Originally Posted November 11, 2024 – The Tale of Two China’s & Their Investors Returns!

Author Positions as of 11/11/24 are KLIP, KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB, LI US

Charts Source: KraneShares

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!