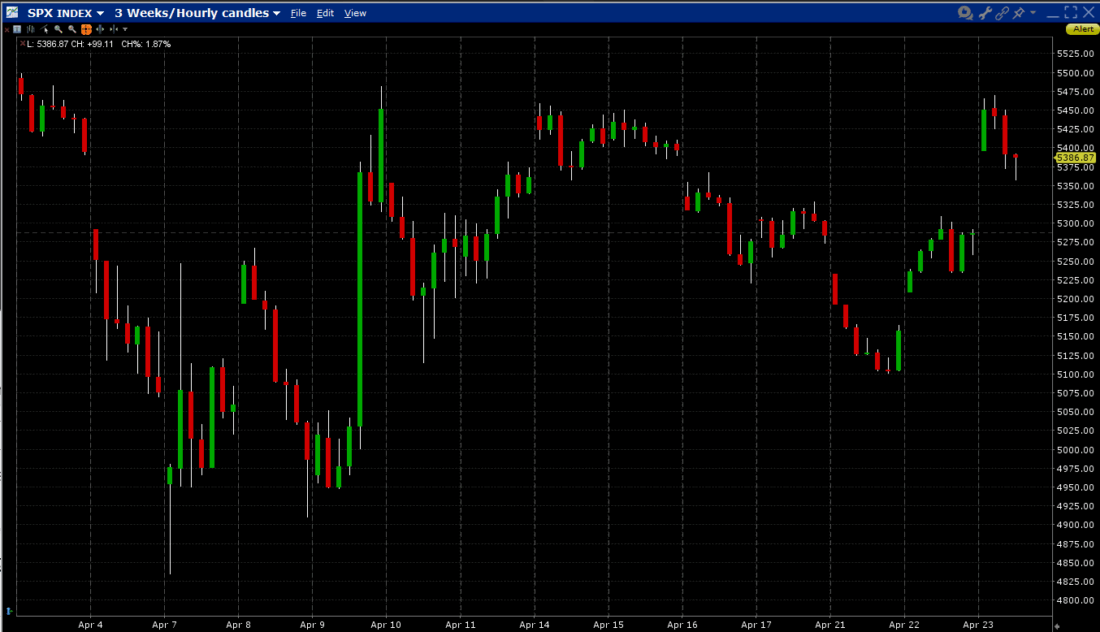

I have a suggestion for Six Flags – The SPYder. Tag line: “Thrills and Spills Galore as your portfolio takes you on a terrifying series of ups and downs, before returning you to the ride’s original starting point.” Seriously, a recent chart of the S&P 500 (SPX) looks like that of a roller coaster:

SPX, 3-Weeks, Hourly Candles

Source: Interactive Brokers

Bear this fact in mind: the chart above reflects the entire period since the “Liberation Day” tariff announcement on April 2nd. Yes, it’s only been three weeks!

The ostensible reason for the rallies that we’ve seen over the past two days is a more optimistic tone about potential tariff negotiations from various key members of the administration, particularly from Treasury Secretary Bessent. This morning’s rally was bolstered by President Trump’s remark that he had no intention of firing Federal Reserve Chair Powell, though the index’ upward move appears to have run into resistance around levels that have caused other recent short-term rallies to fall back.

I’ve been asked several times recently about why market sentiment persists in rapidly lurching from one extreme to the other. The reason I offer is that we are getting major announcements with potentially huge macroeconomic consequences on a daily, if not intraday, basis. Remember, in just three weeks – 3 weeks! – we had significant multilateral tariffs announced for every country on the globe, had most of them reduced to a 10% baseline, saw a series of tit-for-tat increases with China that have culminated at triple-digit levels, then some helpful commentary about potential negotiations. And this is not to mention the on-again, off-again threats to central bank independence. Policy lurches of this magnitude make it extraordinarily difficult, if not impossible, for corporate managers, and thus investors, to plan for the intermediate and longer terms.

Yet there is an optimistic way of looking at the recent “sturm und drang”. Because so much of the recent turmoil was “man-made”, meaning that it stemmed from a series of policy decisions and pronouncements from the President and his administration, it can also be unwound in the same manner.

A friend of mine, a major institutional portfolio manager, wondered aloud to me if some cooler heads had gotten through to the President recently, urging him to look at the market dislocations that his statements had caused. That got me thinking. Remember, the post-tariff selloff worsened when the President seemed unconcerned about the markets’ reaction after he dug in his heels about the initial proposal. This was very jarring to investors who remembered someone who, during his first term, tended to view the stock market as a barometer for his economic performance.

And this is, perhaps, why investors seem so encouraged by the comments of the past couple of days. Investors might be getting the type of market-friendly administration they had expected.

The post-election rally was largely predicated upon investors’ hopes that a second Trump administration would offer a conducive investment climate bolstered by deregulation and tax cuts. There was some initial disappointment that the administrations initial priorities were elsewhere – immigration and rapidly shrinking the federal government — but the disaffection metastasized when unpopular tariff policies arrived, and the complaints appeared to fall upon deaf ears. Now, if the President’s softer tone implies that he is once again taking investor concerns into consideration, that is indeed a welcome development. And the wild roller coaster ride might get a bit more subdued.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

The market is not a roller coaster, it never returns to the same spot. The number might recur but the circumstances are never quite the same. Hence, “it rhymes, not repeats.” It is a fact that we have seen the market greatly determined by the remarks (actions) of a single actor and his minions, and not infrequently he will deny that he said what we saw him say the week before. So the market may recover some, but like the child having been bit by the neighbor’s dog, most will be wary about walking past that yard again.

The market couldn’t possibly care less. The market makes the news not the other way around. All this gyration is just merely an excuse to move the market and wipe out the most people possible.

SHIPIRO YOUR ALL WET !! BECOME A BOY SCOUT AND BE PREPARED

I think confidence and trust is lost in many of these statements made by this administration. Lot of goodwill built up over several decades with foreign countries is lost. For me, CASH is the position now after losing some chunk. I am actually wondering there is some insider trading going on with these statements. Not sure whether SEC can investigate the actual administration.

Good will has been built up over the years, by stupid politicians , who watched our factories shutter and become empty hulks across the rust belt. The foreign countries are just realizing the party is over. The SEC doesn’t need to investigate this administration , they need to investigate the last 40 years of who has been in charge. Oh , what a coincidence Stupid , Sleepy, Uncle Joe was in Congress for the last 40 years, locking the doors as he waved and glad handed everyone. The biggest company in the world is the US Goverment, thank God we have a real business man in charge who knows what levers to pull. As Obama said , What are you going to do wave a magic wand, proof Obama had no clue what to do. And we can’t forget , “you can keep your doctor “and “health care costs will actually go down $2,000 a year.”