Key Takeaways

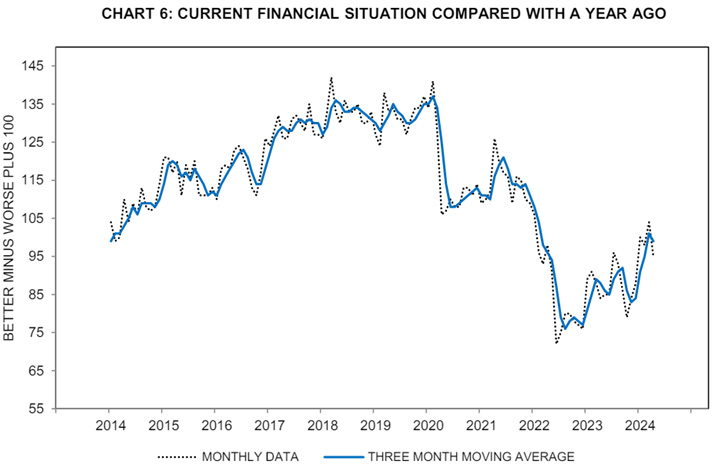

- Consumers are experiencing the impact of rising inflation, particularly in the grocery sector, leading to a shift in consumer sentiment and the need to reassess budgets.

- Major retailers like Target and Walgreens are addressing consumer concerns by announcing price cuts, aiming to break the perception that prices only go up.

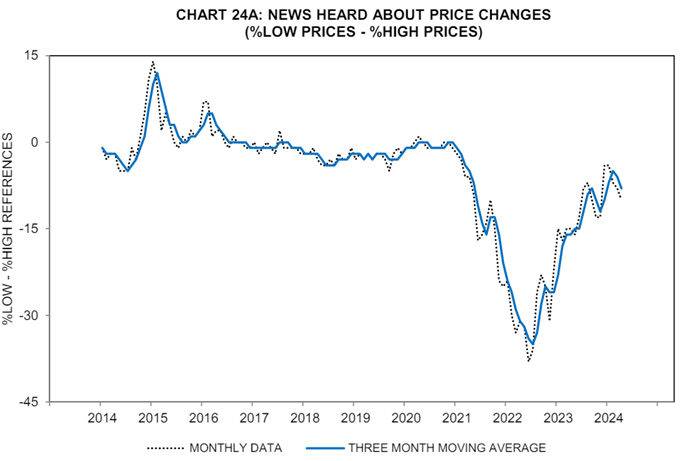

- The perception of lower prices has a powerful effect on consumer sentiment, but for now, many consumers still feel that prices are not right.

Inflation is not fun. And—for the past 30 years—it has largely been a non-issue for consumers. That dynamic has changed. The relevant question is whether this is something persistent and meaningful or simply a fleeting feeling.

Source: University of Michigan Consumer Sentiment Survey.

This is where some extrapolation is worthwhile. There should be little doubt the price hikes of 2022–2023 were problematic for consumers. They noticed. Volumes for the major grocery store aisle companies fell, and over the past few quarters many announced plans to regain their lost volumes. Now, there is a different narrative. First, it was Target announcing price cuts. Then it was Walgreens. These will not be the last.

And these announcements matter. Sure, they are likely to drive some incremental foot traffic. But, more importantly, the announcements are critical to breaking the mentality that “prices only go up.” If you are the Federal Open Market Committee (FOMC), that is welcome news. Maybe—finally—the inflation cycle is breaking in the parts that can be controlled. The FOMC is not going to break the inflation coming through the insurance channel. That is regulated and sticky, beyond the reach of interest rates. The FOMC breaking inflation at the grocery store is a victory it can relish.

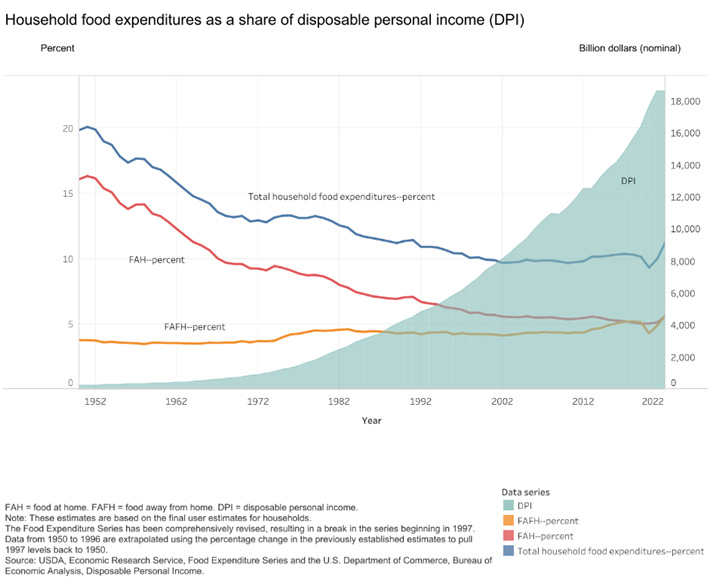

Consumers do not like having to redo their budgets. An underappreciated tailwind for the U.S. consumer for the past 70 years was the declining cost of food relative to discretionary income. Less budget spent on necessities meant more budget spent on other things. And that meant a boom for truly discretionary spending.

Source: University of Michigan Consumer Sentiment Survey.

That is not the current situation. Like nearly every economic theory and dataset, Covid and the resulting oddities challenged or broke many of the traditional empirical relationships. The invasion of Ukraine did not help matters. Consumer sentiment data was not spared in the resulting model fractures. How can the U.S. consumer feel so bad when wages are moving higher, jobs are plentiful and the economy is growing? It is the first time in a couple generations that buying groceries is consuming a more significant share of disposable income.

That does not feel great.

There is an odd justification to the “economy is good” and the “economy is not good” argument. And it hinges on the “feels” of the consumer. One of the most noticeable things for the consumer? The grocery bill. The recent announcements by a few major retailers should not be ignored as a catalyst for consumer sentiment. The perception of lower prices is a powerful thing. But, for the time being, the prices don’t feel right.

—

Originally Posted June 10, 2024 – The Prices Don’t Feel Right: Unraveling the Inflation Perception

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!