Today’s market continues the good spirits that prevailed late last week. We noted on Friday that the rally reflected the sudden change to a sanguine mood after a period of relative nervousness. Yesterday’s inauguration brought a surfeit of executive orders, but since none directly pertained to tariffs or economic policies that might have immediate consequences, stocks and bonds are showing a generally enthusiastic response.

Quite frankly, because of some downgrades to Apple (AAPL), stocks are actually doing better than they might appear on the surface. When the largest company in capitalization-weighted indices (including the S&P 500 (SPX) and Nasdaq 100 (NDX)) is over -4% lower, it has a depressing effect on their performances. At midday we see NYSE advancers outpacing decliners by more than 4:1, and 350 of the 500 stocks in SPX are higher. The only sector showing losses is energy. The idea of “drill baby drill” was discussed in President Trump’s inauguration speech, but the idea of adding supply to an oil market that seems to be adequately supplied at present was not well-received by commodity traders.

One of the stars today is the bond market. We see 10-year Treasury yields falling by more than 5 basis points, which continues the retreat from oversold levels that prevailed last week. I raised the idea in a media appearance last week that a lighter than expected “Day One” could lead to a bounce in bond prices, though frankly the bounce occurred a bit sooner than I anticipated. Interestingly, 2-year yields have barely budged, which tells us that today’s bond rally was more about sentiment and positioning than major changes to near-term Fed rate policy. Lower rates and lack of tariffs have also caused the dollar to sell off somewhat against most major currencies since Friday.

To my mind, the most striking element of the market reaction continues to be decline in the Cboe Volatility Index (VIX). The current level of 15.21 – which would represent the lowest close since the day after Christmas– shows that traders are anticipating relatively placid markets over the coming month. Remember, VIX does not explicitly measure fear, but instead is constructed to portray the market’s best estimate of SPX volatility over the next 30 days. Bear in mind that this period includes the peak of earnings season, an FOMC meeting, and the potential for tariffs against Canada and Mexico to begin on February 1st. Virtually no one expects a rate change from the Fed next week, but the statement and press conference might offer important clues about the timing of future potential cuts.

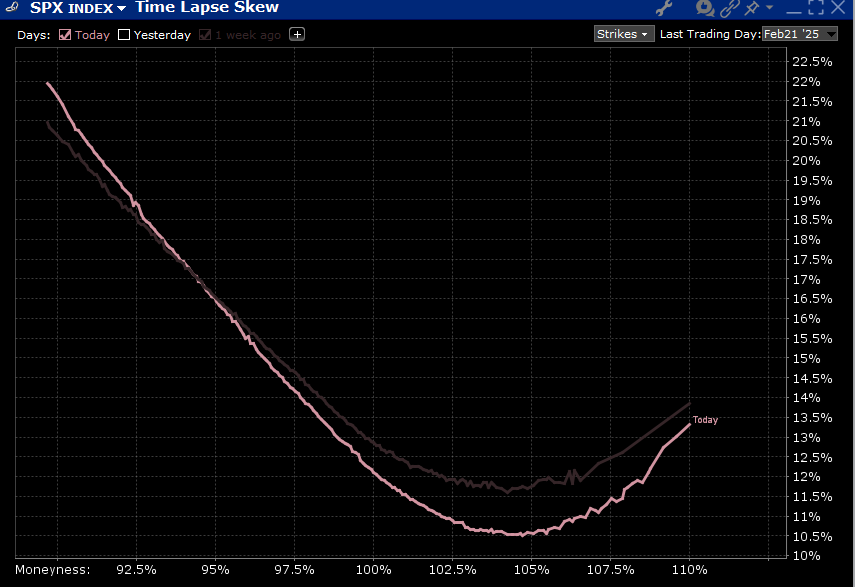

Keeping in mind that 10 of the past 20 days have featured SPX closes of more than +/- 1%, perhaps we have gotten a bit too complacent. The skew chart below shows that SPX volatilities are down pretty much across the board since last week, but especially in at-money and near-upside options. Could the market be telling us that the easy money has been made?

SPX Index Skew For Options Expiring February 21st, 2025; today (darker pink), last week (fainter pink)

Source: Interactive Brokers

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

The market went down today because Trump will crash the economy!

Is this Joe Biden?

Looks to me like the markets went up today: DJX closed up 1.24%; SPX up 0.88%. Nothing spectacular, but certainly respectable gains, seems to me.