One of the most frequent questions I’ve been asked recently is whether there is a precedent for what we’re seeing in the market right now. The short answer is “history doesn’t repeat itself, but it often rhymes.” Unfortunately, that leads us to the most dangerous phrase in investing, “this time it’s different.” There are elements of the current market environment that are reminiscent of 2020’s Covid crisis, but the likely policy responses differ substantially.

The similarities are fairly straightforward. In springtime, an exogenous event hit a market that had been trading near all-time highs. The ensuing reaction had wide-ranging consequences beyond just a significant, rapid selloff in stocks. It was clear that the Covid-related shutdowns were going to have an immediate, unpredictable negative effect on the economy, and markets certainly fear that something similar could result from last week’s tariff announcement (yes – it’s only been a week!). I went back to see what we might have said at that time, and found a video from February 27th, 2020, entitled “Could the Coronavirus be a Black Swan?” While I acknowledged that it while it seemed “black swan-like”, I stopped short of a full declaration. Two weeks later, it was clearly that type of event.

Yet that is where the most obvious similarities end. For starters, the tariff reaction is self-inflicted. The Covid virus came from abroad; the tariff policies arose from a duly elected domestic administration. Defending against an unfamiliar virus brought a set of challenges that defied an immediate solution, but the actions that created the current angst could be unwound with the stroke of a pen — even though there is currently a clear unwillingness to do so.

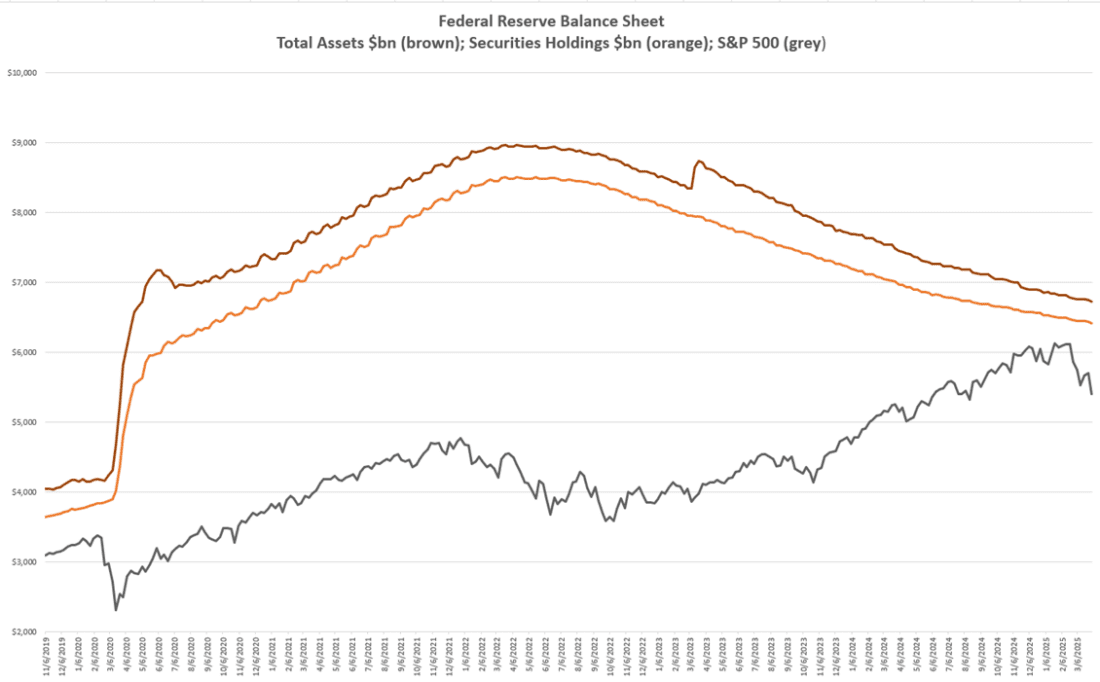

The clearest difference, and the one with the most immediate consequence for investor decision-making, rests in the likely policy responses. The world’s central banks, most notably the Federal Reserve, unleashed a series of unprecedented monetary accommodation. The Fed Funds target was quickly slashed from 1.75% to 0% alongside a wave of quantitative easing. The chart below shows that the Fed nearly doubled the size of its balance sheet almost immediately, and continued to add assets for roughly a full year: At

Sources: Federal Reserve H.4.1 reports, Interactive Brokers

At the same time, many governments around the world unleashed waves of fiscal stimulus. Many in the US remember receiving stimulus checks. We can certainly debate whether those measures led to unintended consequences down the road, but one positive side-effect was that a new horde of investors was created. Millions of people who had previously shown little interest in markets found themselves with time on their hands and excess liquidity, much of which found its way into investment accounts.

It is nearly impossible to expect either of those types of responses. For starters, fiscal stimulus is all but out of the question. The Trump administration has prioritized shrinking the size of the Federal government. It is essentially impossible to expect them to reverse course on that front.

On the monetary front, remember that the immediate effect of the Covid shutdown was deflationary. Demand for services and many goods evaporated overnight. That gave central banks the ability to add liquidity with impunity – especially because inflation was already well-contained (the CPI was averaging 2% gains pre-Covid). Now we have policies that are almost certain to raise prices for end consumers at a time when inflation is already above the Fed’s target. It is difficult to expect that the Fed will have any impetus to cut rates or markedly increase the size of its balance sheet unless circumstances become truly dire.

The “Fed Put” might still exist, but it won’t be exercised unless the broad economy or the banking system requires it. What we wrote in May 2022, when some investors were hoping that the Fed would rescue a falling stock market, still holds:

Here’s the real thing – the Fed has never stated that they will intervene in equity markets just because they are down. But they will almost certainly intervene if there is a crisis in credit markets that threatens the banking system or the flow of money. That is a huge difference – a crucial facet that equity investors need to understand.

None of this means that stocks are condemned to further declines or that the effects of the current volatility will metastasize in nasty ways. The situation remains fluid, and volatility can work in either direction. But if you’re expecting the cavalry to ride in to save the markets from themselves, don’t.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

I don’t know? Things like “The Art Of The Deal” have been mentioned. I do believe that something needs to be done regarding these tariffs. I thought that NAFTA translation was North American Free Trade Agreement. Where in the h-ll did these tariffs come from?

At least for the moment, you could not have been more wrong. This story was released within minutes of the cavalry riding to the rescue, at least for the moment. Nice timing!

The cavalry (in this case the Fed) did come to the rescue. trump indicated this morning with his “this is a great time to buy stocks” that something was up. trump temporarily came to his own rescue. It remains to be seen if stocks will fully recover their losses anytime soon

Well, well, well. Looks like the cavalry finally arrived. Maybe there is an adult in charge and he can stop the madness?

Just a reminder that the madness is not only about tariffs. The US threatened to invade Canada, Greenland, Panama, Gaza. Trump offended Canada so badly, almost daily, that 85% of Canadians are boycotting American products (source KPMG), and a number between 40 to 70% (different sources) of Canadians canceled trips to the US. A blow that may cause the loss of hundreds of thousands of American jobs. Europeans are doing the same. There is more: the world has always admired the US for the rule of law. This is gone. The US has a king now. And to conclude, Trump portraits the US as a victim! The US is the richest country of the world that benefited from the world order created by…. the USA!!!!! It is PATHETIC!!!!! The markets, the economy will go down. It is just consequence.

I’ve always found it more than a little curious that within 6 weeks of the Covid selloff beginning, smart money decided the uncertainty just wasn’t happening. As a result money went barreling into stocks and never looked back. Almost like the elites KNEW that Covid would not be that big an issue.