Markets are recovering in stride as investors hope that this afternoon’s presentation by Fed Chief Powell solidifies a rate cut in September. Stocks are also gaining support on the back of decelerating wage costs and slowing job growth stateside, both of which missed estimates. But bullish prayers didn’t work across the Pacific in Tokyo, as the BoJ dished out a larger-than-expected hike, generating sharp gains for the yen and possibly producing selling pressure for risk assets. Meanwhile, on the other side of the Atlantic, European price pressures arrived stronger than projected, and that’s bolstering wagers that the ECB will pause in September. In light of the uncertain nature of inflation, the Fed should remain data dependent and wait for July and August reports before tilting toward an accommodative stance.

Employers Ease Off Hiring

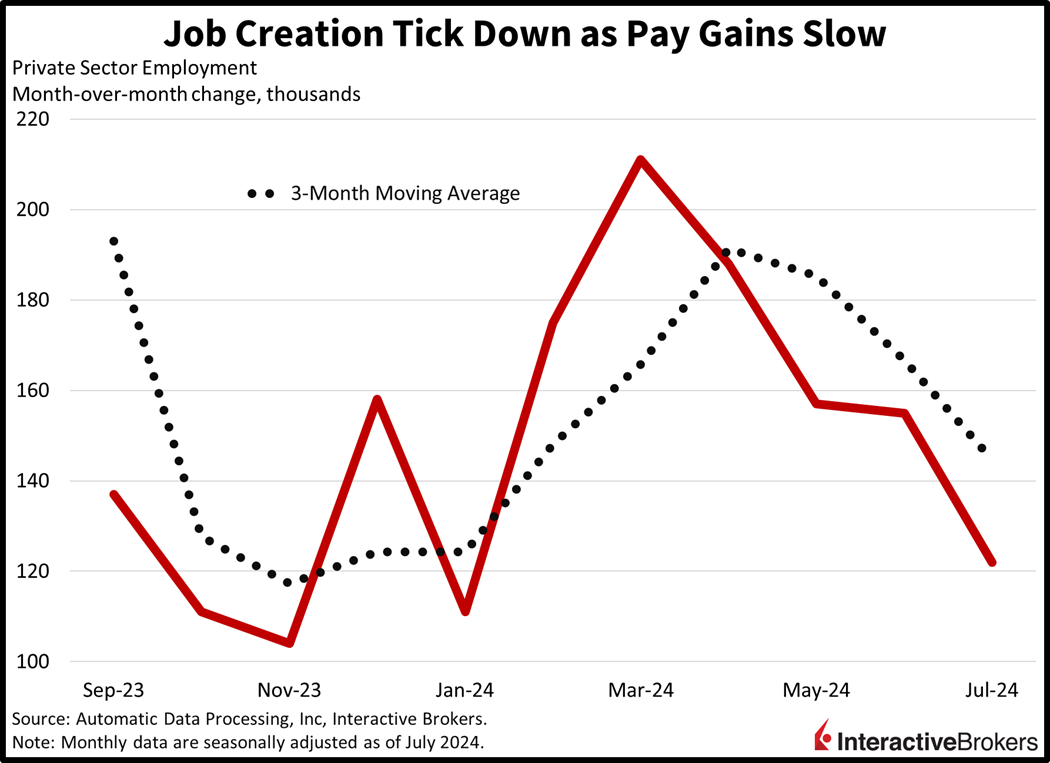

Employers took it easy on the hiring front this month, with a few sectors reducing headcounts. Businesses added 122,000 jobs in July, beneath June’s 155,000 and estimates calling for 150,000. Leading the gains were the trade/transportation/utilities, construction, leisure/hospitality, education/health services and other services sectors; they increased rosters by 61,000, 39,000, 24,000, 22,000 and 19,000. Financial activities and natural resources/mining expanded at more modest degrees of 14,000 and 2,000, but professional/business services, information and manufacturing experienced payroll declines of 37,000, 18,000 and 4,000. Across firm sizes, small businesses lost 7,000 workers but the mid-size and large segments saw increases of 70,000 and 62,000.

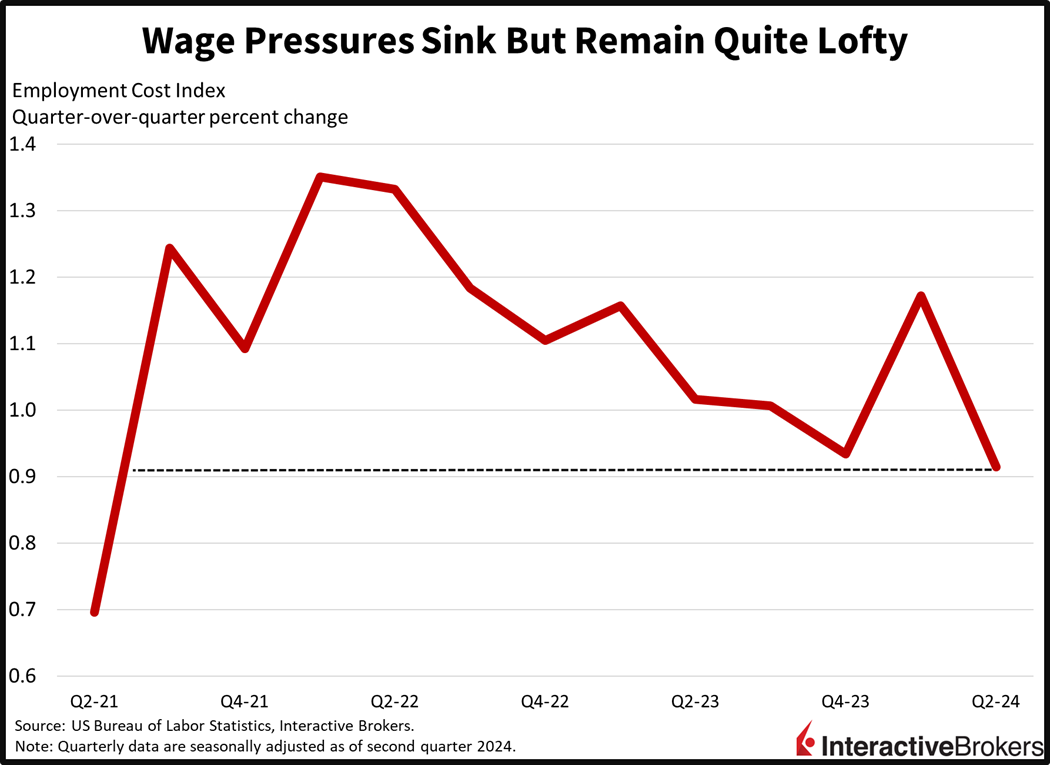

While hiring activity slowed, wage pressures also softened, according to both ADP and BLS. ADP reported that paycheck increases for job changers and job stayers declined from 7.7% and 4.9% year over year (y/y) last month to 7.2% and 4.8% in July. Additionally, the BLS’s second-quarter Employment Cost Index (ECI), which includes wages and benefits, rose 0.9% quarter over quarter, below the 1% estimate and the 1.2% reported in the prior period.

Residential Real Estate Shows Signs of Hope

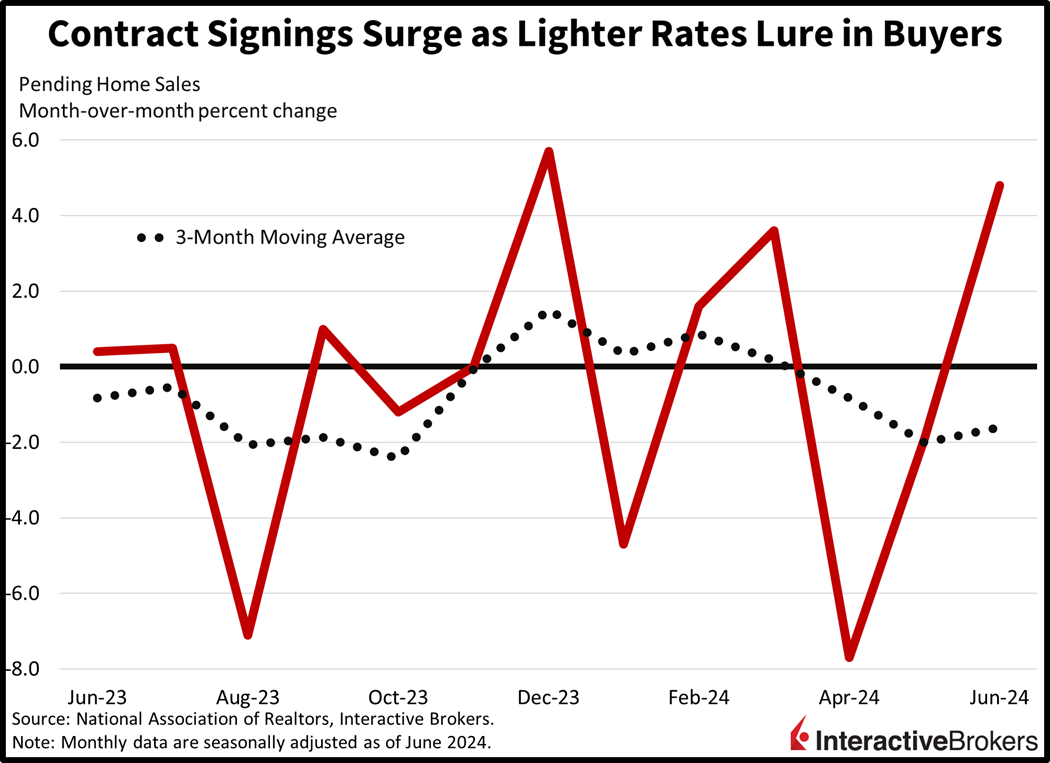

The real estate market may be reaching a turning point, with lighter mortgage costs boosting short-term demand. This morning’s pending home sales data release from the National Association of Realtors reflected a sharp 4.8% month-over-month (m/m) gain in June, overwhelming the median projection of a mere 1.5% and the 1.9% decline in May. Contract signings are benefitting from greater inventory and a narrower gap in buyer-seller negotiations. Pending home sales serve as a leading indicator of closed transactions, as contracts are typically completed prior to keys being exchanged.

Eurozone Squeezed by Price Pressures

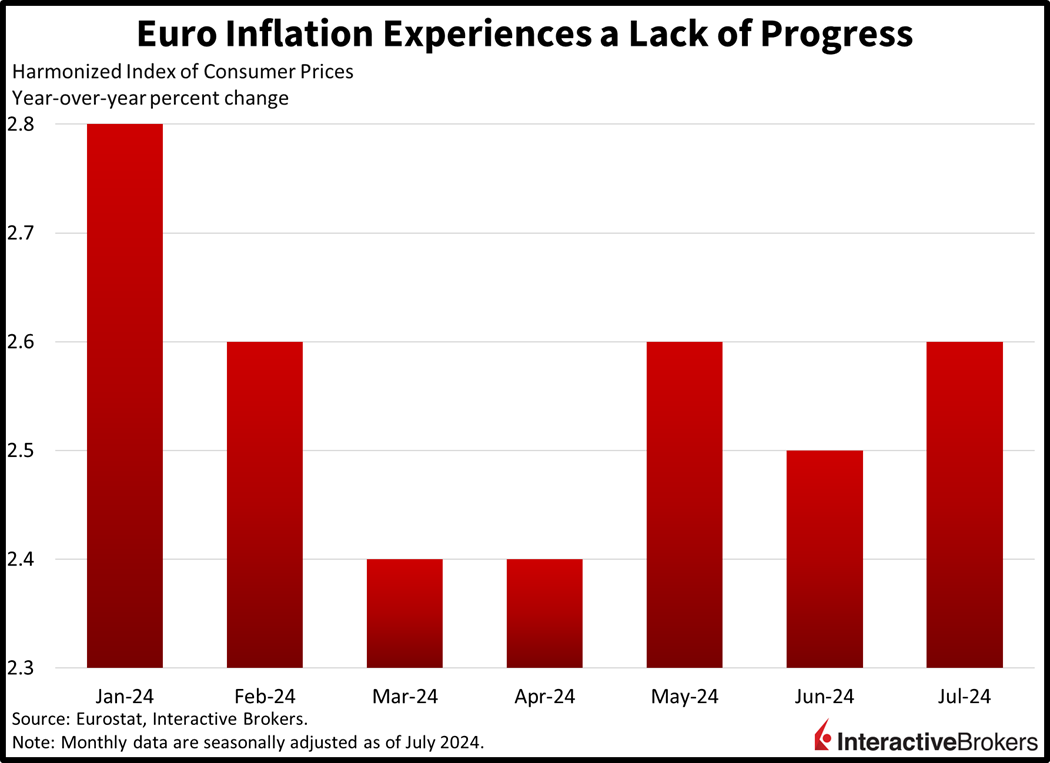

Price pressures accelerated in the eurozone this month, with headline and core inflation increasing 2.6% and 2.9% y/y. The results arrived ahead of expectations of 2.4% and 2.8% but near June’s rates of 2.5% and 2.9%. Services and energy led the climb, rising 1.2% and 0.9% m/m. Goods, and food/alcohol/tobacco offset some of the pain though, as charges declined 2.6% m/m for the former while remaining flat in the latter case.

Bank of Japan Raises Key Interest Rate

The Bank of Japan (BoJ) hiked its key interest rate 15 basis points (bps), explaining that inflation is in check. The decision, rolled out while the Japanese yen is experiencing considerable weakness, was contrary to the majority of economists that expected no increase. The BoJ also said it will reduce its bond buying in the first quarter of next year. Bank Governor Ueda mentioned that the country’s weak yen creates a risk of inflation and that the increase was approved in anticipation of wage pressures. He said policymakers anticipate additional hikes and he denied speculation that the benchmark won’t exceed 0.5%.

AI Powers Strong Earnings Results

Demand for artificial intelligence (AI) has driven strong quarterly results of a trio of tech firms that released earnings last night. In other news, Starbucks’ revenue missed expectations.

- Samsung Electronics (KRW) reported a 23.4% y/y jump in revenue and a 1,458% increase in operating profit with the growth of AI boosting demand for its advanced memory devices. Both metrics exceeded analyst consensus estimates. After experiencing a record loss in 2023 after strong computer sales driven by Covid-19 stay-at-home orders faded, Samsung is benefiting from AI applications and demand for high-bandwidth memory chips supporting higher pricing. KRW climbed more than 1.40% last night and continued to gain this morning.

- AMD (AMD), which produces and distributes its MI300 chips for AI, also beat analyst estimates for earnings and revenue. Profit jumped from $27 million in the year-ago period to $265 million while revenue climbed 9%. AMD CEO Lisa Su said sales of AI processors, which are distributed through the company’s data center segment, were stronger than expected. Sales for personal computers were also strong, climbing 49% y/y, but sales of products for gaming consoles declined. In April, AMD’s guidance called for processing unit revenues to reach $4 billion this year. It is now guiding for $4.5 billion, significantly more than analysts expected. AMD is up approximately 4% today.

- Microsoft (MSFT) revenue and earnings exceeded analyst expectations, but weak results from its Azure cloud-computing service caused its shares to fall more than 7% in after-hours trading. The company’s total fiscal fourth-quarter revenue leaped 15% y/y while earnings contracted slightly. Revenue for the company’s Intelligent Cloud segment, which includes Azure, Windows servers and other products, grew 19%, but missed analysts’ estimates. Within that segment, Azure revenue expanded 29% of which eight percentage points came from AI services. MSFT initially dropped 7% after the earnings release but pared some of the losses in early trading.

- Starbucks (SBUX) said same-store sales in China collapsed 14% y/y following a first quarter decline of 11% with sales challenged by persistent consumer weakness and increased competition from local brands. Additionally, the metric sagged 3% in the US with foot traffic sinking 6% despite the company increasing its sales promotions. Starbucks’ implementation of technology to make its stores more efficient, however, contributed to the company’s earnings meeting analysts’ expectations despite revenue falling short of estimates. SBUX gained 5% in extended trading with investors encouraged by results that weren’t as bad as feared.

Optimism of Dovish Fed Drives Equity Gains

Investors are flexing their muscles, largely expecting dovish talk following Chair Powell’s steps to the mound. All major US equity indices are firmly in the green alongside slipping yields across the curve and a softer greenback. The Nasdaq Composite, S&P 500, Russell 2000 and Dow Jones Industrial benchmarks are marching north by 2.5%, 1.7%, 0.6% and 0.6%. Sectoral breadth is terrific with every segment gaining on the session and led by technology, consumer discretionary and communication services; they’re up 3.6%, 1.7% and 1.5%. Treasurys are catching bids with the 2- and 10-year maturities changing hands at 4.35% and 4.11%, 1 and 3 bps softer on the session. The dollar is slipping 26 bps, meanwhile, as the yen gains 1.5% versus the greenback. The euro, pound sterling, franc, yuan and Canadian dollar are also appreciating against the US currency. The Aussie dollar is depreciating on a relative basis though. Commodities are experiencing bullish action with crude oil, copper, silver, lumber and gold higher by 2.5%, 1.9%, 1.2%, 1% and 0.5%. WTI crude is trading at $77.74 per barrel as Israel-Hamas tensions escalate, generating supply uncertainty.

Markets Could Pivot on Powell Comments

While this morning’s trading action is certainly compelling for the bulls, a neutral Powell can certainly lead to a market reversal this afternoon. If the chair comes out emphasizing further patience and data dependence on the inflation front, then yields will climb, resuming the recent turbulence in equity markets. I think remaining on pause is the most prudent position, especially considering that the Fed has gotten just two months of inflation data going their way all year. Turning to AI, it seems that the exuberance has been waning, notwithstanding earnings results reported last night, but just as certain highflyers reach pivotal technical support levels, bullish notes are sent by some sell-side analysts to motivate more valuation expansion. Indeed, everyone seemed to quickly forget Microsoft and Google’s lackluster results. Finally, earnings from Amazon, Meta and Apple this week may finally provide the hungry and motivated bears with the ammunition for a traditional 10% correction this quarter.

Visit Traders’ Academy to Learn More About the Consumer Price Index and Other Economic Indicators

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!