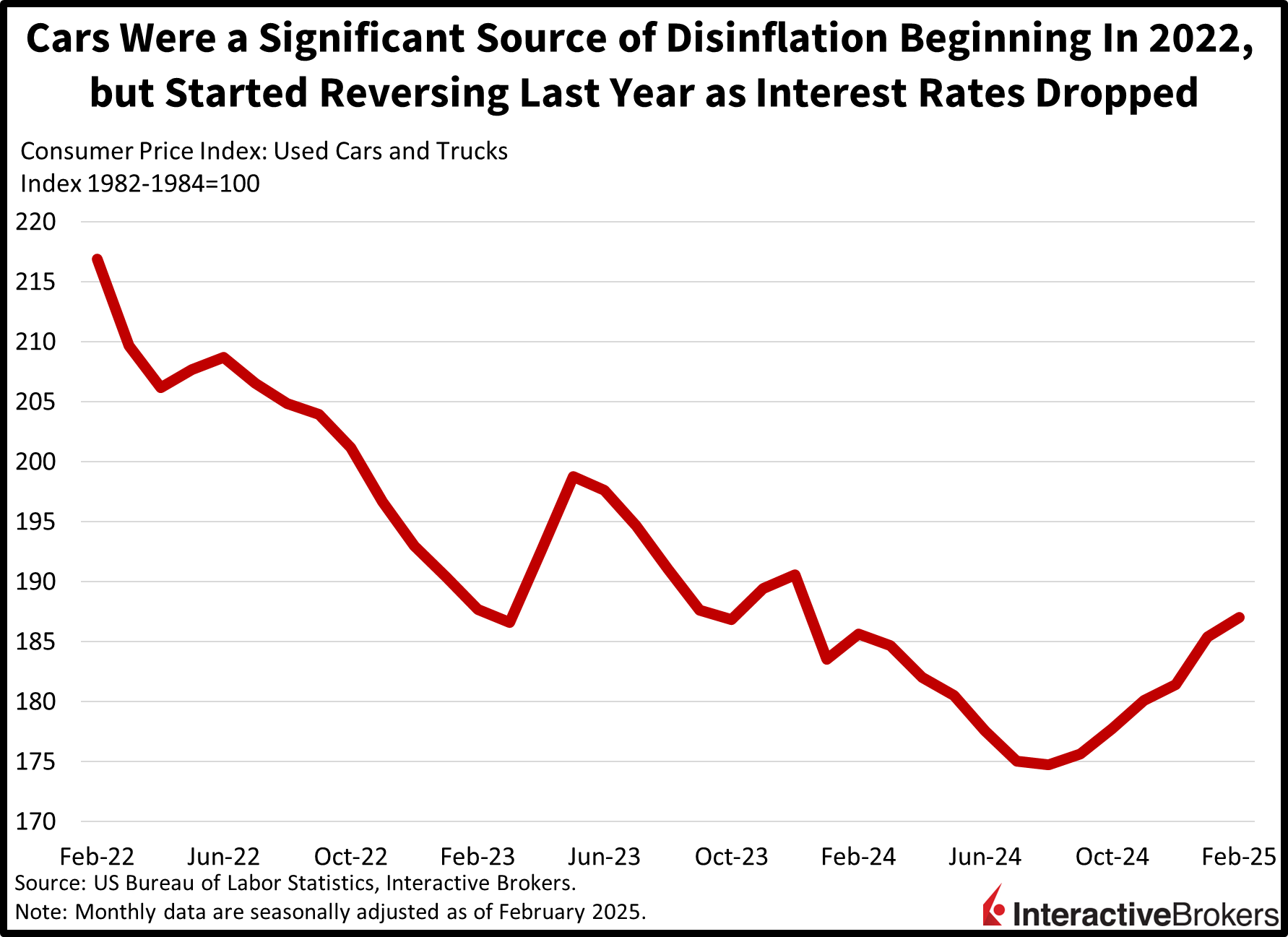

Stocks are recovering from this morning’s selling pressure, which was motivated by President Trump announcing 25% tariffs on all automobiles not made in America. And while equity investors are tired of pricing out risks and evaluating countless scenarios related to trade policy, rate watchers in the fixed-income space are bumping up their inflation expectations, leading to a steepening across the curve. After all, foreign rides are quite popular in the states, but softening car prices were one of the consistent forces driving cost pressures south in the US economy. A return to higher stickers will certainly reverse the goods disinflation that brought the CPI from a 9-handle in 2022 down to a 2 in 2024. Meanwhile, the economic calendar didn’t deliver any significant news today, as contained unemployment claims and a modest recovery in pending home sales coincided with an upgraded GDP figure alongside downgraded PCE inflation during the fourth quarter.

Another Week of Range Bound Unemployment Claims

The labor market remained stable during the past two weeks, with unemployment offices experiencing similar levels of volumes. Indeed, initial jobless claims declined to 224,000 for the week ended March 22, beneath the median estimate of 225,000, which would have been unchanged from the prior period. Continuing filings also dropped, slipping to 1.856 million, below the projection of 1.890 million and the previous interval’s 1.881 million. Four-week moving averages were bifurcated, however, with the segments shifting from 228,750 and 1.868 million to 224,000 and 1.870 million.

Pending Homes Sales Barely Gain

In the real estate sector, lower mortgage rates are doing little to motivate transaction activity as prospective buyers remain cautious about securing residences. Furthermore, recent data on consumer confidence and sentiment reflect households feeling angst regarding political uncertainty, government spending reductions, price pressures and job security, conditions which are certainly contributing to hesitation. Pending home sales were emblematic of the worries, climbing only 2% month over month (m/m) in February, recovering just marginally from January’s 4.6% fall and remaining near record lows. Still, the result exceeded the median estimate for a 1.5% gain. There were bifurcated performances across regions, with the South and Midwest rising 6.2%, and 0.7% m/m while the West and Northeast saw declines of 3% and 0.9% during the period.

Fourth Quarter GDP Upgraded

US GDP expanded at a 2.4% rate in the fourth quarter, according to a final report released this morning that upgraded a prior estimate of 2.3%. Net exports were adjusted higher due to lower imports, contributing to the faster growth pace. Meanwhile, the personal consumption expenditures (PCE) price index was downgraded from 2.4% to a pace of 2.3% for the same three-month period. Corporate profits recovered to a quarterly advancement of 5.9%, up significantly from the previous quarter’s -0.4%.

Car Prices, Commodities Are at Significant Risk

If 25% tariffs on automobiles are maintained, the Consumer Price Index’s former 3-handle will return by mid-year, as stickers for used and new cars would accelerate. Folks, physical products have been the major driver keeping a lid on prices since 2022, as services have failed to cooperate, a result of tight labor conditions and limited real estate inventory sending wage bills and housing charges north. Costs for commodities ex-energy, too, are probably going to continue climbing following the expansion of duties on April 2, with copper and lumber, crucial inputs for manufacturing and construction, already driving the commodity benchmarks notably higher, even as crude oil has been tempered throughout the year. A reignition of goods and materials inflation alongside a continuation of services cost pressures will likely keep the Fed on the sidelines this year, despite market participants expecting a cut or two. And the administration’s focus on the 10-year yield will also be heightened, as rate watchers weigh the critical factors of inflation expectations, growth projections and fiscal deficit dynamics. Finally, inflation is bad for bonds but not necessarily for stocks, as long as the Fed plays ball. Remember, 2023 and 2024 featured elevated CPI readings, but stocks, whose tickers and earnings are priced nominally and not in real terms, delivered returns of almost 25% each year.

International Roundup

A slight uptick in manufacturing helped China’s businesses slow the overall decline in earnings during the first two months of 2025. Net income dropped 0.3% after two years of much sharper declines. The recent moderation throughout the first two months of this year was driven by profits growing 4.8% and 13.5% y/y in the manufacturing and utilities sectors. The mining industry was the most significant laggard with results dropping 25.2%.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!