Markets are approving of this morning’s in-line Personal Consumption Expenditures (PCE) inflation numbers from the Commerce Department, with buying activity spanning across stocks, bonds and cryptocurrencies. While prices climbed at a pace inconsistent with the Fed’s 2% inflation objective, contracting consumer spending and a pickup in layoffs served to cool today’s economic narrative. Continuing claims exceeded the 1.9 million level for the first time since November, pointing to reduced hiring momentum as laid off workers take longer to replace their old jobs.

Is The Consumer in Trouble?

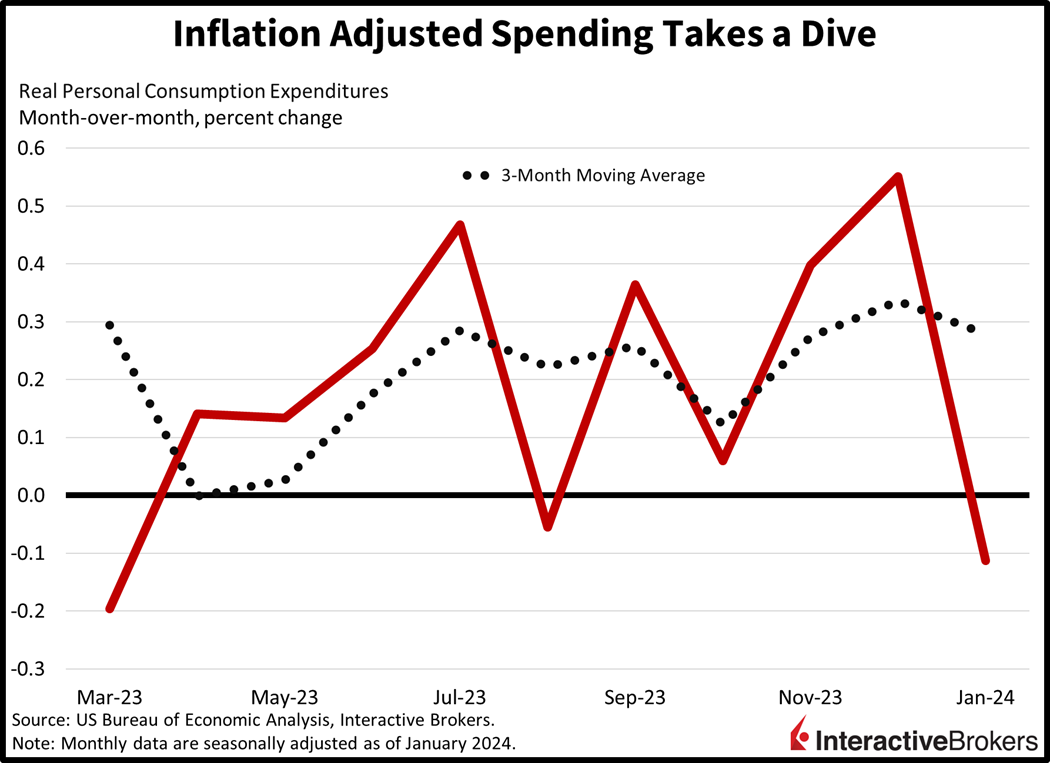

Consumer spending adjusted for inflation contracted last month, confirming the weakness illustrated by the retail sales report two weeks ago and the sluggishness reflected in consumer confidence data released on Tuesday. Consumption rose 0.2% month over month (m/m), in-line with projections but descending sharply from December’s 0.7% increase. Since prices rose 0.3% m/m, however, real spending dropped 0.1%. Folks spent their money on services, with real sales increasing 0.4% m/m while they neglected rate-sensitive goods, which experienced a 1.1% decline. Among goods consumption, durables fell a sharp 2.1% while non-durables fell 0.5%. On the compensation side, personal income rose a sharp 1% m/m, beating estimates of 0.4% and growing from the 0.3% increase during the previous period. The rise in income alongside slower spending resulted in the personal savings rate increasing from 3.7% to 3.8% m/m.

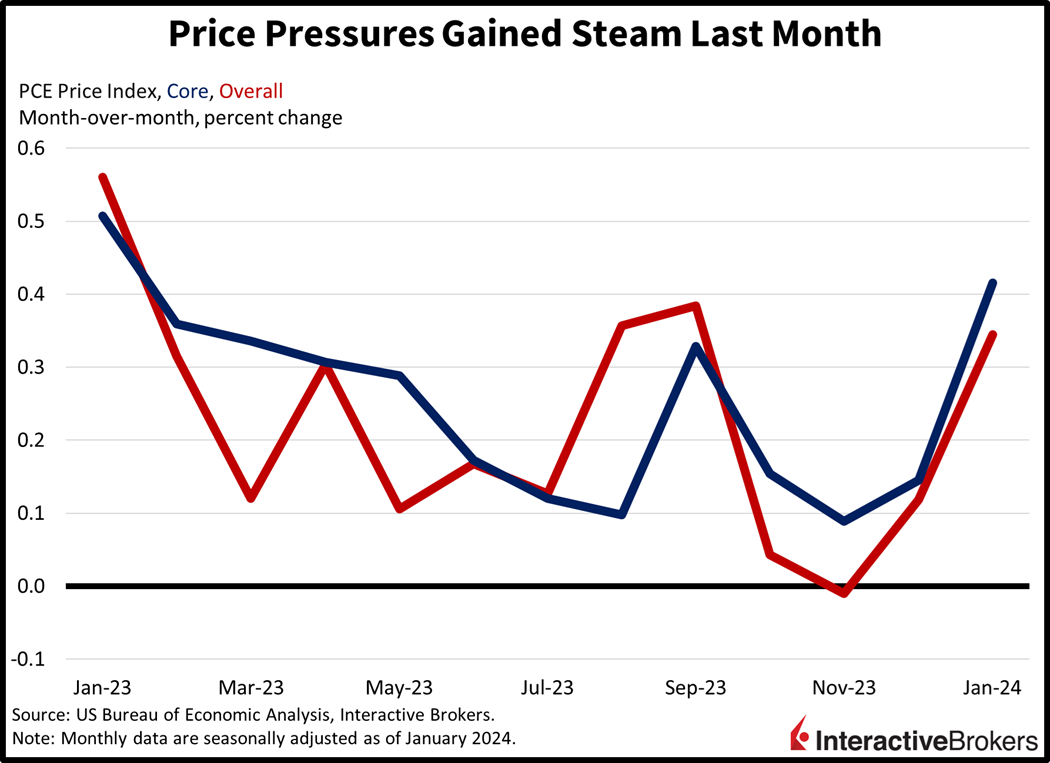

Accelerating Price Pressures Meet Expectations

PCE inflation data was certainly hot, but it met expectations across categories. Forecasting the Fed’s preferred measure of inflation, the core PCE price index, has become easier over the years, since data on consumer and producer prices serve as inputs that are released roughly 2 weeks earlier every month. The core PCE price index rose 0.4% m/m, accelerating meaningfully from December’s 0.1%. The overall PCE price index, which includes food and energy unlike its core counterpart, rose 0.3%, also picking up steam from the previous month’s 0.1%. On a year-over-year (y/y) basis, the core and overall indices rose 2.8% and 2.4%, slightly cooler than December’s rates of 2.9% and 2.6%.

Services and food were the main drivers of price pressures last month and while durable goods spending declined, prices for them rose. Services prices increased a sharp 0.6% m/m, food prices climbed 0.5% and durable goods gained 0.2%. Services prices rose at one of the fastest clips in decades. Unfortunately, services inflation is the hardest segment to cool when compared to commodities and goods, because it is a labor-intensive category that generally requires headcount trimming to curtail price pressures. We’ve noticed, despite tighter monetary policy, labor conditions are still tight, which is driving services inflation higher. Non-durables provided some relief, however, with prices falling 0.2% during the period.

Labor Market Eases Slightly

The labor market showed some weakness in the past few weeks, with continuing unemployment claims rising above the significant 1.9 million threshold while initial claims also added. Continuing claims increased to 1.905 million for the week ended February 17, well above projections of 1.874 million and the previous week’s 1.860 million. Initial claims increased to 215,000 for the week ended February 24, slightly above forecasts of 210,000 and the previous week’s 202,000. While the four-week trend of initial claims has moderated a bit, continuing claims are picking up steam, pointing to decelerating hiring momentum alongside subdued layoffs. The four-week moving averages for initial and continuing claims went from 215,500 and 1.877 million to 212,500 and 1.880 million.

Earnings Calls Highlights

- Salesforce, which provides business software, grew its fourth-quarter earnings per share (EPS) 11% y/y but provided disappointing guidance and said its AI product has yet to increase revenues. However, its internal use of artificial intelligence is helping the company become more productive. For the fiscal fourth quarter ended January 31, the Salesforce subscription and support segment led growth with revenue increasing 12.3% y/y. The company provided fiscal-year revenue guidance that missed analysts’ expectations, which raised concerns that businesses are curtailing tech spending. On an encouraging note, the company’s EPS guidance exceeded expectations. After reducing its staffing in the recent fiscal year, Salesforce expects to add workers to support its AI offering.

- Cloud services provider Snowflake grew its sales 32% and narrowed its losses during the fourth quarter. However, its revenue and operating margin guidance for the first quarter missed the analyst consensus expectation. The company said it has issued conservative guidance based on customer spending patterns during the past year.

- Best Buy, which reported fourth-quarter results that exceeded expectations, warned of another year of weak sales and will lay off workers and cut other costs. The company will invest the savings in projects that can help it buffer the impact of inflation. The company says signs of green shoots in the housing market and an uptake in home entertainment system installations are encouraging, with installations pointing to a potential start of a home technology refresh cycle.

Investor Sentiment Drives Gains

Asset prices are generally higher across the board as investors appear motivated by in-line inflation figures, contracting spending and rising unemployment claims. All major US equity indices are higher on the session, with leadership coming from the small-cap Russell 2000 and the tech-heavy Nasdaq Composite indices; they’re up 0.9% and 0.6%. The S&P 500 and Dow Jones Industrial indices are up a milder 0.2% and 0.1%, respectively. Sectoral breadth is positive with real estate, materials, and energy leading as the segments rise 0.9%, 0.7% and 0.6%. Only 3 out of 11 sectors are lower. Healthcare, financials and consumer staples are today’s laggards with prices slipping 0.5%, 0.1% and 0.1%. In fixed-income land, traders are incrementally pricing in the risk of an economic slowdown, but the path for Fed rate cuts this year remains intact at three. The 2- and 10-year Treasury maturities are trading at 4.62% and 4.23%, 2 and 3 basis points (bps) lower on the session. Lower yields aren’t weighing on the dollar though, with its index rising 10 bps to 104.02 on the back of awful economic data out of Germany, the European Union’s largest economy. Rising unemployment and declining retail sales in Germany are weighing on European currencies, with the euro, pound sterling and franc all down relative to the greenback. The US currency is slipping relative to the yuan, yen and Aussie and Canadian dollars, however. The yen’s recent relative strength has been driven by expectations of a return to positive interest rates. In energy markets, crude oil is higher as OPEC + is expected to prolong production cuts even as traders disregard the rise in US inventories. US rig activity has also been declining, pointing to reduced oil production stateside in the coming months. The oil futures curve is in backwardation, meaning prices in later months are cheaper than today’s due to current supply tightness, a bullish development in the short-term. WTI crude is up 0.7%, or $0.54, to $78.78 per barrel.

Another Stagflationary Report

Today’s Personal Income & Outlays report depicted contracting real spending amidst rising prices, a troubling development. One month of data is just that, but when examining the state of the consumer and the momentum of price pressures, there’s real risk that this dynamic is here to stay. For market participants, this is a confusing trend because we haven’t been conditioned to navigate these kinds of waters. Indeed, we haven’t seen stagflation since the 1980s. Weaker spending amidst rising prices is a terrible mix for capital markets, driving interest rates higher while compelling companies to cut costs in order to maintain earnings. If too many cost cuts occur, the significant risk is that there may not be a sufficient number of working individuals to sustain overall revenues, leading the nation to descend into recession. Unfortunately, cost cutting has become too frequent of a topic on recent earnings calls. When the labor market turns, it happens at the snap of a finger.

Visit Traders’ Academy to Learn More About Personal Income & Outlays and Other Economic Indicators.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!