Investors are pocketing some gains on the back of escalating tensions regarding international commerce. The EU announced that it will respond with tariffs of its own if the US implements levies across the Atlantic. But the selling is only modest, as markets remain supported by strong fundamentals, such as growing earnings, sturdy consumer spending, a healthy labor market and cooperative inflation. Emblematic of the economic momentum was Fed Chair Powell telling the Senate this morning that the central bank is in no hurry to lower interest rates further. Moreover, he cited that the committee’s policy stance is appropriate and that the group is prepared to respond to risks and uncertainties. Top of mind for market participants in terms of vulnerabilities is the potential uptick in price pressures that may stem from a wider trade conflict or a contraction in the labor force as a result of restrictive immigration measures. But these possible headwinds are unlikely to manifest, as President Trump has remained committed to reaching deals with allies rather than bump heads with them and an increase in compensation charges due to a lack of workers may be countered by decelerating shelter expenses. Housing costs have indeed cooperated in the last few CPI reports and the category is poised to transition from a persistent stimulator to a collaborative inhibitor. But today’s monthly report from NFIB on small business optimism offered a reminder of the challenges that enterprises face in filling job openings.

Optimism Among Small Businesses Dips

After jumping to its highest level since the fall of 2018 during the last month of 2024, small business optimism dropped from 105.1 to 102.8, according to last month’s read from the National Federation of Independent Business (NFIB). The result fell below the median estimate of 104.6, but was still strong, remaining substantially above the 51-year average of 98. The gauge was dragged down by owners experiencing difficulty filling job openings and managing inflation associated with inputs and labor. Taxes were cited as the third-most-significant problem following labor and price pressures. Additionally, the net percentage of business owners expecting the economy to improve dropped five percentage points to 47%.

On a positive note, a separate report comprised of larger establishments reached a fresh all-time high. The Bank of America Corporate Sentiment Score, which tracks positive and negative comments made by executives, hit its loftiest level since its creation in 2004.

Markets Tilted Slightly Bearish

Asset values are moving sideways for the most part with markets tilted slightly bearish. All major domestic equity benchmarks are trading south, however, with the Russell 2000, Dow Jones Industrial, S&P 500 and Nasdaq 100 indices down 0.6%, 0.2%, 0.1% and 0.1%. Similarly, sector breadth is deeply negative, with 8 out of 11 segments in the red. The laggards are represented by utilities, financials and consumer discretionary, which are down 0.8%, 0.6% and 0.5%. The gainers, on the other hand, are comprised of materials, energy and technology, which are up 0.7%, 0.4% and 0.2%. Fixed-income instruments are also getting sold at the margins with the 2- and 10-year Treasury maturities changing hands at 4.30% and 4.55%, 2 and 4 basis points (bps) heavier on the session. Additionally, the dollar is facing selling pressure; its gauge is 19 bps lower as the greenback depreciates relative to the euro, pound sterling, loonie and Aussie tender but is limiting the blow by appreciating against the franc, yuan and yen. Commodities are trending south as copper, lumber, silver and gold are lower by 2.5%, 1.1%, 0.4% and 0.2%, but crude oil is higher by 1.4%. WTI is trading at $73.44 per barrel as concerns of sanctions against Tehran and Moscow weigh on the supply outlook.

Can Shelter Turn to Friend from Foe?

Housing costs have been a consistent driver of services inflation throughout the disinflation that occurred from 2022 to today. And while much of the risks of immigration policy are centered on the possibility for wage pressures to strengthen, not much attention is placed on the shelter element, which should experience an alleviation. The downshift can certainly help to counter the possibilities of loftier goods costs and heavier wage bills. Furthermore, the immense category comprises roughly almost half of the Consumer Price Index (CPI) with its weighting well north of 40%. Finally, we’ve seen a deceleration in housing costs in the last two months and shall it continue, the path toward non-inflationary growth would widen significantly for the Trump administration.

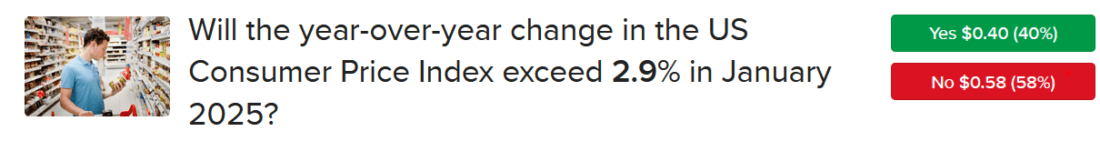

IBKR Forecast Traders are expecting an annualized figure of 2.9% in tomorrow’s CPI.

Source: ForecastEx

ForecastEx Weekly Pick

Chief Strategist Steve Sosnick and Senior Economist José Torres like the “Yes” Forecast Contract for a figure above 2.6% in this Thursday’s Producer Price Index. The “Yes,” currently priced at $0.67, pays a dollar if correct. Torres adds that his estimate of the figure is much higher at 3.2%.

Source: ForecastEx

International Roundup

Canada Building Permits Surge at Year-End

Canada produced a surprisingly strong uptick in building permits during December with the total value of construction approvals jumping 11% m/m to 13.15 billion Canadian dollars, the equivalent of $9.18 billion. Since permits are a preliminary step in projects, the indicator implies that construction activity could be strong this year. The encouraging result was a reversal from two-consecutive months of declines and surpassed Wall Street’s expectation of 1.4%. Multi-unit residential led the gains with a 33.3% increase followed by the 1.8% gain in single-family homes. Conversely, non-residential permits sank 5.9%.

Australian Consumers’ Caution Persists

Australian households continue to have a cautious view of the economy as illustrated by the Westpac-Melbourne Institute Consumer Sentiment Index rising only 0.1% to 92.2 after having fallen in December and January. Strains on family finances and an “unsettled global backdrop” have stalled the gains in sentiment that occurred during the first half of last year, according to Westpac, which is an Australian bank. On a positive note, nearly 50% of survey respondents with mortgages expect rates to decline. Two months ago, only one-third of respondents anticipated that interest rates would fall.

And Business Confidence Sags

Business confidence in Australia sank 3 points to +6 last month, according to the National Australia Bank index of conditions. Sentiment regarding sales and profitability dropped 4 points and 6 points to +6 and -2, with particularly significant weakness for margins expectations in the retail sector. Moving in the opposite direction was the overall opinion of the labor market with the employment index climbing 1 point to +5.

To learn more about ForecastEx, view our Traders’ Academy video here

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

I had J and J stock and was notified that – J and J stock had an ” unknown BULL AND BEAR source controlling the stock ” . Therefore I sold my stock at a loss, Subsequently the stock went up ! I do not trust IBKR – NOT HAPPY , I will not recommend you to anyone.

Hello, thank you for reaching out. We are sorry to hear you had an unsatisfactory experience. For a time-sensitive trading inquiry, please contact Client Services via phone call: http://spr.ly/IBKR_ClientServicesCampus