The S&P 500 recently had its biggest pullback since March, though only about 5% from its early September all-time high and thus quite mild in the context of normal market volatility historically. The Russell 2000 has not hit a new high since mid-March but was also only about 5% off that peak, having been mostly range-bound since then. Major indices have since recovered much of those declines in the last week and are again approaching their highs.

As we have discussed with clients, surveys of investor sentiment have shown a more dramatic decline in bullishness on stock prices than one might expect given the market’s moderate correction.

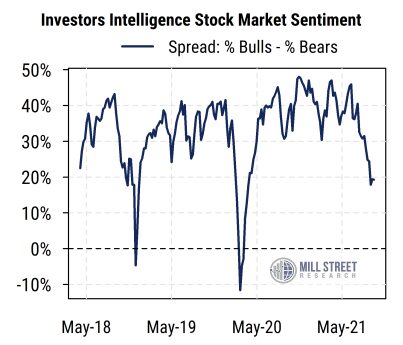

The widely-watched Investors Intelligence survey now shows the proportion of outright bulls on stocks outnumbering outright bears (ignoring the “correction” group) by only 19% at the latest reading (chart below). This is down sharply from a recent peak of 46%, and now well below the five-year average of about 34%. Typically such large drops in sentiment have followed more significant market pullbacks or volatility (i.e., more than just a 5% pullback).

Source: Mill Street Research, Investors Intelligence

A similar picture can be seen in the survey data from Consensus Inc. on the proportion of bulls on US stock indices (chart below). Before this week’s uptick, the prior week’s reading of 55% bulls was down from an April peak of 76%. That marked a 21% decline in bulls even though the S&P 500 was, even at its recent low, actually still about 4% higher than it was in April when the bulls were at a peak. The average reading over the last five years has been about 63% bulls, so the recent low reading was also notably below average. The latest uptick follows the market’s rebound over the last two weeks, but is now only back to the longer-term average level.

Source: Mill Street Research, Consensus Inc.

Our take on these sentiment readings has been that investors have been quick to turn more cautious on a mild correction after such a big, uninterrupted run in leading indices such as the S&P 500 and NASDAQ-100. Headlines have been especially worrisome recently (supply chain, political sand in the fiscal policy gears, COVID, etc.), building up the proverbial “wall of worry”. However, earnings estimates continue to rise (though at a more moderate pace) and real interest rates are still historically low.

While sentiment is always tricky to use as a timing tool, the current alignment of sentiment, price, and fundamentals looks like sentiment is more cautious than would be expected, and thus a potentially favorable contrarian indicator. There could be more near-term volatility, but our indicators overall remain positive and thus we would maintain our long-standing overweight equity positions.

—

Originally Posted on October 21, 2021 – Moderate Correction Provoked A Sharp Drop in Bullishness

Disclosure: Mill Street Research

Source for data and statistics: Mill Street Research, FactSet, Bloomberg

This report is not intended to provide investment advice. This report does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance of any security mentioned in this report.

All information, opinions and statistical data contained in this report were obtained or derived from public sources believed to be reliable, but Mill Street does not represent that any such information, opinion or statistical data is accurate or complete. All estimates, opinions and recommendations expressed herein constitute judgments as of the date of this report and are subject to change without notice.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mill Street Research and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mill Street Research and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!