Markets are bouncing back today ahead of tonight’s big tech earnings from Apple, Amazon and Meta. Yesterday’s stock market battering occurred as Fed Chief Jerome Powell closed the door on a March rate hike when he provided his FOMC presentation. On the economic data front, layoffs are ticking up and goods price pressures are re-inflating while Euro inflation has arrived hotter than expected. Indeed, during yesterday’s FOMC, Powell implied that goods deflation is unlikely to cooperate to the extent it did last year, requiring services to drive much of this year’s potential disinflation.

Manufacturing Contraction Continues

Manufacturing contracted in January for the fifteenth-consecutive month with this morning’s Institute for Supply Management (ISM) Purchasing Managers’ Index for Manufacturing reporting a score of 49.1, missing the expansion-contraction threshold of 50. The figure beat estimates of 47 while the sector shrank at a slower rate than December’s 47.1. Driving the upside surprise were new orders and prices, which achieved lofty levels of 52.5 and 52.9, respectively. Looser financial conditions, enhanced credit accessibility and lower interest rates led to the surge in customer orders while offering pricing power to goods sellers. Also driving up prices are the geopolitical tensions that are disrupting transportation routes, pushing up the cost of both shipping and oil. Manufacturers also worked down their backlogs while cutting headcounts.

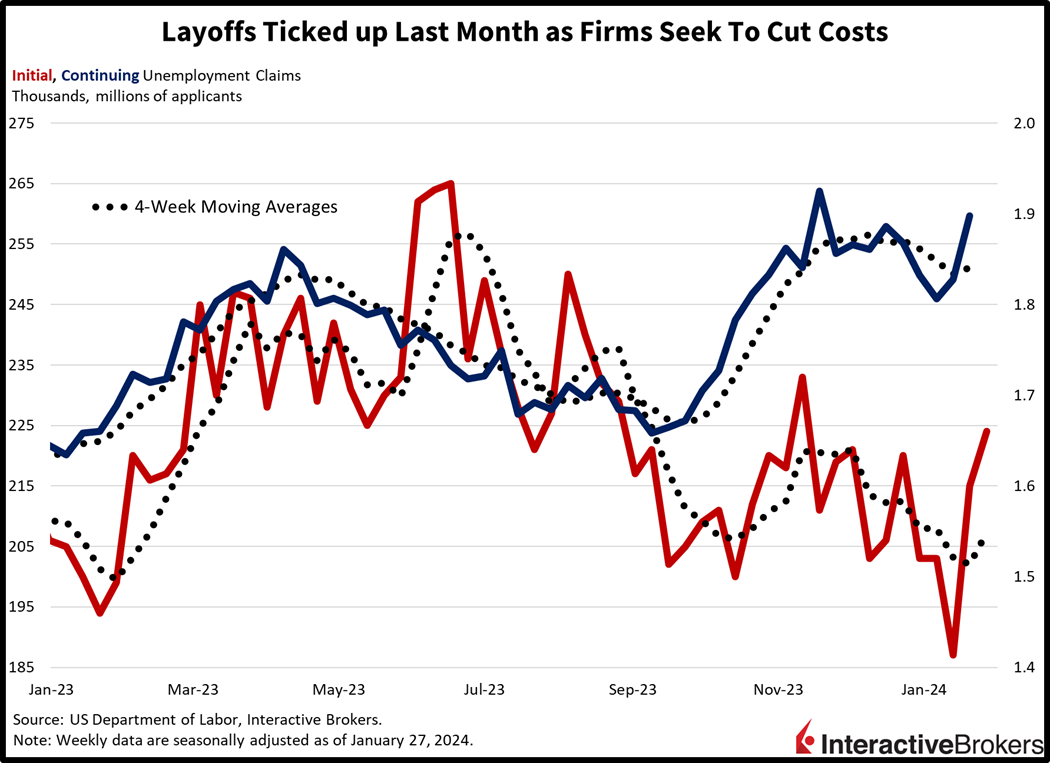

Tight Labor Market Appears to Ease

Unemployment claims jumped last week against the backdrop of a troubling trend of layoffs across corporate America. Initial claims rose to 224,000 for the week ended January 27, the loftiest level since early November. The figure arrived higher than estimates expecting 212,000 and the prior week’s 215,000. Similarly, continuing unemployment claims rose to the highest tally since mid-November, coming in at 1.898 million for the week ended January 20. The Street was expecting a number closer to 1.840 million while the previous period came in at 1.828 million. The trend of layoffs has now reversed to the upside, with the four-week moving average on both measures increasing from 202,500 and 1.834 million to 207,750 and 1.841 million week over week. Additionally, job cuts announced by the Challenger Report came in at 82,307 in January, a 136% month-over-month (m/m) increase but a 20% year-over-year (y/y) decline. Hiring plans are also amongst the lowest ever reported.

Mortgage Rates Boost Construction

Construction spending in the US rose sharply in December as builders took advantage of lower mortgage rates to ramp up activity. Construction spending rose 0.9% m/m, much better than the 0.5% expected and in-line with November’s growth. The residential sector was responsible for much of the gains, growing 1.4% m/m, while the smaller road and conservation categories contributed as well; they grew 4.1% and 1.6%, respectively, during the period. Offsetting some of the progress were the water supply and sewage segments, which declined 2.5% and 1.1% m/m.

European Inflation Weakens as Consumers Spend Less

Euro inflation softened last month as weak consumer demand weighed on goods prices. Overall prices arrived in-line with estimates, declining 0.4% m/m but rising 2.8% y/y. Core prices, which exclude food and energy due to their volatile characteristics, rose 3.3%, exceeding anticipations of 3.2% while improving slightly from December’s 3.4%. Inflationary relief was provided by goods and services, which saw m/m price declines of 2.4% and 0.1%. However, prices for the food, alcohol and tobacco category increased 1% and energy prices climbed 0.9%, offsetting some of the deflation. On balance, and similar to the US, Euro inflation appears to be bottoming near 3%.

Americans Spend on Smartphones and Flock to Cruises

Smartphone sales are supporting demand for semiconductor chips but appear to be weakening in other consumer segments such as virtual reality headsets. While consumers may be backing away from certain electronic products, they are flocking to ocean cruises as lower-cost alternatives to land-based outings. Consider the following highlights from recent earnings reports:

- Qualcomm generated strong quarterly results that benefited from a 16% y/y increase in handset chip sales. For the quarter ended December 24, Qualcomm produced an earnings per share (EPS) of $2.75 after adjusting for irregular expenses. The EPS soared past the $2.37 analyst consensus expectation. Net income on an adjusted basis totaled $3.1 billion and jumped 16% y/y from $2.68 billion while revenue climbed from $9.4 billion to $9.92 billion. The handset sales helped Qualcomm buck a trend of weakening industry results with both Taiwan Semiconductor Manufacturing Company and Texas Instruments recently reporting y/y declines in earnings and revenues. In its earnings call, Qualcomm said its chips demand was driven, in large part, by Samsung’s launch of high-end Galaxy phones. The news helped alleviate investors’ fears that Samsung might dump Qualcomm products and use its own chips in its higher end products. Other segments were challenging with Qualcomm’s internet of things segment, which provides chips for virtual reality headsets and other devices, experiencing a 31% y/y decline. Qualcomm’s guidance for adjusted EPS of between $1.73 and $1.93 for the current quarter missed the analyst expectation of $2.25. In the same quarter last year, the company produced an adjusted EPS of $2.15. Qualcomm expects its current-quarter revenue to range from $8.9 billion to $9.7 billion while analysts expected guidance of $9.3 billion. In the same quarter last year, the company’s revenue was $9.26 billion.

- Royal Caribbean Group, a cruise ship operator, also posted strong earnings growth, explaining that consumers are turning to its vacation packages as a lower cost option to land-based trips and that its passenger volumes recently exceeded pre-pandemic levels. Royal Caribbean Chief Executive Officer Jason Liberty also said the company anticipates record profits this year. For the recent quarter, the company’s revenue jumped almost 28% to $3.33 billion, but fell slightly below the analyst consensus forecast of $3.36 billion. However, its EPS of $1.25 adjusted for irregular expenses surpassed the analyst expectation of $1.13. In the year ago-quarter, the company reported a loss of $1.12 per share. The full year was strong with the company having 7.6 million passengers, up 17% from peak levels prior to the pandemic. Based on its strong bookings, Royal Caribbean issued 2024 adjusted EPS guidance of between $9.50 and $9.70 per share, significantly above the analyst estimate of $9.19 per share. For 2023, the company produced an adjusted EPS of $6.77.

Dead-Cat Bounce?

Stocks are recovering some of yesterday’s lost ground as market players focus on weaker economic data rather than Powell’s hawkish remarks. US stock indices are mostly higher, with the Nasdaq Composite, S&P 500 and Dow Jones Industrial benchmarks up 0.4%, 0.4% and 0.2%. The small-cap Russell 2000 Index is down 0.1% though, as investors remain nervous about a potential acceleration in regional bank stress following yesterday’s debacle. Indeed, lofty interest rates, declining commercial real estate values, the end of the Bank Term Funding Program (BTFP) and delayed relief from the Fed are weighing heavily on regional bank health. Sectoral breadth is positive, with almost all sectors higher as the consumer staples, communication services and materials sectors lead; they’re up 1.4%, 0.8% and 0.7%. The financials sector is the sole laggard, declining 0.9% while regional banks (KRE), more specifically, are down a whopping 5%. Bond yields are tumbling with the 2- and 10-year Treasury maturities trading at 4.18% and 3.84%, 3 and 8 basis points (bps) lighter on the session. Economic weakness amidst lower yields is pushing down the dollar, with the greenback’s index down 36 bps to 103.14. The US currency is down relative to the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Crude oil is jumping as OPEC + announces that the group is adhering to production cuts while geopolitical tensions remain a risk as Tehran and Washington relations appear to be worsening. WTI crude is up 1.1%, or $0.83, to $76.61 per barrel.

Can Big Tech Spare Sentiment?

Investors’ wall of worry has now steepened with expectations for a March rate cut out the door and incrementally delaying aid to a number of regional banks that have been exposed to significantly higher interest rates and cratering commercial real estate values. In the coming weeks, commentary from these institutions is likely to shed light on just how significant the delay in rate cuts and the end of the BTFP may affect them. Investors have also hoped that rate cuts would shore up corporate earnings with equity valuations trading at nose-bleed valuations while profits from AI, have yet to meaningfully materialize for most companies. As investors face the steep and intimidating wall of worry, tonight’s earnings reports from Apple, Amazon and Meta are likely to be pivotal in determining the market’s direction.

Visit Traders’ Academy to Learn More About ISM and Other Economic Indicators.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!