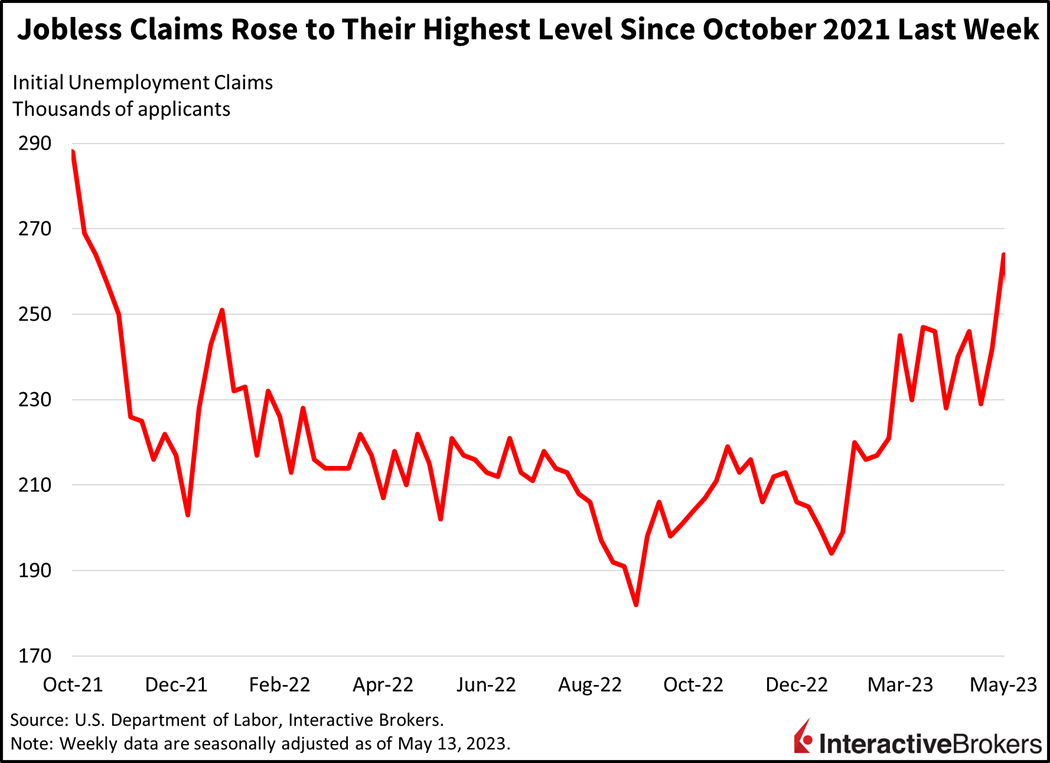

Stocks are higher this morning on hopes that a debt ceiling deal could be reached as early as next week, just in time for the June 1 tentative deadline identified by Treasury Secretary Yellen. On the economic data front, however, a faster pace of initial unemployment claims is pointing to a weakening job market at a time when consumers are winding down their pandemic savings while piling on credit card debt while interest rates are elevated.

As these cross currents surge through the economy, President Biden is seeking to strike a compromise with Republicans to increase the debt ceiling. Even if he succeeds and averts both a government shutdown and a default on U.S. debt, the U.S. will need to print approximately $1 trillion in new Treasury securities, which is likely to strain liquidity in capital markets and provide an additional headwind to economic growth.

The Labor Department reported this morning that initial unemployment claims totaled 242,000, for the week ended May 13, a decline of 22,000 from the previous week, but still high enough to support concerns of a weakening labor market. The 242,000 claims were lower than last week’s 254,000 and from expectations calling for 254,000. The less volatile four-week moving average for the period ended May 13 was 244,250 down by 1,000 from the previous week’s revised average of 245,200.

Fears of a government debt default were eased yesterday when President Biden said talks with Republicans on raising the debt ceiling have been productive. In a similar manner, House Speaker Kevin McCarthy this morning said negotiators could reach a deal in time for the House to hold a vote on the matter next week. But a deal isn’t a shoo-in. Senate Agriculture Committee Chairwoman Debbie Stabenow, a Michigan Democrat, said she is opposed to any cuts to the Supplemental Nutrition Assistance Program (SNAP). McCarthy has previously said a lack of cuts to the program will be a deal breaker. Other Democrats have expressed concerns about additional potential spending changes such as reducing efforts to slow climate change while accelerating fossil fuel consumption. Those items are key goals among conservative Republicans. Additionally, President Biden has said he is opposed to significantly expanding work requirements for individuals to qualify for Federal aid, such as Medicare.

While investors are optimistic that a deal to raise the debt ceiling may avert a catastrophic default of U.S. debt that could push the country into a recession, a resolution of the issue won’t end fiscal policy challenges for the economy. With the current spending proposal, the U.S. would have to issue approximately $1 trillion in new debt by the end of the third quarter. This tsunami of debt issuance would be required to replenish cash that is currently being drawn down as well as to support additional deficit spending. At a time when consumers are tightening their purse strings and the labor market appears to be cooling, the size of this debt issuance could drain liquidity from banks and have the same impact on the economy as a rate hike or two.

Equities are rallying this morning on the back of progress on the debt ceiling negotiations. The S&P 500 Index is up 0.3% led by tech stocks with the Nasdaq Composite Index up 1%. Yields are rising too, however, with increasing expectations of Fed tightening as the market places 33% odds of another 25-basis point (bp) hike by the Powell at the Fed’s June meeting following hawkish comments from the Fed’s Jefferson, Barr and Logan. While the 1-month Treasury yield is down 5 bps to 5.44% as the markets breathe a sigh of relief on the debt ceiling, the 2-year is up 6 bps while the 10-year is up 5 bps to 4.22% and 3.63%, respectively. The dollar is rallying again, supported by a central bank that is defying political pressure and keeping at it, with the Dollar Index climbing 61 bps to 103.52. Crude oil is down 1.6% to $71.71 per barrel as the stronger dollar weighs on external demand while Chinese industrial production and retail sales disappointed hopes for a more buoyant recovery. Recent earnings reports underscore the impact of inflation upon consumers and separately, how supply chain improvements and other developments are causing corporations to be more prudent with capital expenditures.

The following examples illustrate these themes:

- Walmart posted first-quarter adjusted earnings per share (EPS) of $1.47, up from $1.30 in the year-ago quarter and beating the consensus expectation of $1.32. Walmart’s total revenues climbed from $141.6 billion to $152.3 billion year-over-year (y/y), a 7.6% increase and above the consensus expectation of $148.7 billion. Excluding fuel, same-store sales climbed 7.4% and e-commerce climbed 27% y/y. Like many retailers, Walmart said shoppers have cut back on purchasing discretionary items, especially large ticket items. Growth in the company’s grocery business helped offset the decline in discretionary items. Walmart also said a decline in spending driven by the end of pandemic-related emergency funds from the government caused sales to weaken as the first quarter progressed. Consumers have been resilient, however, and the company raised its sales growth guidance for the current year to 3.5%.

- Cisco, which provides routers, software, security services and cloud computing technology, reported earnings of $1 a share on an adjusted basis, narrowly exceeding the consensus expectation of $0.97 and up 15% from the year ago quarter EPS of $0.87. Its revenue also climbed, reaching $14.6 billion compared to $12.8 billion for the first quarter of last year. For the current fiscal year, Cisco anticipates revenue will increase by 14% to 16% y/y. Cisco noted, however, that its orders have declined 23%, due in part to an elongated sales cycle as customers are being more prudent with their technology spending. Customers are also working to implement prior orders and with improving supply chain conditions they have become less aggressive in placing new orders.

The Hot Seat in the Oval Office

For Biden, this is an opportunity to strike a Republican-Democrat compromise such as deals forged by former President Bill Clinton and former House Speaker Gingrich or former President Ronald Reagan and former House Speaker Thomas “Tip” O’Neill.

All eyes are on President Biden as he seeks to forge a compromise among Democrats and Republicans who have strong differences in their political agendas and fiscal-policy beliefs. For Biden, this is an opportunity to strike a Republican-Democrat compromise such as deals forged by former President Bill Clinton and former House Speaker Gingrich or former President Ronald Reagan and former House Speaker Thomas “Tip” O’Neill. While the differences among political parties are substantial, the stakes are also high for Biden and negotiators as investors anxiously wait for a resolution to the issue and frequent changes in the outlook for a potential compromise drive market sentiment.

Visit Traders’ Academy to Learn about Initial Unemployment Claims and Other Economic Indicators.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!