By: Global X CIO Team

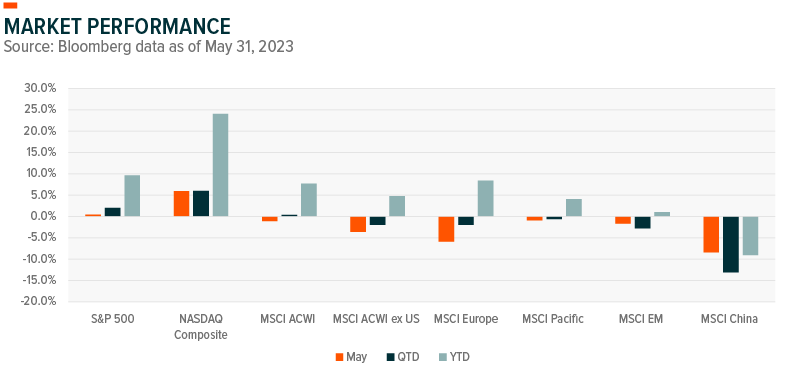

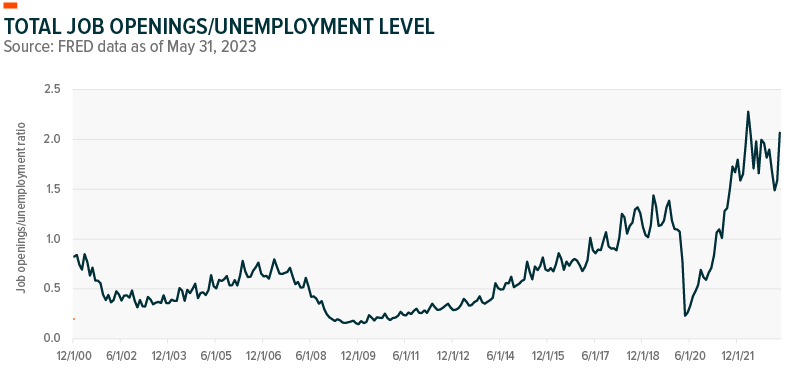

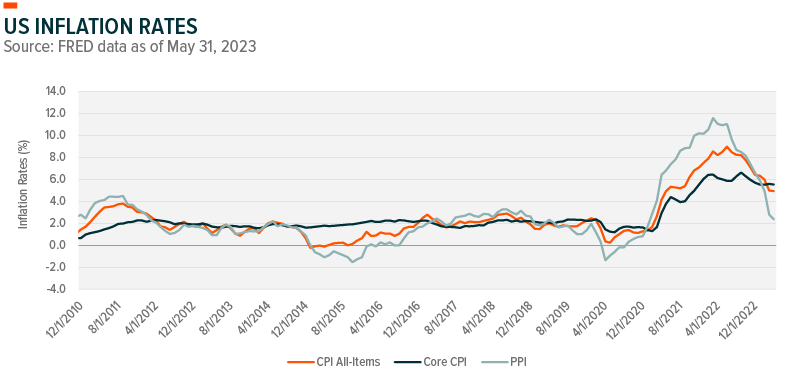

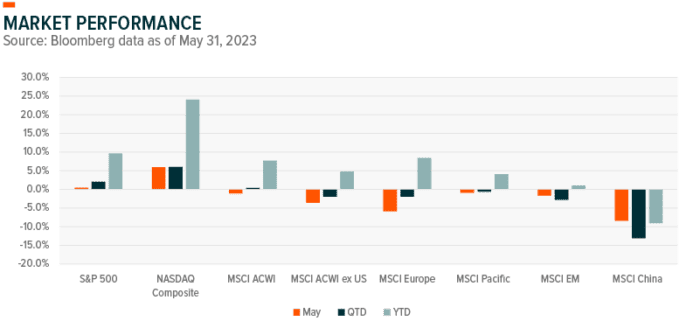

Large-cap US tech stocks continued to outperform in May, with the Nasdaq returning 5.9% and the S&P 500 up 0.4%. Artificial intelligence stocks powered most of the market’s gain as tech innovation fueled investor optimism. US equities held up despite rising Treasury yields and a more hawkish Federal Reserve. Yields rose mostly at the front-end as debt ceiling concerns surfaced. Positive consumption, GDP, and labor market data may have delayed expectations for a recession. Meanwhile, the contraction in US manufacturing has diverged from services data, reflecting an uneven economic cycle. US inflation continued to ease, albeit less than expected.

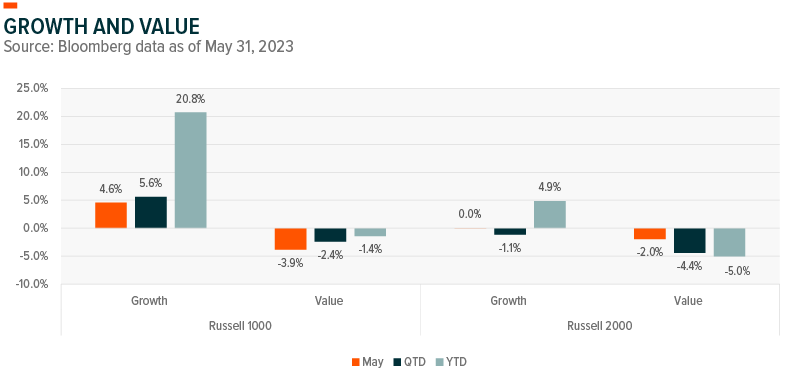

Within the US market, growth outperformed value, with Information Technology and Communication Services in the lead. Energy and Materials lagged the broader market as oil and industrial metal prices declined. Defensive sectors such as Consumer Staples and Utilities continued to underperform.

Outside the US, emerging market equities declined as the dollar strengthened. Chinese equities continued lower as earnings and economic data came in below expectations. European equities also underperformed the broader MSCI ACWI Index in May, partly because of negative economic surprises.

Click here to download Global X’s Market Snapshot.

FOOTNOTES

All data sourced from Bloomberg as of May 31, 2023.

—

Originally Posted June 5, 2023 – Market Snapshot – June 2023

Investing involves risk, including the possible loss of principal.

Index returns are for illustrative purposes only and do not represent actual fund performance. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. One cannot invest directly in an index. Past performance does not guarantee future results.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Global X Management Company LLC serves as an advisor to the Global X Funds.

Disclosure: Global X ETFs

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!