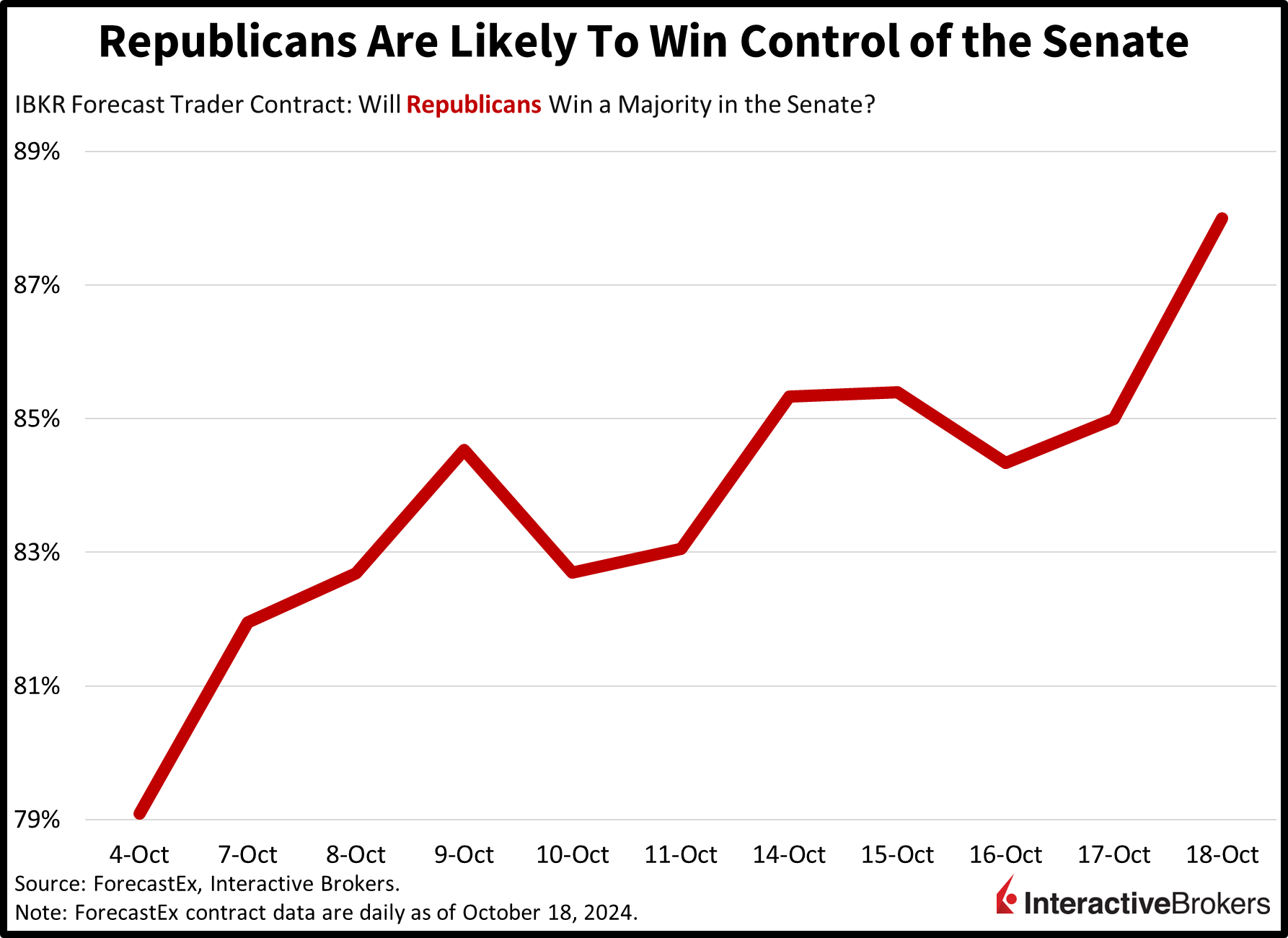

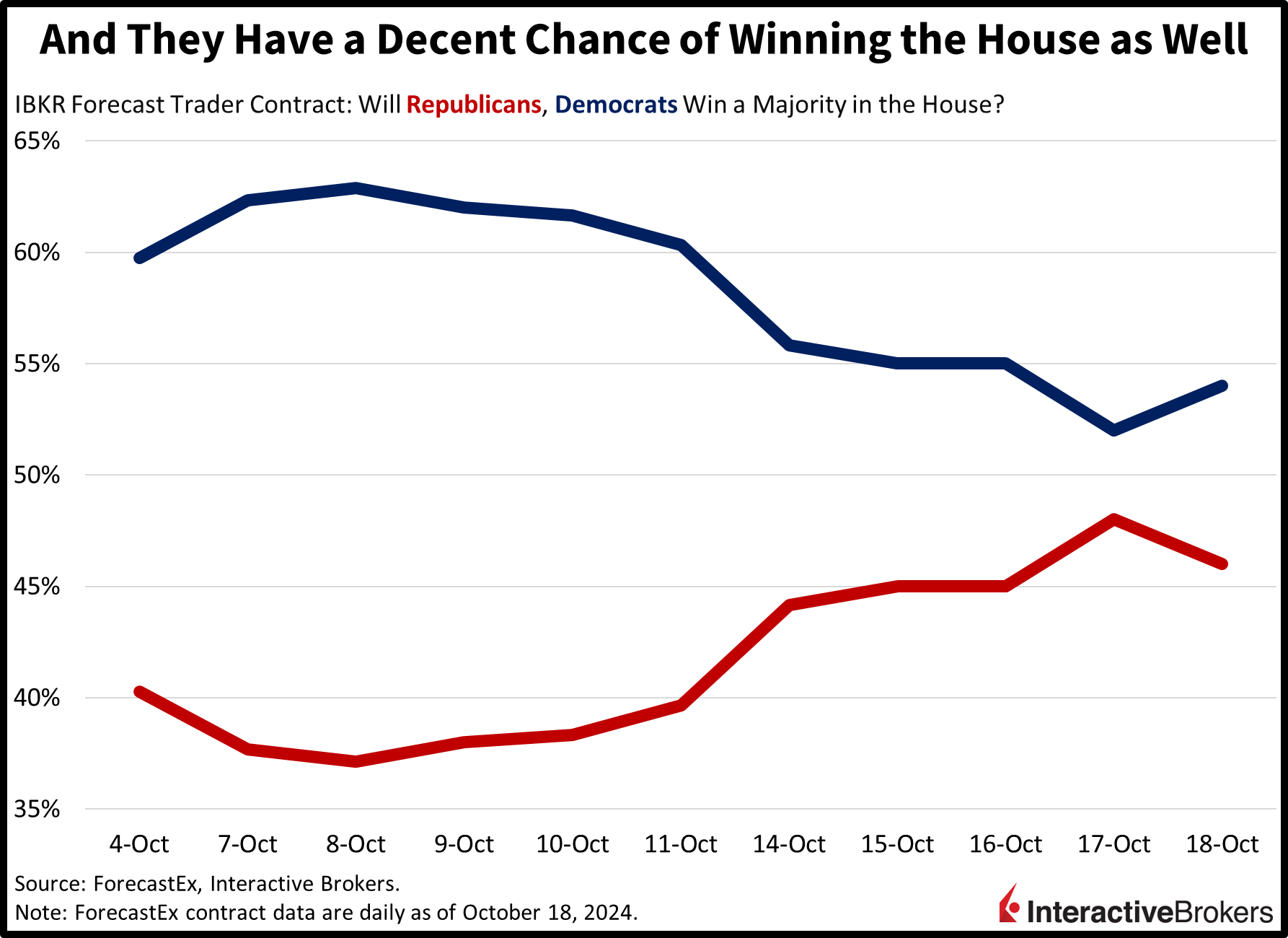

Interest rates and oil prices are drifting south today on news of worse-than-expected economic growth out of Beijing amidst continued sluggishness in the stateside real estate sector. Stocks are catching a bid, however, as additional stimulus measures from China bolster investor sentiment, for now. But equities aren’t gaining much on this monthly options expiration day, as market participants gear up for elections which are just 17 sunsets away. Forecast contracts, probability data and polls suggest that the GOP is gaining momentum on all fronts, with odds favoring control of the White House and Senate. And while a red sweep seemed out of reach for Republicans a few weeks ago, the path for control of the House is widening as well.

Surprise Jump Weighs on Housing

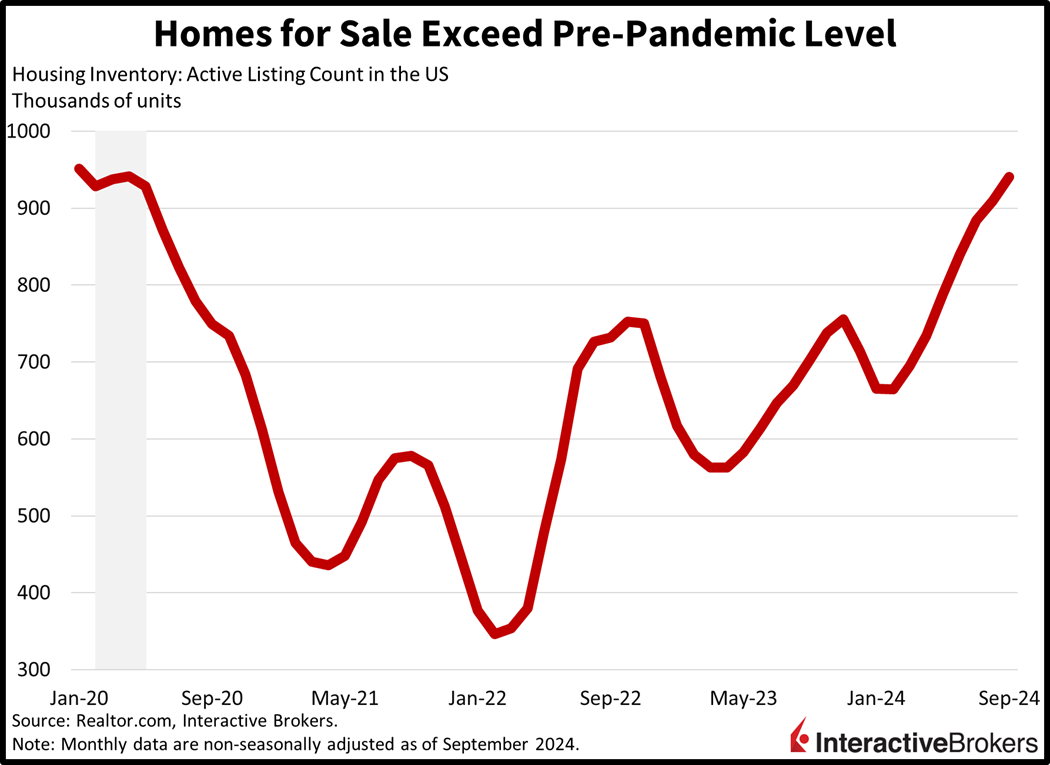

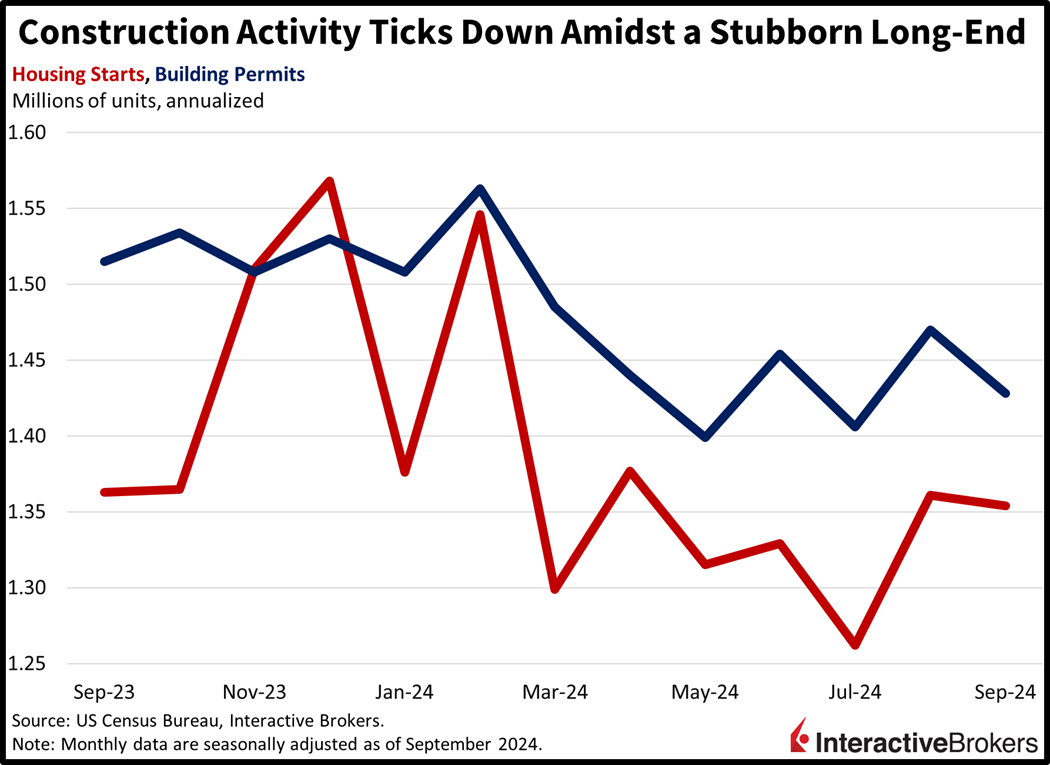

After picking up slightly in August, housing construction weakened last month as the industry continues to languish, a result of record-low home affordability and a surprise jump in long-end yields following the Fed’s 50 basis point (bp) reduction. In addition to high prices, mortgage rates have climbed from a September low near 6% to north of 6.6% today. My contacts in the space have been anxiously calling me, because they expected the central bank’s move to drive transaction volumes, but their computer screens reflected loftier, not lighter, borrowing costs shortly after the Fed’s action. They’re not alone: channel checks reveal automobile dealerships and furniture showrooms are suffering from the same phenomenon. The central bank’s relief plan actually stifled deal flow in these sectors. Furthermore, active real estate listings just exceeded pre-pandemic levels last month and are expected to continue climbing, as prospective seller patience is painfully tested.

Housing Starts and Permits Falter

September housing starts and building permits declined in August to 1.354 million and 1.428 million seasonally adjusted annualized units. Starts exceeded the median estimate of 1.350 million but fell 0.5% from a 1.361 million pace recorded in August. Permits, which are issued before breaking ground, furthermore, missed the estimate of 1.450 million and declined 2.9% from a rate of 1.470 million in the preceding month.

Apartment Buildings, Labor Hampered Results

For single-family projects, starts and permits climbed 2.7% and 0.3% m/m, respectively. Conversely, apartment building starts and permits contracted 4.5% and 10.8%. Among regions, a 57.9% m/m increase in housing starts in the Northeast dampened the impact of declines in the South, West and Midwest of 3.4%, 10.1% and 9.1%. Permits increased 10.9% in the West but fell 13.1%, 2.9% and 6.1% in the Northeast, Midwest and South.

Labor developments are also weighing on activity with a recent survey by Arcoro and the Associated General Contractors of America determining that 94% of contractors are having a hard time filling open positions. The study found that 54% of contractors are experiencing project delays due to workforce shortages. Among other measures to address the issue, contractors are creating training programs and increasing base pay.

China Disappoints

Beijing dished out a disappointing economic growth print this morning with its third-quarter GDP expanding only 4.6%, below the Chinese Communist Party’s 5% target. While the result exceeded the consensus forecast of 4.5%, it fell 0.10% from the previous quarter and was the weakest growth in 18 months. On a positive note, retail sales picked up in September, a result of the country seeking to stimulate its economy with an appliance and goods trade-in program. Fixed-asset investment and industrial production and fixed-asset investment also strengthened but the housing sectored continued to bog down growth. Investors are hoping that stimulus measures boost activity figures, but doubt is prevalent considering the response of Asian markets.

Markets Are Quiet as Investors Gear Up

Markets are quiet heading into the weekend with participants awaiting more earnings reports and additional insight from Washington. For stocks, the Nasdaq 100 and S&P 500 benchmarks are gaining 0.5% and 0.2% while the Dow Jones Industrial and Russell 2000 baskets are losing 0.2% each. Sectoral breadth is green, however, with 10 out of 11 segments higher and led by communication services, materials and utilities; they’re up 0.8%, 0.5% and 0.4%. Energy is the sole loser as crude oil gets punished due to disappointing activity figures out of Beijing and milder geopolitical conditions on a relative basis. Energy equities are lower by 0.4% in response to WTI crude shaving 1.6% off its price to $68.95 per barrel. All other major commodities are higher though, with silver, copper, lumber and gold up 3.3%, 1.2%, 1% and 0.9%. Gold reached a fresh all-time high earlier. The dollar is finally losing steam after a long winning streak in the face of dwindling yields. Indeed, the 2- and 10-year Treasury maturities are being offered at 3.97% and 4.08%, 1 and 2 bps lighter on the session while the greenback’s gauge is down 22 bps. The US currency is depreciating relative to most of its significant counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders.

Possible Volatility Ahead

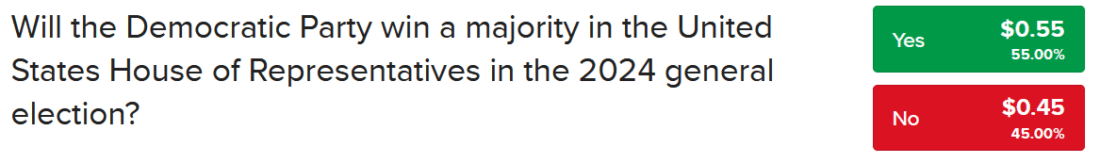

As we close in on election day, there is no shortage of upcoming economic data and central bank speakers. In fact, next week’s domestic calendar features the Conference Board’s leading economic index, unemployment claims, flash PMIs, new and existing home sales, durable goods, the central bank’s beige book and regional surveys and more. We’ll also hear from the Fed’s Logan, Kashkari, Schmid, Harker, Bowman, Hammack and Barkin as well as the ECB’s Lagarde, McCaul, Lane, Cipollone and Buch. Finally, I’m expecting markets to increasingly focus on election outcomes amidst rising turbulence as investors examine strong GOP odds of securing the White House and Senate while the IBKR Forecast Trader carries a 45% probability of the Republicans controlling the House of Representatives. Yields are likely to move higher, while equities pare gains as a result.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

this is a confusing the article as the facts are incorrect. The Democrats are the majority in the Senate while /Republicans are in the majority in the House.

I believe once you fix those problems, the reader can focus on your point

Hello, we appreciate your comment. The title of the graph states “Republicans are likely to win control of the Senate”. This explains how they do not currently have the majority.

Yes