Recessions typically involve a sharp pullback in consumer spending that creates excess inventory among retailers and manufacturers. These gluts often cause businesses to clear out inventory by deeply discounting their products and services. The resulting decline in revenues and earnings is often accompanied by employee layoffs as companies seek to minimize losses. New technology, however, is helping businesses better control their supply chains and inventory, which can potentially reduce the impact upon the economy of companies dramatically reducing their prices to sell excess products. Furthermore, the pandemic experience characterized by sharp increases and decreases in the demand for goods has conditioned companies to better manage shifts in spending patterns. In this commentary, we provide a brief overview of supply chain and inventory technology. We also assess current inventory levels to understand which economic sectors may face the most pressure to discount their products if a recession occurs.

Paper, Pen and Fax Machines

Retailers and manufacturers have traditionally lacked technology for managing supply chains and tracking inventory in real time, which has prevented companies from quickly making changes in their production or supplies of products. In the not-so-distant past, for example, products were inventoried only occasionally because the process was labor intensive and often done with paper, pen and fax machines.

Without real-time data, businesses were often stuck with excess inventory when customers curtailed their spending which in turn caused deep price discounting to help sell excess products. This problem may have been worsened by poor visibility into supply chains, especially with supply chains spanning the globe. While deep discounting of products can help reduce financing costs and physical storage expenses associated with maintaining excess inventory, it also triggers employee layoffs as companies seek to preserve earnings during periods of declining revenues. These layoffs have prolonged and deepened past recessions.

Businesses Brace for a Weakening Consumer

The following significant developments may prevent, or at least minimize, this problem if the Federal Reserve’s aggressive monetary policy tightening to contain inflation sparks a recession:

- Companies have improved supply chains and inventory technology so they can better align product availability with consumer demand.

- Goods producers experienced a huge surge in demand for products during Covid-19 lockdowns. This was followed by consumers shifting their spending to services, such as entertainment and travel, as pandemic containment measures were rolled back. This sharp decline in spending on goods resulted in companies holding excess inventory. Companies are now better conditioned to weather sharp inventory shifts in the future.

- Many companies have already decreased their inventory in part due to growing expectations of a consumer slowdown.

Challenges Increase in a Digital Age

Technology is a double-edged sword for businesses. While it has helped to automate tracking inventory and improve supply chains, it has also made those functions more complicated as companies now distribute products directly via the internet as well as through traditional brick and mortar channels. This process is also complicated because businesses must also track items that have been returned by customers at numerous locations. Additionally, without real-time inventory and supply chain technology, businesses may be unable to spot trends among customers that would otherwise influence inventory decisions.

In a similar manner, supply chains, which are networks of companies that provide value in delivering products and services to end users, have also been problematic. Traditionally, supply chain information has been linear. That is, providers of raw materials have communicated with manufacturers and then manufacturers communicated with distributors who then communicated with retailers. That can create delays for retailers to learn of issues, such as a shortage of materials that can hold up manufacturing. These delays in updated supply chain information can cause retailers to order similar products elsewhere even if manufacturers have been able to resume making items. If the original order arrives along with the newest orders, retailers will go from bare shelves to an inventory glut.

Technology Improves Supply Chains

Cloud-based inventory systems and distributed ledgers such as blockchain are improving supply chain and inventory management by providing real-time updates. Cloud systems provide a centralized location for businesses to monitor inventories in multiple warehouses and within multiple sales channels, such as ecommerce, direct to consumer and retailers such as department stores. When this inventory data is combined with real-time sales information, businesses can better manage their inventories, a potential benefit of technology that is experiencing strong growth—as of 2022, the global inventory management software market was estimated at $3.072 billion and is now expected to reach $5.386 billion in 2028.

Distributed ledger technology such as blockchain that is part of the digital currency network is also helping to improve supply chain management because it offers a “non-linear” tracking system. With distributed ledgers, each step in the inventory process is recorded with an encrypted, tamper-proof, digital stamp. This real-time process can be monitored, allowing businesses to check the flow of items through each stage of supply chains.

Bracing for Recession

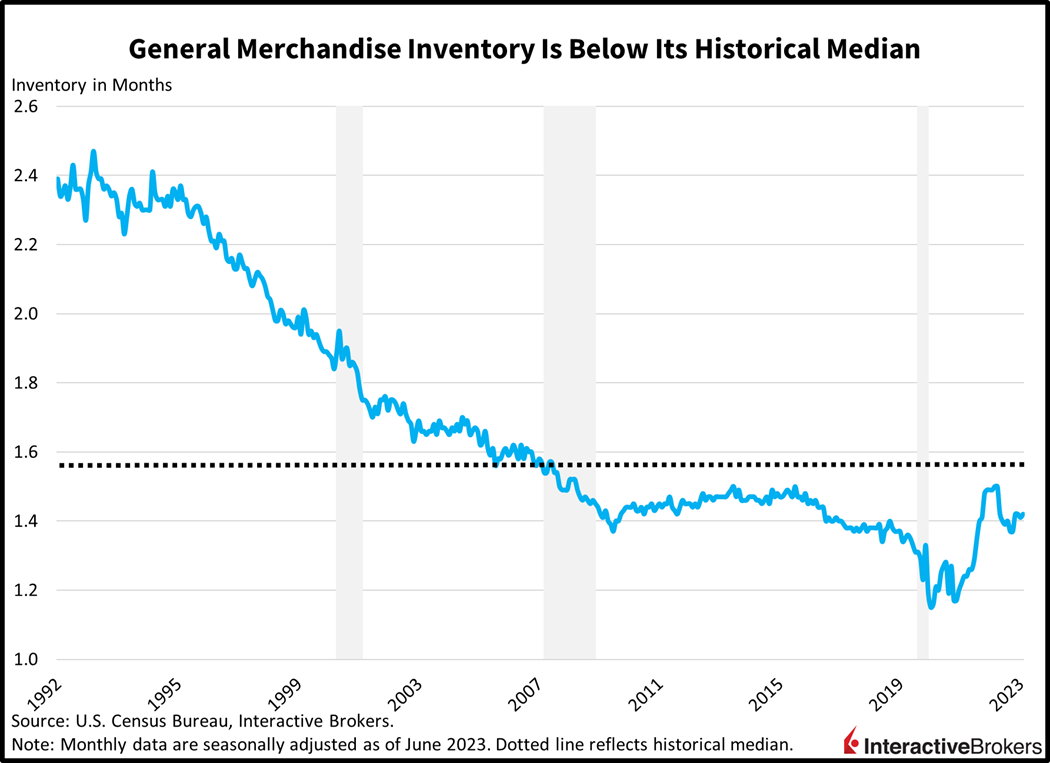

Consumers gorged on home goods, such as entertainment devices, computers and home furnishings, while working from home during the Covid-19 pandemic. As consumers shifted to services, inventory at retailers increased dramatically. Many retailers, including Macy’s, Target, Home Depot and Walmart, have spent the past year offering discounts to clear out excess inventory in anticipation that consumer spending will continue to slow in the coming months. Retailer Five Below, furthermore noted during its second-quarter earnings report that it is focusing on using technology and data analytics to better manage inventory. Today, all categories except for building materials have retail inventory levels that are either at or below their historical medians, positioning companies to better withstand the possibility of a slower consumer. On the other hand, enhanced technology can also help rapidly increase inventory if demand surprises to the upside.

A Sector-by-Sector Assessment

Building Materials Stores, which includes paint, wallpaper, garden equipment, hardware and building supplies stores, demonstrate various powerful trends during the past few years. During the Covid-19 pandemic, supply chain issues combined with a surge in home renovations caused inventory levels to plummet in 2020. Additionally, many urban office workers fled to the suburbs, boosting housing demand. With many homeowners having already completed renovation projects and high interest rates weighing on affordability, home renovations and new construction has weakened, allowing inventory to increase.

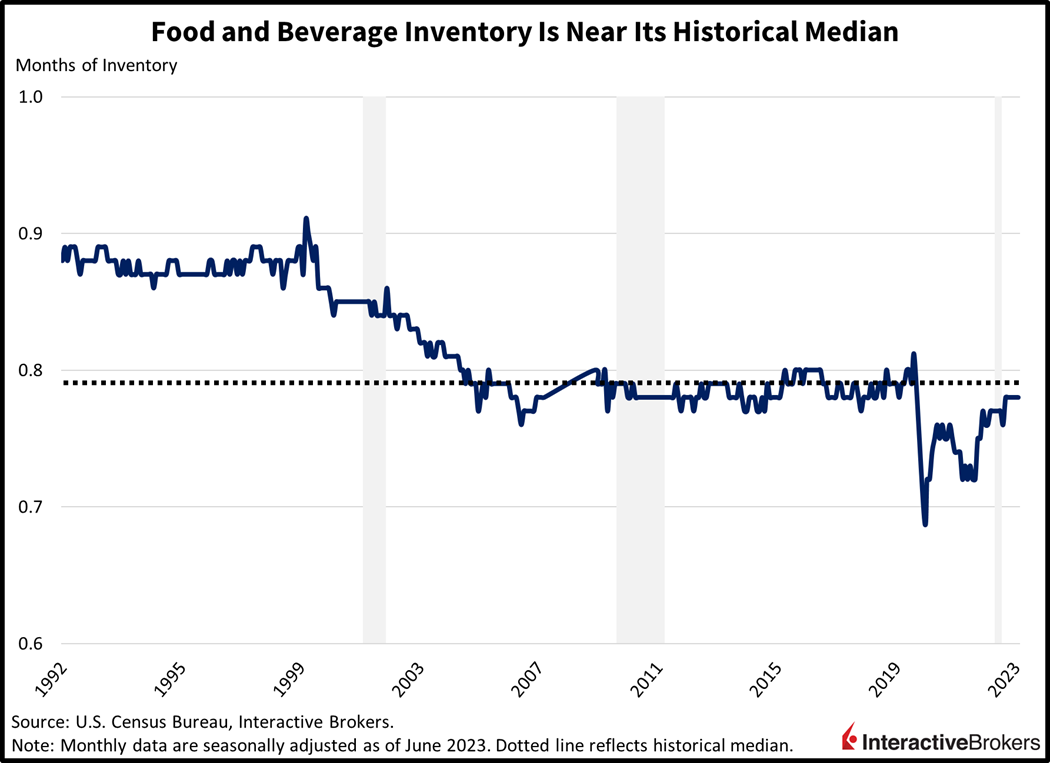

Food and Beverage stores include grocery stores, liquor stores, pharmacies, and certain gasoline stations. This category has less variation in inventory levels because demand for its components isn’t cyclical. Additionally, foods are perishable, causing food distributors and retailers to manage their stock to avoid excessive waste. The notable decline in the Food and Beverage category during the pandemic was due to supply chain issues.

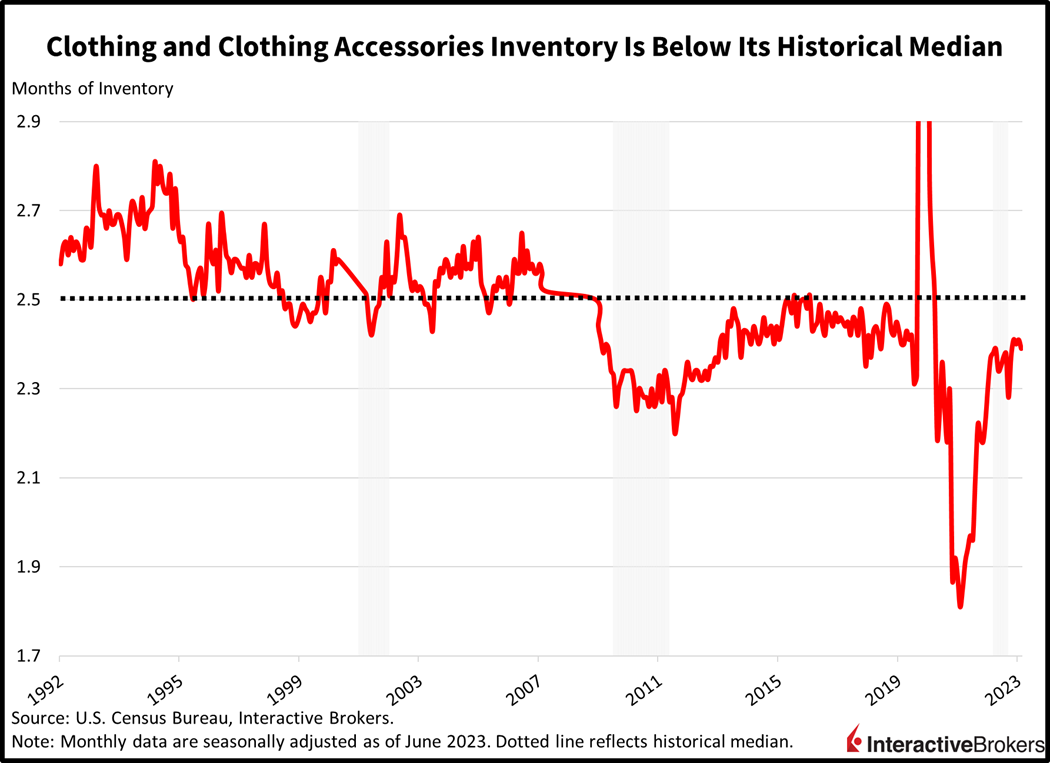

The next-lowest inventory level is in the Clothing and Clothing Accessories store category. Inventory initially rose during the Covid-19 pandemic, but accommodative fiscal and monetary policies alongside the reopening of the economy caused consumers to splurge, causing inventory to plummet up until late last year when consumers shifted their spending to entertainment and traveling, which allowed inventory levels to increase. Additionally, clothing brands have cut back on their orders, with U.S. imports from Bangladesh declining considerably. Manufacturers, furthermore, have implemented on-demand manufacturing technology which allows them to start production after orders are received, thereby reducing the possibility of creating excess product.

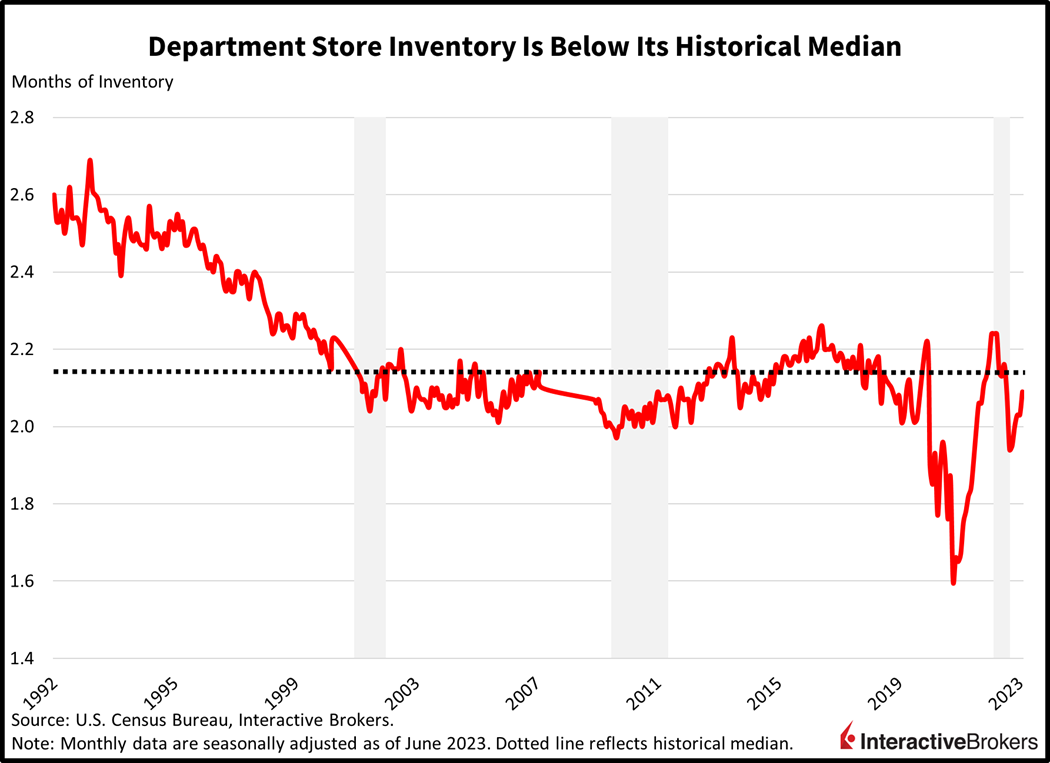

A similar trend explains why the Department Stores category experienced a strong surge in inventory during the pandemic. As the economy began to re-open and consumers flocked to brick and mortar stores, inventory levels declined up until consumers switched their spending to services. Department stores have since discounted excess inventory items and scaled back their orders, with their inventory below the historical median.

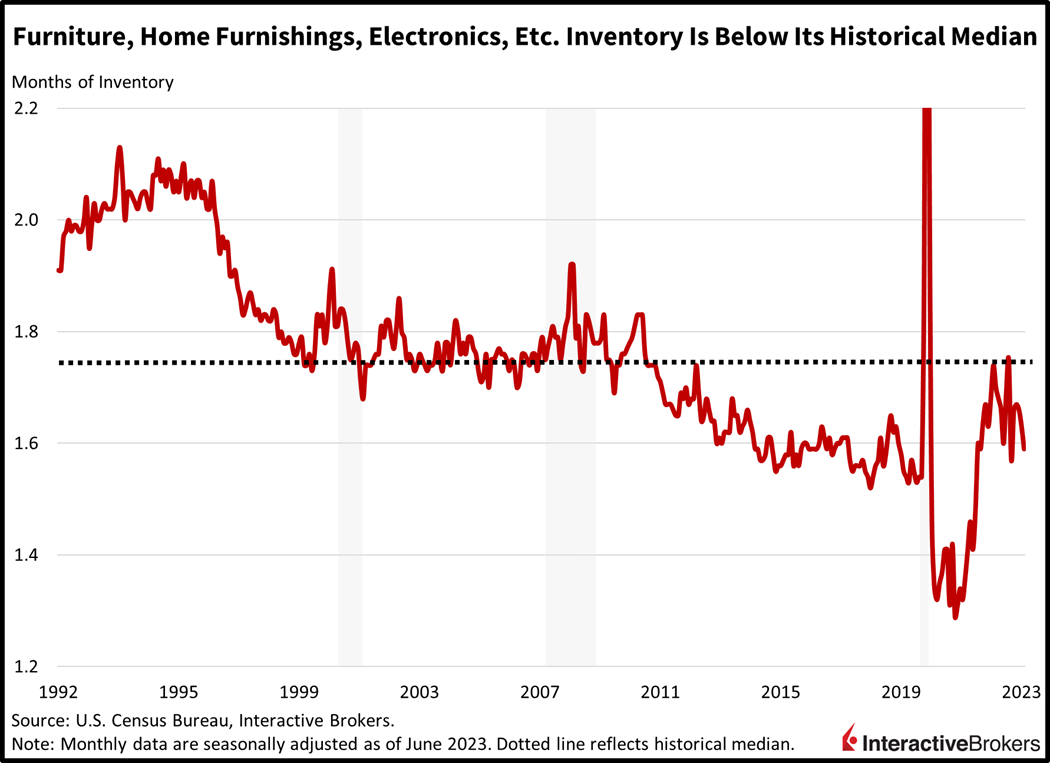

Inventory for Furniture, Home Furnishings, Electronics and Appliance stores is also below the historical median. Similar to the Clothing and Department Store categories, this category experienced a large increase in inventory during the Covid-19 recession only to experience a sharp inventory decline as individuals received stimulus checks and rushed to buy electronics for working from home and for entertainment.

The General Merchandise Stores category, which includes office supplies, gift stores, mail order businesses, fuel dealers, online retailers, and certain food establishments, has maintained low inventory.

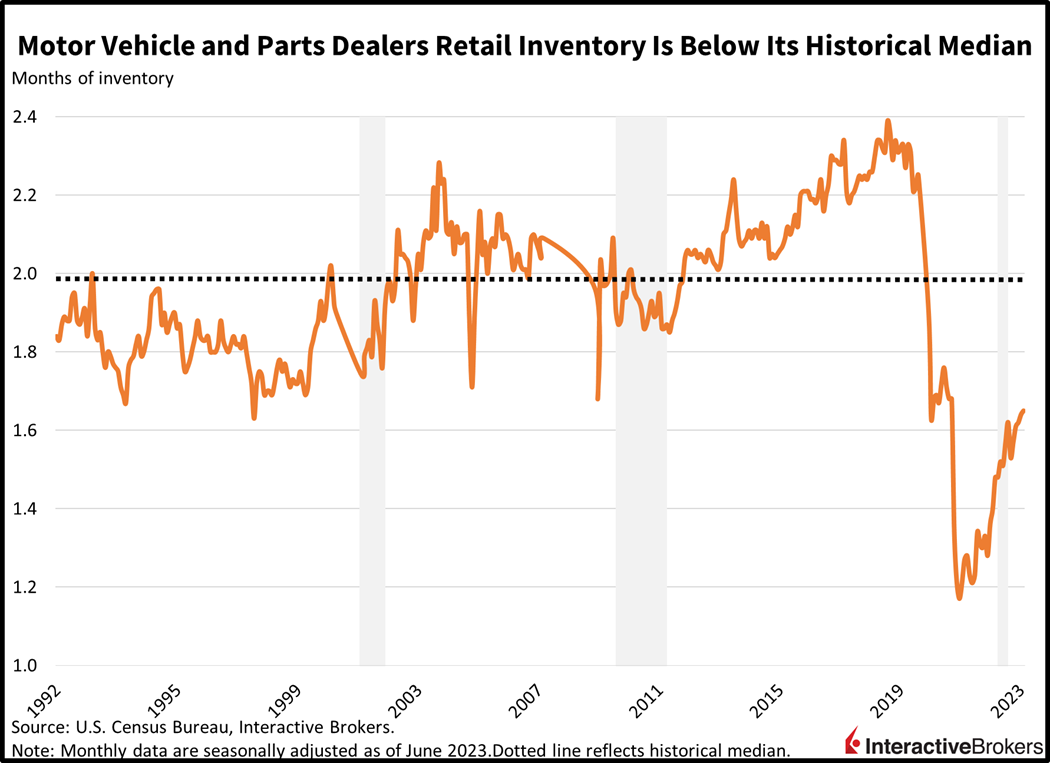

The Motor Vehicles and Motor Vehicles Parts stores category has the lowest inventory level. This category includes both dealers of new cars and used cars along with parts stores and tire retailers. With considerable supply chain issues that limited the availability of computer chips, car manufacturing slowed dramatically and inventory plummeted during the middle to later part of 2020. More recently, it has been increasing but the inventory to sales ratio of 1.64 is still significantly below the median of 1.96. This low inventory level means consumers have few choices when car shopping and less clout in negotiating prices, but could create an uptick in manufacturing, which has experienced four months of declines. Such an increase would be favorable for the economy because manufacturing tends to pay attractive wages.

A Test of Inventory Management Could Surface

Companies are continuing to reduce inventory levels in anticipation that consumer spending will decline with many Americans having their pandemic savings dwindle under the pressure of higher financing costs, loftier prices and reduced credit availability. Consumers have also taken on large amounts of consumer debt with high interest rate credit cards. Additionally, many folks will soon have to resume paying back student tuition loans. A strong job market, however, is helping to support consumer spending including the strong shift to services, such as travel and entertainment.

While consumer spending has remained surprisingly strong, prospects of a slower economy and the challenges of supply gluts in recent years have caused retailers to increase their focus on inventory and supply chain technology to avoid both bare store shelves and inventory gluts.

While consumer spending has remained surprisingly strong, a slowing economy and the challenges of supply gluts in recent years have caused retailers to increase their focus on inventory and supply chain technology to avoid both bare store shelves and inventory gluts. As the Federal Reserve maintains its hawkish monetary policy stance, it will be interesting to see how nimble retailers have become with managing inventory to avoid deeply discounting prices and laying off workers. If successful, companies may maintain profit margins and reduce layoffs as the economy slows in the fourth quarter of this year. Perhaps more significantly, by preserving their earnings and refraining from trimming headcounts, retailers may play an important role in reducing the length and depth of the next economic slowdown.

Visit Traders’ Academy to Learn More About Economic Indicators.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!