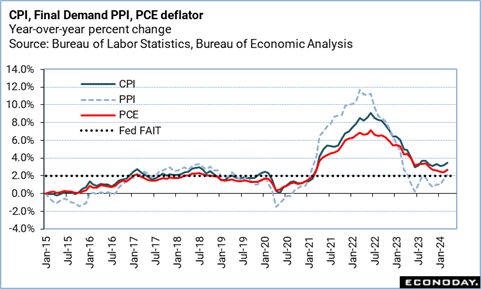

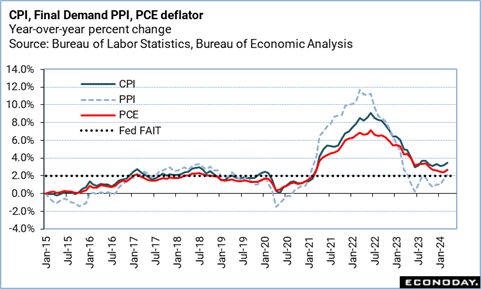

In the wake of the softer-than-expected payroll gains for April in the monthly employment report, the inflation data for April in the May 13 week become the next signpost for the outlook for Fed monetary policy. Markets reacted to the hint of softening in the labor market by anticipating easier financial conditions. However, it is only one month’s data and only half of the Fed’s dual mandate for maximum employment and price stability. The FOMC’s vigilance on the inflation front means that its attention may shift back more to the latter even if the FOMC statement from May 1 said that risks at that time were more balanced.

The CPI report is scheduled for 8:30 ET on Wednesday. It is preceded by the PPI report at 8:30 ET on Tuesday and followed by the import and export price indexes at 8:30 ET on Thursday. The April readings for all-items and the core measures will get the first consideration as to whether the disinflation begun in 2022 is running out of steam. The second is services inflation and how slow it has been easing off. As for goods, now that supply-chain issues have stabilized, further improvements are likely to be more limited.

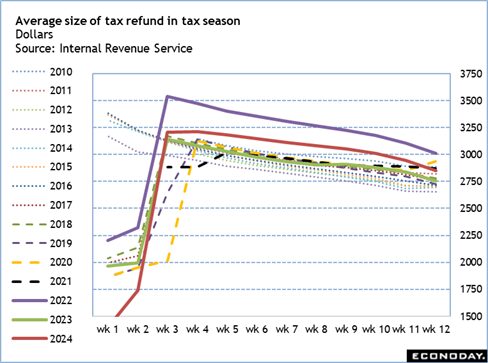

Economic growth should still look supported by consumer spending in the first month of the second quarter 2024. The April numbers on retail and food services sales at 8:30 ET on Wednesday should reflect the uptick in the pace of sales of motor vehicles. Gasoline prices were on the rise in April, but that is a normal pattern as refineries change over to summer fuel formulations and should be accounted for in seasonal adjustment factors. However, travel around the holidays and spring break may have increased the volume of sales, so it could be a positive for retail as well. Spending in April may get a boost from tax refunds in 2024 which are larger than those sent out in 2023. Tax refunds go to buying big ticket items such as cars and appliances, but could also be directed to savings or paying down debt.

—

Originally Posted May 10, 2024 – High points for US economic data scheduled for May 13 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!