Economic data with market-moving potential is hard to find for the June 24 week. The calendar is not lacking in reports as the second quarter comes to a close. It is simply that most of the pivotal reports from May are already published and the next wave of data on the labor market and inflation in June are a week or two away.

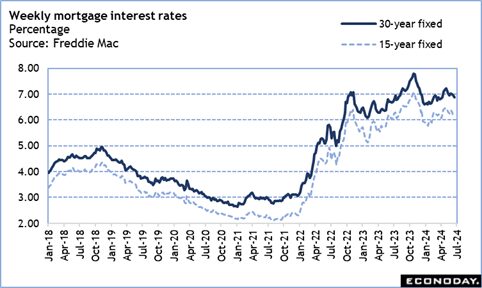

There’s already a good sense that the housing market continues to feel the pinch of mortgage rates hovering near the 7 percent mark back in May. The dip in the rate for a 30-year fixed rate mortgage in the last two weeks won’t be visible in most of the housing numbers for another month. Only the NAR pending home sales index for May on Thursday at 10:00 ET will offer much indication of movement in existing home sales. Contracts taken out in May will reflect rates mostly for April and early May when at least some homebuyers were acting while they had a lock on rates around 6.8 percent and at a time when rates were trending higher.

There isn’t much in the way of labor market data during the week, but there is a major inflation report. The PCE deflator for May – part of the report on personal income and spending on Friday at 8:30 ET – could shape market expectations for the timing of a rate cut. Financial markets have not exactly ignored the hawkish tone of comments from Fed policymakers, but do seem to be convinced that the resumption of a mild disinflationary trend will mean that the FOMC will change its tune and cut rates a bit sooner than the current rhetoric would suggest. Policymakers are data-dependent and looking for more than one or two months of minor dips in the inflation measures before shifting the stance of monetary policy.

Perhaps markets will listen when Fed Chair Jerome Powell delivers his semiannual monetary policy testimony before Congress. At this writing, the date of the testimony hasn’t been announced yet. With the Independence Day holiday in the July 1 week and Congressional recession the following week, it isn’t likely to take place before mid-July. If so, it will only precede the July 30-31 FOMC meeting by a short period. It would be highly unusual for the testimony to take place within the communications blackout period (midnight Saturday, July 20 through midnight Thursday, August 1) around the meeting. That leaves a narrow window in the July 15 week.

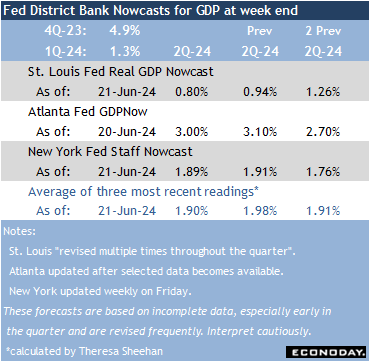

The third and final estimate of first quarter GDP is set for release at 8:30 ET on Thursday. It will put the seal on expansion for the January-March period. However, it is the advance report for second quarter GDP at 8:30 ET on Thursday, July 25 that is now in the sights of Fed watchers. The three Fed district bank GDP Nowcasts are telling somewhat different stories about growth in the second quarter ranging from about up 1 percent to up 3 percent. The midpoint of slightly under 2 percent suggests that growth strengthened somewhat from 1.3 percent reported in the second estimate of the first quarter. Ongoing modest expansion is the sort of scenario that will keep monetary policy on hold.

—

Originally Posted June 24, 2024 – High points for US economic data scheduled for June 24 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!