The November 11 week is shortened by the federal holiday on Monday to observe Veterans Day. It is a full market close in the US for stock and bond markets. Not all businesses are closed; some will save the holiday time for November 29 to create a four-day weekend. The three-day weekend will be another mile marker on the road in the winter holiday shopping season. Retailers will be offering discounts and incentives to get consumers into stores.

The two reports likely to stand out in the week are the October numbers on retail sales at 8:30 ET on Friday and the consumer price index (CPI) at 8:30 ET on Wednesday.

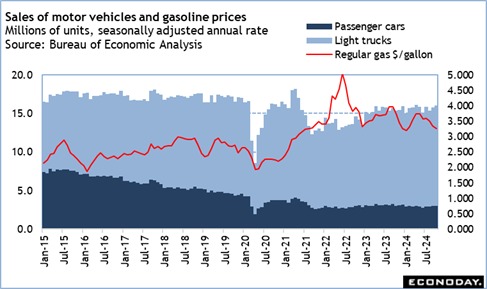

In retail, ongoing recovery efforts after Hurricanes Helene and Milton are likely to give some boost to overall spending at the start of the third quarter. Consumers will need to replace household goods of all types destroyed in the winds and water dumped by the storms. The first solid hint of this is sales of motor vehicles which rose to 16.0 million units at a seasonally adjusted annual rate for October after a gain to 15.8 million units in September which in turn was above 15.328 million in August. Gasoline prices have been on the decline in October, so that probably won’t make much of a contribution to sales. However, consumers will be buying building materials for repairs and replacing appliances and electronics. Closets and pantries will need to be replenished. Also in October, Amazon held a Prime Day sales event on October 8-9 which could add to sales at nonstore retailers which includes online shopping.

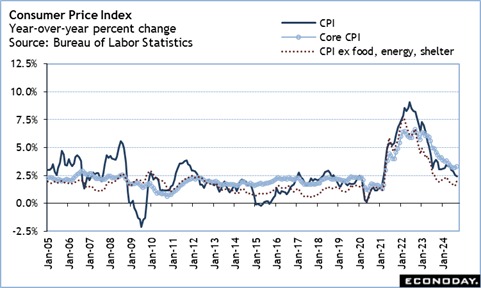

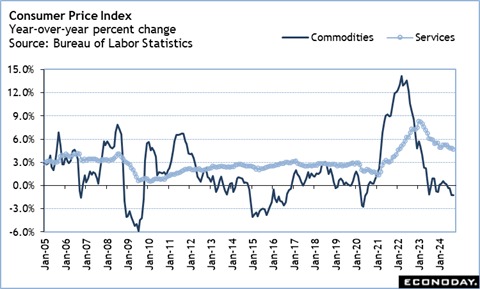

The consumer price index report may not feel quite as compelling as it has in recent months. The October index will probably reflect the year-over-year change in the all-items CPI as continuing to trend lower and move within reach of the Fed’s 2 percent inflation target. However, the core CPI will probably be closer to 3 percent from a year ago. The problem for Fed policymakers is that while commodities prices have moderated, and in some cases fallen, services costs remain stubbornly elevated, especially for shelter. The FOMC may be ready to remove some restriction of monetary policy in order to stay ahead of the “long and variable lag” to drive inflation, but it will proceed cautiously after the cumulative 75 basis points in rate cuts since September.

—

Originally Posted November 8, 2024 – High points for economic data scheduled for November 11 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!