The December 9 week does not have a busy data schedule, but it does include the November CPI report at 8:30 ET on Wednesday. This is one of the last reports that could mean an adjustment to the outlook for the outcome of the FOMC meeting on December 17-18 and the content of the quarterly summary of economic projections (SEP). The last significant one will be the retail sales numbers for November at 8:30 ET on Tuesday, December 17.

In any case, the coming week is firmly within the communications blackout period around the FOMC meeting (midnight, December 7 through midnight, December 19). There will be no public comments from Fed officials that could influence market expectations for the FOMC meeting. The numbers will have to do the talking in the context of prior public remarks.

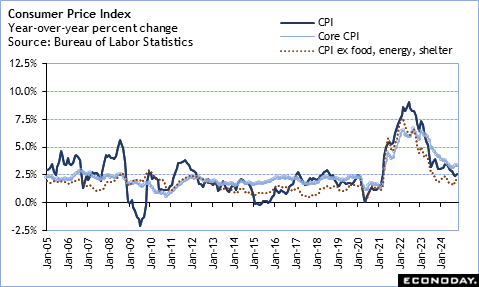

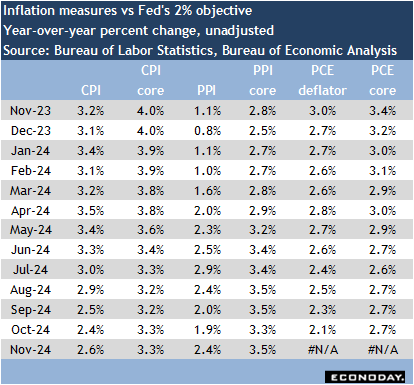

The October CPI data pointed to a stall in the pace of disinflation at both the all-items and core levels. In October, the CPI was up 2.6 percent year-over-year compared to up 2.4 percent in September. The core CPI was up 3.3 percent, the same as the prior month’s annual pace. Food prices were up 2.1 percent compared to October 2023 while energy costs were down 4.9 percent. Underlying inflation continued to run above the Fed’s 2 percent objective for several important categories. Most notably it was to be seen in shelter costs which are up 4.9 percent year-over-year in October, the same as in September. But inflation was also sharp for things like insurance, medical care, and tuition which add up in household budgets. Non-housing services inflation remains a problem in getting inflation sustainably under control.

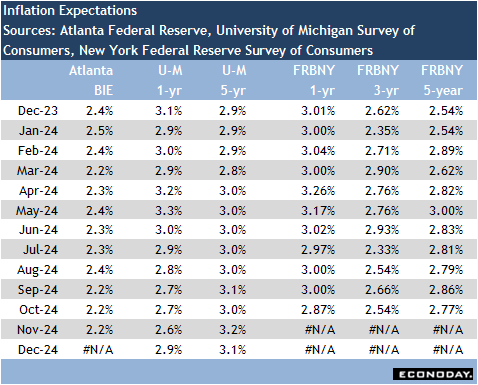

If the November CPI reveals a plateau in disinflation for consumers, it raises the possibility that the expected 25 basis point rate cut on December 18 at 14:00 ET might not materialize. Even if the FOMC does cut the fed funds target rate range, it would likely mean that the speed of future rate cuts would slow with fewer forecast for 2025 and into 2026. The most recent data on inflation expectations suggests that consumers are not expecting much more improvement in inflation in the near-to-medium terms, although expectations remain anchored.

The FOMC will have reassurance that the maximum employment side of the dual mandate is not suffering under restrictive monetary policy while it continues to address price stability.

—

Originally Posted December 6, 2024 – High points for economic data scheduled for December 9 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!