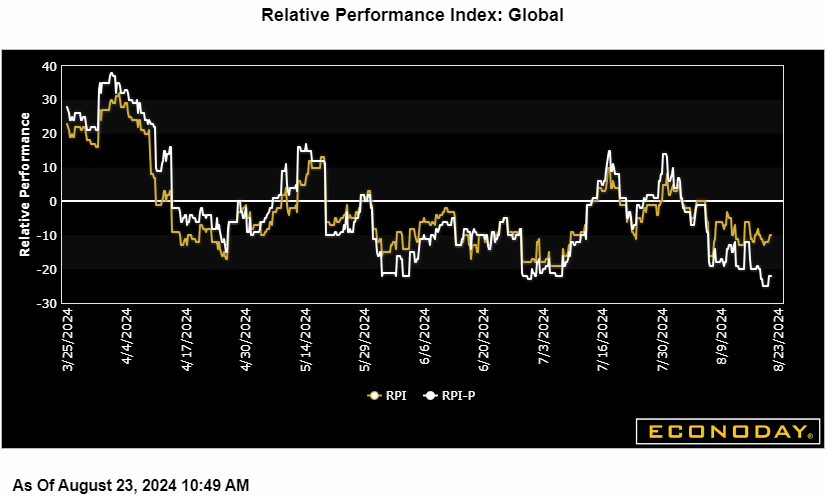

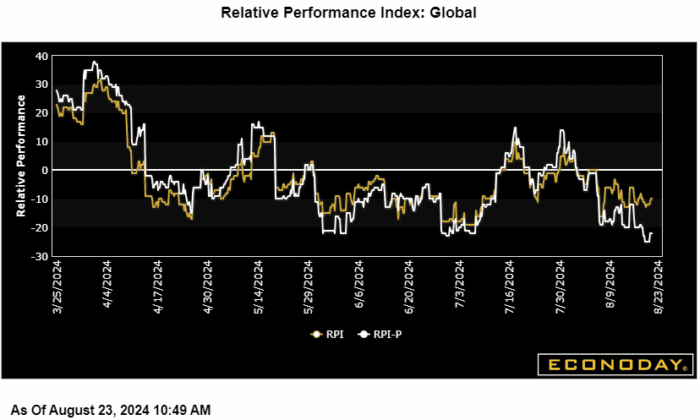

Global data held steady in the underperformance column, ending the week at minus 8 on Econoday’s Relative Performance Index (RPI) and at minus 21 when excluding price data (RPI-P), the latter indicating greater underperformance in real economic activity.

In the Eurozone, economic activity continued to undershoot market forecasts and put the RPI at minus 18 and the RPI-P at minus 32, the latter matching its weakest mark since the start of July. The economy would welcome another ECB ease in September but that would need further proof that inflation is behaving itself.

In the UK, upside and downside surprises effectively cancelled each other out. This left both the RPI and RPI-P at minus 5 and so close enough to zero to indicate overall economic activity performing much as expected. Another cut at the BoE MPC’s September meeting hangs in the balance.

In Japan, the RPI (6) and the RPI-P (4) remained in positive surprise territory, but only just. The BoJ still intends to tighten but the broader economic picture continues to argue against any aggressive moves.

There were no significant data releases in China leaving the RPI at minus 29 and the RPI-P at a lowly minus 60. Such levels were not weak enough to prompt another cut in loan prime rates but must at least keep the door open to further monetary easing down the road.

Lifted at week’s end by new home sales, both the RPI and RPI-P for the US ended at plus 13 to now indicate that recent US data, which had been flat to underperforming, are now coming in just ahead of Econoday’s consensus estimates.

At the top is Canada which is increasingly outperforming, at 37 on the RPI and 42 on the RPI-P in strength that would seem to make a third straight rate cut at the Bank of Canada’s September 4 meeting unnecessary, especially given cooling in consumer prices to 2.5 percent in July.

—

Originally Posted August 23, 2024 – Global data continues to underperform; China, Eurozone weak

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!