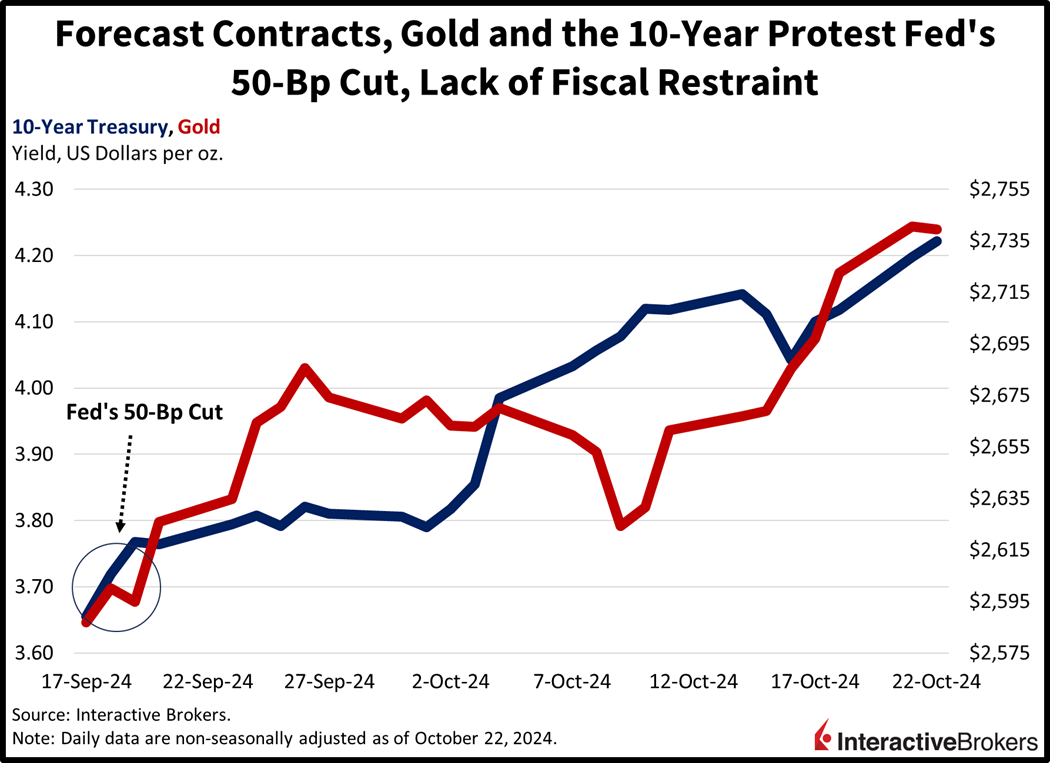

Market participants are coming to the realization that the US’s fiscal situation won’t be solved by the next administration, whether it’s Trump or Harris. Furthermore, proposals on both sides of the aisle have been labeled as inflationary, at times because they’re too expensive from a budgetary standpoint or highly restrictive of global trade. Investors have responded by purchasing Yes Forecast Contracts regarding the growing national debt as well as scooping up gold bars while they unload duration from their portfolios. Indeed, the Fed’s 50-basis point jumbo rate reduction on September 18 served to send yields north, and not south, which was largely expected. Folks are worried about price pressures down the road, as well as unsustainable revenue and spending dynamics in Washington. Stocks, meanwhile, are beginning to pay attention to these risks, as traders scoop up volatility protection across the curve while they modestly unload shares. On the one hand, equities are priced nominally and serve as a hedge to loftier inflation, but taller long-term yields complicate the valuation conversation.

Forecast Traders Project Fiscal Mismanagement

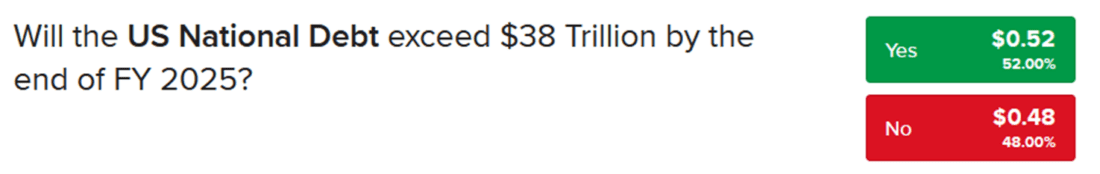

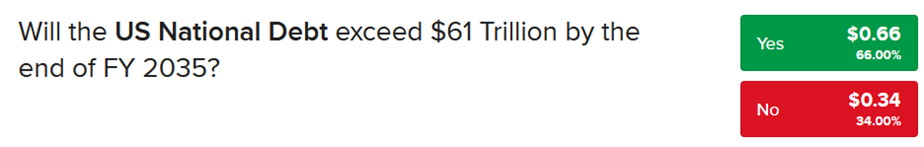

IBKR Forecast Traders believe there’s no end in sight to fiscal mismanagement, with players anticipating debt loads in excess of $38 trillion and $61 trillion by the end of fiscal years 2025 and 2035. The Yes choices, which closely reflect implied probabilities, are priced at $0.52 and $0.66. And while Democrats generally think that the answer is higher tax burdens, Republicans prefer to grow out of these debt problems via pro-growth policies. But ladies and gentlemen, the longer we continue on this road, the narrower and narrower the path becomes for solutions across party lines.

Source: ForecastEx

Traders Increasingly Point to a Trump Win

Meanwhile, IBKR Forecast Trader contracts are increasingly pointing to Donald Trump securing the Oval Office, while polling results continue to underscore the importance of swing state votes, including the need for his competitor, Kamala Harris, to win Pennsylvania. The Forecast Trader contract with the Yes answer to the question, “Will Donald Trump win the US Presidential Election in 2024?” now shows a 62% likelihood of the Republican defeating Harris, up significantly from 48% on October 9.

Source: ForecastEx

PA, NC and GA are Pivotal

The two candidates are focusing on swing state votes, which will be the deciding factor in the race to secure the 270. According to Real Clear Politics, among non-toss-up states, Harris is likely to win 215 electoral points so she needs to capture 55 among swing states, slightly more than half of the 104 votes up for grabs. Trump has 219 likely secured, requiring him to win only 51 more. The toss-up states and congressional district along with each battleground’s electoral total as identified by Real Clear Politics are as follows:

- Pennsylvania (19)

- North Carolina (16)

- Georgia (16)

- Michigan (15)

- Arizona (11)

- Minnesota (10)

- Wisconsin (10)

- Nevada (6)

- Nebraska CD2 (1)

One likely path to success for Trump would be to sweep Pennsylvania, Georgia and North Carolina, with the three states having a total of the 51 electoral points he needs, allowing Harris to capture only 53. If she wins Pennsylvania and loses both Georgia and North Carolina, then she would need to capture an additional 36 votes of the remaining 51 up for grabs. By sweeping three of the four remaining states with the largest electoral votes, Michigan, Arizona and either Minnesota or Wisconsin, her swing state tally, when including the Keystone state, would then climb to 55. However, if Trump beats her in Georgia, North Carolina and Michigan, she would have to secure Pennsylvania, Arizona, Minnesota, Wisconsin and Nevada to get past 55.

A 23-Year Tradition of Deficit Spending Continues

In conclusion, after 23 years of deficit spending, a continued failure to implement fiscal restraint will persistently weaken the nation’s economic prospects over time. Interest rates, gold, forecast contracts and society are all listening and punishing government officials that have excessively relied on debt and the printing press as their path of least resistance to solving significant problems. The next tempting option would be to further balloon the central bank’s balance sheet in sight of economic volatility to the point that it’s the Treasury’s majority lender, like in Japan. To be fair though, debt issues are not isolated to the US: they’re a consequence of complacent public servants worldwide. America should lead the globe here, folks, and start solving these challenging troubles by making the tough adjustments sooner rather than later. A failure to implement these difficult choices today will lead to inferior options tomorrow.

To learn more about ForecastEx, view our Traders’ Academy video here

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

Really? Trumps economic history for his first term numbers were all positive until the China virus hit. For the most part, the whole world suffered, as could be expected and any inclusion of statistics during that time is totally illogical and unrealistic. You have to show me exactly how his policies will be worse than Harris’s crazy spending plan, that’s why inflation is not gonna reverse if she gets in office. Oh yeah, don’t forget energy policy!

Talk about forgetting. Do you remember President Trump’s calamitous leadership during the pivotal first wave of the COVID-19 pandemic — when a science-based response would have saved hundreds of thousands of American lives?? I will remind you. First and foremost, Donald Trump politicized the pandemic and ignored the 70-page Federal Pandemic Response Plan. Why? Because it was developed by the preceding Democratic-led administration. He then proceeded to: 1) enact no strategic response to the earliest reports of an impending pandemic, 2) suggest we hit our bodies with “a powerful light”, or “inject ourselves with disinfectant”, 3) continually and ruthlessly discredit our nation’s leading scientists at the NIH, and 4) fail to support international collaboration between researchers to accelerate development of a vaccine. The result? The US suffered the highest number of COVID-19 deaths by far (more than 1.1 million) of any nation in the world! Think about it. You and I will make money under any president that gets elected. What matters most in selecting a new president is: a) character & integrity, b) mental fitness & rational thought processing, c) respect and support for science & technology d) best role model for all of our children and grandchildren. Do the right thing when you vote.