This morning’s economic releases are stronger than expected on several fronts, which is generating confusion among market participants ahead of pivotal monetary policy announcements out of Tokyo and Washington. In the US, job openings and consumer confidence beat projections, developments that coincide with a firmer-than-anticipated economic recovery in Europe. Rate watchers are responding by carefully scaling back the probabilities of imminent US and EU cuts amidst the troublesome reality that price pressures could once again accelerate. This risk is especially pronounced against the backdrop of what’s been a bumpy ride for disinflation. Emblematic of this fact are reports this morning pointing to inflation picking up steam in Berlin but decelerating in Madrid.

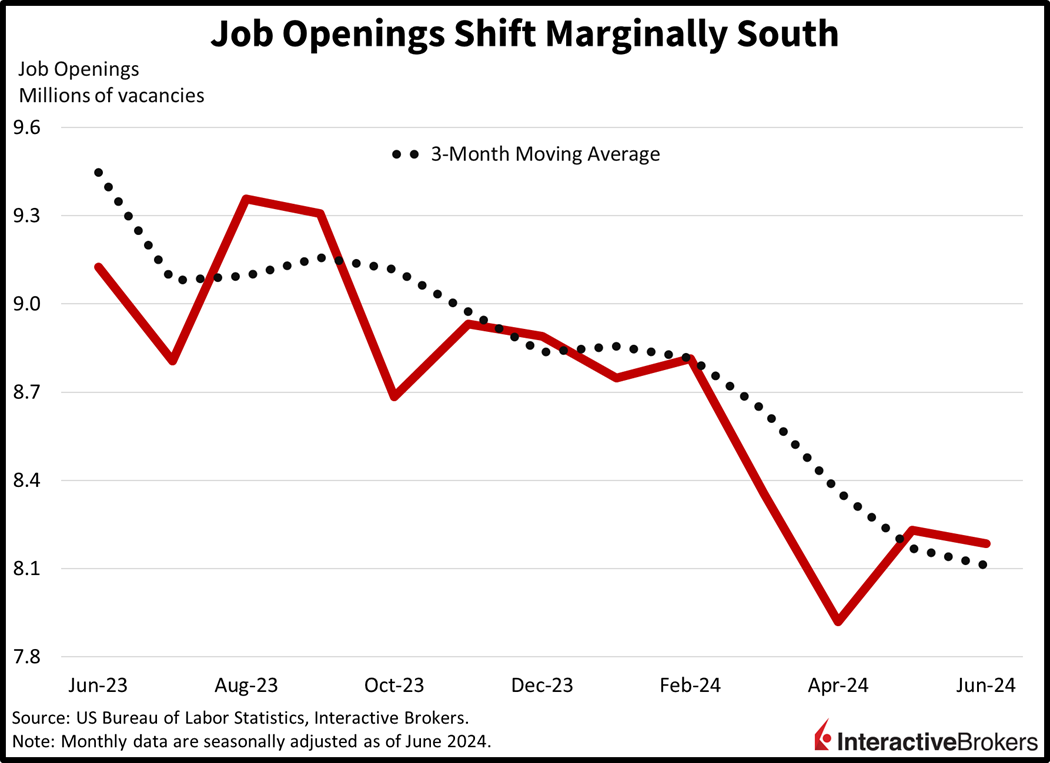

Bond Bulls Swallow Bitter JOLTS Pill

The number of businesses posting help wanted signs declined just marginally last month, issuing a blow to bond bulls who are looking for supporting evidence of a September reduction from the Fed. Job openings declined to 8.18 million, beneath an upwardly revised 8.23 million in the previous period but above the median estimate of 8 million. Quits declined, however, pointing to existing workers feeling increasingly pessimistic about replacing their current paychecks elsewhere. Continuing unemployment claims are reflecting the same dynamic, as jobless folks are taking longer to secure labor opportunities.

Jobs Weigh Upon Consumer Sentiment

Softer employment conditions were also a dominant theme in this morning’s consumer confidence print, with folks feeling the worst about current labor opportunities since March 2021. Still, people are feeling slightly better than they did last month on the back of improved expectations for the future. The Conference Board’s headline figure rose to 100.3, better than the awaited 99.7 and June’s downwardly adjusted 97.8. Sentiments shifted in a bifurcated way, however, with the Present Situation Index slipping from 135.3 to 133.6 while the Expectations Index climbed from 72.8 to 78.2 during the period. Overall, households are still suffering from the familiar headwinds of elevated prices and tall interest rates, but worsening job security is the newest development weighing on families. Also hurting consumer psyche are uncertainty about November’s presidential election, a fresh 12-year low in home purchasing plans and deteriorating discretionary budgets.

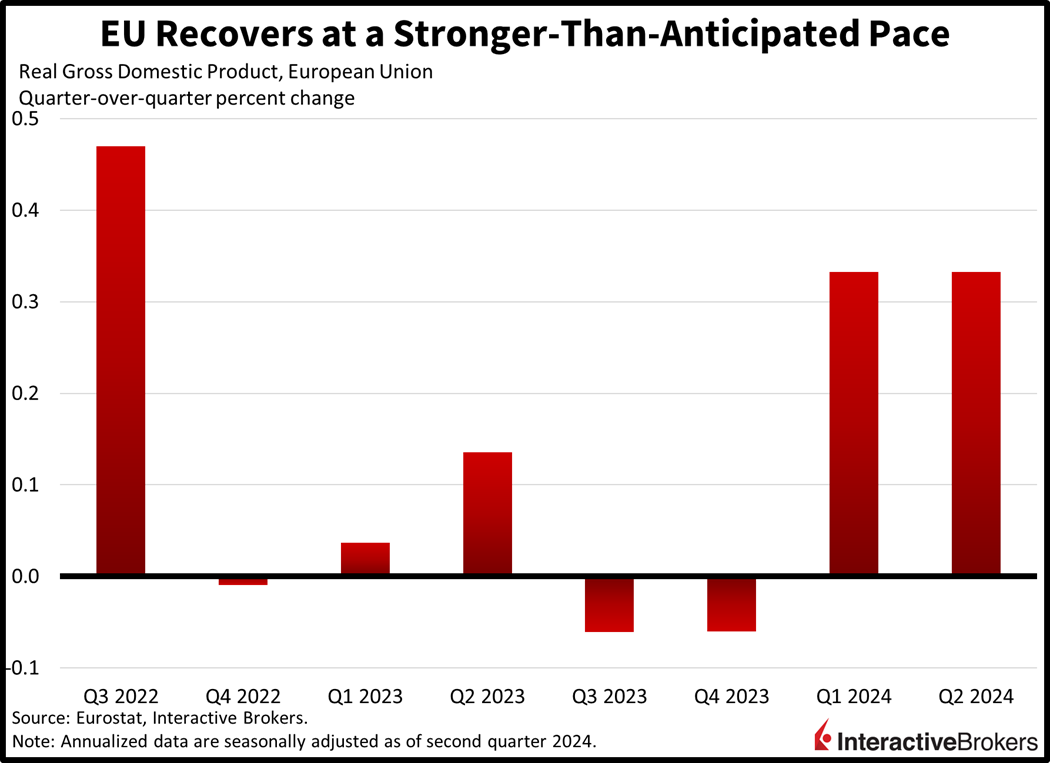

Europe GDP Beats Expectations

Across the Atlantic in Europe, second quarter economic growth expanded at the same pace as the previous period. The European Union’s Gross Domestic Product (GDP) release pointed to a 0.3% gain in activity, which was better than the 0.2% projection. Strong momentum in Paris and Madrid neutralized an unexpected 0.1% contraction in Berlin, the region’s largest economy.

Digital Transactions and Home Product Sales Point to Healthy Consumers

Digital payment volumes and sales of home products imply that consumers are resilient, although at least one airline has experienced a revenue decline. These are a few observations from the following earnings highlights:

- PayPal (PYPL) posted revenue and earnings that climbed 8% and 36% year over year (y/y) and exceeded analyst consensus expectations. However, the total payment volume of transactions fell short of estimates despite jumping 11%. In a positive development, transaction margin, which measures the profitability of the company’s services, exceeded expectations. The company’s branded checkout service, Braintree, and payment service Venmo were the primary contributors to the margin uptick. PayPal’s previous earnings per share (EPS) guidance for the current quarter called for growth in the mid-to-high single-digit range, but the company now estimates an increase in the low-to-mid teens with expectations of strong shopping during the back-to-school season and December holidays. Analysts expected guidance calling for a drop in EPS. PYPL climbed more than 9% in early trading, reversing a decline that occurred just prior to the earnings release as investors feared the company’s results would be hurt by competition from Apple Pay and Google.

- Procter & Gamble (PG) reversed a trend of declining sales volume, a metric that excludes pricing, during the second quarter while producing an EPS adjusted for one-time events that advanced 2% y/y and exceeded the analyst consensus expectation. The results come after the company raised prices across the board during the past two years. Procter & Gamble’s second-quarter revenue, however, was flat and missed the analyst consensus expectation, but after excluding the impact of currency exchange rates, acquisitions and divestitures, it climbed 2%. The volume increase was driven by gains within grooming, health, home-maintenance and fabric-care segments. Growth in fabric care products, which include Tide laundry detergent, was led by North America and Europe, but revenue gains were offset by increased promotional spending. Procter & Gamble, in issuing guidance for the current fiscal year that started July 1, said increased commodity costs and foreign exchange rates will create a $500 million drag on results, which is comparable to $0.20 per share. It expects total revenue to expand 2% to 4% y/y. PG declined more than 6% in reaction to revenue missing expectations.

- JetBlue Airways (JBLU) posted a surprisingly strong earnings beat, sending its share price up more than 20% in early trading. While revenue dropped 6.9% y/y, aggressive cost cutting, including dropping unprofitable routes and delaying a $3 billion purchase of new aircraft, boosted profits at a time when analysts were expecting the company to lose money. The reduced expenses helped to offset the impact of higher costs associated with inspections of Pratt & Whitney engines that have grounded some of the airline’s aircraft. Even with the decline in revenue, the metric exceeded expectations. The airlines’ current-quarter guidance calls for sales to fall as much as 5.5%, contrary to analysts’ expectations for growth of 1%.

Stocks Reverse on Profit Taking

Market participants used this morning’s equity gains as an opportunity to unload stocks in the afternoon ahead of pivotal announcements from the Fed and Bank of Japan (BoJ) tomorrow as well as four of the Mag7 reporting this week. Stocks have plunged into the red with the Nasdaq Composite and S&P 500 benchmarks down 1.4% and 0.7%. The Dow Jones Industrial and Russell 2000 baskets are struggling to hold on, but are bucking the trend for now; they’re both up 0.1%. Sectoral split is negative with six out of eleven segments south on the session. Technology, consumer staples and consumer discretionary are taking the most pain, with the categories lower by 2.4%, 0.9% and 0.8%. Financials, energy and real estate are piloting the bulls, sporting gains of 1%, 0.7% and 0.3%. Treasurys and the dollar are relatively steady, however, as they await clues and commentaries from central bankers. The 2- and 10-year maturities are changing hands at 4.38% and 4.17% while the dollar appreciates relative to the euro, pound sterling and Aussie and Canadian dollars but depreciates versus the franc, yuan and yen. Commodities are taking a beating, with crude oil, copper and lumber down 1.7%, 0.8% and 0.6%. Silver and gold are trying to offset some of the bearishness with little success; they’re up by 0.3% and 0.1%. WTI crude is trading at $74.61 on worries that Beijing, the world’s largest energy importer, may fall into a recession this year. This Chinese headwind is countering supply concerns stemming from escalating geopolitical tensions between Israel and the Tehran-backed Hezbollah militia.

Investors Shift Focus to Central Banks and AI

This week’s events are critical as we approach the weakest seasonal period for equity investors. A stacked economic calendar is lined up with big-tech earnings and central bank decisions. In Tokyo, traders will look for the BoJ to likely continue tightening policy, increasing the potential for a stronger yen and an unwinding of stock holdings. In Washington, market participants are hoping the Fed is sensitive to the risk in today’s erratic consumer behavior amidst a turn in labor market conditions. Big-tech earnings are also significant, with artificial intelligence (AI) optimism serving as the number one catalyst to this year’s stock market rally. Bullish players will be aiming for a bright picture on the future of AI in Mag7 earnings calls while bears wish that firms allude to AI delivering to the bottom line years from now, rather than right now.

Visit Traders’ Academy to Learn More About Consumer Confidence and Other Economic Indicators

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!