Tumbling interest rates haven’t halted the sharp bearish reversal that occurred shortly after the 9:30 am bell. Costs of capital are dwindling following this morning’s PCE report, which also featured softer-than-expected consumer spending. Contracting consumption volumes were indeed reported just as worries of corporate earnings mount, which are leading to investors scooping up Treasuries while dumping stocks. US inflation data, released in the same report, arrived largely as expected, but well above the Fed’s 2% target, meanwhile. Across the Atlantic in the eurozone, however, price pressures arrived fiercer than anticipated, just as the ECB is gearing up for rate reductions.

Consumer Spending Slows

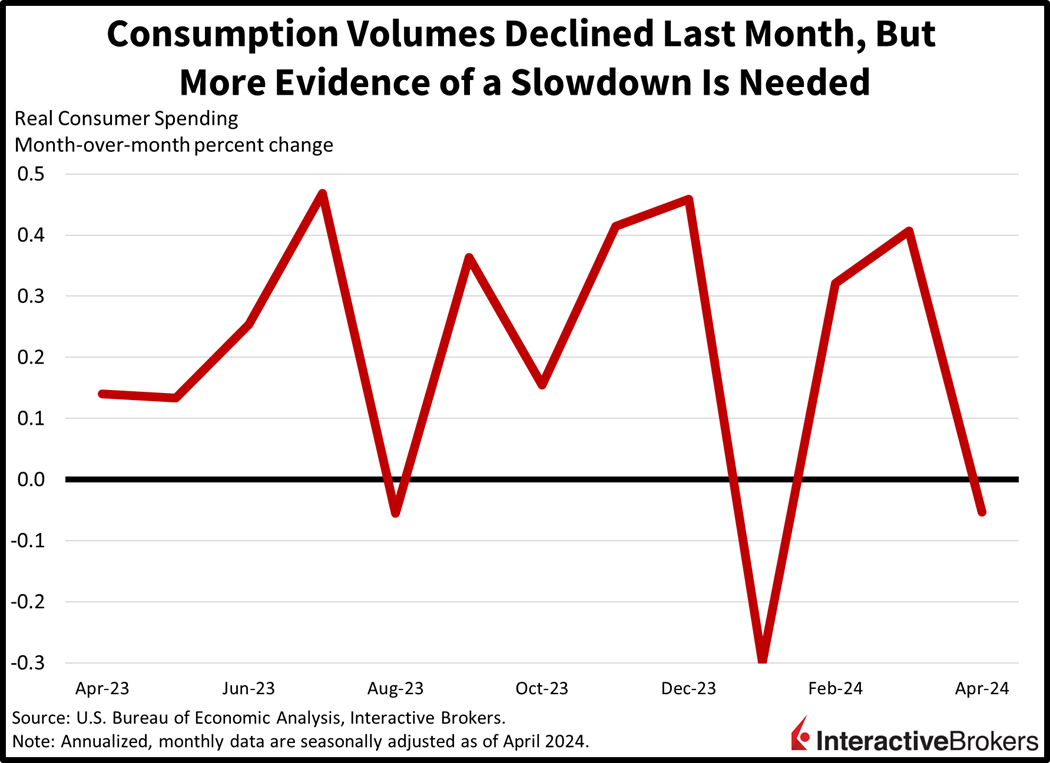

This morning’s Personal Consumption Expenditures (PCE) data depicted slowing consumer spending amidst persistent price pressures. The rate of personal outlays rose just 0.2% month over month (m/m) in April, down from 0.7% in March while missing the median estimate of 0.3%. Real spending, which is adjusted for inflation, declined, however, and was pressured by a 0.4% m/m drop in goods volumes. Services volumes offset some of the weakness though, rising 0.1% during the period. Incomes rose 0.3%, in-line with the Street, and they supported the personal savings rate, but they moderated from a 0.5% increase during the prior month.

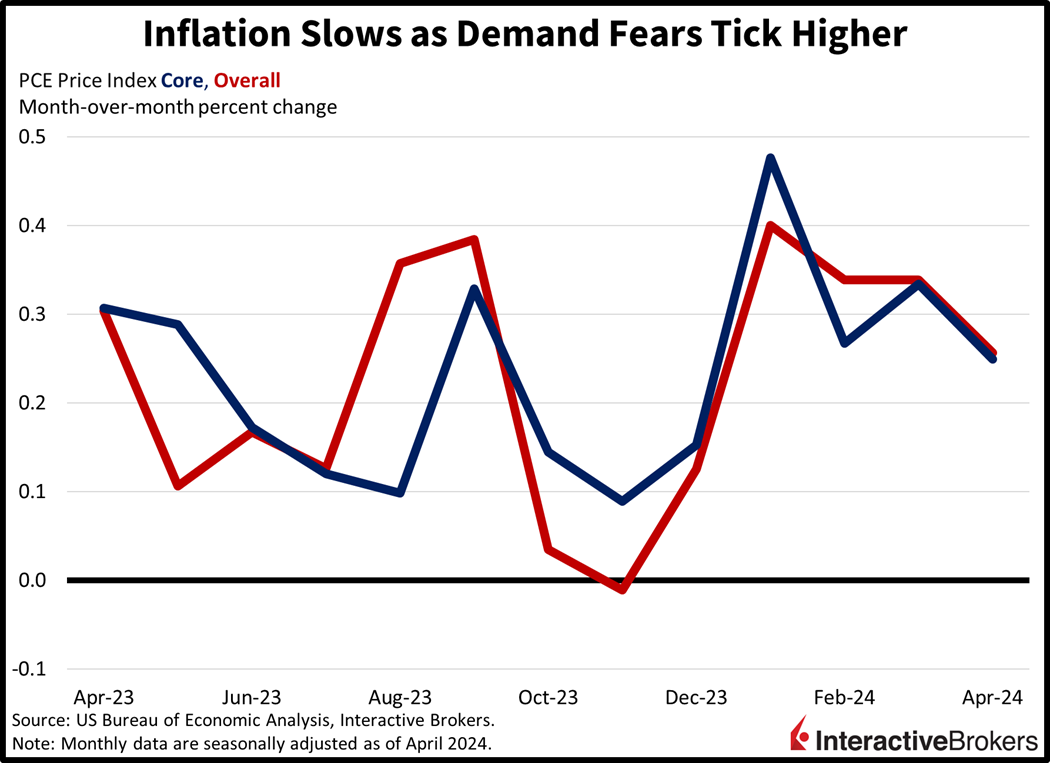

Inflation Data Matches Expectations

Headline and core PCE price indices increased 0.3% and 0.2%, in-line with expectations and near the previous month’s 0.3% on both fronts. On an annualized basis, headline and core figures arrived exactly as projected while remaining unchanged at 2.7% and 2.8% year over year (y/y). Driving prices higher were non-durable goods and services, which saw stickers rise 0.5% and 0.3% m/m. Offsetting some of the pressures were durable goods, which saw m/m deflation of 0.3%.

Inflation and Labor Data Cast Clouds Over ECB Policy

Investors are assessing if the European Central Bank (ECB) may cut its three key rates at a slower pace than previously anticipated following hotter-than-expected inflation data released this morning and yesterday’s unemployment report pointing to a tight labor market. Consumer prices in the eurozone, which consists of 20 countries that use the euro, rose 2.6% in the twelve months through May, up from the 2.4% rise as of April, according to the European Union’s statistics agency. Analysts anticipated a May rate of 2.5%. The ECB’s headline inflation goal is 2%. Core inflation, which lacks volatile food and energy prices, increased 2.9%, 20 basis points (bps) higher than in April, while services price climbed 4.1% from 3.7% in the preceding month. On a month-over-month basis, headline inflation increased 0.2% and core climbed 0.4%. Inflation during the past 12 months was led by services, up 0.6%; food/alcohol/tobacco, up 0.2%; and goods, up 0.1%. Energy provided some relief, however, with prices falling 1.2% m/m.

This morning’s stronger-than-expected inflation report comes just one day after data showed that the eurozone unemployment rate fell to 6.4% in April, an all-time low for the area. Investors still expect the ECB to cut rates next week from the current record high levels that range from 4% to 4.75%, but the strong inflation and labor data are clouding the outlook for a potential subsequent rate cut in July.

Shoppers Seek Bargains While Companies Crimp on IT

Recent earnings releases confirm a trend of consumers seeking out bargains, but in at least one example, shoppers are increasing discretionary spending. Also among consumers, the power of celebrity promotions and branding helped Gap Inc. produce strong quarterly results. In the tech industry, companies are continuing to splurge on artificial intelligence, but they are slowing the pace of buying other types of technology. Those are a few highlights from the following earnings summaries:

- Costco CFO Gary Millerchip said consumers are increasing spending on discretionary items, a result of inflation moderating. For the recent quarter, the company beat analyst consensus expectations for both earnings and revenue, with same-store sales in the US climbing 6% y/y and even faster internationally. The company experienced growth in its membership, foot traffic, ecommerce and delivery service. Millerchip said toys, tires, lawn and garden, and health and beauty aids led the increase in discretionary item sales. The company has reduced prices for certain Costco Kirkland-branded items but doesn’t see a need to do so with other products.

- Gap posted a strong earnings and revenue beat and upgraded its full-year guidance. Impressively, all four of the company’s brands—Gap, Banana Republic, Athleta and Old Navy—beat earnings and revenue expectations and overall sales climbed 3% y/y. The company previously said it expects sales this year to be flat but now anticipates a slight increase. In a CNBC interview, CEO Richard Dickson said he attributes the strong results, in part, to reinvigorating the company’s brands and to actresses Da’Vine Joy Randolph and Ann Hathaway appearing at public functions in attire by Gap designer Zac Posen. Additionally, the company has improved its marketing and reduced its inventory, resulting in a decrease in price discounting. Shares of Gap jumped 20% following the earnings release.

- MongoDB, which provides cloud-based database services, echoed comments from yesterday’s Salesforce earnings release, explaining that businesses are slowing their purchases of technology. In the recent quarter, MongoDB grew revenue 22% y/y, marking the third-consecutive quarter of growth deceleration from a rate of 57% in 2022. Despite the slowing growth, earnings and revenue surpassed analyst consensus expectations. The company’s fiscal second quarter and fiscal year 2025 guidance for both earnings and revenue fell short of analyst expectations and MongoDB shares declined 23%.

- Dell Technologies also provided disappointing guidance, causing its stock price to decline approximately 17% in after-hours trading despite the company posting strong first-quarter results. In the most recent quarter, Dell’s earnings per share (EPS) met the analyst consensus expectation but revenue fell short of estimates despite increasing 6% y/y. It was the first time in six quarters that revenue increased. Sales of personal computers were flat y/y but enterprise products such as storage, servers, and networking items climbed 22%. Enterprise sales benefited from customers implementing artificial intelligence.

Bears Spark Broad Equity Selloff

Risk-off trading is dominating today as equity bears appear to have awakened from a long hibernation. Not one major US equity index is in the green as investors worry about profit sustainability. Steering the vessels south are the Nasdaq Composite and S&P 500 benchmarks, which are losing by 1.4% and 0.5%. Small-caps and cyclicals are trying to hang in there, with dip buyers lured in by lower rates and cheaper valuations, but the Russell 2000 is down 0.1% while the Dow Jones Industrial is near the flatline. Sectoral breadth is mixed, with technology, consumer discretionary, and industrials leading the way lower; they’re down 1.7%, 0.8% and 0.5%. Leadership is comprised of real estate, healthcare and energy with the segments higher by 1.2%, 0.8% and 0.7% so far. Treasurys are catching a bid on the back of heightened fears of an economic slowdown, with the 2- and 10-year maturities changing hands at 4.89% and 4.5%, 5 basis points lower on the session. The dollar is near the flatline, though, as the greenback gains versus the pound sterling, franc, yuan and yen but loses relative to the euro and Aussie and Canadian dollars. Commodities are getting battered on the back of demand fears and a lack of safe-haven demand. WTI crude oil, copper, gold and silver are lower by 1%, 1.6%, 0.6% and 2.7%.

Worries About Corporate Profit Increase

At this point in the cycle, incoming economic data are starting to increasingly align with corporate earnings calls. Investors are growing worried that the consumer may be close to tapping out, while the profitability prospects of AI may fail to offer broad benefits to many segments of the market. Yesterday’s figures on corporate profits were emblematic of this development, which is characterized by the early innings of artificial intelligence being unable to lift the revenue proposition of businesses at a time of constrained spending. As for consumer outlays, however, many months of weakness are required before an established trend is made. In many of the post-pandemic months, we’ve seen consumption stall to a halt or contract, only to recover strongly in the following reports.

Visit Traders’ Academy to Learn More About Personal Income and Outlays and Other Economic Indicators

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!