TLDR:

The United States of America is known as the Land of the Free, Home of the Brave and Owner of an Insurmountable Amount of Debt. According to the US Treasury Department, the Federal Government has accumulated $33.70 trillion in debt. Is it time to sound the alarm?

Of course not. This is America baby!

Jokes aside, government spending has skyrocketed. From FY 2019 to FY 2021, the government’s attempt to soften the blow from the pandemic through tax cuts and its stimulus program led to a 50% increase in spending.

Simultaneously, GDP has not been able to keep up. Currently sitting at 123%, the debt to GDP ratio is unfavorably skewed on the debt side, indicating that the US has almost a fourth more of debt than its total economic output can handle.

Now that the US is getting a little strapped for cash, it needs to carefully choose where to spend its money.

That’s where Congress comes in, but disagreements between Democrats and Republicans on spending is delaying the passing of bills that are necessary to keep the government running.

Absent some kind of new funding bill, the government could shut down by Saturday.

Government shutdowns are old news to this market and in the past 10 since the 1980s, the S&P on average has surprisingly seen positive returns in the following month.

Sectors such as materials, energy and industrials have specifically been the best performers during this time. On the other hand, IT and consumer discretionary stocks have had a hard time over this period.

Even though the government has a habit of reaching last minute deals, history fortunately shows that a government shutdown is not the end of the world for equity markets.

What’s happening in the markets?

This section is powered by Open AI connected to TOGGLE AI

XPeng Motors, a prominent Chinese electric vehicle manufacturer, is poised to announce its earnings tomorrow morning as the electric vehicle (EV) earnings season continues.

Analysts are projecting a loss of $0.53 per share and revenues totaling $1.16 billion for the quarter.

Historically, out of the nine instances in which the company has reported earnings, it has surpassed expectations only twice. Despite this, the stock has exhibited a tendency to rise on average even after falling short of earnings forecasts.

In a competitive market, XPeng Motors has defied challenges and delivered an impressive year-to-date return of approximately 54%, earning it the distinction of being Deutsche Bank’s top pick in the electric vehicle sector.

Aggregated Leading Indicators!

Subscribe to Pro here to receive our pre-market Leading Indicator newsletter and access all Leading Indicators online!

Learn more about the Leading Indicators in the Learn Center!

Earnings Update: TJX Companies reports tomorrow

TJX Companies Inc, the parent company of TJ Maxx, is likely to benefit from increased customer traffic across all divisions as shoppers hunt for bargains in a tough macro environment.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

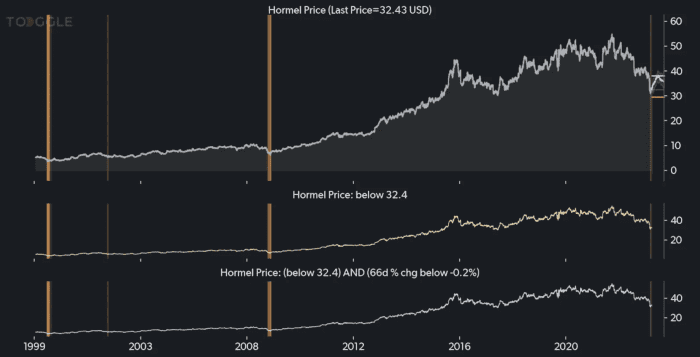

Asset Spotlight: Hormel Foods at a low

Toggle analyzed 7 similar occasions in the past where Hormel Food’s stock was trading near a low and historically this led to a median increase in the stock’s price over the following 6 months. Read full insight!

General Interest: Goodbye NYC Traffic

This past weekend, electric vertical take-off and landing aircraft (eVTOL aka air taxi) company Joby Aviation performed a brief demonstration flight over New York City.

The display was part of a press conference hosted by Mayor Eric Adams who announced that the city plans to electrify two heliports on the island – Downtown Manhattan and East 34th st.

It’s only a matter of time before they start delivering your UberEats orders too.

—

Originally Posted November 14, 2023 – Drowning in debt

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!