Yesterday’s rate projection and economic outlook from the Federal Reserve and today’s European Central Bank actions illustrate that monetary policymakers believe additional hawkish actions are still needed to curtail moderating but still high inflation. Meanwhile, the U.S. labor market is continuing to show signs of weakening while an uptick in retail sales last month illustrates that shoppers are still spending despite higher interest rates and increases in the overall cost of living. With this week being the second-consecutive week of high unemployment claims investors are betting that the Fed isn’t going to keep raising rates, as market bulls push equities to the highest level since April of last year.

The Fed decided to keep its target fed funds rate at 5.13%, but to the short-term dismay of investors, projected the need for two more rate hikes this year to a terminal fed funds rate of 5.63%. Some members even believe a terminal rate of 6.13% may be required to stifle inflation. You can probably guess which members those are. Prior to yesterday’s meeting, investors had anticipated only one more 25-basis point (bp) hike followed by a rate cut by year-end.

These developments occur after a 12-month runup in equities that has generated a 20% S&P 500 total return, a result of expanding valuations driven by investors anticipating that earnings will strengthen as the Fed backs off its tightening campaign. This optimism was illustrated by the S&P 500’s trailing price-to-earnings ratio climbing from 18 to 22 during the 12-month period. At a pivotal time for equities, the Fed’s Summary of Economic Projections (SEP) yesterday disabused investors of optimism about an easing of monetary policy while this morning’s report depicting a high level of layoffs reignited their optimism.

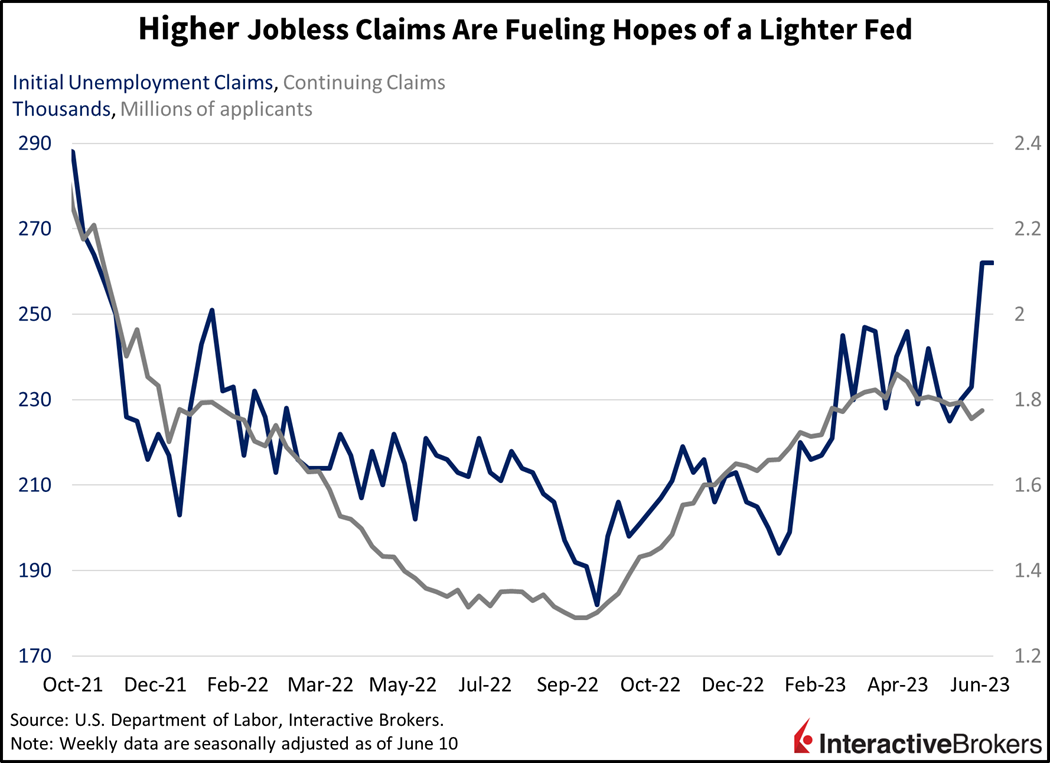

On the labor market front, signs of continued softness are emerging. Initial unemployment claims remained at their highest level in 20 months, coming in at 262,000 for the week ended June 10. The 262,000 claims were the exact level of the prior week and exceeded the consensus who were awaiting 249,000. Continuing claims came in at 1.775 million for the week ended June 3, growing from the previous week’s level of 1.755 and exceeding projections calling for 1.765.

May retail sales were strong, increasing 0.3% from April. The May increase was better than projections calling for a 0.1% contraction but cooled off from the previous month’s 0.4% pace of growth. The headline figure grew just 0.1% when excluding automobiles but 0.4% ex-automobiles and gasoline. On a year-over-year (y/y) basis, retail sales, which aren’t adjusted for inflation, grew 1.6%, faster than the 1.2% notched in April.

Broad-based gains existed across segments with 10 out of 13 categories notching gains. Driving the locomotive were motor vehicle and parts dealers and building material and garden equipment suppliers with 2.2% and 1.4% month-over-month (m/m) gains. Other contributors included the following:

- Restaurants and bars, up 0.4%

- General merchandise stores, up 0.4%

- furniture shops, up 0.4%

- Ecommerce, up 0.3%

Weighing on results were gasoline stations, with a decline of 2.6%, largely due to lower prices. Miscellaneous shops and apparel stores with declines of 1% and 0.1% also weighed upon results.

Industrial Production Contracts

Industrial production for the month of May was the worst m/m change of the year, signaling significant weakness in oil production due to lower prices and contracting margins as a result. Industrial production contracted 0.2% m/m, much worse than the prior month’s 0.4% growth rate. May’s contraction was the steepest since last December. While manufacturing achieved a modest 0.1% growth rate, mining and utilities declined a whopping 0.4% and 1.8% during the period. Crude oil and electricity production weighed the most on results as local producers stepped back from the playing field due to crude oil prices continuing their downtrend and nearing their own breakeven levels.

Markets were bearish for most of the pre-market with yields higher and equities lower until the 8:30 am Unemployment Claims report gave stock bulls another reason to rally. The ongoing high level of layoffs strengthened confidence that the Fed will not actually continue hiking like its SEP suggest

Markets were bearish for most of the pre-market with yields higher and equities lower until the 8:30 am Unemployment Claims report gave stock bulls another reason to rally. The ongoing high level of layoffs strengthened confidence that the Fed will not actually continue hiking like its SEP suggest. The 8:30 am report pulled bond yields lower and pushed equities higher, with the S&P 500 Index making a new high of 4410 this morning. The fear of missing out is continuing to effect markets with most sectors of the S&P 500 Index contributing to gains minus real estate, consumer discretionary, materials and semiconductors. Bond yields reversed strongly following the report as well, with the 2- and 10-year Treasury maturities falling from 4.79% and 3.85% to 4.62% and 3.71% as a result. The dollar is also believing the narrative that the labor market is continuing to get weaker and will lead to a lighter Fed and the Dollar Index is down 56 bps to 102.42. Crude oil is also rallying on a weaker dollar and hopes of a looser U.S. labor market amidst confidence of lighter central bank tightening from China and the U.S. that may avert recession. WTI crude oil is up 1.8% to $69.52 per barrel.

Investors Don’t Believe Powell

Throughout the current tightening cycle, investors have frequently dismissed Jerome Powell’s hawkish statements, resulting in the current runup in equity valuations. In the coming weeks, equity markets may reflect if investors have finally accepted the Fed’s warnings of persistent inflation and the need for restrictive policy. In addition to the SEP calling for two more rate hikes this year, Powell was rather direct yesterday when he said it will take a while for the Fed to push inflation down to its 2% target. If investors accept Powell’s statements, they will reprice equities and bonds based on the anticipated impact upon earnings and bond premiums of the fed funds rate being pushed higher than anticipated and maintained for a longer period than investors have forecast. At the moment, however, investors are pricing in just one rate hike for the year at next month’s meeting, while the Fed’s guidance calls for two.

Visit Traders’ Academy to Learn More about Retail Sales and Other Economic Indicators.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!