Little is expected from Thursday’s policy announcement. A very sizeable consensus sees Bank Rate being left at 5.25 percent and investors and financial markets alike seem quite convinced that the next move will be down, albeit not until well into 2024. Comments early last month from BoE Chief Economist Huw Pill essentially concurred with this view and have left most simply wondering about when, and how quickly, the rate cuts will be delivered. That said, recall that in November, three MPC members (Jonathan Haskell, Catherine Mann and Megan Greene) all still wanted a 25 basis point hike and the ongoing stickiness of wages could well see some or all of them renew their call to tighten this week.

Meantime, the bank continues to drain liquidity via its QT programme. In September, the MPC announced that over the 12 months beginning in October, asset sales would aim to reduce the stock of gilts held in the Asset Purchase Facility by £100 billion to £658 billion. As of early December, overall disposals stood at about £150 billion, implying a near-17 percent decline in the stock of QT to £745 billion since its peak in the first quarter of last year. There is no reason for supposing that the current policy will be amended.

Compared with a month ago, financial markets have become more certain that Bank Rate has peaked and anticipate a faster pace of easing through 2024. The MPC meeting in June is seen currently as the most likely to deliver a 25 basis point cut. Beyond that, expectations have also been trimmed and futures now put 3-month money rates just shy of 4.4 percent at year-end, about 30 basis points or so lower than thought likely previously.

Inevitably, much will depend upon inflation which, in large part due to an energy-induced spike in prices a year ago, fell very sharply in October. At 4.6 percent, the headline rate was down from 6.7 percent in September, its steepest drop in more than 30 years and its lowest mark since October 2021. More importantly, the core rate declined too and at 5.7 percent matched its weakest mark since February 2022. The bank’s own inflation survey released last week also found household expectations for the coming year softening from 3.6 percent in August to 3.3 percent, a 2-year low. However, more ominously, the 5-year ahead rate climbed to 3.2 percent from 2.9 percent. Indeed, while the broad-based deceleration in actual inflation bodes well for a trend decline over coming months, the bank will note that all the main measures remain well above the 2 percent target and will be alert to the fact that future falls will be increasingly dependent upon softening domestic pressures. All of which keeps the labour market in sharp focus.

Unfortunately, conditions in the labour market remain far from clear. Since September, the Office for National Statistics (ONS) has been unable to provide a reliable monthly labour market report due to inadequate survey responses. This has left the employment data being estimated by applying implied growths from the Pay As You Earn (PAYE) Real Time Indicator (RTI) series, itself very volatile and often subject to sizeable revision. Unemployment has been modelled by applying implied growths from the Claimant Count series, itself no longer recognised as a National Statistic and, since 2015, deemed only an Experimental National Statistic. The bank recently warned that the official employment data could be out by as much as one million. For what it is worth, in general the picture would seem to show tight, but gradually easing, conditions with, in particular, steadily declining vacancies which hit more than a 2-year low in the three months to October.

Even so, wages have been slow to respond. Headline third quarter regular earnings growth (7.7 percent) was just a couple of ticks below its record high and nowhere close to being consistent with the 2 percent inflation target. The bank’s seemingly preferred metric, which annualises the latest 3-month change, has recently been better behaved but, at currently 6.3 percent, it too remains uncomfortably strong. Moreover, on this basis, the key service sector (7.4 percent) is still particularly robust.

As things currently stand, the economy will avoid recession this year as GDP managed to hold flat in the third quarter. However, the reprieve could easily prove short-lived with domestic demand weak and export volumes at best flatlining. In particular, retail sales have fallen in three of the last four months and in October hit their lowest level since the Covid lockdown in February 2021. Consumer confidence has improved but remains historically weak. Manufacturing is stagnating but declining orders point to worse to come and company insolvencies have hit their highest levels since the aftermath of the financial crisis. The ailing housing market has recently shown some signs of life but an estimated 1.6 million homeowners will see their current mortgage deal expire next year and replacement loans will be much more expensive. All in all, economic prospects do not look good but if there is to be a recession, on current trends it at least looks likely to be only shallow.

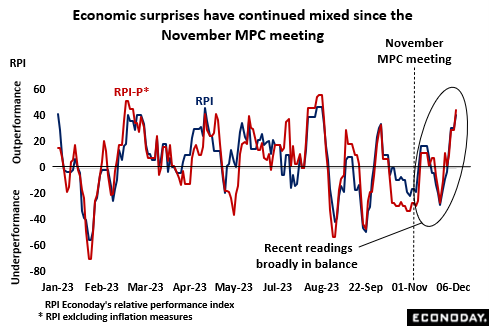

All that said, while surprises in the data have remained quite evenly balanced since November’s meeting, the most recent reports have clearly exceeded expectations. At currently 41, Econoday’s relative performance index (RPI) stands at its strongest level since mid-August and indicates economic activity in general outperforming forecasts by some margin. Ignoring inflation, the RPI-P is even higher at 45. Such readings increase the likelihood of a split vote.

Against this backdrop, it looks likely that only a majority of MPC members will again settle for no change in Bank Rate on Thursday. There are some participants, notably arch-hawk Catherine Mann, who believe that policy has only recently become restrictive and even then, not by much. So near-term, the risks to stability probably remain biased towards additional tightening rather than an early rate cut. In any event, expect the MPC to emphasise the need to maintain a restrictive stance for an extended period to ensure that the inflation target is achieved within an acceptable timeframe. Any early cut in Bank Rate is simply not on the table.

—

Originally Posted December 11, 2023 – December BoE MPC Preview: In no rush to ease

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!