Did you know that every time you type a query into ChatGPT, it requires about 10 times as much electricity to process as a Google search?

That’s according to Goldman Sachs, which writes in a new report that electricity consumption in the U.S. is poised for a major surge for the first time in years, due in large part to the rapid buildout of data centers that power AI platforms such as ChatGPT. Goldman says it’s projecting electricity demand to rise approximately 2.4% from 2022 to 2030, with data centers representing the largest growth segment at 0.9 percentage points—nearly a third of total new demand.

Goldman isn’t the only firm that’s forecasting huge changes to the U.S. energy grid. The Electric Power Research Institute (EPRI), a Washington, D.C.-based nonprofit, estimates that data centers could consume up to 9% of U.S. electricity generation by 2030, more than double their current consumption.

To help put things in perspective, ChatGPT currently has over 180 million users, but there are around 5.3 billion internet users around the world. Imagine if each of them became a regular user of energy-intensive ChatGPT, whose servers are located in the U.S., according to owner OpenAI.

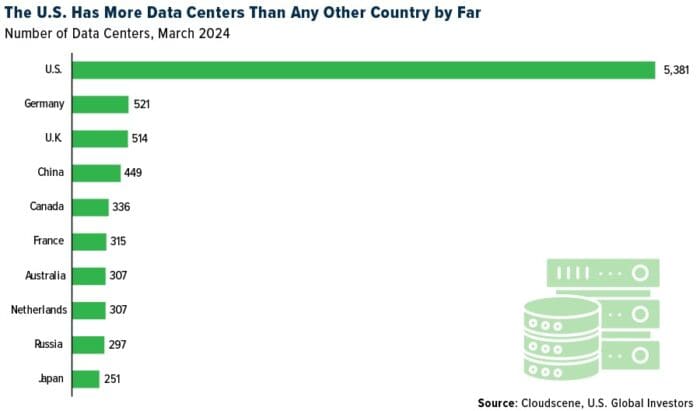

The U.S. is currently home to nearly 5,400 data centers, the most of any other nation by far. Even so, additional capacity will need to come online to meet runaway demand, and giant tech companies—from OpenAI and Microsoft to Google, Meta, Amazon and more—are spending billions to position themselves as leaders in the nascent industry.

Data Centers: A Boon To Natural Gas?

So how will this biblical amount of electricity be generated? According to a separate Goldman report, natural gas is expected to supply 60% of the growth from AI and data centers, with renewables providing the remaining 40%.

The resurgence in natural gas demand is already being felt, with analysts at Wood Mackenzie now expecting total U.S. gas demand to increase by 30 billion cubic feet per day (bcfd) by the early 2040s, a substantial increase from previous estimates. This spike is due to the AI boom and the corresponding rise in data center activity.

For investors, this presents a unique opportunity. Natural gas prices, which are down more than 32% so far this year due to strong production and lower demand, are expected to rebound. Wells Fargo projects that prices could average $3.50 per thousand cubic feet by 2030, a 46% increase over the 2024 average price of $2.39. This potential for price appreciation, I believe, makes natural gas an attractive investment.

Copper Is The New Oil

While natural gas will be a key player in meeting future power needs, copper is equally essential, particularly for its role in the energy transition. Copper is the only critical mineral present in AI as well as all of the most important clean energy technologies, including electric vehicles (EVs), solar photovoltaics (PV) and wind power. Its combination of conductivity, longevity, ductility and corrosion resistance makes it an indispensable mineral.

However, the supply side of the copper market is fraught with challenges. To meet current trends, an astounding 115% more copper must be mined in the next 30 years than has been mined in human history. The International Energy Forum (IEF) warns that under current policy settings, it’s unlikely there will be sufficient new mines to achieve 100% EV adoption by 2035. This is compounded by declining ore quality, which leads to increasing capital and operating costs.

Ready or not, demand for the red metal continues to soar. Year-to-date, copper prices are up nearly 25% and recently hit an all-time high of over $11,000 per ton. This price surge is driven by long-term demand forecasts and supply constraints, making copper a highly attractive commodity.

Ivanhoe Looks Even More Attractive After Completion Of Copper Mine Expansion

The anticipated rise in U.S. power demand, driven by AI, EVs and the energy transition, will undoubtedly impact the markets. As I see it, natural gas and copper stand out as assets I might want to have exposure to going forward.

Natural gas offers a stable and growing demand outlook, with prices poised to recover from recent lows. Investing in natural gas companies or ETFs that focus on this sector could provide significant returns as the demand for power grows.

Similarly, copper’s essential role in the energy transition makes it a critical investment. I don’t believe anyone can deny its long-term demand viability. Investors should consider exposure to copper through mining companies, ETFs or even futures contracts to capitalize on this trend.

Our favorite copper play remains Ivanhoe Mines, which announced last week that operations began at the latest expansion of the Kamoa-Kakula Copper Complex in the Democratic Republic of the Congo (DRC), of which Ivanhoe owns approximately 40%. The new phase was completed early and on budget, “a rare feat in an industry plagued by cost overruns and delays,” says Robert Friedland, Ivanhoe’s billionaire founder and executive co-chairman. Robert adds that this new expansion brings the company closer to its goal of reaching 800,000 tonnes per year, which would make Kamoa-Kakula one of the world’s two largest copper projects. Ivanhoe is up close to 50% year-to-date.

—

Originally Posted June 3, 2024 – Data Centers Are Driving An Electricity Demand Surge From AI Platforms Like ChatGPT

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2024): Amazon.com Inc., Ivanhoe Mines Ltd.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Very interesting, seems like it’s still a great time to start scaling in for the long run.