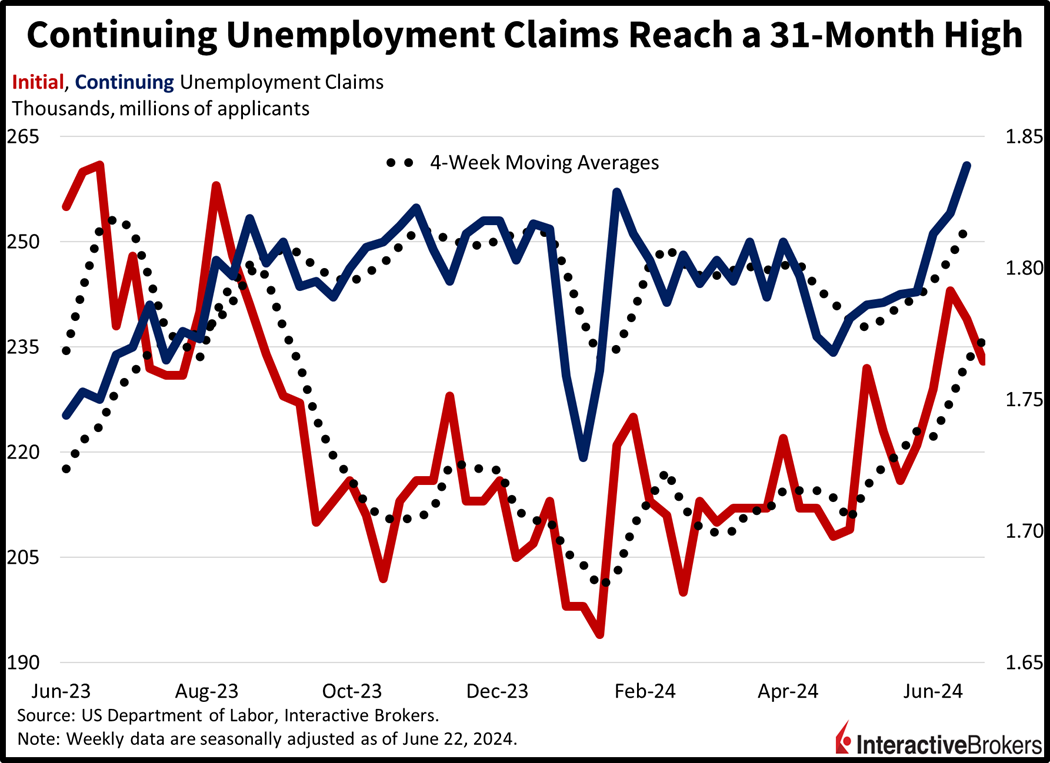

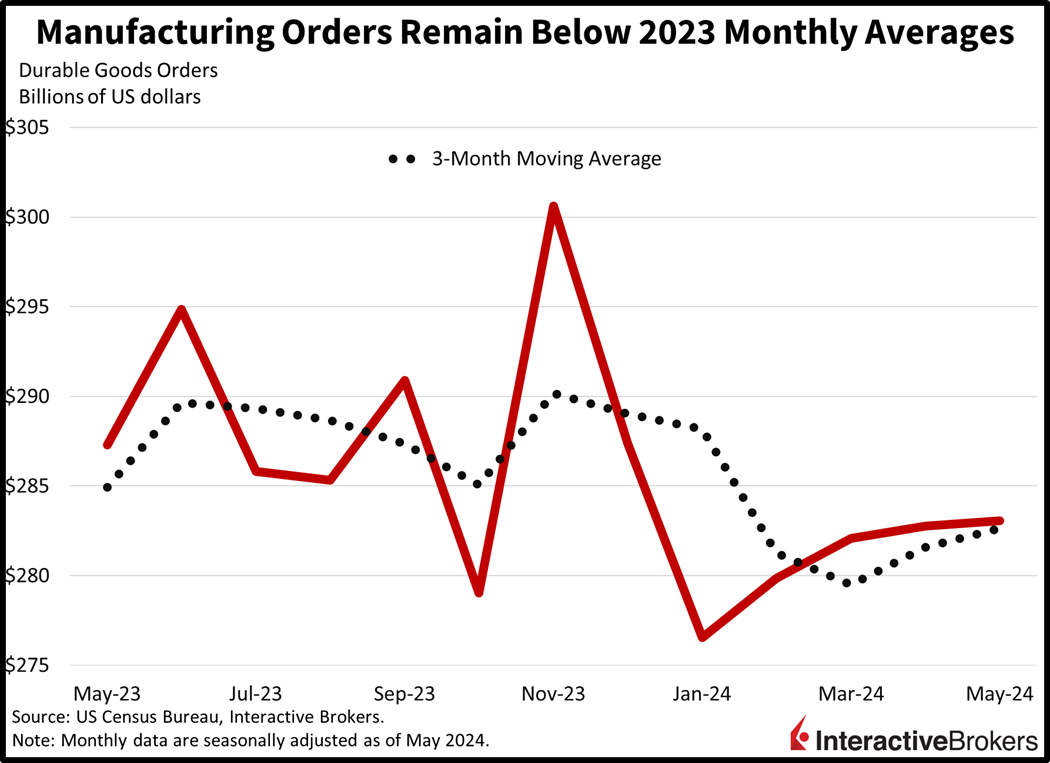

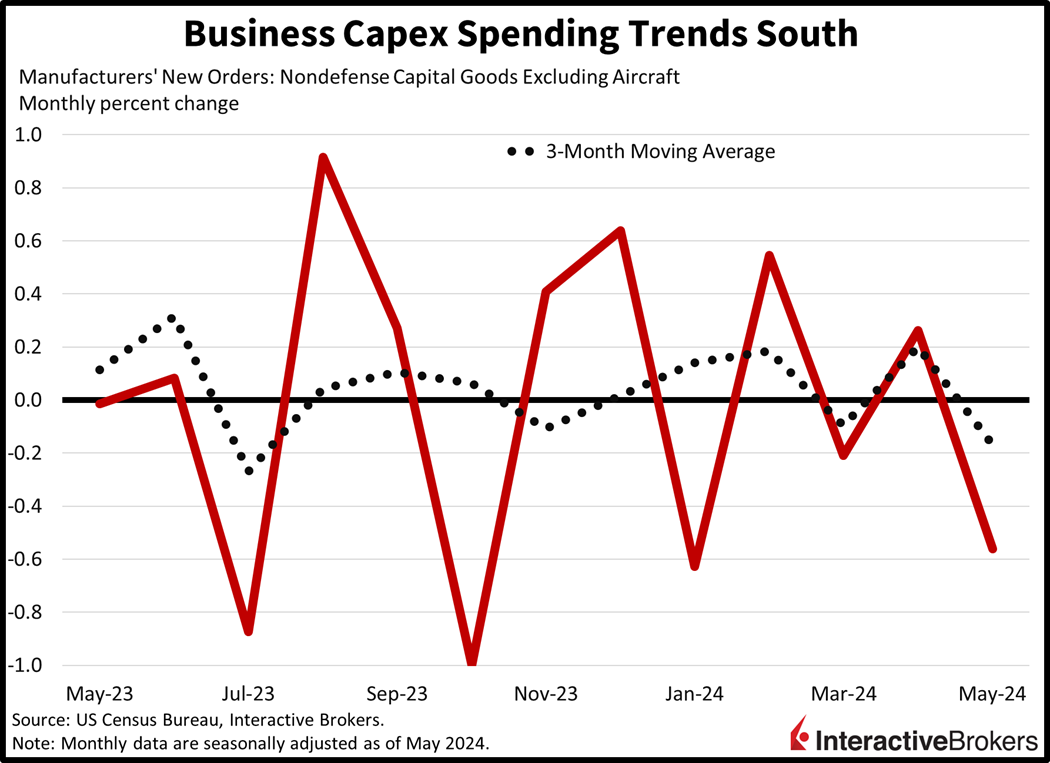

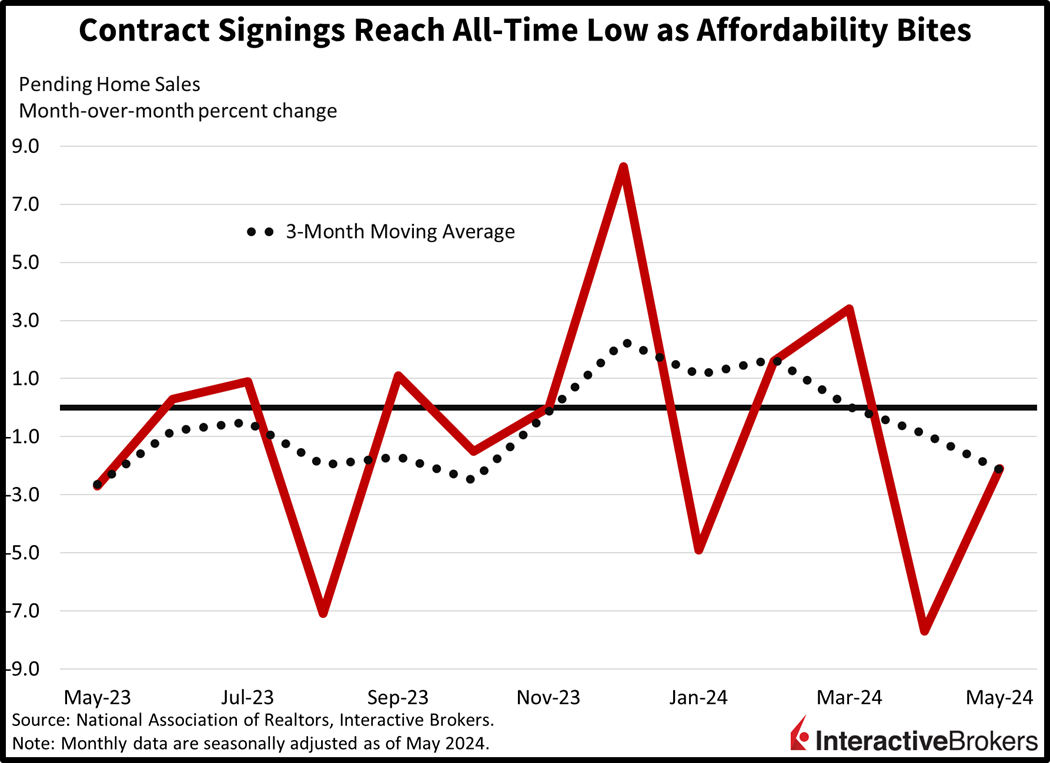

Interest rates are offering investors a reprieve after this morning’s news that continuing unemployment claims have hit the loftiest level in almost three years. Separate reports depicting the sharpest contraction in business investment since January amidst the lowest level of pending home sales in history are also serving to suppress yields while bolstering the case for rate cuts from the Fed. Indeed, softening labor conditions, weakening capital expenditure plans and a lack of homebuyers are raising odds of a 25-bp reduction in September to 66%.

More Americans Dust off Resumes

The employment market continued to cool in the last two weeks, with unemployment claims extending their upward climb. Indeed, four-week moving averages have risen for three and six consecutive weeks for initial and continuing unemployment claims. On a week-over-week basis, the four-week moving averages ticked up from 233,000 and 1.804 million to 236,000 and 1.816 million, respectively. Furthermore, the 1.839 million continuing claims reported for the week ended June 15 trounced expectations of just 1.82 million and was the tallest level since November 2021.

Durable Good Purchases Moderate

Elevated financing costs, rising prices and uncertain demand prospects weighed on manufacturing orders last month. Durable goods purchases rose just 0.1% month over month (m/m), beating projections for a 0.1% decline but still beneath last year’s monthly average of $286.2 billion. Moreover, we have yet to report one month in 2024 where transaction strength exceeded the 2023 monthly average. Broad-based weakness existed in this morning’s print, with just a few categories providing gains. Defense aircraft, computers, automobiles and parts, and fabricated metal products were the only m/m gainers, sporting transaction progress of 22.6%, 1.3%, 0.7% and 0.3%. Passenger aircraft and communication equipment were the weakest, with purchases slipping 2.8% and 1.6% during the period. Finally, the proxy for business investment in the report, nondefense capital goods excluding aircraft, shrunk 0.6% m/m, the sharpest decline since January.

Less Ink Spilled on Home Buying Contracts

This morning’s data on contract signings in the residential real estate sector didn’t provide much optimism for transactions in the current month. Pending home sales fell 2.1% m/m, a shallower rate of decline relative to April’s 7.7% debacle but still well below the median estimate of a 2.5% recovery. Also, the figure marked its lowest level ever recorded since the series began in 2001. Pending home sales serve as a leading indicator of closed transactions, as contracts are signed prior to mortgages being finalized and keys exchanged.

GDP Revised Upward but Is Still Slowing

Today’s final revision for first quarter Gross Domestic Product (GDP) saw economic growth and inflation adjusted from 1.3% to 1.4% while the overall and core personal consumption expenditures price index were estimated at 3.4% and 3.7% versus the 3.5% and 3.6% previously reported. The big surprise in the update was a 50-bp downgrade to first-quarter consumer spending, which was revised from 2% down to 1.5%. GDP has slowed so far this year after averaging 2.5% in 2023.

Levi’s Revenue Misses While Micron Disappoints

At least one retailer is maintaining that US consumers are strong while in other economic sectors, Micron has provided lukewarm guidance while Jefferies has reported an uptick in business dealmaking. Those are a few highlights from the following earnings call summaries:

- Micron, a provider of computer memory and storage, provided in-line guidance for the current quarter, causing its share price to drop approximately 7% last night, a result of investors anticipating a stronger outlook from the company in order to sustain its 67% year-to-date stock rally. Micron is among a small group of companies that provides high bandwidth memory used for artificial intelligence (AI). Market participants expected that the rapid growth of AI would result in Micron providing a strong revenue outlook, but the middle of the company’s fiscal third-quarter guidance of $7.6 billion to $7.8 billion was only in line with analysts’ forecasts. On a positive note, Micron said its high bandwidth products are sold out through the end of 2025. The firm’s revenue and earnings for the recent quarter exceeded analysts’ expectations.

- Jefferies Financial Group reported a strong fiscal second quarter ended May 31, fueling optimism that businesses are increasingly turning to capital markets for funding after a lull in such activity caused by high interest rates and geopolitical fears. For the quarter, the company’s investment banking revenue soared 59%. Securities underwriting, advisory services, trading and sales all grew substantially. In a Bloomberg interview, Jefferies President Brian Friedman said he believes a recovery in capital markets is occurring and if it halts, it’s unlikely to happen anytime soon. The firm’s earnings and revenue surpassed analyst expectations.

- Levi Strauss shares dropped 12% last night after the company reported quarterly earnings that beat expectations but said it generated only $1.44 billion in revenue, missing the analyst forecast for $1.45 billion. Revenue climbed 7.8% y/y; however, sales for the second quarter of 2023 were reduced because the company shifted its wholesale shipments to the subsequent reporting period, creating an easy comparable. Investors were also disappointed by the revenue results because they had anticipated that the increasing popularity of denim would lead to a bigger sales increase. For the most recent quarter, revenue was hurt by the timing of wholesale orders for the company’s Docker’s brand and declining sales in Europe and Asia. Encouragingly, revenue in the Americas region grew 17%. Chief Financial Officer Harmit Singh, in a MarketWatch interview, said the US consumer is more “resilient and at a better spot.” He believes European consumers are still cautious, but he is bullish on Asia. Levi Strauss maintained its guidance for the current fiscal year.

Cyclical Stocks Gain

Markets are moving in a trifurcated way today as traders look forward to the first presidential debate tonight between former President Trump and President Biden. Stocks are near the flatline, rates and the greenback are down, but commodities are generally green. Across the major US equity indices, the cyclically tilted Russell 2000 and Dow Jones Industrial benchmarks are up 0.1% and 0.2% while the Nasdaq Composite and S&P 500 baskets are down 0.1%. Similarly, sector breadth is split, with 5 out of 11 segments green on the session. Real estate, communication services and utilities are leading the charge higher; they’re up 0.8%, 0.3% and 0.1%. Driving the laggards are materials, consumer staples and healthcare with the segments losing 0.4%, 0.4% and 0.3%. Soft economic data is leading to traders locking in the rates of today, with the 2- and 10-year Treasury maturities changing hands at 4.71% and 4.29%, 4 and 3 bps on the session. Lighter economic performance is also weighing on the dollar as its index loses 13 bps. The US currency is up relative to the franc, yuan and Aussie and Canadian dollars but losing versus the euro, pound sterling and yen. Commodities are experiencing relief on the back of perceptions favoring an incrementally shorter journey across the monetary policy bridge. Gold, crude oil, lumber, and silver are higher by 1.2%, 1.1%, 0.9% and 0.8%, but manufacturing weakness is weighing on copper, which is lower by 0.5%. WTI crude oil prices are jumping to $82.04 per barrel as supply concerns stemming from heightening tensions between Beirut and Jerusalem offset softer stateside demand prospects and rising inventories.

Political Landscape To Take Center Stage

Investors’ focus is at risk of shifting from AI euphoria to the political environment tonight when the presidential debate kicks off. Former President Donald Trump and President Joe Biden will wrestle with issues that have led to increasing political polarization. The event is likely to offer belligerence and may spark market volatility as the candidates trade barbs and expound on their views regarding hot topics, such as immigration, taxation, energy, regulation, inflation, trade with China, Middle East conflicts, the Ukraine-Russia war and the rapidly growing debt of the US. While both Trump and Biden are unlikely to cut spending, the extent to which the nation can grow out of its problems will be top of mind. Or more specifically, can tax revenue offset the current environment of unsustainable outlays?

Visit Traders’ Academy to Learn More About Unemployment Claims and Other Economic Indicators

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!