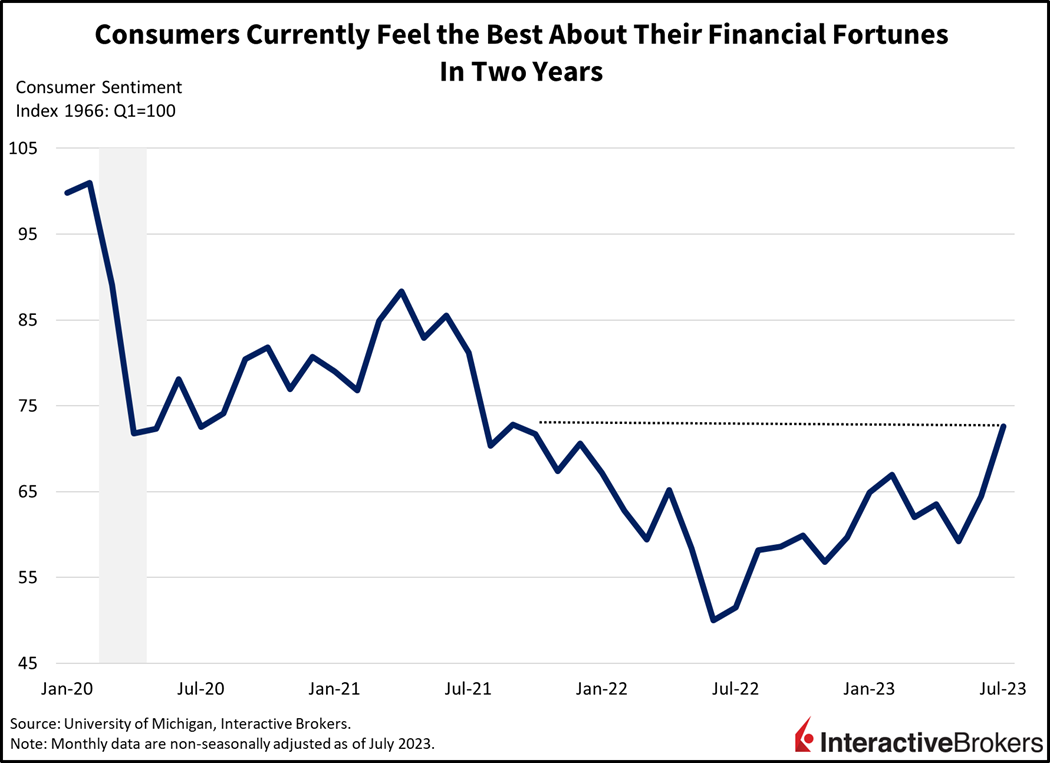

Shortly after news of declining inflation and continued tightness in the labor market sparked optimism that the Federal Reserve may achieve an economic soft landing, this morning’s University of Michigan Consumer Sentiment report shows that shoppers became much more optimistic in July. This increase in optimism illustrates that highly resilient consumers aren’t likely to significantly curtail spending and that the ongoing demand for goods and services will continue to challenge the Fed as it seeks to contain inflation.

Consumer sentiment data surprised to the upside this morning, with July’s preliminary read of 72.6 shattering expectations. The 72.6 was much higher than the 65.5 expected and reflected a notable gain from June’s 64.4 level. With broad-based gains across components, July’s reading indicates the highest optimism among consumers since September 2021. The current conditions and consumer expectation sub-indices both grew above consensus estimates to 77.5 and 69.4 from 69 and 61.5 during the period.

Rising asset prices, stabilizing gasoline prices and plentiful job opportunities served to boost sentiment among consumers who are benefitting from declining inflation rates. In fact, the boost in sentiment also points to a possible momentum pickup in consumer spending that may drive inflation higher in the coming months. Within the report, 1-year inflation expectations picked up from 3.3% to 3.4% while long-term 5–10-year expectations remain anchored at 3.1%. The strength of recent economic data has led members of the Fed to come out and warn against declaring victory on inflation too early.

Inflation Appears to Weaken

Earlier this week investors grew increasingly optimistic that weakening inflation could cause the Fed to back off its aggressive monetary policy tightening that could otherwise potentially push the country into recession. Both the headline Producer Price Index and the core version of the index climbed only 0.1% month-over-month (m/m) in June, according to data released yesterday. Also this week, the core Consumer Price Index showed only a 0.2% m/m increase. The optimism about a potentially less hawkish Fed may be unfounded, with San Francisco Federal Reserve Bank President Mary Daly and Federal Reserve Governor Christopher Waller maintaining this week that the inflation battle isn’t over and is likely to require two more fed fund rate increases before yearend. Daly said she believes the risk of doing too little to fight inflation outweigh the risks of being overly hawkish. Waller, meanwhile, said wage growth exceeds the rate that is required to achieve the central bank’s 2% target.

Market Rally Continues

Equities are continuing their fierce momentum to the upside, with all major U.S. indices higher except for the small-cap Russell 2000. While the S&P 500 Index is up 0.3% to 4,525 and reached a fresh year-to-date high earlier at 4,527, breadth among sectors is poor, with only health care, staples, consumer discretionary and technology higher out of the 11 segments. Treasuries are selling off, however, as the acceleration in inflation expectations and recent hawkish commentary weigh on bond prices. Yields are higher across the curve with the 2- and 10-year maturities up 11 and 4 basis points (bps) to 4.72% and 3.8%. The Dollar Index is roughly unchanged, however, as global traders increasingly view the European Central Bank as more hawkish than the Fed, propping up the euro against the greenback. The Dollar Index is up 7 bps to 99.85, below important support at 100. Crude oil is set for a strong weekly gain alongside risk assets but is down today, however, as traders lock in profits right below the commodity’s 200-day moving average. WTI crude oil is down 1.6% to $75.70.

A handful of banks including JPMorgan Chase & Co., Citigroup, Inc. and Wells Fargo wrapped up the workweek by reporting second-quarter earnings that exceeded consensus expectations with results benefiting from increases in net interest income, or the difference in interest collected from loans and interest paid on customers’ deposits. State Street Corp. and BlackRock, Inc. also reported earnings that exceed consensus expectations. At a time when consumers are spending down Covid-19 stimulus payments and racking up credit card debt, JPMorgan Chase Chief Executive Officer Jamie Dimon said consumers are slowing their spending. He believes balance sheets are weakening but are still healthy. In the immediate term, he says declining cash assets, the potential for interest rates to remain higher for longer than expected and the Ukraine war are significant risks. Citigroup’s earnings beat occurred even though profits declined, with investment banking and trading generating disappointing results. Citi said many investors held off on trading while they waited for a resolution to the U.S. debt ceiling issue. Also this morning, Wells Fargo said it is experiencing a minor increase in loans that the company writes off.

Liquidity Hurts

Inflation is not over and done and will remain a lingering headwind for years to come, causing asset prices to fluctuate as inflationary dynamics shift from fire to ice and then from the igloo to the oven.

While investors point to recent inflation reports depicting slowing price pressures, persistent labor market strength and a resurgence in commodity prices can turn the tide. It takes several reports to make a trend and what we’ve learned from previous inflation reports is that the loosening of financial conditions that occurs alongside weakening price pressures actually pushes inflation higher moving forward. Even Chair Powell has fallen victim to this mistake, when he labeled policy being neutral last summer while championing disinflation during February 1’s meeting. In both cases, inflation ended up reaccelerating shortly after risk assets rallied and bond yields plunged. Inflation is not over and done and will remain a lingering headwind for years to come, causing asset prices to fluctuate as inflationary dynamics shift from fire to ice and then from the igloo to the oven.

Visit Traders’ Academy to Learn More about Economic Indicators.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!