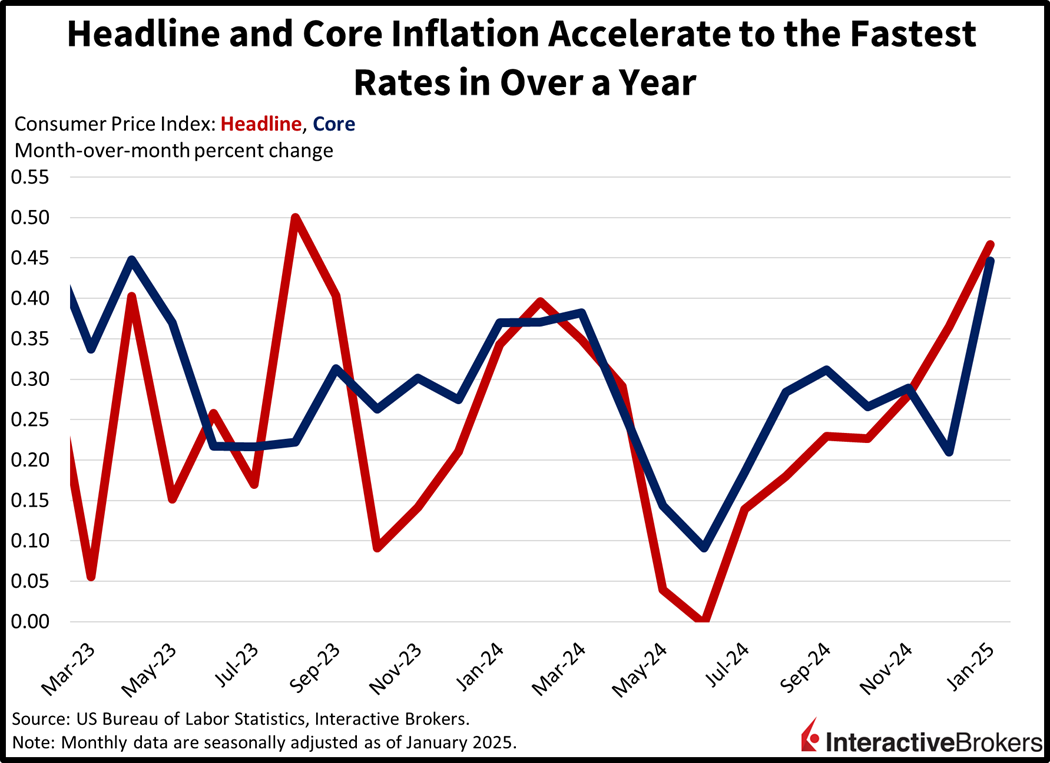

This morning’s monumental CPI beat is fueling cross-asset volatility as investors unload stocks and bonds alike. The report was just awful and utterly unexpected, with both the monthly and annualized figures reaching their highest levels in 17 and 8 months, respectively. Similarly, the monthly core reading jumped to its tallest height in 21 months, illustrating the significant surge in cost pressures to start the year. And as Fed Chair Powell is testifying to members of the House of Representatives on Capitol Hill, market participants are pushing back their timeline for the central bank’s first interest-rate reduction of 2025 from this summer to autumn. The reconsideration of when the committee can continue its walk down the monetary policy stairs is leading to traders trimming equities as heavier borrowing costs weigh on risk premiums. The bull case was indeed supported by a lighter overnight benchmark from the FOMC, which could generate a bull-steepening across the yield curve and propel economic momentum and corporate earnings while justifying stretched valuations.

Broad-Based Price Increases Hit Shoppers

Consumer inflation jumped to start the year as broad-based increases weighed on household budgets and sentiment. The January Consumer Price Index (CPI) leaped a whopping 0.5% month over month (m/m) and 3% year over year (y/y), trouncing expectations of 0.3% and 2.9%. Comparably, the core CPI, which excludes food and energy due to its volatile characteristics and is considered a better gauge of the longer-term trajectory of price pressures, rose 0.4% m/m and 3.3% y/y, 0.1% and 0.2% higher than median estimates. Furthermore, the figures marked an uptick from December, when the headline and core varieties arrived at 0.4% and 0.2% on a monthly basis and 2.9% and 3.2% from an annualized framework.

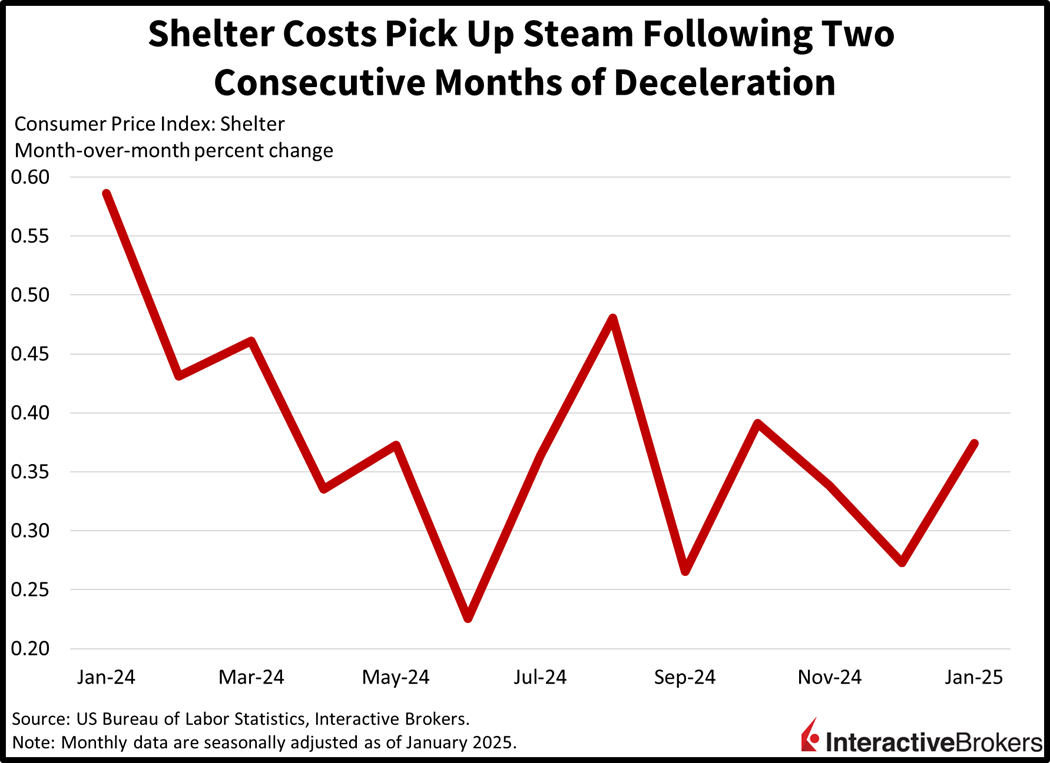

Housing Costs Disappoint

Upside charge pressures were sharp amongst most categories and the downshift in shelter expenses that I’ve been awaiting and wrote about yesterday hasn’t materialized yet, with housing costs accelerating for the first time since October. The component is integral because it comprises roughly 45% of the basket as Americans spend an elevated share of their incomes on rents and mortgages. But leading the expenses to the upside were used automobiles, gasoline, heating service, transportation services, food at markets, shelter and food at dining establishments with prices increasing 2.2%, 1.8%, 1.8%, 1.8% 0.5%, 0.4% and 0.2%. Serving to marginally cushion the blow to the pocketbook, however, were unchanged stickers for new automobiles and medical care services and a 1.4% decline in costs for apparel.

Markets Struck with Broad Selloff

Markets are selling off across the board with every equity sector trading south while rates jump. All major domestic stock benchmarks are lower as the Russell 2000, Dow Jones Industrial, S&P 500 and Nasdaq 100 indices drop into the red by 1.3%, 0.8%, 0.6% and 0.3%. The real estate, financials and materials segments are leading the bearishness; they’re trimming 1.1%, 0.9% and 0.9%. Treasurys are also getting sold and the 2- and 10-year maturities are changing hands at 4.38% and 4.65%, 9 and 11 bps heavier on the session. Climbing borrowing costs are helping the greenback; however, it’s gauge is up 20 bps as the US currency appreciates relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan, loonie and Aussie dollar. Commodities are moving north as well, as some investors prefer physical materials as an inflation hedge. Lumber, copper, silver and gold are up 2.2%, 2%, 1.3% and 0.1%, but crude oil is lower by 1.5% and trading at $72.06 per barrel on the back of heavier-than-expected inventories stateside, according to this morning’s Energy Information Administration report.

CPI Could Complicate Trump Agenda

Last month’s significant rise in inflation is partially due to the Federal Reserve rushing to lighten its policy late last year. The central bank even started its easing cycle with a super-sized half-point reduction in September, which essentially compelled policymakers to dish out two more quarters in November and December to justify the early 50-bp move. Folks, it’s certainly not a coincidence that the CPI bottomed in September at 2.4%, the same month that the FOMC aggressively cut its benchmark by double the norm. This was the same period in which the long-end of the curve began to protest the lighter short-end by jumping 120 bps from trough to peak: the 10-year rose from 3.6% to 4.8%. Turning to the White House, today’s report is especially problematic for the new administration, which wants softer borrowing costs while also preferring to maintain leverage in trade negotiations. This CPI makes the nation much more vulnerable to a meaningful return in goods price pressures as a result of reduced international cooperation as it relates to commerce. Finally, a colossal risk for markets going forward is if the central bank has to turn around and begin hiking again to correct previous mistakes. That vulnerability of tighter policy is certainly possible considering the strong fundamentals of this economy, namely robust consumer spending and subdued unemployment, which aren’t necessarily conducive to disinflation, and the potential for loftier fed funds would especially hit the forefront of investors’ focus if the CPI returns to 3.5%.

International Roundup

Japan Machine Orders Grow as Mortgages Increase in Australia

January machine orders in Japan recorded a y/y 4.7% increase but fell 12.8% m/m. In comparison, December orders rose 12.6% and 19.9% y/y and m/m. For the recent period, analysts anticipated a 1.6% y/y increase. While orders declined m/m, January was the fourth-consecutive month of y/y gains, pointing to the country’s economy expanding. Demand from foreign countries grew 4.7% y/y while domestic orders grew 4.5%.

Australia Mortgages Get Bigger

The average value of home loans issued during the final quarter of 2024 was A$811,000, an all-time high and up A$44,000 from the year-ago period. Loan volumes gained 2.2%, marking the third-consecutive quarter of increases. Despite the encouraging numbers, home affordability is a major issue that has prompted the country’s government to pass regulations that prohibit including student loan payments when assess loan applicants’ ability to service request homes loans.

And Bank Benefits from Improving Economy

An improving economy has allowed the Commonwealth Bank of Australia (CMWAY) to lower its loan impairment charges despite its customers struggling with higher costs of living. In releasing its results for the first half of its fiscal year, the country’s largest lender said hardship cases dropped 15% during the six-month period ended in December. Additionally, many borrowers are ahead on making payments. Customers are benefiting from rising wages and income tax cuts enacted last July.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!