Stocks are taking a break from this week’s terrific comeback in the aftermath of the Japanese carry trade carnage with this morning’s conflicting economic data generating investor hesitation. On the one hand, consumer sentiment progressed for the first month in five, but on the other, construction activity plunged to depths last seen near the peak of COVID-19 in the spring of 2020. The cross currents have traders sitting on their hands as they await next week’s central banking developments with hopes that policymakers will offer clues on the path forward. We are certainly looking forward to a long list of Fed speakers, ECB commentary and Chief Powell’s presentation in Jackson Hole, Wyoming.

Consumers Are Going All-In on Harris, Trump

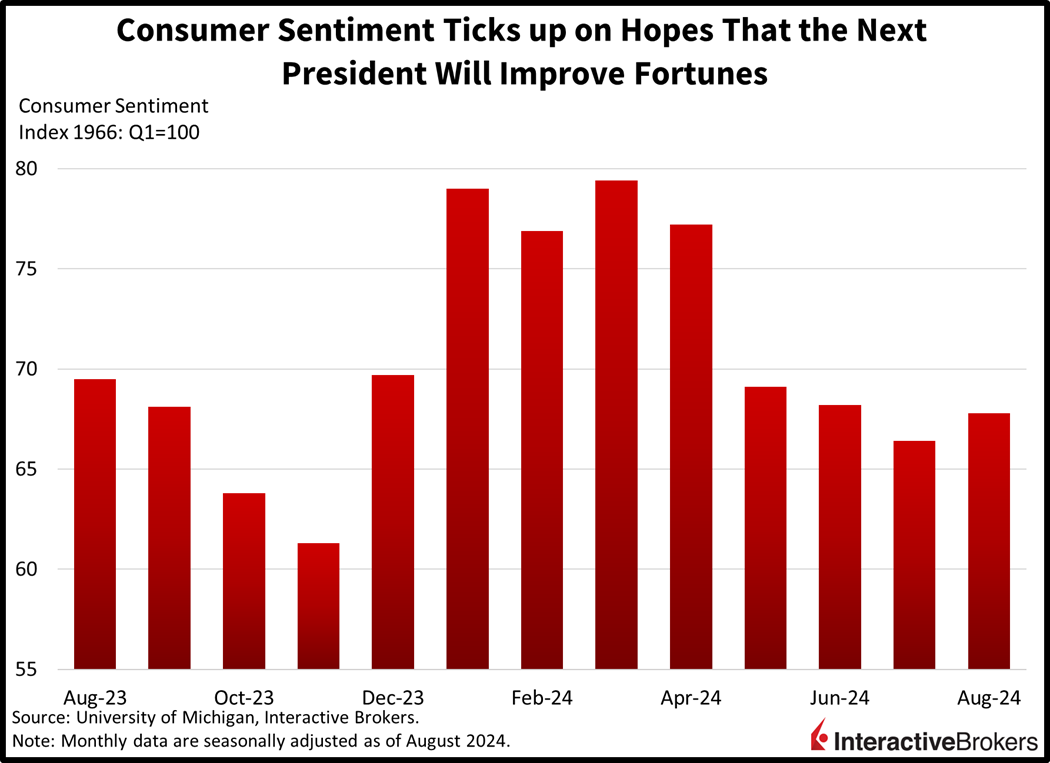

Today’s University of Michigan consumer sentiment survey release showed a modest improvement for August, with the gauge climbing from 66.4 to 67.8 month over month (m/m) and reaching the tallest level since June. While the figure exceeded the Wall Street consensus of 66.9, the IBKR Forecast Trader nailed the threshold at exactly 67.8. The report, however, showed bifurcated trends across the current conditions and consumer expectations sub-indices, with the former shifting south from 62.7 to 60.9 while the latter flew north from 68.8 to 72.1. Inflation expectations remained unchanged though, with both 1- and 5-year projections steady at 2.9% and 3%. Households are incredibly polarized when providing election opinions and their economic outlooks. Democrats believe the economy will fall apart if Harris doesn’t win, while Republicans believe if Trump fails to regain the helm, their financial fortunes will suffer.

Real Estate Suffers from More Than Summer Doldrums

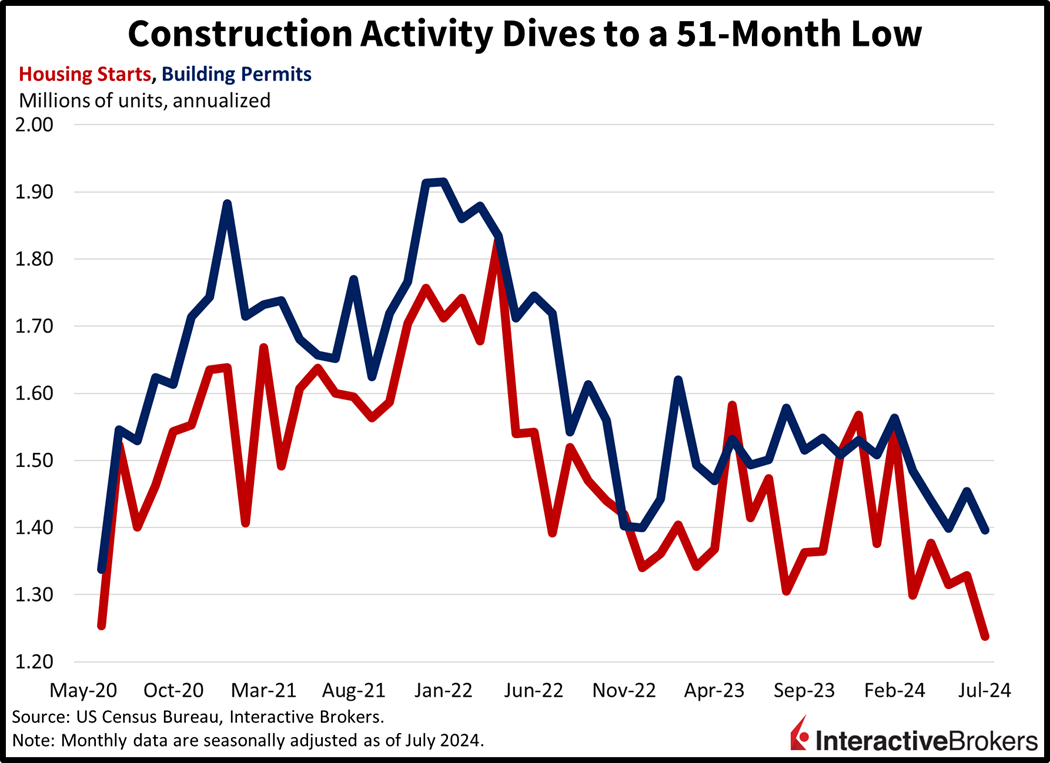

Last month’s real estate activity was dismal, but lower rates this month and loftier lumber costs point to a recovery around the corner. Housing starts and building permits plunged to 1.238 million and 1.396 million seasonally adjusted annualized units, missing the median estimates of 1.33 million and 1.43 million. July’s figures were worse than June’s 1.329 million and 1.454 million.

Starts were mixed across single- and multi-family properties while permits, which are filed prior to shovels hitting the ground, reflected widespread weakness. For starts, the pace of construction sank 6.8% m/m, hampered by the single-family segment dropping 14.1%. But the multifamily sector saw an increase of 11.7% and served to offset a heavy chunk of the sluggishness. Similarly, a 42.6% m/m increase in the Northeast blunted declines of 13.6%, 12% and 1.7% in the South, West and Midwest. Regarding permit applications, single- and multi-family declined 0.1% and 14.6% m/m and were also helped strongly by the Northeast, which saw a 16.2% bump. But the Midwest, West and South came in weak with declines of 12.6%, 5.3% and 4.2%.

Brute Computing Clout Isn’t Enough for AI

Companies that are developing artificial intelligence (AI) are looking for increased energy efficiency in computing systems, which is creating demand for Applied Materials’ products. In other earnings news, H&R Block reported strong quarterly results, causing its shares to rally more than 8% last night. Consider the following quarterly highlights:

- Applied Materials (AMAT) surpassed both revenue and earnings forecasts with the metrics climbing 5% and 12%, respectively, year over year (y/y). Additionally, the semiconductor equipment provider’s sales climbed to an all-time high. Results in China were particularly strong, while sales in South Korea also advanced. In contrast, US sales were nearly flat and Taiwan sales fell in the mid double digits. In a press release, Chief Executive Gary Dickerson said the race to develop artificial intelligence is fueling demand for the company’s products and services. Dickerson also observed that clients are emphasizing energy efficiency rather than pure computing strength as AI requires huge amounts of electricity. Customers, he said, are looking for a 10,000 times improvement in performance-per-watt over the next 15 years. AMAT’s upwardly revised guidance for the current quarter narrowly exceeded analyst expectations. Its shares rallied more than 5% yesterday but declined nearly 3% this morning.

- H&R Block (HRB) revenue climbed from $1.03 billion to $1.06 billion y/y, and along with its earnings, exceeded analyst consensus expectations. Its strong results for the fiscal fourth quarter were driven by higher net charges in both its tax return assistance service and online do-it-yourself offering. However, revenues were weaker for its Emerald Prepaid Mastercard that clients can fund with their tax returns. Shares of H&R Block jumped in response to the strong quarterly results and the company upgrading its guidance.

A Sleepy Summer Friday

Markets are a snooze fest as traders await clues from central bankers to embrace a more bullish or bearish tilt. Stocks and yields are near the flatline, but there is some livelier action occurring in currencies and commodities. The Dow Jones Industrial, Nasdaq Composite, Russell 2000 and S&P 500 are close to unchanged amidst mixed sector breadth featuring 5 out of 11 sectors in the green. Leading the bulls are the financials, consumer discretionary and communication services categories, which are moving north by 0.4%, 0.3% and 0.3%. To the downside, we have real estate, industrials and energy ticking south by 0.4%, 0.3% and 0.2%. In fixed-income land, the 2- and 10-year Treasury maturities are being offered at 4.09% and 3.91%. The Dollar Index is lower by 31 basis points (bps) as the greenback loses ground relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. The weakness stems from folks being concerned about the Fed being too accommodative during its anticipated easing cycle, with monetary policy hawks deciding to scoop up gold bars, with the metal’s price climbing 1.4% and exceeding the $2,500 an ounce level for the first time ever. Silver is up as well, but only by 0.3%, while crude oil, lumber and copper decline 1.6%, 0.3% and 0.2%. WTI crude is trading at $76.84 per barrel on the back of Qatar prime minister Mohammed bin Abdulrahman bin Jassim Al Thani sending a message from Doha to Tehran requesting an imminent ceasefire.

Powell’s Trip to Mound in Focus

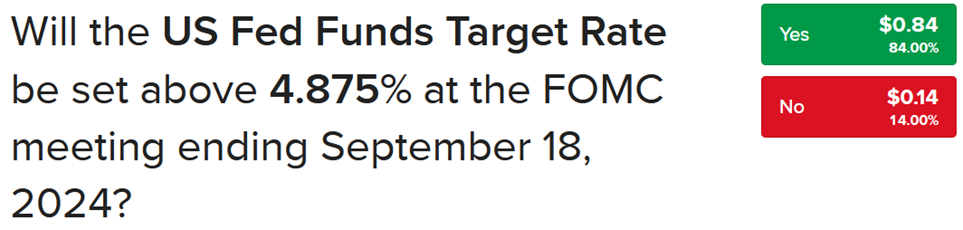

The strong market recovery this week is in many senses attributable to a relief rally and investors scooping up equities following the unwinding of the Japanese carry trade. Firmer-than-expected retail sales and unemployment claims reports helped ease recession fears but the news, along with accelerating shelter costs within the Consumer Price Index, dampened investor optimism for the Fed to slash 50 bps rather than the more typical 25 bp trim. With the exception of shelter expenses, inflation data this week was fairly benign, but a step down by the Fed, while widely expected, isn’t a shoo-in. Federal Reserve Bank of Chicago President Austan Goolsbee told NPR this morning that the central bank needs to be cautious about keeping borrowing costs restrictive for too long, especially since the economy doesn’t show signs of overheating. Despite his dovish comments, he declined to say if he will support a rate reduction next month. Fed Governor Michelle Bowman, however, appears more concerned about price pressures. Against the backdrop, the fed funds future market is now placing a 76.5% likelihood of the Fed slicing by only 25 bps, but our IBKR Forecast trader places it at 84%, presenting yet another golden arbitrage opportunity.

To learn more about ForecastEx, view our Traders’ Academy video here.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!