By: Jon Maier and Damanick Dantes

Editor’s Note: Conversational Alpha® (CA) is a vehicle we use for deeper and more relatable discussions about portfolio construction. In that sense, it represents both a journey and a destination. This report is a periodic look at journeys and destinations that investors may want to consider.

Market observers in the soft landing camp got a boost from a strong Q2 2023 GDP report and GDPNow’s expectations for the positive GDP trend to continue in Q3.1 Other market observers looked past the recent GDP exuberance and continued to point to the inverted yield curve and declining leading indicators as harbingers of a recession. They argue that the market may have to contend with one or two more Fed rate hikes, especially considering its 2.0% inflation target and the Personal Consumption Expenditures (PCE) Index lingering at about 4%.

The path to a goldilocks period is tenuous. It’s not easy to get everything “just right,” where there’s enough growth to avoid a recession without rising inflation. Potential downturns and declines in business activities and negative data surprises never seem too far away. To that end, the market’s been more sensitive recently, with the relatively small market downturn in August and early September due in part to concerns about China’s stalling economic growth and property market woes. Also, just how long the U.S. consumer can hold up is a question with debt levels rising and student loan payments due.

No matter which camp you’re in regarding recession prospects, it can be useful for investors to take a step back and identify what’s working. Because behind what’s working are often compelling investment opportunities that put a different spin on economic uncertainty and market volatility. When it comes to tangible inputs that drive economic performance, I’m of the view that America’s current monetary policy, recent economic activity, and business investment (hello, AI) suggest that it is uniquely positioned and set-up for long term growth.

Conversation Starters

- Inflation and jobs data suggest the Fed’s done pretty well compared to other central banks.

- The government’s investing in America and shovels are starting to hit the ground.

- U.S. companies are AI leaders and helping to usher in a new era in American manufacturing.

- Portfolio Considerations: Reasons for optimism and reasons for caution, so stay diversified.

- Moving On… Let’s Chart: Markets get a reality check and pull back on rate cut expectations.

The Fed Deserves a Pat on the Back

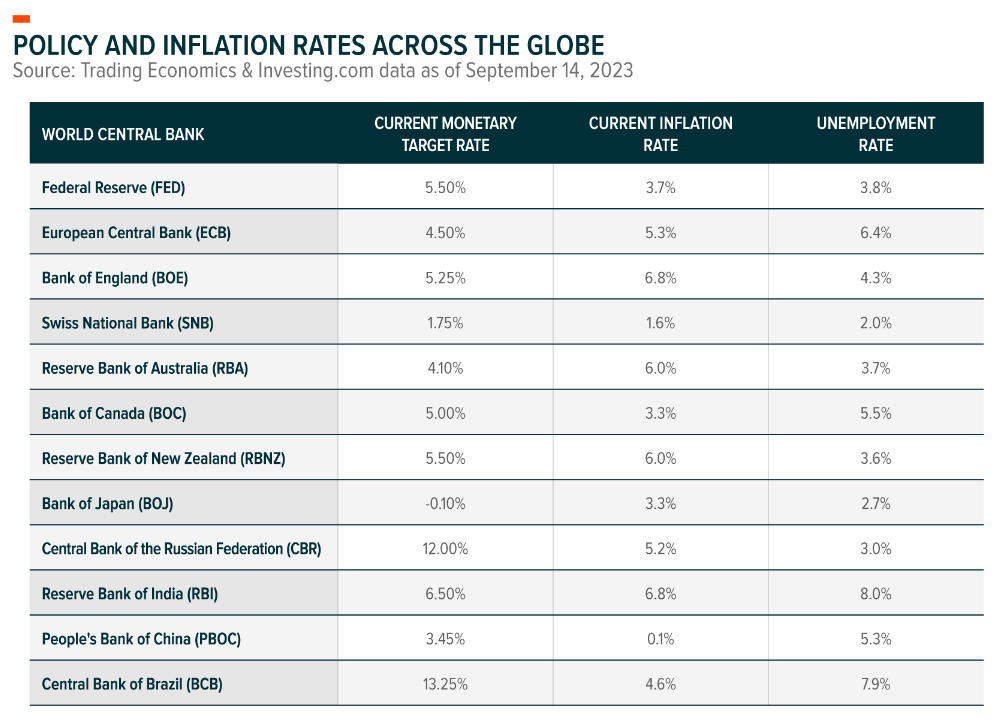

Compared to the rest of the world, we can make the argument that the Fed has done better at taming inflation while maintaining a strong labor market. For example, the European Central Bank raised its target policy rate to 4.25%, 125 bps lower than the Fed, but inflation is still over 5% and the unemployment rate is nearly 3% higher. The Bank of England’s approach is similar to the Fed’s, with its target policy rate just 25bps lower, but UK inflation is still hot, running at over 6.5% in the latest print.

Now, the situation in Europe is something of an unfair comparison, as central bankers there must moderate inflation while contending with variable rate mortgages and impacts from the war in Ukraine. But when looking for perspective on the U.S. situation, I think the comparison’s apt.

Elsewhere, the Bank of Japan (BoJ) held onto its decade-long strategy of long-term yields below 0.5% in an attempt to spark the economy and inflation. It was only in late July that the BoJ announced “greater flexibility” in its yield curve control program, to the surprise of many market participants.2 The People’s Bank of China is on an easing path amid an economic slowdown marred by a struggling real estate market, rising corporate debt obligations, and U.S. dollar strength hampering trade deals. Also, youth unemployment is over 21%, which is weighing heavily on sentiment.3 These factors contributed to the yuan falling to its lowest level this year.

Investing in America Shows Its Economic Might

When assessing the state of U.S. economic activity, one number stands out to me: 37,000. That’s the approximate number of new manufacturing, infrastructure, and clean energy investments announced since the passage of the Inflation Reduction Act and the CHIPS Act passed in August 2022 and the Infrastructure Investment Jobs Act in November 2021. Here’s another weighty number: $800 billion. That’s the approximate total investment in these projects thus far.4

We expect the Biden Administration’s Investing in America agenda to have significant impacts on the U.S. economy for years to come. These dollars hit different, as nonresidential construction is among the sectors with the most significant ripple effects in the United States. For each dollar of direct spending, there’s over three times as much in associated expenditure.5 Critically, spending U.S. dollars on these projects makes them less susceptible to currency fluctuations, especially as the dollar strengthens.

U.S. Reshoring Is Trending, and It’s an AI Story

Talk about AI efficiencies and the robotic revolution isn’t just theoretical, it’s happening, and U.S. companies are leading the charge. Nvidia and its chipmaking prowess is one example. OpenAI and its potentially transformation ChatGPT is another, albeit early stages. Maintaining and expanding this technology leadership is seen as national security, which was one of the primary motivations for the CHIPS Act. The bill directs about $53 billion for semiconductor manufacturing and another $24 billion worth of tax credits for chip production.6

Reconstituting supply chains is also a matter of national security, as the pandemic and geopolitical tensions revealed the fragility of long supply chains. U.S. companies are actively reshoring manufacturing operations to American soil, or at least contemplating a return, incentivized by capital expenditure benefits and fiscal stimuli. The integration of AI and robotics to automate manufacturing is part of the reshoring trend as companies seek to increase productivity and find new efficiencies.

Over the past 12 months, investment in the next generation of U.S. manufacturing surged over 80%, and for good reason.7 To replace the goods imported from China and Taiwan in just 2022, American companies would have to boost their domestic manufacturing production by 9%.8

Portfolio Considerations: No Surprise, Caution and Diversification Are Watchwords

An economic slowdown is our base case though we are not ruling out a mild recession. The specter of rate hikes at this stage of the cycle could have delayed repercussions, including a mild recession in the latter half of 2024. Tightening tends to manifest its effects in about 18 months. However, the reduced effectiveness of monetary policy could mean the lag of monetary policy may have gotten even longer. Therefore, yields may need to remain elevated for an extended period, potentially drawing out the length of time before the economy bottoms.

These factors increase the importance of diversification between both interest rate and economic growth sensitive areas of the market. Fiscal support and strong capex remain a key driver for infrastructure development while exceptionally strong demand for AI chips reflects a growing trend in AI adoption.

Let’s Chart: Markets Trim Rate Cut Expectations

The implied fed funds rate path shifted higher in September versus June, which occurred alongside a jump in short-term Treasury yields. This repricing also triggered a pullback in equities with prior leadership in cyclicals and technology stocks retreating.

Pricing for a Fed pause appears to be the most likely path over the next few months, emphasizing the importance of upcoming labor, consumption, and inflation data. Keep in mind there could be a limit to rising yields at this stage in the hiking cycle, especially with rates in restrictive territory and extreme bearish Treasury futures positioning. The adjustment in market expectations may also be influenced by latent lag effects, wherein prior monetary policy actions take time to manifest in the broader economy.

Footnotes

- Federal Reserve Bank of Atlanta, GDPNow, Sept 1, 2023.

- Reuters, Bank of Japan loosens grip on rates as prices rise, markets bet on bigger pivot, July 28, 2023.

- NY Times, China Young Unemployment, August 15, 2023.

- The White House, Investing in America¸ August 29, 2023.

- Stephen S. Fuller, Ph.D, The Contribution of Residential Construction to the U.S. Economy, May 14, 2020.

- McKinsey, The Chips and Science Act: Here’s What’s In It, October, 4, 2022.

- Forbes, US Manufacturers Reshoring but it will take a long time, August 19, 2023.

- Forbes, US Manufacturers Reshoring but it will take a long time, August 19, 2023.

—

Originally Posted September 15, 2023 – CIO Insights: The Case for America’s Current Economic Exceptionalism

Information provided by Global X Management Company LLC.

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Global X Management Company LLC serves as an advisor to the Global X Funds.

Disclosure: Global X ETFs

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!