According to the latest “China Luxury Report” by Bain & Company, China’s luxury market is poised for modest growth this year after a commendable 12% year-on-year increase in 2023. Looking ahead to the end of the decade, Bain estimates that Chinese consumers will represent between 35% and 40% of the global total.

This potential growth is underpinned by a surge in retail sales and tourism revenues, as well as an expanding consumer class. During the recent Lunar New Year holiday, tourism revenues surged 47.3% compared to the previous year, alongside record-breaking entertainment spending.

During the pandemic, over 90% of China’s luxury shopping occurred domestically as international borders were slammed shut. This figure is projected to fall to around 70% this year as more Chinese consumers are able to travel abroad, Bain says. Chinese luxury spending in Europe and Asia last year was 40% to 65% of 2019 levels, but this is also expected to improve.

109 Million New People Joining The Consumer Class

The global share of Asia in the personal luxury goods market has reached an impressive 38%, with China contributing the lion’s share, according to KPMG. This dominance is not only a testament to the country’s economic might but also its evolving consumer market, fueled by rising incomes and middle-class consumption. By 2030, the World Bank says, the Chinese middle class is expected to represent a staggering 70% of the country’s population, wielding considerable purchasing power and reshaping global luxury consumption patterns.

Moreover, the World Data Lab believes that 109 million people will enter the consumer class this year, despite economic slowdowns in Asia. India and China are at the forefront of this expansion, adding millions of new consumers and significantly influencing global luxury dynamics.

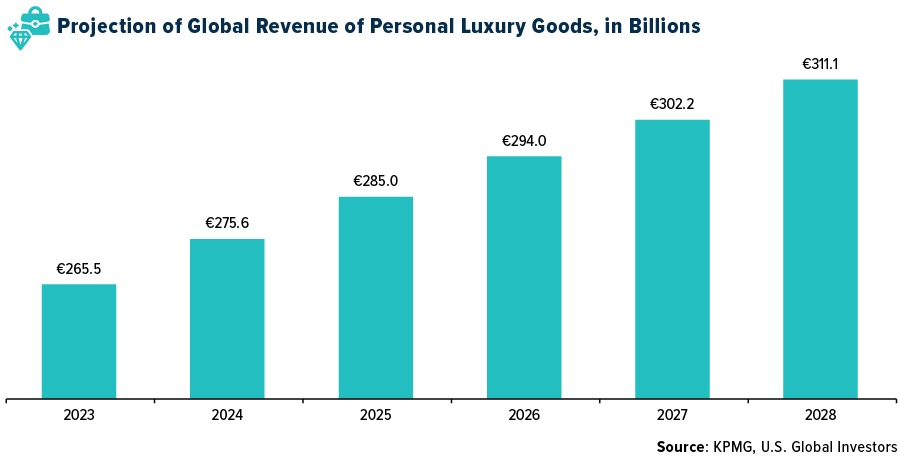

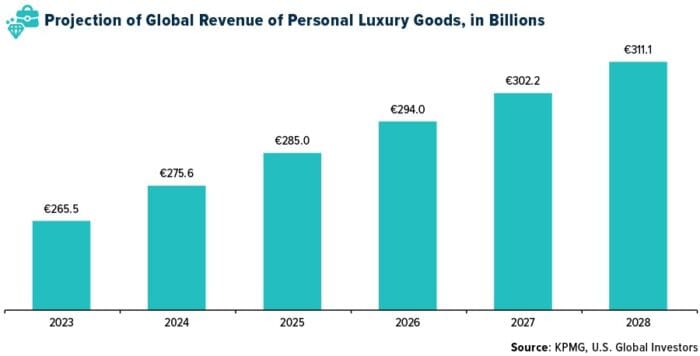

We are cautiously optimistic about the global personal luxury goods market, despite economic headwinds. Luxury revenues are projected to expand at a compound annual growth rate (CAGR) of 3.2% from 2023 to 2028, hitting over €311 billion by 2030. Factors such as rising disposable income, technological advancements and heightened brand awareness through social media and marketing strategies are poised to drive growth, appealing to a broader consumer base.

—

Originally Posted March 6, 2024 – China’s Luxury Market Set For Modest Growth In 2024

Performance data quoted above is historical. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

The S&P Global Luxury Index is comprised of 80 of the largest publicly-traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

Mutual fund investing involved risk. Principal loss is possible. Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Companies in the consumer discretionary sector are subject to risks associated with fluctuations in the performance of domestic and international economies, interest rate changes, increased competition and consumer confidence.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!