ZINGER KEY POINTS

- Country Garden’s bonds jumped 20% as the company narrowly avoided default.

- Analysts remain skeptical about the long-term outlook for the developer.

Bonds issued in U.S. dollars by China’s troubled real estate developer Country Garden Holdings Co. Ltd. soared on Tuesday after the company made a last-minute interest payment following the end of the grace period.

Grace Period Drama

After missing the $22.5 million coupon payments on two $500 million bonds in August, Country Garden Holdings settled the payment on Sept. 5, just before the 30-day grace period deadline, successfully avoiding a default that could have sent shockwaves through China’s fragile property sector.

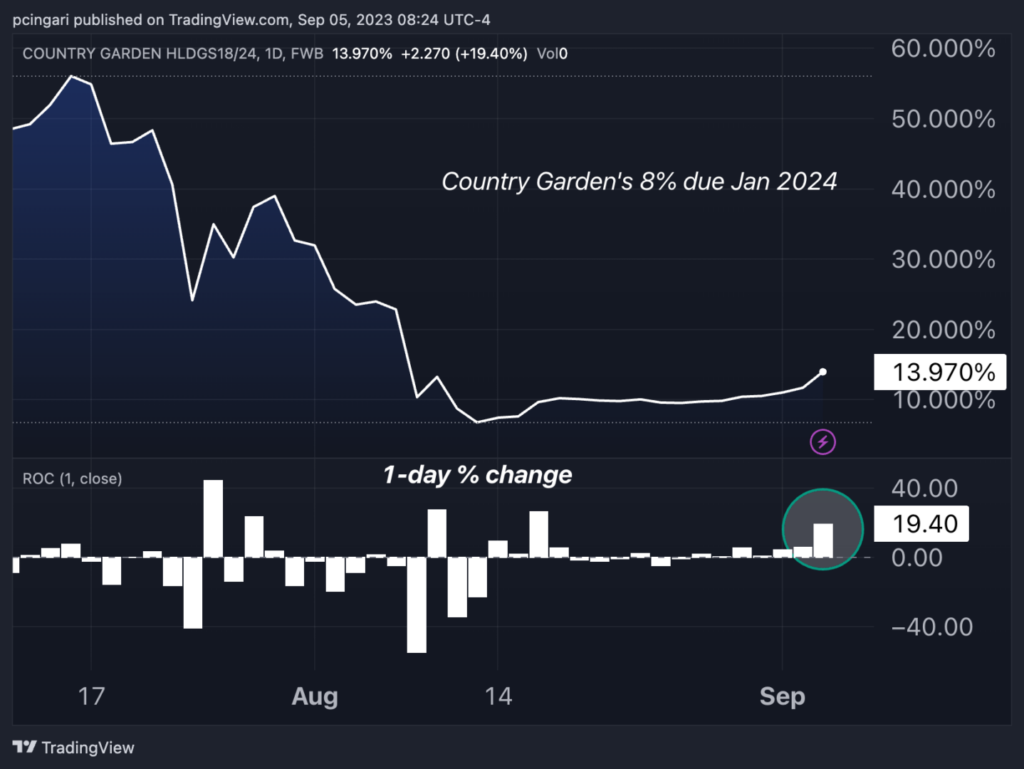

The bond, set to mature in January 2024 with a semi-annual coupon of 8%, saw an astonishing 20% jump in value on Tuesday, after the developer avoided a default.

However, it closed at a still precarious 14 cents on the dollar, underscoring the persistent threat of a looming debt default.

Chart: Country Garden Holdings Company Limited 8.000% 27 Jan 2024

Market Response

On Monday, the company’s Hong Kong-listed shares had soared 15% as the developer received creditor approval to extend payments on a 3.9 billion yuan ($540 million) onshore private bond over the next three years, providing some breathing room.

However, despite avoiding a default on Tuesday, shares of Country Garden traded in Hong Kong closed 1% lower, highlighting lingering concerns about the company’s future.

Despite narrowly avoiding a technical default, industry experts express reservations about the company’s long-term outlook. J.P. Morgan analysts caution that with 18 billion yuan in bond servicing due by year-end and continuing weak sales, the risk of default, distressed exchange, or potential restructuring is on the ascent.

Zerlina Zeng, a senior credit analyst at CreditSights, echoes these concerns in an interview with Bloomberg, emphasizing that Country Garden’s recent actions haven’t substantially improved its financial standing. She suggests that the company’s future hinges on a sustained increase in home sales, which currently seems challenging.

Not Out Of The Woods

Country Garden grapples with a staggering debt load of $187 billion, earning the distinction of being the world’s most indebted developer. The company’s extensive projects across markets, including mainland China, Australia, Indonesia, Hong Kong, and the U.S., are under scrutiny.

The broader market sentiment reflected Country Garden’s struggles, as the Hang Seng Index, tracked by the iShares MSCI Hong Kong Fund Index tumbling 2.06% on Tuesday, underscoring concerns about China’s faltering economic recovery.

The nation’s service activity gauge, as assessed by the Caixin Services PMI, further eased to 51.8 in August 2023, largely missing market expectations of 53.6 and underscoring the lowest rate of expansions since the start of the year.

Country Garden’s last-minute bond payment may have bought them time, but the broader challenges facing China’s real estate sector remain unresolved, leaving investors cautiously watching Beijing’s future moves.

—

Originally Posted September 5, 2023 – China’s Country Garden Skirts Default, Dollar Bond Spikes 20%: Unresolved Risk Remains

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!