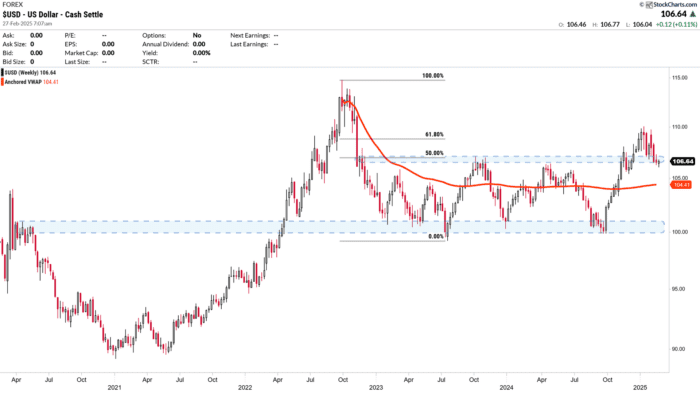

1/ USD at a Crossroads

2/ Will the Yen Continue to Strengthen?

3/ Preference for Value Stocks

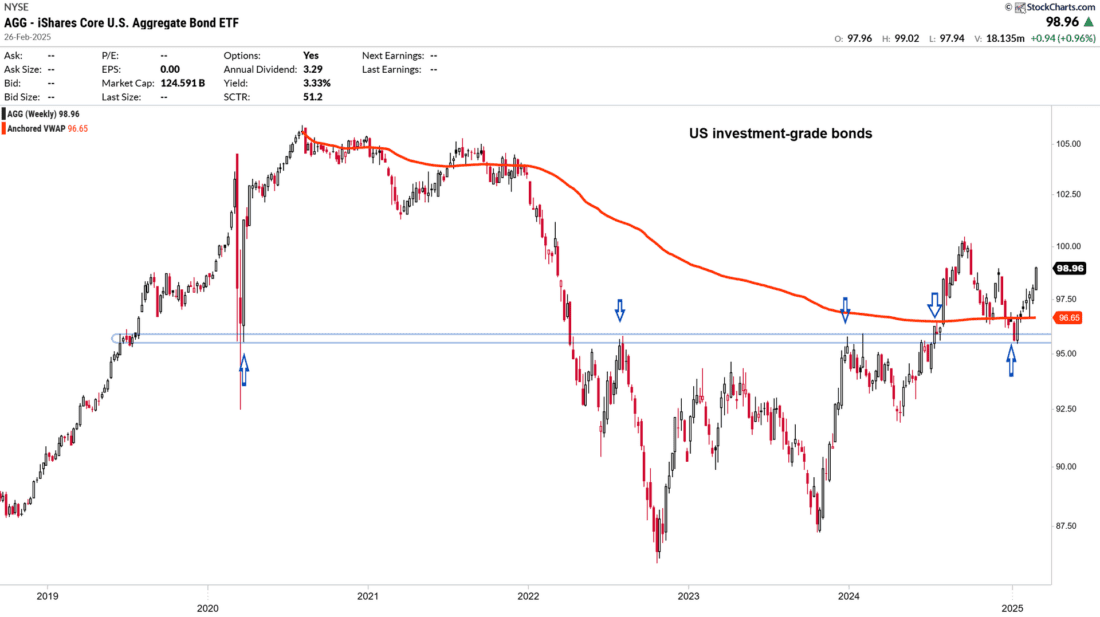

4/ AGG Looking Higher

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

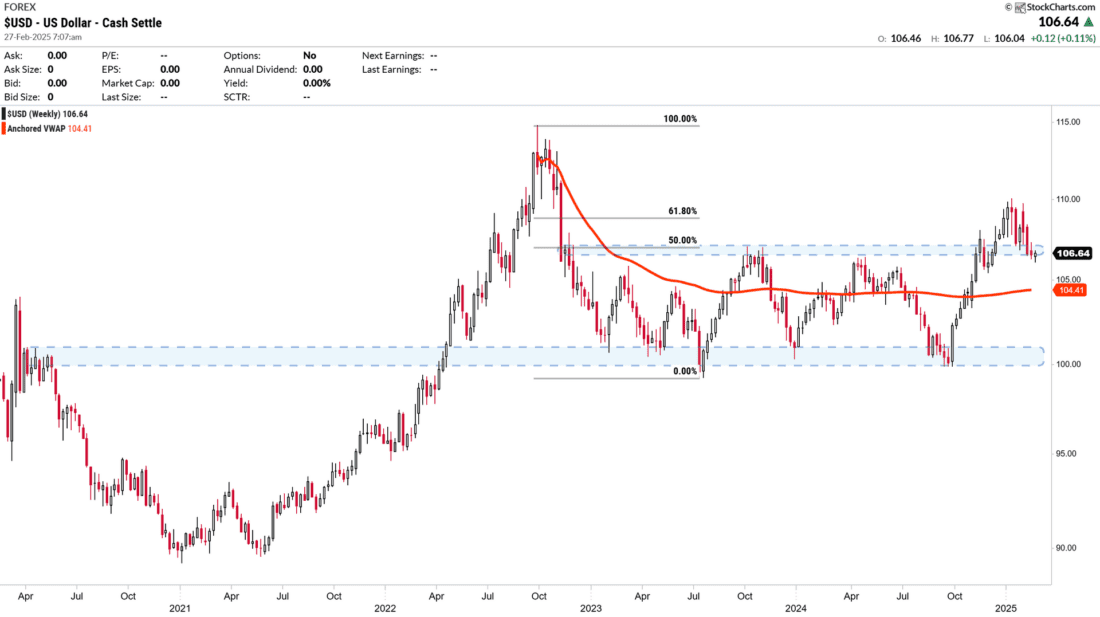

USD at a Crossroads: Key Support at 106 in Focus

The US dollar rose 0.30% during today’s session. However, the trend remains bearish, influenced by concerns about US economic growth and the possibility of new tariffs by the Trump administration.

The price continues to hold on to the 106 area, which is still quite relevant, now with a supporting role. The 106 level has been a key resistance on multiple occasions in 2023 and 2024. At various times when the dollar attempted to overcome this barrier, it faced rejection. Once it was broken to the upside, it became support, meaning it is now a reference level where buyers can enter if the dollar continues to correct.

If the index breaks below 106, we could see a bearish acceleration towards 105 levels. If this zone is lost, the fall towards the 100-point support would have very little resistance.

Investors are watching for the Fed’s comments on future interest rate decisions. If the DXY holds at 106, it could signal that the market remains confident that the Fed will keep rates high for longer. If, on the other hand, it were to break below this level, it could signal that the market is pricing in more aggressive rate cuts in the coming months.

2/

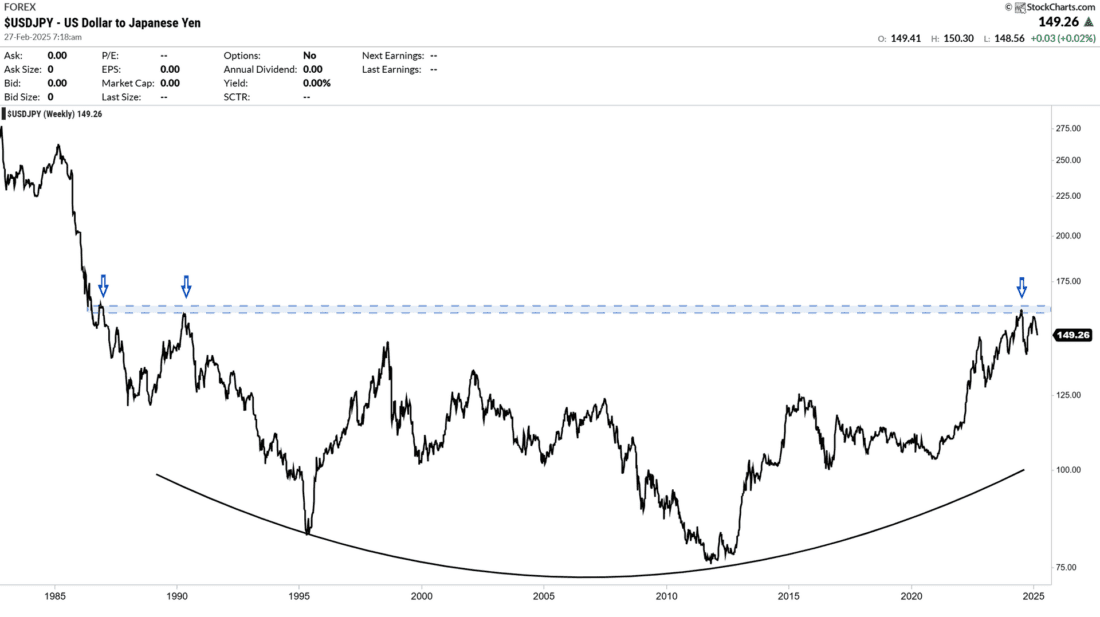

Will the Yen Continue to Strengthen?

The dollar’s recent weakening has been reflected in a strengthening in other pairs such as the euro and the Japanese yen. If this trend continues, it could have an impact on international trade and the competitiveness of U.S. exports.

[eos] The USD/JPY pair is around 149.09 and continues its decline after bouncing off the 160 area. Several months ago, there was talk of the importance of this area, which had already slowed the pair’s rise in 1986 and 1990. Many questioned the relevance of this area, as many years had passed. But, as the definition of what resistance is, the price has been rejected by this zone again in 2024 and, since then, the pair has not been able to overcome it.

The global risk-off sentiment and rising expectations for further interest rate hikes by the Bank of Japan (BoJ) could boost the Japanese Yen (JPY) and limit the pair’s upside potential. The BoJ is anticipated to raise rates from 0.50% to 0.75% this year, which could influence investor sentiment and support the JPY.

The combination of tighter monetary policy by the Bank of Japan, strong economic indicators, and a weak U.S. dollar suggests that the yen could maintain its strength in the near term.

3/

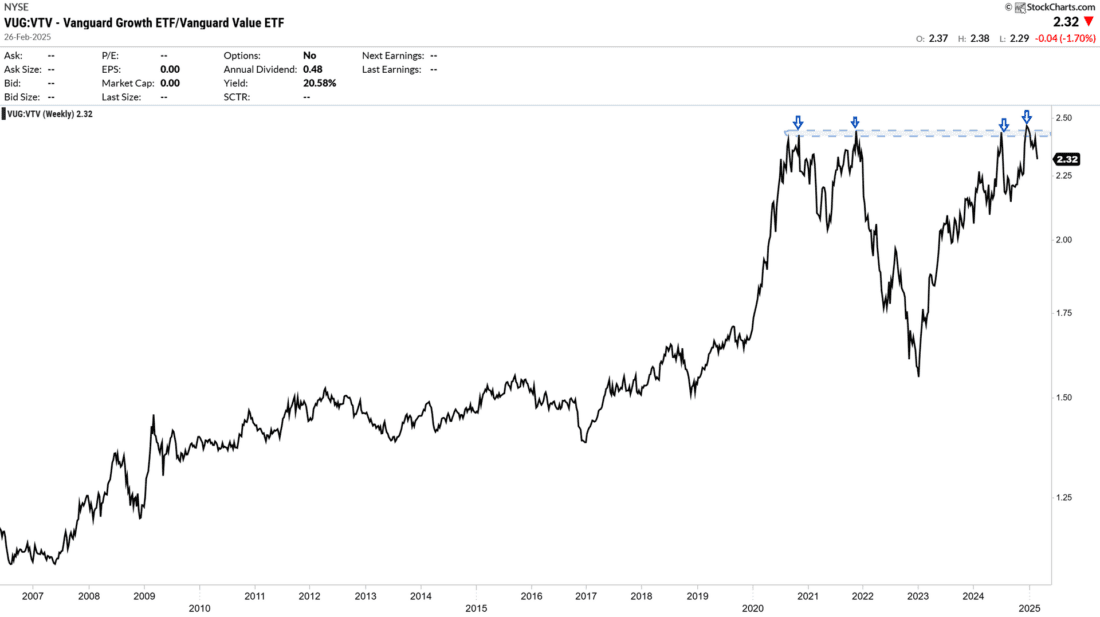

Growth vs. Value: VUG/VTV Ratio Signals Market Preference for Value Stock

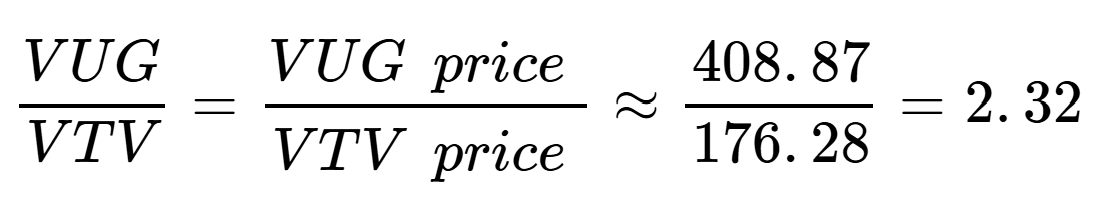

The VUG/VTV ratio measures the ratio between the Vanguard Growth ETF (VUG) and the Vanguard Value ETF (VTV), providing insight into the relative performance of growth versus value stocks.

To calculate the VUG/VTV ratio, we divide the price of VUG by that of VTV:

A ratio of 2.32 indicates that growth stocks (VUGs) are currently outperforming value stocks (VTVs). This increase in the ratio suggests a recent market preference for growth-oriented investments. However, when analyzing the results of this ratio since the end of December, we see how the ratio has gone from around 2.50 to the current 2.32. This denotes a bearish trend after being rejected again by resistance around 2.5.

While in the long term, growth stocks have outperformed value stocks, macroeconomic conditions such as interest rates and economic growth expectations may influence the market’s preference for growth or value stocks.

At the moment, we are seeing a rotation towards value companies by investors, taking a more defensive stance.

4/

AGG: A Stable Investment Opportunity in a Shifting Rate Environment

The iShares Core U.S. Aggregate Bond ETF (AGG) is an exchange-traded fund that seeks to track the performance of an index composed of the total U.S. investment-grade bond market. This ETF offers investors diversified exposure to Treasuries, mortgage-backed securities, and high-credit-quality corporate bonds. More defensive stance.

AGG is composed of:

- US Treasuries: 44.54%

- Mortgage-backed securities (MBS): 22.53%

- Corporate bonds: 24.67%

- Others: 8.26%

The expectation of rate cuts from the Federal Reserve has boosted bond appetite, as a reduction in rates tends to increase prices for longer-duration bonds.

Recent volatility in equities has led some investors to take refuge in bonds, benefiting AGG. Inflation hesitancy: While inflation is down from 2022 peaks, it remains above the Fed’s 2% target, maintaining uncertainty about the pace of future rate cuts.

After the rebound on that marked support zone, where the VWAP drawn from the highs of 2020 and the 95-point zone, which has changed roles as many times, converge, the price remains on the rise and has been positive for almost 4 weeks.

—

Originally posted 27th February 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!