1/ US Home Construction Eyes Further Gains

2/ Mexico Faces Imminent Decline

3/ Consumer Staples Peaks, Pullback Expected Soon

4/ S&P 500 Equal Weight Near Highs, Pullback Expected

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

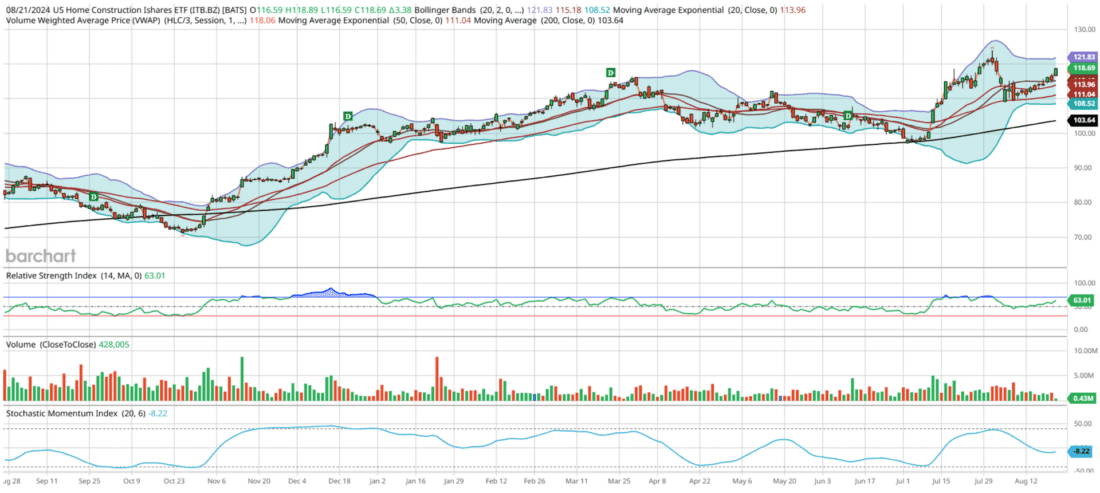

US Home Construction Eyes Further Gains

Courtesy of barchart

One of the hottest subsectors over the past year has been U.S. Home Construction, as reflected in the ITB ETF. Despite dipping below its 200-day moving average only once, during the 52-week lows last October at $71.22, and never reaching oversold territory on the Relative Strength Index (RSI), this group has rebounded impressively, hitting an all-time high of $123.89 on July 31st. Notably, ITB maintained overbought conditions throughout December—a rare achievement for a subsector—and remained overbought for half of July.

With DR Horton and Lennar making up 29% of its holdings, ITB’s 200DMA is on a strong upward trend, currently at $103.64. Remarkably, this ETF was largely unaffected by the Japan crash, quickly resuming its bullish trajectory. Given the strong momentum, I anticipate further gains in the next two weeks, with ITB likely to rise to $123.35, just shy of its all-time high, for a potential 4% advance, even after today’s 2.9% gain.

2/

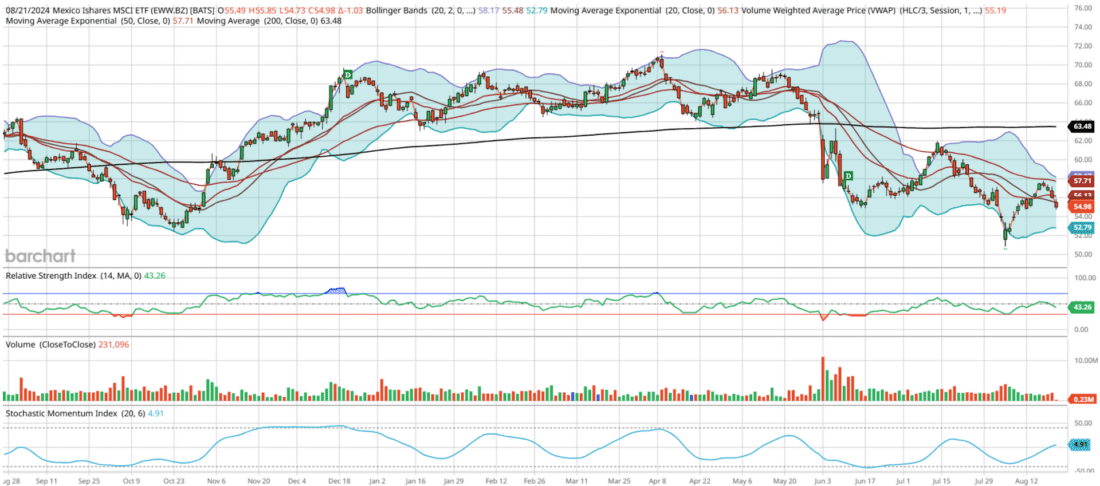

Mexico Faces Imminent Decline

Courtesy of barchart

Mexico’s chart presents a compelling narrative, deeply influenced by the political turbulence surrounding the June 3rd elections. The aftermath of these elections triggered an oversold phase that persisted for nearly two weeks, causing significant market jitters. The iShares MSCI Mexico ETF (EWW) plunged to a new 52-week low of $50.84 during the Japan crash, highlighting the broader market’s vulnerability to global shocks.

The 200-day moving average (200DMA), currently at $63.48, has remained stagnant since the ETF hit its previous 52-week high of $71.12 on April 9th. This flatlined 200DMA has become a formidable barrier, acting as a critical resistance level since the June elections, reflecting the market’s struggle to regain momentum. Despite these challenges, the ETF staged an impressive recovery, surging 14% over an 11-day

period from August 5th to 16th, showcasing the market’s resilience. However, this rally appears to have expended much of its energy, with the Relative Strength Index (RSI) only reaching 50, indicating a lack of strong upward momentum.

Given the ETF’s recent performance and the broader market conditions, I anticipate a period of consolidation over the next three weeks. This consolidation is likely to result in a decline to around $52.47, representing a 4.5% drop from current levels. Even after today’s 1.8% decline, the outlook suggests that the market may struggle to maintain its recent gains, and investors should prepare for potential further downside.

3/

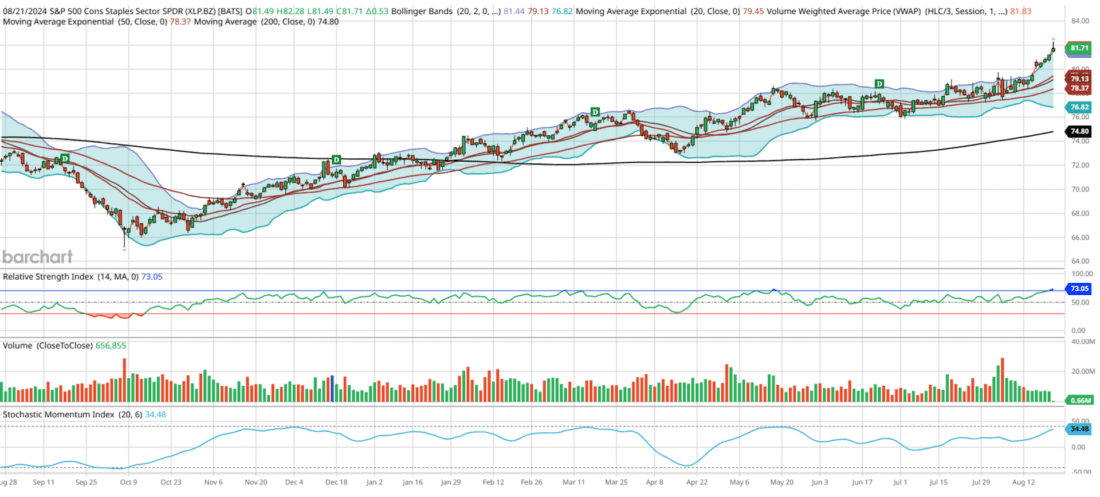

Consumer Staples Peaks, Pullback Expected Soon

Courtesy of barchart

I want to highlight the evolving trends seen in the upcoming charts, particularly focusing on the S&P 500 Consumer Staples Sector SPDR (XLP). Today, XLP reached new all-time highs, largely driven by Walmart’s record performance, which followed strong earnings from Target. This ETF, with 39% of its holdings in major companies like Procter & Gamble, Costco, and Walmart, had struggled until late January but has since held

above its 200-day moving average (200DMA) of $74.80.

After hitting a 52-week low of $65.18 on October 6th, the sector has shown impressive recovery. Factors contributing to this strength may include a shift in investor focus beyond mega-cap tech stocks, changes in consumer spending patterns, and a flight to defensive plays. Despite the strong momentum, XLP rarely stays overbought for long, and its current position above the upper Bollinger Band suggests it might be approaching a near-term peak.

Given this context, I anticipate a pullback to around $79.15 over the next three weeks, which would be a decline of about 3%. This correction would be a typical retracement in the context of an overall uptrend, allowing the ETF to consolidate before any potential further gains.

4/

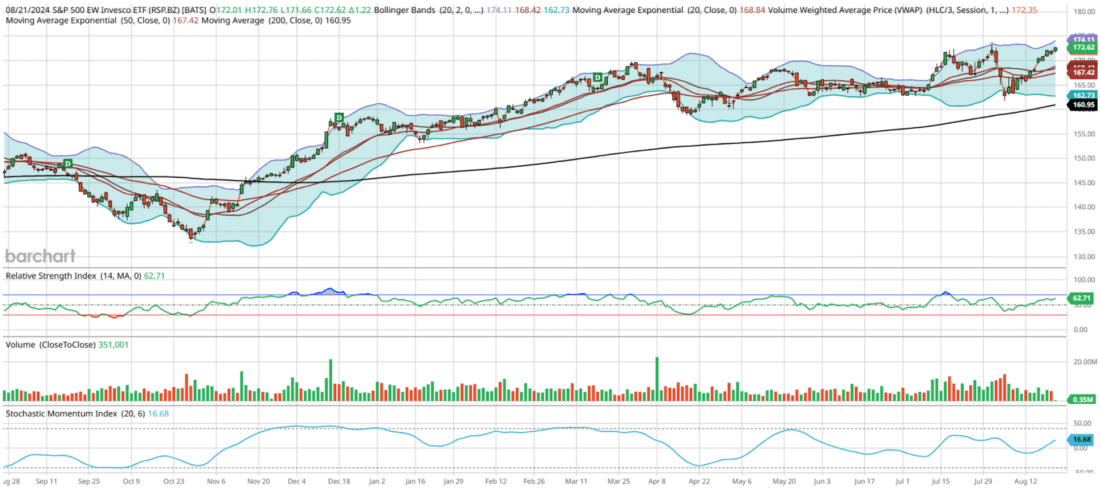

S&P 500 Equal Weight Near Highs, Pullback Expected

Courtesy of barchart

One of the most critical charts in the market, on par with semiconductors, is the Invesco S&P 500 Equal Weight ETF (RSP). Unlike tech-heavy funds like SPY or QQQ, RSP holds all 505 S&P members with equal weighting, around 0.20% each, offering broader diversification. Currently, it’s just 0.35% away from new all-time highs, following a strong rise from its 52-week low of $133.34 on October 27th. After successfully holding its 200-day moving average (200DMA) starting in mid-November, that important support level is now at $160.95, about 7% below current levels.

RSP has been range-bound between $159 and $173, a 9% range, for the last six months. With a rising 200DMA, a breakout is likely in the future, but not immediately. There may be a 1% or more upside this week, possibly driven by Federal Reserve Chair Jerome Powell’s comments at Jackson Hole, amid interest rate cut expectations. However, I expect RSP to pull back to $168.38, its 21-day exponential moving average, over the next three weeks, marking a decline of about 2.5%.

—

Originally posted 22nd August 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!