1/ PCE on Friday

2/ Home Appliance Pricing Woes

3/ Is Good Inflation a Thing?

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

PCE on Friday

Monday markets were treated to the S&P Global flash PMIs (Purchasing Managers’ Indexes) for March for several countries. This data is intended to offer investors insight into how businesses are faring currently, in hopes that analysts will find it useful. As a result this information is thought to be influential to market price movements.

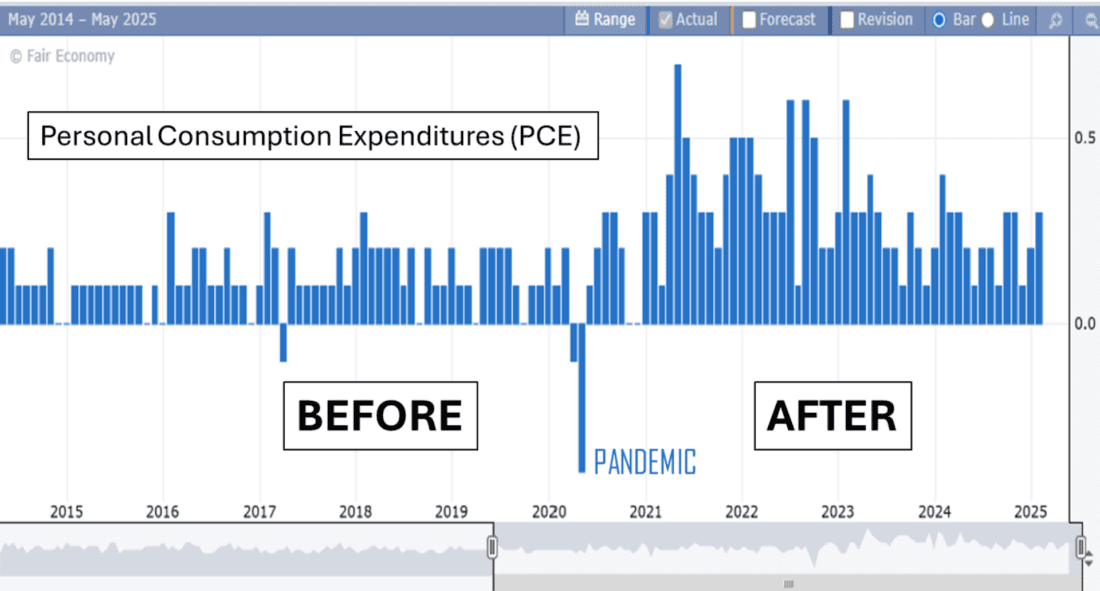

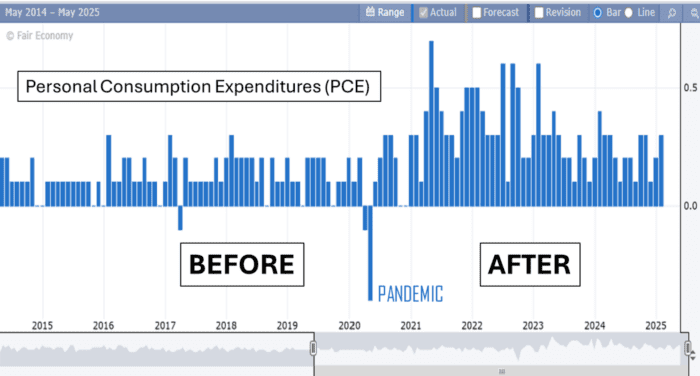

Except for when it is not, as was the case today. Although the report contained a fair bit of reference to tariffs and inflation, the market shrugged it off. So it seems the fear of inflation has appeared to lose its ability to scare anyone. Consider that Friday’s Personal Consumption Expenditures (PCE) report is perhaps the most influential number the Fed is watching right now, but the data here has only one recognizable pattern to it (see chart).

Though inflation has cooled from its post-pandemic highs, the impact of helicopter money still lingers, prompting Fed watchers to feel doubtful about the influence of continuing to hold rates high. Now, most investors have all fingers crossed for a rate cut or two this year.

2/

Home Appliance Pricing Woes

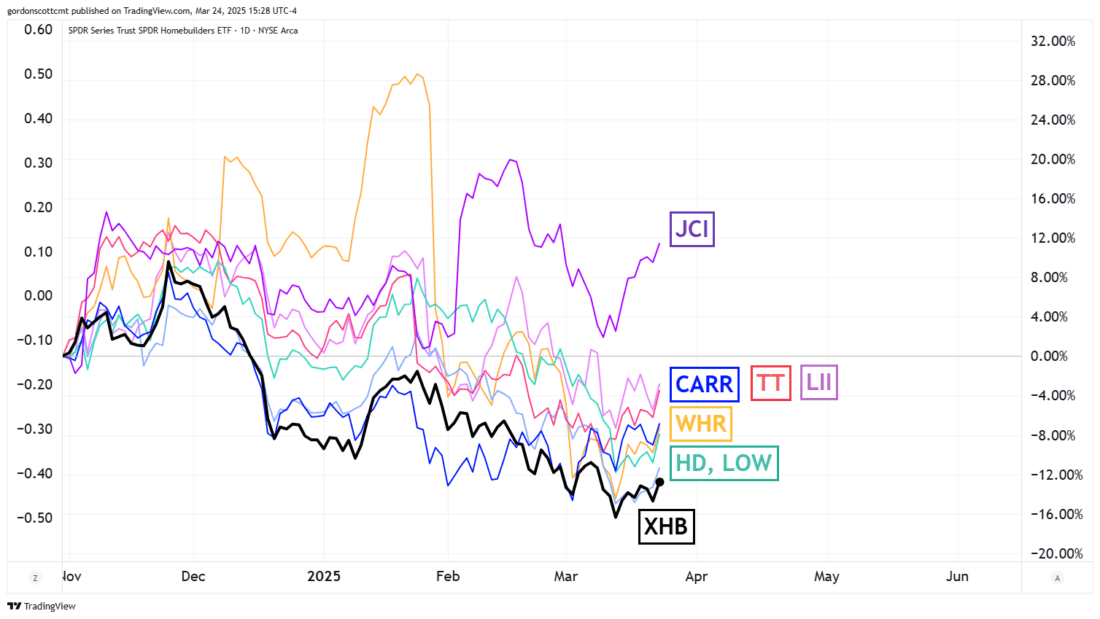

One influence that should show up in the PCE report would include the price of appliances. These are considered the tip of the spear in the conversation about tariffs and inflation. But just how valid is that concept? Consider the second chart which compares the SPDR S&P Homebuilders ETF (XHB), with several of its appliance-company components.

This chart shows that nearly all of these companies are outperforming the index that they are a part of since the election (when the word “tariff” began to enter the financial news). Johnson Controls (JCI) is actually up 12% since then, though all others have declined. This chart seems to indicate that investors are more concerned about housing demand rather than inflation in particular.

3/

Is Good Inflation a Thing?

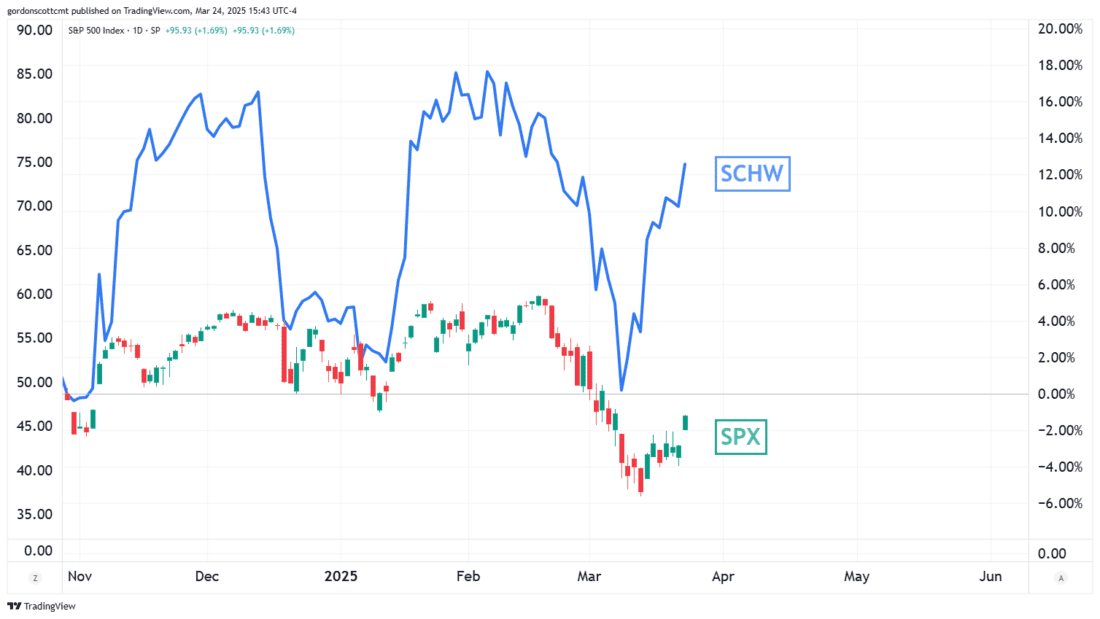

At least one company is likely to benefit from inflationary pressures and the outlook of continued high interest rates. Charles Schwab (SCHW) has been the beneficiary of a very large self-clearing operation. This allows them to benefit from the spread between what they can earn on investors held cash and the interest rates they pay out to their customers (which aren’t too bad actually).

If there were such a thing as good inflation, it would be in the minds of SCHW shareholders. Schwab’s business model benefits from higher interest rates. Should the Fed enact rate cuts, expect this broker’s stock price to see downward pressure.

—

Originally posted 25th March

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!