By J.C. Parets & All Star Charts

Thursday, 29th June, 2023

1/ Stocks Post a Perfect Month

2/ JPMorgan Makes the Move

3/ Is Copper Due for a Bounce?

4/ Airlines Fly Through Resistance

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

1/ Stocks Post a Perfect Month

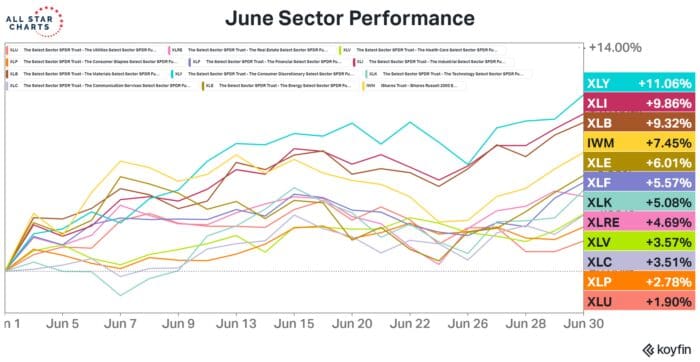

Not only is June now in the books, but the second quarter and first half of 2023 are officially behind us as well. Let’s take a step back and review the sector performance.

While the majority of sectors are positive on a year-to-date basis, we’ve been looking at whether lagging groups like financials and energy will pick up the pace and play catch-up. This month, it appears that this is finally happening.

Here is the monthly performance of all the large-cap sector SPDR ETFs:

Notice how energy and financials are toward the top of the list with gains of roughly 6% in June. We’ve also included the small-cap Russell 2000 Index (IWM) in the performance chart, as it is in the laggard camp as well.

IWM gained 7.45% this month, marking the first time the small-cap average has outperformed the Nasdaq 100 all year. We think this is constructive, as it speaks to a healthy broadening of the current bull market.

When we look at our expanded universe of 42 sector ETFs and indexes, every single one was higher in the month of June. Long story short, this is bull market behavior at its finest.

2/ JPMorgan Makes the Move

When we look at individual stocks, JPMorgan Chase (JPM) stands out this week as it emerged to new 52-week highs.

We treat JPM itself as an index, as it provides us with excellent information regarding the banking industry and financial sector at large.

As you can see, price is piercing through a critical level of overhead supply around $145. This level coincides with the 61.8% retracement from the last decline, making this breakout even more notable. JPM is also making new highs relative to its financial sector peers (not shown in chart). We’re looking for additional confirmation in the form of an overbought momentum reading next week.

If the biggest bank in the U.S. is achieving new highs, we don’t see the stock market and global economy falling apart anytime soon. Instead, banks and other underperforming stocks could start catching higher.

3/ Is Copper Due for a Bounce?

Few commodity-related stocks provide a closer pure play on their underlying commodity market than Freeport-McMoRan (FCX).

If you don’t want to trade copper futures, look no further than FCX, as 90% of its revenues come from copper mining.

Because of this, notice how closely the stock trades alongside the price of copper:

We don’t want to make the assumption that these lines resolve in opposite directions over longer time frames. So who’s got it right?

Will the near-term weakness in copper abate as it catches higher to a more resilient FCX? Or will FCX correct lower to its underlying commodity market?

Based on the overwhelming strength from the industrial and materials sectors in June, there is evidence to suggest that copper futures could be due for a bounce.

4/ Airlines Fly Through Resistance

Cruise lines are moving and airlines are taking off. People are going places. Such a bustling travel industry is typically not associated with a weak consumer or economy.

At the beginning part of June, Delta Air Lines (DAL) broke above its early 2023 resistance zone. As the biggest holding in the global airline ETF (JETS), this was a sign that other airlines had positive performance ahead of them.

We are now seeing that take place as the rest of the industry is really kicking it into gear and following Delta’s lead. It took a few weeks, but JETS is now sporting the same pattern as DAL as it breaks above its equivalent level at the year-to-date highs.

With groups like airlines and transportation stocks resolving from textbook bases and making fresh 52-week highs, the market continues to send risk-on signals.

—

Originally posted 29th June 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!