By Kapil Mokashi, CMT, CFP

1/ Nasdaq’s Silent Warning: A Closer Look at Key Components

2/ Natural Gas – Bearish Pressure to Persist

3/ Is this Indian E-commerce stock waking up from the slumber?

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Nasdaq’s Silent Warning: A Closer Look at Key Components

Although the index itself appears neutral with a sideways movement in the last 1 week, several of its heavyweight stocks are showing signs of weakness that could foreshadow a broader downturn. Let’s look at a few of these bellwether stocks.

Apple (AAPL):

Apple has been trading in a narrow range, displaying a series of bearish to indecisive candles. This price action is occurring around the levels of a previous professional gap-down, which has served as a strong resistance zone. The stock’s inability to break above this level indicates that the bulls might be losing steam.

Nvidia (NVDA):

Nvidia is encountering multiple hurdles in the $135 to $140 range, highlighted by two strong bearish engulfing patterns. These patterns suggest significant selling pressure, making it difficult for the stock to break through this resistance, irrespective of any positive earnings outcomes.

Microsoft (MSFT):

Microsoft stands out as one of the weaker stocks among the tech giants. The stock has broken below a long-standing weekly upward-sloping trendline and was one of the first to breach its 20-week EMA. This technical breakdown could signal further downside potential.

Amazon (AMZN):

Amazon’s chart tells a similar story, with the stock entrenched in a well-defined downtrend on the daily chart. Additionally, Amazon has broken below its 20-week EMA, further confirming its bearish stance.

Other Key Players: Meta, Tesla, Alphabet, and Netflix –

The charts of Meta, Tesla, Alphabet, and Netflix also exhibit signs of weakness. Each of these stocks is struggling near key resistance levels, with the presence of bearish or indecisive candles signaling potential downside risk.

To summarize, while the Nasdaq Composite Index may appear neutral or sideways at first glance, a closer examination of its individual components reveals a different story. The cracks forming in these top Nasdaq stocks suggest that the index could be on the verge of a meaningful correction in the short term. Traders and investors should remain cautious and monitor these key levels closely.

2/

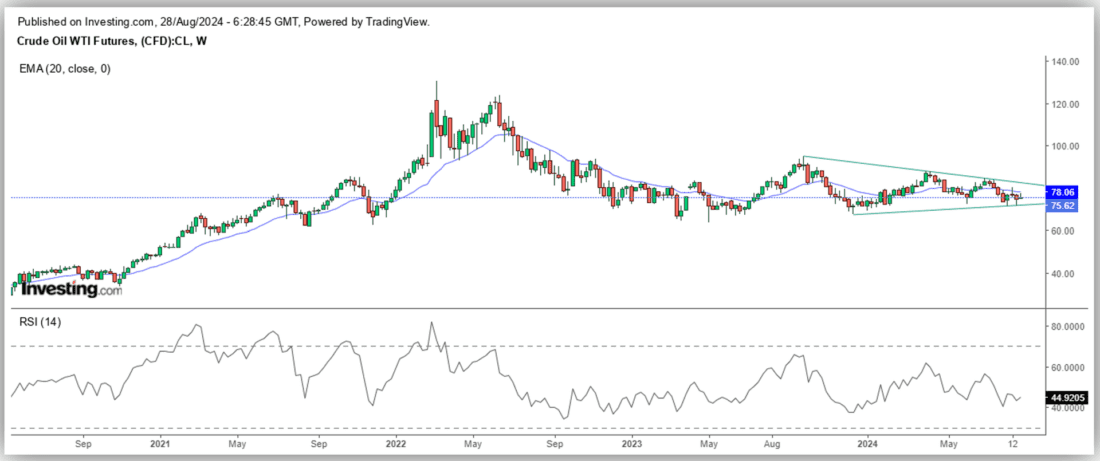

Bearish prospects for Crude

Crude oil prices are under pressure after an initial rally of 3% following the temporary halt in Libya’s production. While the supply disruption initially buoyed prices, the rally has since faded. Goldman Sachs has projected that Libya’s production halt will be short-lived, and their outlook has shifted, reflecting broader concerns about global demand. The investment bank recently cut its average Brent forecast for 2025 by $5 per barrel, now expecting prices to range between $70 and $85, with an average of $77 per barrel.

The bearish sentiment is further compounded by economic indicators from the world’s largest economies. In the U.S., consumer confidence surged to a six-month high in August, yet this optimism is clouded by rising anxiety over the labor market. The unemployment rate has jumped to 4.3%, a level not seen in nearly three years. Meanwhile, Germany’s economy contracted in the second quarter, adding to fears of a broader slowdown.

China’s economic deceleration is particularly concerning. As the world’s largest energy consumer, any significant slowdown in China would likely dampen global oil demand. This is reflected in Goldman Sachs’ downward revision of its oil price forecasts.

From a technical perspective, crude oil is trading within a weekly descending triangle pattern, with the Relative Strength Index (RSI) hovering around 43, signaling a potential breakdown in prices. Additionally, the monthly chart reveals a Bollinger Band squeeze, characterized by lower highs, which may indicate prolonged weakness ahead. I highlighted this in more detail in my previous article this week.

In summary, both fundamental and technical indicators point towards a bearish outlook for crude oil. Any temporary spikes in prices, such as those triggered by events like the Libya production halt, are likely to be short-lived and could present opportunities for short positions. As global economic uncertainties persist, the downside risks for crude oil appear to outweigh the upside potential.

3/

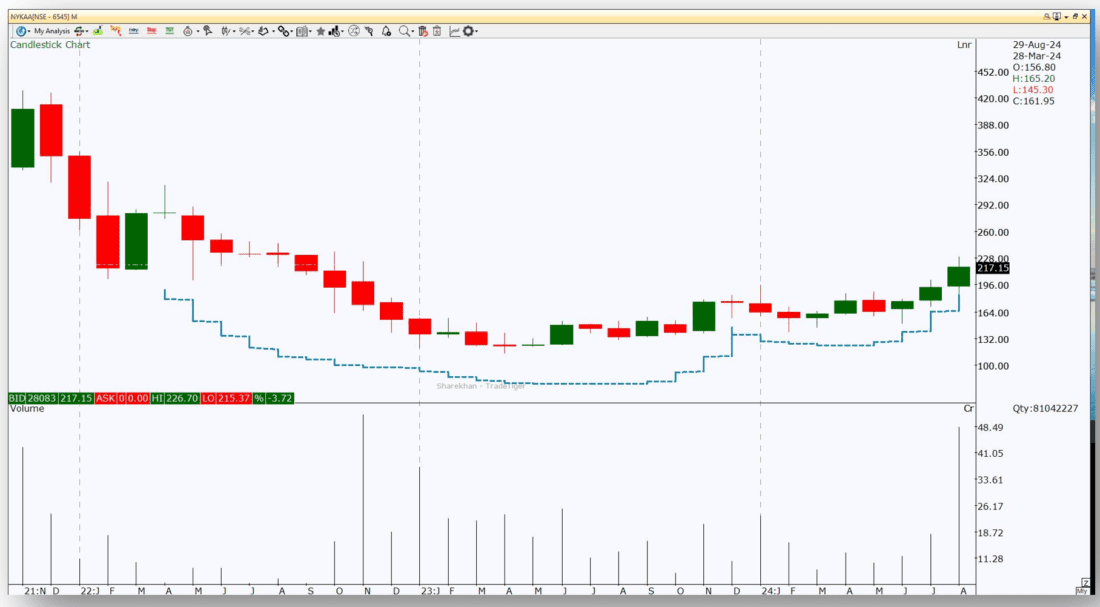

Is this Indian E-commerce stock waking up from the slumber?

The 2021 listing of Nykaa was nothing short of euphoric, with investors driving the stock price to impressive heights. However, the excitement quickly faded as the reality of stretched valuations set in. The stock plummeted from its peak levels of Rs 420 to nearly Rs 120 (adjusted for corporate action), reflecting a sharp correction as the market reassessed its true value.

Despite this steep decline, there are now signs that Nykaa may be on the cusp of a significant recovery. After a prolonged period of consolidation throughout 2022 and 2023, the stock is showing clear signs of breaking out of a classic cup and handle pattern—a powerful bullish signal in technical analysis. Notably, this breakout is accompanied by the highest trading volumes seen in the past 12 months, further reinforcing the strength of the potential move.

Given the accumulation phase that preceded this breakout, it seems likely that Nykaa is poised for a strong rally in the upcoming weeks and months. The technical setup suggests that the stock could be ready to regain some of the lost ground, offering an attractive opportunity for investors looking to capitalize on a potential upward trend.

Moreover, this positive momentum in Nykaa could also have ripple effects across the broader e-commerce space, with peers potentially benefiting from a renewed interest in the sector. As always, it’s crucial to stay vigilant and monitor the stock’s performance closely, but the current indicators are certainly promising.

—

Originally posted 29th August 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!